25.06.2017

The 1C 8.3 Accounting 3.0 program has some functionality for maintaining personnel records and payroll. It is certainly not as advanced as in 1C: Salaries and HR Management, but still, in small organizations it is quite sufficient. Documentation and reporting complies with the law and is constantly maintained and updated. In this article we will look at the main aspects of accounting for insurance premiums in 1C 8.3 and recommendations on what to do if they are not charged.

- “Analysis of contributions to funds”

Pre-setting

Before you start calculating insurance premiums, you need to do a little setup of the program. The correctness of the calculations depends on it. Insurance premiums are a serious matter, so do not neglect the settings and be careful.

If you have not previously indicated the taxation system of your organization, be sure to do so in your accounting policy.

Accounting setup

First of all, let's start setting up accounting for our contributions. They are set up in the same place as the salary. In the “Salary and Personnel” menu, select “Salary Settings”.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

By clicking on the “Insurance Premiums” hyperlink in the “Classifiers” section, you can view the parameters for calculating premiums. We will not focus on them, since the data in these registers is already filled in in the standard configuration delivery according to current legislation.

Now let's move on to setting up accounting for our contributions. In the salary settings form, select “Salary accounting procedure”.

At the very bottom of the form that opens, follow the link to set up insurance premiums.

In the window that opens, go to the “Insurance Premiums” section and fill in the required fields.

The tariff for NS and PP is set depending on the main type of activity for the previous year. The minimum tariff is 0.2 percent. It is approved by the FSS, to which documents are submitted every year to confirm the main type of activity.

Here you can also set up additional contributions for those professions who are entitled to them, and indicate whether there are employees with hazardous working conditions. At the very bottom you can put a mark on the transfer of additional insurance contributions for a funded pension in accordance with Federal Law No. 56 of April 30, 2008.

Expenditures

To correctly reflect insurance premiums in accounting, you need to make one more setting. In the salary setup form, select “Cost items for insurance premiums.” This is where the procedure for reflecting mandatory contributions from the payroll fund on accounting accounts is set up.

A list already filled in by default will open in front of you. If necessary, it can be supplemented or adjusted.

By default, the debit account will be 26, the credit account will be 69.

Accruals

There are many different types of accruals. This includes salary, sick leave, vacation and others. For each of them, you need to configure whether insurance premiums should be paid from them.

Let's return to the salary settings form. In the “Payroll calculation” section, select the “Accruals” item.

A list of all charges will appear in front of you. They can be edited or new ones added.

Open any accrual. You will see the “Type of Income” field. It is the value indicated in it that will determine whether insurance premiums will be calculated on it or not. In our example, we opened one of the standard accruals, so everything is already filled in here, but when adding new ones, do not forget to indicate the type of income.

Payment of contributions, registration of payments and reimbursements from the Social Insurance Fund

Payment of insurance premiums, like any other transfer of funds through a bank, is reflected in the program by the document “Debit from the current account.”

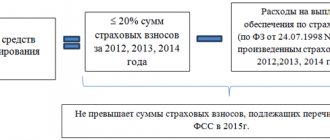

In order for the paid premiums to be reflected in the reporting, it is necessary to register them using the document “Calculations for insurance premiums”.

Menu: Salary – Insurance premium payments