Since conducting a special assessment of working conditions relates to preventive measures to reduce industrial injuries and occupational diseases of workers, the employer can contact the territorial body of the Social Insurance Fund at the place of its registration to receive its financing. In case of a positive response from the FSS, it spends its own funds to carry out a special assessment (the amount is agreed upon with the FSS), after which it shows the money spent in Form No. 4-FSS. As a result, the amount of insurance contributions to the Social Insurance Fund in the current year is reduced by the amount of funds spent by the employer on a special assessment of working conditions in the current year.

Who can count on funding?

The policyholder, that is, a legal entity of any organizational and legal form, or an individual who:

- employs persons subject to compulsory social insurance against industrial accidents and occupational diseases,

- makes insurance contributions to the Social Insurance Fund of the Russian Federation, in accordance with Federal Law dated July 24, 1998 N 125-FZ (as amended on December 1, 2014) “On compulsory social insurance against industrial accidents and occupational diseases”

Documenting

Situation: what documents need to be submitted to the FSS of Russia in order for the fund to transfer to the organization compensation for the costs of paying out insurance coverage?

The procedure for reimbursement of expenses for insurance against accidents and occupational diseases is established by regulations governing the activities of the Federal Social Insurance Fund of Russia (Clause 1, Article 15 of the Law of July 24, 1998 No. 125-FZ).

Currently, branches of the FSS of Russia require the following documents from the organization:

- a written statement drawn up in any form;

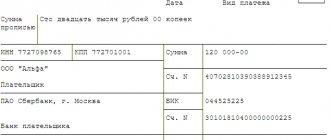

- Form-4 FSS for the reporting period;

- copies of payment documents confirming payment of contributions for insurance against accidents and occupational diseases;

- copies of documents confirming the validity of expenses for insurance against accidents and occupational diseases, certified by the head of the organization and its seal.

Documents confirming the validity of expenses for insurance against accidents and occupational diseases may be:

- report on an industrial accident in form N-1 (Article 230 of the Labor Code of the Russian Federation, clause 26 of the Regulations approved by Resolution of the Ministry of Labor of Russia dated October 24, 2002 No. 73);

- report on an industrial accident in the form N-1PS (Article 230 of the Labor Code of the Russian Federation, clause 26 of the Regulations approved by Resolution of the Ministry of Labor of Russia dated October 24, 2002 No. 73);

- acts on cases of occupational diseases (clauses 19, 27, 30 of the Regulations approved by Decree of the Government of the Russian Federation of December 15, 2000 No. 967);

- sick leave certificates, salary certificates, etc. (clause 9 of the Methodological Instructions approved by Resolution of the Federal Social Insurance Fund of Russia dated May 21, 2008 No. 110).

An example of reducing contributions for insurance against accidents and occupational diseases by expenses incurred by the organization for the payment of insurance provisions. Expenses exceeded assessed contributions

For the current year, the organization has established a rate of contributions for insurance against accidents and occupational diseases in the amount of 0.2 percent (corresponding to the 1st class of professional risk).

In June, the organization accrued salaries in favor of its employees in the amount of 6,500,000 rubles.

Contributions for insurance against accidents and occupational diseases for June amounted to 13,000 rubles. (RUB 6,500,000 × 0.2%).

In the same month, an employee of the organization received a trip to a sanatorium from the FSS of Russia in connection with an accident at work. The organization paid him leave (in addition to the annual paid leave established by law) for treatment in a sanatorium in the amount of 25,000 rubles.

As a result, in June, insurance payments were higher than the accrued premiums for insurance against accidents and occupational diseases (25,000 rubles > 13,000 rubles).

The organization decided to contact the branch of the Federal Social Insurance Fund of Russia at its place of registration for compensation for the expenses incurred. Therefore, in July, along with Form 4-FSS for the six months, the organization submitted an application for reimbursement of expenses incurred by it.

Along with the application, the organization submitted copies of the following documents:

- a voucher to a sanatorium provided by the FSS of Russia to an employee of the organization in connection with an accident at work;

- pay slip for the employee, which reflects the accrual of vacation pay during treatment at the sanatorium.

For June, the organization did not transfer anything to the FSS of Russia.

In July, the fund’s branch transferred money to the organization’s account to reimburse insurance costs in the amount of 12,000 rubles.

What can you spend money from the Social Insurance Fund on?

Activities for which the policyholder has the right to request funding from the Social Insurance Fund, in addition to conducting a special assessment of working conditions, include:

- implementation of measures to bring the levels of exposure to harmful and (or) hazardous production factors in the workplace in accordance with state regulatory requirements for labor protection;

- training on labor protection for certain categories of workers;

- acquisition of special clothing, special shoes and other personal protective equipment for employees, as well as flushing and (or) neutralizing agents;

- sanatorium-resort treatment of workers engaged in work with harmful and (or) hazardous production factors;

- Conducting mandatory periodic medical examinations (examinations) of workers engaged in work with harmful and (or) hazardous production factors;

- providing medical and preventive nutrition to workers;

- — purchase by policyholders whose employees undergo mandatory pre-shift and (or) pre-trip medical examinations of devices for determining the presence and level of alcohol content (breathalyzers or breathalyzers);

- acquisition by policyholders engaged in passenger and cargo transportation of devices for monitoring the work and rest schedule of drivers (tachographs);

- purchase by policyholders of first aid kits.

How to fill out the 4-FSS report

Only small companies can submit a paper report. It must be filled out using a pen with blue ink, using block letters. Errors can be corrected by carefully crossing out the incorrect indicator with the signature of the policyholder and the date of correction. You cannot use a corrector.

After filling out 4-FSS, you need to number the completed pages and have the report endorsed by the head of the company or his authorized representative. Each sheet of the report is endorsed.

Each policyholder must submit the title page and sections 1, 2 and 5. The remaining sections are submitted if the relevant information is available.

Title page of the 4-FSS report

- We enter the registration number of the employing company (the policyholder).

- Next, we indicate the code of subordination - this is the number of the FSS branch at the place of registration of the policyholder.

- Enter the adjustment number: 000 (if this is the first report for a given period) or three digits in the range 001 to 010 (if this is an adjusted report).

- We indicate the reporting period. For the first quarter, in the “Reporting period (code)” field we write “03”. For the second quarter - code “06”. For the third quarter - code “09”. For the fourth quarter - code “12”. If the purpose of the report is to receive money from the Social Insurance Fund to pay insurance coverage, then you only need to fill in the last two cells in the column (numbers from 01 to 10).

- We enter the estimated year 2021 in the “Calendar year” column.

- We fill out the “Cessation of activity” column if necessary.

- Next, enter the name of the organization according to the company charter or personal data of an individual - individual entrepreneur.

- Enter the details: TIN, KPP, OGRN and OKVED.

- In the “Budgetary organization” field, the insured’s attribute is entered: 1 - Federal budget 2 - Budget of a constituent entity of the Russian Federation 3 - Municipal budget 4 - Mixed financing.

- Enter your mobile or landline phone numbers and legal address.

- We add information on the average number of employees, the number of employees with disabilities and employees engaged in harmful or dangerous work.

- At the end, we enter the code of the policyholder or his legal representative and submit it for approval.

- Table 1 contains information about the wage fund for each month of the reporting quarter and the total amount of accruals for the year. If there were no excluded payments, these amounts are equal to the contribution base. Additionally, the size of the insurance tariff is indicated, taking into account the percentage of discount or surcharge to it.

- Table 2 is filled out based on accounting records. Contains the calculated amounts for contributions for injuries from accruals for each month of the quarter and the amount of contributions additionally accrued after verification. From here the size of obligations to the budget is derived. The second column of the table reflects information on payment of contributions from the beginning of the year.

- Table 5 contains data on the number of workplaces for which working conditions were assessed and the number of workplaces for which preliminary and periodic medical examinations were carried out. According to the rules, all data in the table must be at the beginning of the year, that is, as of January 1, 2021.

These and other tables must comply with the rules of Appendix No. 2 to FSS Order No. 381 of September 26, 2021.

How much funding can you expect in 2015?

Insurers with less than 100 employees who did not use Social Insurance Fund funds to implement preventive measures in 2013, 2014:

Policyholders who do not fall under the above criteria:

These schemes do not at all mean that you are obliged to independently calculate the amount of possible financing; on the contrary, the Social Insurance Fund determines the amount of funds that you can count on in the current year. To obtain information, you just need to call your FSS branch and give the policyholder’s registration number, TIN.

Zero form 4-FSS in 2021

An organization or entrepreneur that did not work during the reporting period and did not make any contributions to employees must also report in Form 4-FSS. In this case, you need to submit a zero form, which will inform the Social Insurance Fund about the lack of activity in the reporting period.

As part of the zero form, a title page and tables 1, 2 and 5 are submitted, which are filled in with dashes. Along with the form, you can submit to the Social Insurance Fund an explanation that you did not work, did not pay salaries, and, therefore, did not make contributions to the fund. But this is not necessary; if necessary, the FSS itself will request the necessary information.

Submit your 4-FSS report to Kontur.Accounting, a service for convenient accounting and reporting via the Internet.

Deadlines for receiving a decision on financial support from the Social Insurance Fund?

- for policyholders for whom the amount of insurance premiums accrued for 2014 is up to 8,000.0 thousand rubles inclusive - within 10 working days from the date of receipt of the full set of documents (the decision is made by the territorial body of the Social Insurance Fund);

- in relation to policyholders for whom the amount of insurance premiums accrued for 2014 is more than 8,000.0 thousand rubles - the decision is made by the territorial body of the FSS after agreement with the FSS: the territorial body of the FSS, within 3 working days from the date of receipt of the documents, sends them to approval by the FSS. The FSS approves the submitted documents within 15 working days from the date of their receipt. The decision is formalized by order and sent to the policyholder within 3 working days. You can check information on the progress of consideration of an application for financing preventive measures to reduce occupational injuries on the official website of your territorial body of the Social Insurance Fund.

Restrictions on spending insurance premiums

It is possible to reduce accrued premiums for insurance against accidents and occupational diseases to finance preventive measures to reduce injuries within the amount calculated using the formula:

| The maximum amount of contributions for insurance against accidents and occupational diseases allocated to finance preventive measures to reduce injuries in the current year | = | Contributions for insurance against accidents and occupational diseases accrued by the organization for the previous year | – | Expenses for the payment of insurance against accidents and occupational diseases made by the organization in the previous year | × | 20% |

This limitation is established in paragraph 3 of paragraph 2 of the Rules, approved by order of the Ministry of Labor of Russia dated December 10, 2012 No. 580n.

This limitation applies to all policyholders. The exception is organizations with up to 100 employees, which over the previous two years did not finance injury prevention at all. They must comply with two restrictions. Firstly, they are allowed to determine the maximum amount of contributions that can be used to finance these activities in the current year using the following formula:

| The maximum amount of contributions for insurance against accidents and occupational diseases allocated to finance preventive measures to reduce injuries in the current year | = | Contributions for insurance against accidents and occupational diseases accrued by the organization for the three previous years | – | Expenses for the payment of insurance against accidents and occupational diseases made by the organization for the three previous years | × | 20% |

And secondly, this maximum amount can only be fully used if it does not exceed the amount of insurance premiums that must be transferred to the fund in the current year.

Such rules are established in paragraphs 4–6 of paragraph 2 of the Rules, approved by order of the Ministry of Labor of Russia dated December 10, 2012 No. 580n.

Can they refuse funding?

Yes they can. If:

- the policyholder has arrears in the payment of insurance premiums, penalties and fines that have not been paid on the day the policyholder submits an application to the territorial body of the Social Insurance Fund at the place of its registration;

- the submitted documents contain false information;

- if the funds provided by the FSS budget for financial support of preventive measures for the current year have been fully distributed;

- when the policyholder submits an incomplete set of documents.

Excess of expenses over the amount of contributions

If the total amount of expenses incurred from contributions to insurance against accidents and occupational diseases exceeds the accrued amount of contributions, the organization can:

- offset the excess against future payments for insurance premiums against accidents and occupational diseases;

- receive the amount of overspending to the current (personal) account of the organization.

This follows from paragraph 10 of the Rules, approved by Decree of the Government of the Russian Federation of March 2, 2000 No. 184.

When using the first option, do not notify the FSS of Russia. Reflect the fact of debt and offset in FSS Form-4.

When using the second option, for reimbursement of expenses incurred to the organization’s current (personal) account, contact the branch of the Federal Social Insurance Fund of Russia at the place of registration. An organization can do this even if it (he) does not have enough money to pay insurance benefits to employees. This is stated in paragraph 3 of clause 10 of the Rules, approved by Decree of the Government of the Russian Federation of March 2, 2000 No. 184.

What to do if you agree to funding?

Having received a positive conclusion, the policyholder keeps records of funds allocated for financial support of preventive measures to pay insurance premiums, and submits a quarterly report on their use to the territorial body of the Fund. You can view the report form here After completing the planned activities, the policyholder submits to the territorial body of the Fund documents confirming the expenses incurred: the above report on the use of insurance premiums, certified copies of the invoice, invoice, payment order, certificate of completion of work, list of recommended improvement measures working conditions, a summary statement of the results of a special assessment of working conditions. In case of incomplete use of funds allocated by the Social Insurance Fund, the policyholder reports this to the territorial body of the Fund at the place of his registration before October 10 of the current year.

comments powered by HyperComments

Share news:

The entry was published on April 30, 2015 by Maria Anatolyevna Gordeeva in the section Special assessment of working conditions.

Accounting for injury prevention costs

Insurance premiums, which, with the permission of the Federal Social Insurance Fund of Russia, are spent on the prevention of injuries and occupational diseases, constitute state assistance (PBU 13/2000). They should be considered as targeted funding. Depending on the type of resources acquired through targeted funding (materials, workwear, personal protective equipment, services from third-party organizations, etc.), reflect them on the appropriate cost accounts.

Deduct VAT amounts on goods (work, services) purchased for use in injury prevention measures on a general basis (letter of the Ministry of Finance of Russia dated August 14, 2015 No. 03-07-11/47007).

When calculating income tax, do not take into account expenses incurred through insurance premiums. There is also no need to increase income by the amount of funds spent by the Russian Social Insurance Fund. This conclusion follows from letters of the Ministry of Finance of Russia dated February 15, 2011 No. 03-03-06/2/33 and dated September 24, 2010 No. 03-03-06/1/615.

An example of reflecting in accounting the costs of financing preventive measures to reduce injuries

LLC "Proizvodstvennaya" finances preventive measures to reduce injuries.

For 2015, the rate of contributions for insurance against accidents and occupational diseases is set at 1 percent (corresponding to the 9th class of professional risk).

In June 2015, the organization accrued salaries in favor of its employees in the amount of 1,250,000 rubles.

The accountant calculated contributions for insurance against accidents and occupational diseases for June in the amount of 12,500 rubles. (RUB 1,250,000 × 1%).

In June 2015, the organization received permission to conduct a special assessment of working conditions using contributions for insurance against accidents and occupational diseases. The amount of financing was 7,000 rubles. In July, “Master” spent the entire authorized amount to pay for the services of a specialized organization to conduct a special assessment of working conditions. The cost of services for conducting a special assessment of working conditions was offset by the accountant against the payment of contributions for insurance against accidents and occupational diseases.

On October 20, 2015, the accountant submitted to the Federal Social Insurance Fund of Russia at the place of registration of the organization Form 4-FSS and a report on the use of insurance premiums for the third quarter with supporting documents attached.

In accounting, the Master's accountant made the following entries.

In June 2015:

Debit 20 Credit 70 – 1,250,000 rub. – wages accrued for June 2015;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 12,500 rubles. – premiums for insurance against accidents and occupational diseases were calculated for June 2015;

Debit 76 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” Credit 86 - 7000 rubles. – permission was received to conduct a special assessment of working conditions using contributions for insurance against accidents and occupational diseases.

In July 2015:

Debit 91-2 Credit 51 – 7000 rub. – expenses for conducting a special assessment of working conditions are reflected;

Debit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” Credit 76 - 7000 rubles. – the debt to the Federal Social Insurance Fund of Russia for insurance premiums was reduced by the amount of expenses incurred;

Debit 86 Credit 98-2 – 7000 rub. – funds allocated to finance preventive measures are reflected in deferred income;

Debit 98-2 Credit 91-1 – 7000 rub. – other income is recognized in the amount of expenses actually incurred aimed at financing preventive measures to reduce injuries and occupational diseases.