A characteristic feature of unfinished construction projects is that they cannot be used for their intended purpose until they are put into operation. These include residential and non-residential fixed asset complexes. There are a number of signs of unfinished construction:

- the design is characterized by volume;

- above-ground or underground structures have been erected;

- utility lines have been installed.

How does an unfinished construction project differ from a completed construction site ?

Work in progress in the balance sheet: line

2 “Fixed assets” includes table 2.2 “Unfinished capital investments”.

The second position is that information about unfinished capital investments is not reflected in line 1150 “Fixed assets”. This conclusion follows from the norms of PBU 6/01 (later than the above-mentioned PBU 4/99). In particular, the requirements for the disclosure of information about fixed assets in the financial statements are established by clause 32 of PBU 6/01, which does not contain any mention of unfinished capital investments or unfinished construction. In addition, PBU 6/01 “Fixed assets” itself does not apply to capital investments, since they do not meet the conditions for acceptance for accounting as part of fixed assets (clauses 3, 4 of PBU 6/01). An additional argument in favor of this position is that in the Regulations on Accounting and Financial Reporting in the Russian Federation, in the section “Rules for the evaluation of items in financial statements”, the subsection “Unfinished capital investments” is present along with the subsection “Fixed assets”.

Thus, organizations will have to independently, taking into account the above arguments, decide whether to include the amount of unfinished capital investments in the indicator of line 1150 “Fixed assets” or not. In the latter case, the amount of unfinished capital investments can be reflected in Section. I “Non-current assets” according to a separate line “Unfinished capital investments” independently entered by the organization, and if the indicator is not significant - according to line 1190 “Other non-current assets” (on the issue of disclosing data on in-progress capital investments, see also Letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01).

Let us note that when deciding on the reflection of incomplete capital investments in the Balance Sheet, it is advisable to apply a unified approach to reflecting all types of investments in non-current assets.

ADDITIONALLY on this issue, see Letter of the Ministry of Finance of Russia dated December 6, 2011 N 03-05-05-01/95.

Contractor accounting

According to PBU 2/94, contractors, when executing contracts for capital construction, must ensure the formation of information in the context of accounting objects according to the following indicators:

costs of performing contract work on accounting objects in the reporting period and from the beginning of the construction contract;

work in progress in the context of accounting objects, including work paid for or accepted for payment, performed by involved organizations under a construction contract;

income received from the customer for objects handed over to him under a construction contract;

financial result for work performed under a construction contract;

advances received from developers for work performed.

The current regulatory documents defining the relationship between the parties in construction (Civil Code of the Russian Federation - Civil Code of the Russian Federation), the procedure for reflecting in accounting and taxation of their activities (tax legislation and clarifications of the Ministry of Finance of Russia), distinguish three options for maintaining accounting records for the general contractor:

- construction in progress is accounted for at actual costs on the balance sheet of the general contractor until its completion;

- construction in progress is accounted for at the contract value of the work accepted by the developer for payment on the balance sheet of the general contractor until its completion;

- As the work is delivered to the developer, the general contractor writes off the cost of the work performed from the balance sheet and generates a financial result for tax purposes.

2.22: Which MySQL line contains the maximum value for a group?

Home Page » Books on PHP » MySQL lessons for beginners from scratch » Which line contains the maximum value for a group

For each item, find the sales agent with the highest price.

The easiest way to achieve this effect in MySQL is this:

- Get a list of records (product, maximum price).

- For each product, obtain from the table the corresponding rows that have the maximum price.

This can be easily done through a temporary table that is only needed to store the intermediate data set. This is a rather complex sequence of actions, so let's look at it step by step. First create a temporary table in the database:

As you can see, there are only two columns in the temporary table: one for the product code (article), the other for the price (price). The TEMPORARY keyword means a table that is temporarily created to store intermediate data.

Now we need to follow this difficult moment. The fact is that MySQL is a multi-user system. This means that while you are working with the table, someone else can be working with it (there can be any number of such “someone else”). You don’t know anything about each other, nor about who is doing what with the table. You don't need to know this.

But here’s the problem: what will happen if, at the moment when you get data from the table for your analysis, someone takes it and changes it? This will not lead to anything terrible, but you will receive outdated data and you will not see any changes. This means that you must prevent changes from being made until you complete the calculations. This is done using blocking.

lines 1150 and 1190 balance

The topic of locking is vast and complex, and is therefore covered in subsequent chapters.

But now let's look at the simplest option. So, we need to lock the shop table. We don't need to make the table completely inaccessible. It is only necessary that no one can make changes to it. But other users will be able to read the table. Let's get started:

If you are not using the TEMPORARY table, you must also lock the tmp table.

The read word in this command means that you have allowed other server users to read the table. This is where the concept of flow can lead to misunderstandings. The fact is that the table lock applies to all threads, except for the one that created the lock.

It would seem: so what? Here's what: if you have opened several copies of the client and established more than one connection to the server, then the table lock will spread to all your connections, excluding the one in which you set the lock. Accordingly, you can only remove the blocking in the same connection.

It doesn't matter that you logged into the server under the same login in all connections. The important thing is that the blocking is tied to a specific connection, not to the user. This situation often leads novice users to make a mistake: they lock one connection and try to unlock it from another. It won't work, the server won't allow it.

Now comes the reason why we blocked the table. Let’s select the necessary data from it and fill the prepared temporary table with it:

As you can see, another tricky trick is used here. Instead of listing the input values in the INSERT statement (using the word VALUES), we substituted the SELECT statement directly in their place. What will happen? Here's the thing: the SELECT statement will find and return the rows, but instead of displaying them on the screen, they will go straight into the INSERT statement, which will insert them into the tmp table. Thus, one query can be nested within another (here SELECT is nested within INSERT). Please take note for later use.

Now let's find the maximum price. The query uses two tables (shop and tmp), and if so, then the column names are used indicating the table from which data should be retrieved:

Great, data received. Now let’s give other users the opportunity to work with the locked table in full (and not just read it):

This command will release any locks held by the current thread from any tables you have locked. We will talk more about locks later (and a lot: the topic is complex), but for now we will delete the temporary table with all the data in it that has become superfluous:

The DROP command is designed to remove something. Because the table needs to be dropped now, the TABLE keyword is specified, followed by its name. Actually learn English! SQL differs from programming languages precisely in that you work with it, albeit in a very simplified, but quite understandable English language. Most of the words are the same. The DROP command will be discussed in more detail later, in Chapter 7, where operations with tables are discussed.

Could all this be done in a single request?

Yes, but only using the completely ineffective MAX-CON cat technique, which is provided for reference purposes only:

Share with friends

Unfinished construction and equity holders’ funds: how best to show it on the balance sheet

“Construction in progress” refers to the amount of unfinished capital investments. These are expenses for unfinished construction and installation work and other capital works and expenses (design and survey, geological exploration and drilling work, costs of land acquisition and resettlement associated with construction, costs of forming the main herd of productive and working livestock, etc.). d.). In addition, line 130 reflects the costs of acquiring intangible assets and fixed assets that require and do not require installation before their commissioning. Line 130 indicates the amount of costs for work performed both on-site and by contract. Unfinished capital investments are reflected in the balance sheet at actual costs for the developer (investor).

If, according to the accounting policy, the organization does not transfer constructed or acquired real estate to account 01 “Fixed Assets” before receiving documents confirming state registration of ownership, but continues to account for them in a separate subaccount of account 08 “Investments in non-current assets”, then the cost of these real estate objects should also be reflected on line 130.

Please note: for real estate objects for which capital construction has been completed, an acceptance certificate has been drawn up, documents have been submitted for state registration of ownership rights and which are actually operated by the organization, depreciation should be calculated in the generally established manner. Moreover, regardless of which account – 01 “Fixed Assets” or 08 “Investments in Non-Current Assets” – these real estate items are recorded. This requirement is established by paragraph 52 of the Methodological Instructions for Accounting for Fixed Assets. Therefore, when drawing up a balance sheet, the value of such real estate items accounted for on account 08 should be reflected minus the amounts of depreciation accrued on these items on account 02.

The line 130 indicator is formed as the sum of the debit balances of the accounts:

- 07 “Equipment for installation”;

- 08 “Investments in non-current assets”;

- 16 “Deviations in the cost of material assets” (in terms of deviations related to property, the cost of which is reflected in accounts 07 and 08).

Please note: on line 130 of the balance sheet, the amounts of advances transferred to suppliers and contractors cannot be reflected as part of the costs of construction in progress. According to paragraph 3 of PBU 10/99 “Expenses of the organization”, amounts of advances and prepayments are not recognized as expenses of the organization. Line 130 of the balance sheet reflects the organization's actual expenses on capital investments, and the amounts of advances do not apply to such. They form accounts receivable, which are reflected in the corresponding asset lines of the balance sheet (see commentary on line 240 of the balance sheet on page 410).

Let us remind you: the organization has the right to show significant performance indicators separately. If the organization’s capital investments are of a diverse nature, then to decipher the indicator of line 130, it can enter additional lines into the balance sheet form.

Developer accounting

Developers, when executing construction contracts, must ensure the formation of information in the context of accounting objects according to the following indicators:

Construction in progress;

completed construction;

advances issued to contractors and other entities involved in the construction of projects in accordance with construction contracts;

financial result of activities.

The developer's expenses for contract work accepted for payment or paid for, performed by contractors on completed construction projects, are taken into account as part of construction in progress until they are put into operation.

Clause 2.2 of the Regulations on Accounting for Long-Term Investments establishes that during construction, the developer keeps accounting of costs on an accrual basis from the beginning of construction by reporting periods until the commissioning of facilities or the complete production of relevant work and costs. The developer reflects these expenses on account 08 “Capital Investments”, subaccount “Construction of fixed assets”.

Costs for the construction of facilities are grouped according to the technological structure of costs determined by the estimate documentation.

Accounting is carried out according to the following scheme:

- construction costs;

- expenses for installation of equipment;

- expenses for the purchase of equipment handed over for installation;

- expenses for the purchase of equipment that does not require installation, tools and equipment, equipment that requires installation, but is intended for permanent stock;

- other capital expenditures;

- expenses that do not increase the cost of fixed assets.

Line 213 “Costs in work in progress”

Home/ Accounting statements/ Line 213

Line 213 of financial statements

refers to

the balance sheet

up to 2011.

Line 213 “Costs in work in progress”

The costs of unfinished production include products (work) that have not passed all stages (phases, redistributions) provided for by the technological process, as well as incomplete products that have not passed testing and technical acceptance.

Line 213 shows the amount of debit balances on the accounts:

- 20 “Main production”;

- 21 “Semi-finished products of own production”;

- 23 “Auxiliary production”;

- 29 “Service industries and farms”;

- 44 “Sales expenses”;

- 46 “Completed stages of unfinished work.”

In accounting, work in progress (WIP) in mass and serial production can be reflected:

- according to actual or standard (planned) production cost;

- by direct cost items;

- at the cost of raw materials, materials and semi-finished products.

With a single production of products, work in progress is reflected at the actual costs incurred.

The organization independently chooses methods for assessing work in progress and consolidates the choice in the order on accounting policies.

In the balance sheet, work in progress is reflected at the same valuation as in the accounting records. The amount of work in progress must be confirmed by relevant calculations (accounting statements).

If a non-trading organization distributes commercial expenses between sold and unsold products (goods, services), then when filling out line 213, not the entire balance of account 44 “Sales expenses” is taken.

Line 1150 “Fixed assets”

Unwritten-off expenses for packaging and transportation, recorded as commercial expenses on account 44, are reflected on line 217 “Other inventories and costs” of the balance sheet, and not on line 213.

Construction, scientific, design, geological, etc. organizations that carry out settlements with customers in accordance with concluded contracts in stages, on line 213 reflect the cost of work partially accepted by the customer (debit balance of account 46 “Completed stages of work in progress”). Let us remind you that the cost of completed stages of work, reflected in forms No. KS-2 and KS-3 signed by the customer, is taken into account as the debit of account 46 in correspondence with account 90 “Sales”.

useful links

►Economic literature◄ ►Methodology of financial analysis◄ ►Forms of financial statements◄ ►The largest joint stock companies in Russia◄

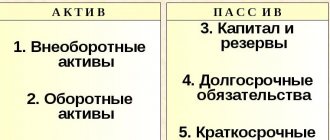

Liabilities and assets of the balance sheet

The balance sheet is the main form of financial reporting. It characterizes the property and financial condition of the organization as of the reporting date. The balance sheet reflects the balances of all accounting accounts as of the reporting date. These indicators are presented in the balance sheet in a certain grouping. The balance sheet is divided into two parts: assets and liabilities. The amount of assets on the balance sheet is always equal to the amount of liabilities on the balance sheet.

Unfinished on the balance sheet

- are his assets. These are all things that can be converted into cash.

Assets are divided into:

- Non-negotiable

- Intangible assets

- Fixed assets

- Construction in progress

- Profitable investments in material assets

- Long-term financial investments

- Deferred tax assets

- Other noncurrent assets

- Negotiable

- Reserves

- Value added tax on purchased assets

- Accounts receivable (payments for which are expected more than 12 months after the reporting date)

- Accounts receivable (payments for which are expected within 12 months after the reporting date)

- Short-term financial investments

- Cash

- Other current assets

Section V. Current liabilities

Borrowed funds. Line 1510 indicates debt on short-term loans and borrowings taken out for a period of no more than 12 months. In this case, the amount should be reflected taking into account interest due at the end of the reporting period.

Accounts payable. The total amount of accounts payable is recorded in line 1520. And this should only be short-term debt.

Please note that there is no separate line for debt to participants (founders) for payment of income. The amount of such debt should be included here and deciphered on a separate line, since this indicator is always significant.

Revenue of the future periods. Line 1530 is filled in when the accounting provisions provide for the recognition of this accounting object. For example, if your organization receives budget funds or targeted funding. Such funds are precisely subject to accounting as part of deferred income in accounts 98 “Deferred Income” and 86 “Targeted Financing” (clauses 9 and 20 of the Accounting Regulations “Accounting for State Aid” (PBU 13/2000), approved Order of the Ministry of Finance of Russia dated October 16, 2000 N 92n).

Estimated liabilities. The explanations that we gave for line 1430 apply here: line 1540 is filled out if the company recognizes estimated liabilities in its accounting. Only line 1430 reflects long-term liabilities, and line 1540 - short-term liabilities.

Other obligations. Line 1550 shows other short-term liabilities that are not reflected in other lines of section. V balance.

So, we have looked at the balance sheet items.

Now we offer a diagram that will help determine its indicators (we denote the debit and credit balances of the accounting accounts as Dt and Kt, respectively).

Section I “Non-current assets”

Line 1110 “Intangible assets” = Dt 04 (without R&D expenses) - Kt 05.

Line 1120 “Results of research and development” = Dt 04 (analytical account for accounting for R&D expenses).

Line 1130 “Intangible search assets” = Dt 08 (analytical account of expenses for intangible search costs).

Line 1140 “Material search assets” = Dt 08 (analytical account of expenses for material search costs).

Line 1150 “Fixed assets ” = Dt 01 - Kt 02 + Dt 08 (analytical account of expenses for construction in progress).

Line 1160 “Profitable investments in material assets” = Dt 03 - Kt 02 (analytical account for depreciation of property related to profitable investments).

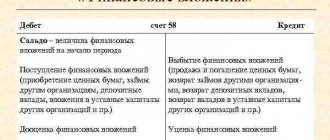

Line 1170 “Financial investments” = Dt 58 + Dt 55, subaccount “Deposit accounts”, + Dt 73, subaccount “Settlements on loans provided” (analytical accounts for long-term financial investments), - Kt 59 (analytical account for accounting for reserves for long-term financial investments).

Line 1180 “Deferred tax assets” = Dt 09.

Line 1190 “Other non-current assets” = the cost of non-current assets not taken into account in other indicators, section. I balance sheet.

Line 1100 “Total for Section I” = sum of indicators in lines 1110 - 1190.

Section II "Current assets"

Line 1210 “Inventories” = the sum of debit balances of accounts 10, 11, 43, 45, 20, 21, 23, 28, 29, 44 + Dt 41 - Kt 42 + Dt 15 + Dt 16 (or Dt 15 - Kt 16) - Kt 14 + Dt 97 (analytical expense account with a write-off period of less than 12 months).

Line 1220 “VAT on purchased assets” = Dt 19.

Line 1230 “Receivables” = Dt 62 + Dt 60 + Dt 68 + Dt 69 + Dt 70 + Dt 71 + Dt 73 (except interest-bearing loans) + Dt 75 + Dt 76 - Kt 63.

Line 1240 “Financial investments (except for cash equivalents)” = Dt 58 + Dt 55, subaccount “Deposit accounts”, + Dt 73, subaccount “Settlements on loans provided” (analytical accounts for short-term financial investments), - Kt 59 (analytical reserve account for short-term financial investments).

Line 1250 “Cash and cash equivalents” = Dt 50 + Dt 51 + + Dt 52 + Dt 55 + Dt 57 - Dt 55, subaccount “Deposit accounts” (analytical accounts for accounting for financial investments).

Line 1260 “Other current assets” = the cost of current assets not included in other indicators in section. II balance sheet.

Line 1200 “Total for Section II” = sum of indicators in lines 1210 - 1260.

Line 1600 “Balance” = line indicator 1100 + line indicator 1200.

Section III "Capital and reserves"

Line 1310 “Authorized capital (share capital, authorized capital, contributions of partners)” = Kt 80.

Line 1320 “Own shares purchased from shareholders” = Dt 81. Enclose the indicator in parentheses.

Line 1340 “Revaluation of non-current assets” = Kt 83 (analytical account for accounting for amounts of revaluation of fixed assets and intangible assets).

Line 1350 “Additional capital (without revaluation)” = Kt 83 (except for the amounts of revaluation of fixed assets and intangible assets).

Line 1360 “Reserve capital” = Kt 82.

Line 1370 “Retained earnings (uncovered loss)” = Kt 84 (Dt 84). If there is a debit balance, the indicator is negative (that is, there is a loss), enclose it in brackets.

Line 1300 “Section III Total” = the sum of the indicators of lines 1310 - 1370. If the result is negative (if there are negative indicators for lines 1320 and 1370), show it in parentheses.

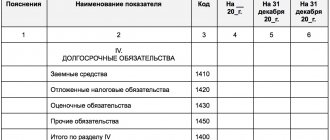

Section IV “Long-term liabilities”

Line 1410 “Borrowed funds” = Kt 67. In this case, accrued interest, the repayment period of which as of the reporting date is less than 12 months, should be excluded and reflected on line 1510 (preferably with an explanation).

Line 1420 “Deferred tax liabilities” = Kt 77.

Line 1430 “Estimated liabilities” = Kt 96 (only estimated liabilities with a maturity period of more than 12 months after the reporting date).

Line 1450 “Other liabilities” = long-term debt that is not included in other indicators in section. IV balance sheet.

Line 1400 “Total for Section IV” = the sum of the indicators of the above lines 1410 - 1450.

Section V “Short-term liabilities”

Line 1510 “Borrowed funds” = Kt 66 + Kt 67 (in terms of accrued interest, the repayment period of which as of the reporting date is not more than 12 months).

Line 1520 “Accounts payable” = Kt 60 + Kt 62 + Kt 76 + Kt 68 + Kt 69 + Kt 70 + Kt 71 + Kt 73 + Kt 75. In this case, take into account only short-term debt.

Line 1530 “Deferred income” = Kt 98 + Kt 86 in terms of targeted budget financing, grants, technical assistance, etc.

Line 1540 “Estimated liabilities” = Kt 96 (only estimated liabilities with a maturity date of no more than 12 months after the reporting date).

Line 1550 “Other liabilities” = amounts of debt on short-term liabilities not taken into account when determining other indicators, section. V balance.

Line 1500 “Total for section V” = sum of indicators in lines 1510 - 1550.

Line 1700 “Balance” = line indicators 1300 + 1400 + 1500.

If all business transactions are reflected correctly and correctly transferred to the balance sheet, the indicators of lines 1600 and 1700 will coincide. If this equality is not observed, an error has been made somewhere. Then you need to check, recalculate and adjust the entered data.

Liability balance

An organization's liabilities are the sources of its assets. These include capital, reserves, as well as accounts payable obligations that the organization has incurred in the process of conducting business activities.

Liabilities are divided into:

- Capital and reserves

- Authorized capital

- Own shares purchased from shareholders

- Extra capital

- Reserve capital

- Retained earnings (uncovered loss)

- Loans and credits

- Deferred tax liabilities

- Other long-term liabilities

- Loans and credits

- Accounts payable

- Debt to participants (founders) for payment of income

- revenue of the future periods

- Reserves for future expenses

- Other current liabilities

Section IV. long term duties

Borrowed funds. Line 1410 is reserved for the debt of the organization itself on long-term (with a repayment period of more than 12 months as of December 31, 2015) loans and credits.

Deferred tax liabilities. Line 1420 is filled in by income tax payers. “Simplers” are not included in their number, so they put a dash in this line.

Estimated liabilities. The specified line 1430 is filled in if the organization recognizes estimated liabilities in accounting in accordance with the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010), approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n. Let us remind you that small businesses, which are the majority of “simplified” ones, may not apply this PBU.

Other obligations. Here (line 1450) other long-term liabilities are shown that are not reflected in other lines of section. IV balance. Please note that Order No. 66n does not provide an indicator for line 1440.

Balance sheet asset

Intangible assets

- a non-monetary asset that has no physical form.

Fixed Assets (Fixed Assets)

(or

Fixed Production Assets

(FPF)) - fixed assets of an organization reflected in accounting or tax accounting in monetary terms.

"Construction in progress"

is the amount of unfinished capital investments.

Profitable investments in material assets

- investments of an organization in part of the property, buildings, premises, equipment and other valuables that have a tangible form, provided by the organization for a fee for temporary use (temporary possession and use) in order to generate income

Long-term financial investments

- investment of free funds of the enterprise, the maturity of which exceeds one year: - funds allocated to the authorized capital of other enterprises; — funds used to purchase securities of other enterprises; — long-term loans issued to other enterprises; and so on.

Deferred tax assets

represent a part of deferred income tax, the purpose of which is to reduce the amount of tax that must be paid to the budget in the reporting period.

Fixed assets

— assets with a useful life of more than one year: long-term financial investments, intangible assets, fixed assets, other long-term assets.

Material and production

Inventories are assets used as raw materials, materials, etc. in the production of products intended for sale (performing work, providing services), purchased directly for resale, and also used for the management needs of the organization.

Value added tax on purchased assets

- an account intended to summarize information about the amounts of value added tax paid (due to payment) by the enterprise on acquired assets.

Short-term financial investments

- short-term (for a period of no more than one year) financial investments of an enterprise in income-generating assets (shares, bonds and other securities) of other enterprises, associations and organizations, funds in time deposit accounts of banks, interest-bearing bonds of state and local loans, etc. - are the most easily realizable assets.

Accounting for construction costs of an object from the developer

When reflecting operations related to capital construction, the customer reflects the following entries in his accounting:

D-t 51, K-t 96 - funds for construction were received from the investor;

D-t 61, K-t 51 - advance payments to the general contractor for the execution of work are listed;

D-t 08, K-t 60 - acceptance of completed construction work by the developer on the basis of form N KS-3 monthly (quarterly) or upon completion of construction;

equipment is accepted at actual costs or materials used for construction;

D-t 60, K-t 61 - advances to contractors are closed;

Dt 96, Kt 08 - upon completion of construction, the facility is accepted for operation and handed over.

The construction project is reflected on the developer’s balance sheet throughout the entire construction period. The accumulation of costs is carried out on account 08 “Capital investments”. The developer collects a complete list of costs associated with the construction of the facility and forms the inventory value of the facility at the time of commissioning.

In the case where the customer is also a construction investor, the application of income tax benefits associated with the financing of capital investments for production purposes is legal according to the current tax legislation.