A tax period is a code that allows you to quickly and accurately determine the time for which reporting information was submitted. Officials have provided individual designations - a special codification or encoding. We'll tell you how to correctly identify codes when preparing fiscal statements.

For each type of fiscal report, officials have provided individual codification. It is difficult to remember all the values. Therefore, accountants are often confused: what quarter or month is tax period 21? Depending on the type of fiscal declaration, one code has several meanings. But there are ciphers that are identical for several types of declarations.

Tax period codes for VAT

According to the Order of the Federal Tax Service dated October 29, 2014 N ММВ-7-3 / [email protected] (as amended on December 28, 2018).

| Code | Name of period |

| 01 | January |

| 02 | February |

| 03 | March |

| 04 | April |

| 05 | May |

| 06 | June |

| 07 | July |

| 08 | August |

| 09 | September |

| 10 | October |

| 11 | November |

| 12 | December |

| 21 | I quarter |

| 22 | II quarter |

| 23 | III quarter |

| 24 | IV quarter |

| 51 | I quarter during reorganization (liquidation) of the organization |

| 54 | II quarter during reorganization (liquidation) of the organization |

| 55 | III quarter during reorganization (liquidation) of the organization |

| 56 | IV quarter during reorganization (liquidation) of the organization |

| 71 | January, during the reorganization (liquidation) of the organization |

| 72 | February, during the reorganization (liquidation) of the organization |

| 73 | March, during the reorganization (liquidation) of the organization |

| 74 | April, during the reorganization (liquidation) of the organization |

| 75 | May, during the reorganization (liquidation) of the organization |

| 76 | June, during the reorganization (liquidation) of the organization |

| 77 | July, during the reorganization (liquidation) of the organization |

| 78 | August, during the reorganization (liquidation) of the organization |

| 79 | September, during the reorganization (liquidation) of the organization |

| 80 | October, during the reorganization (liquidation) of the organization |

| 81 | November, during the reorganization (liquidation) of the organization |

| 82 | December, during the reorganization (liquidation) of the organization |

Example for generating a declaration

You can understand how the UTII declaration form is filled out using a simple example. All data are shown in Table 1.

Table 1. Conditional organization parameters

| Parameter | Value for the fourth quarter of 2021 |

| Name | LLC "Malysh" |

| Kind of activity | Retail trade of children's goods |

| Place of business | Elektrogorsk city, Moscow region |

| Store area | 120 sq. meters |

| Employees | 3 persons |

| Insurance premiums | For a month - 22,000 thousand rubles, for a quarter - 66,000 thousand rubles |

Prepare a UTII declaration for only 149 rubles

Codes of tax periods according to the simplified tax system

According to the Order of the Federal Tax Service of Russia dated February 26, 2021 N ММВ-7-3/ [email protected]

| Code | Name of period |

| 34 | Calendar year |

| 50 | The last tax period upon reorganization (liquidation) of the organization, as well as upon termination of activities as an individual entrepreneur |

| 95 | Last tax period when switching to a different taxation regime |

| 96 | Last tax period upon termination of business activity (including in respect of which the taxpayer applied a simplified taxation system) |

Regulatory framework

The main regulatory regulator of taxation issues is the Tax Code of the Russian Federation (TC RF). Article 17 calls the tax period (TP) an element of tax: mandatory payment cannot be introduced without specifying deadlines .

Article 55 of the Tax Code of the Russian Federation explains that a tax period is a period of time based on the results of which tax is calculated and paid to the budget system. The period can be divided into reporting periods (OPs) necessary for the transfer of advance payments and the provision of interim reporting documents.

Tax period codes for UTII

According to the Order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected]

| Code | Name of period |

| 21 | I quarter |

| 22 | II quarter |

| 23 | III quarter |

| 24 | IV quarter |

| 51 | I quarter during reorganization (liquidation) of the organization |

| 54 | II quarter during reorganization (liquidation) of the organization |

| 55 | III quarter during reorganization (liquidation) of the organization |

| 56 | IV quarter during reorganization (liquidation) of the organization |

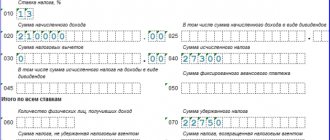

Section 2.1.1

It is needed as part of the declaration only for those categories of payers who pay income tax. Please note that persons paying a trade tax in addition to tax will not need this section.

So, it is advisable to fill out a declaration under the simplified tax system starting from this section.

In line 102 you must indicate one of two characteristics of the taxpayer:

- code “1” - for companies and individual entrepreneurs with employees;

- code “2” - exclusively for individual entrepreneurs without employees.

Lines 110–113 collect information about income for the first quarter, six and nine months, and the year. The main principle: all income and expenses are recorded on an accrual basis. Using the example of Elka LLC, we will show what income is on an accrual basis. Initial income data: I quarter - 13,976 rubles, II quarter - 24,741, III quarter - 4,512 rubles, IV quarter - 23,154 rubles. To fill out lines 110–113, the accountant at Elka LLC will add the current value to the previous value. So, in line 110 the accountant will write 13,976, in line 111 - 38,717 (13,976 + 24,741), in line 112 - 43,229 (38,717 + 4,512) and in line 113 - 66,383 (43,229 + 23,154 ).

The tax rate is fixed in lines 120–123.

Line 130 records the tax advance for the first quarter. Lines 131–133 reflect advances and tax. How to calculate them is indicated directly on the declaration form to the left of the corresponding line.

In lines 140–143, entries are made about the amounts of insurance premiums, sick leave and payments for voluntary personal insurance. An accountant of any company must remember that the amount of tax and advances can be legally reduced by the amount of these expenses, but not more than 50%. Elka LLC has calculated the annual tax, and it is equal to 74,140 rubles. Contributions for employees amounted to 68,324 rubles, and the sick leave of director Stas Igorevich Kopeikin amounted to 17,333 rubles. Total expenses amounted to 85,657 rubles (68,324 + 17,333). The accountant of Elka LLC decided to take advantage of the legal right and reduced the tax. For this, accountant Olkina S.T. calculated half of the amount of expenses, which turned out to be 42,829 rubles (85,657: 2). The amount received is more than half the tax (74,140: 2 = 37,070). This means that Olkina S.T. can reduce the tax by only 37,070. Elka LLC will have to pay 37,070 (74,140 - 37,070) to the budget. In line 143, the accountant will enter the amount 37,070, not 42,829.

Let us add that individual entrepreneurs in lines 140–143 reflect contributions for themselves. Single entrepreneurs have a special advantage - they can reduce taxes by 100% of contributions transferred to the budget. Individual entrepreneur Semechkin V.O. (without employees) for the year, according to preliminary calculations, should send 36,451 rubles to the budget, the contributions paid amounted to 17,234 rubles (this is exactly the amount Semechkin paid). Individual entrepreneur Semechkin V.O. reduced the tax on contributions (by 17,234) and transferred 19,217 rubles (36,451 - 17,234) to the Federal Tax Service.

Codes of tax periods for income tax

According to Order of the Federal Tax Service of Russia dated October 19, 2021 N ММВ-7-3/ [email protected]

| Code | Name of period |

| 13 | First quarter for the consolidated group of taxpayers |

| 14 | Half-year for the consolidated group of taxpayers |

| 15 | Nine months for a consolidated group of taxpayers |

| 16 | Year by consolidated group of taxpayers |

| 21 | First quarter |

| 31 | Half year |

| 33 | Nine month |

| 34 | Year |

| 35 | One month |

| 36 | Two month |

| 37 | Three months |

| 38 | Four months |

| 39 | Five months |

| 40 | Six months |

| 41 | Seven months |

| 42 | Eight months |

| 43 | Nine month |

| 44 | Ten months |

| 45 | Eleven months |

| 46 | Year |

| 50 | Last tax period for reorganization (liquidation) of an organization |

| 57 | One month for a consolidated group of taxpayers |

| 58 | Two months for a consolidated group of taxpayers |

| 59 | Three months for a consolidated group of taxpayers |

| 60 | Four months for a consolidated group of taxpayers |

| 61 | Five months for a consolidated group of taxpayers |

| 62 | Six months for a consolidated group of taxpayers |

| 63 | Seven months for a consolidated group of taxpayers |

| 64 | Eight months for a consolidated group of taxpayers |

| 65 | Nine months for a consolidated group of taxpayers |

| 66 | Ten months for a consolidated group of taxpayers |

| 67 | Eleven months for a consolidated group of taxpayers |

| 68 | Year by consolidated group of taxpayers |

Please note: codes 35-46 and 57-68 are indicated by taxpayers paying monthly advance payments based on the actual profit received.

How to indicate correctly

To eliminate possible disagreements and misunderstandings on the part of recipients of reports and mandatory payments, it is required to correctly indicate the tax period code in reporting documents, payment orders and payment receipts. The numerical designation of the NP is given simultaneously with recommendations for filling out tax returns and is indicated on the title page.

The use of numerical values is also provided for field 107 of the payment order for the correct identification of funds transferred to the budget.

Income tax

The NP for corporate income tax is recognized as a calendar year , at the end of which payers are required to submit tax returns, even if they have no income. NP code:

- 34 - in general;

- 46 – for legal entities calculating the amount of advance payment based on monthly actual profit;

- 50 – upon completion of the activities of the liquidated or reorganized organization.

a consolidated group of payers deserves special attention (Chapter 3.1 of the Tax Code of the Russian Federation). This is an association of organizations paying income tax for the purpose of calculating the mandatory payment based on the overall financial result. Calculation and payment are carried out by the responsible participant - a legal entity to which such responsibilities are assigned by the agreement. The meaning of the NP in this case:

- 16 - in general;

- 68 – when calculating actual income on a monthly basis.

Code 50 remains relevant for the group of taxpayers.

Organizational property tax

Similar to the previous paragraph, NP is considered to be a calendar year:

- 34 - in general;

- 50 – for the last year of activity.

simplified tax system

The tax period under the simplified taxation system (STS) is the year at the end of which the declaration is carried out taking into account the values:

| Code | Decoding | |

| 34 | year | |

| 50 | last NP | a reorganized (liquidated) organization or an individual entrepreneur completing its activities |

| 95 | when changing the tax regime | |

| 96 | upon completion of the activity for which the simplified tax system was used | |

UTII

The single tax on imputed income is calculated and paid quarterly. The declaration is also submitted:

| Code | Decoding | |

| 21 | 1st | quarter |

| 22 | 2nd | |

| 23 | 3rd | |

| 24 | 4th | |

| 51 | 1st | quarter for a reorganized (liquidated) organization or an individual entrepreneur terminating its activities, when the taxation regime changes, as well as the termination of activities subject to UTII |

| 54 | 2nd | |

| 55 | 3rd | |

| 56 | 4th | |

By quarter

Quarterly NP is also established for VAT. With the exception of information under production sharing agreements, period codes are established similarly to UTII.

Insurance premiums

In 2021, the Tax Code of the Russian Federation was supplemented with Section XI on insurance premiums. Reporting on such mandatory payments began to be sent to tax inspectorates.

Contributions are characterized by the concept of a billing period of a calendar year:

- 34 - in general;

- 90 – last year of activity.

Codes of tax periods for corporate property tax

According to the Order of the Federal Tax Service of Russia dated March 31, 2017 N ММВ-7-21/ [email protected]

| Code | Name of period |

| 21 | I quarter |

| 17 | Half year (2nd quarter) |

| 18 | 9 months (3rd quarter) |

| 51 | I quarter during the reorganization of the organization |

| 47 | Half-year (2nd quarter) during the reorganization of the organization |

| 48 | 9 months (3rd quarter) upon reorganization of the organization |

| 34 | Calendar year |

| 50 | Last tax period for reorganization (liquidation) of an organization |

Salary reports

Reports on wages, insurance premiums and withholding taxes provide individual coding.

For the 6-NDFL report, a separate reporting period is provided - code 90, which indicates the year before the reorganization and (or) liquidation of the reporting company. Use a similar code to create a single calculation for insurance premiums.

General values for salary reports:

- tax period 21 - the first three months of the year: January, February, March;

- tax period 31 - 1st half of the year or the first 6 months on an accrual basis;

- code 33 - 9 months from the beginning of the year;

- tax period 34 (which quarter is this?) is a full calendar year, or 12 months from January to December.

It is worth noting that tax reporting period 34 in almost all types of reporting forms in the Federal Tax Service denotes a full calendar year (January-December). Moreover, the status and category of the taxpayer does not play any role. That is, organizations (legal entities), individual entrepreneurs, and ordinary citizens are required to use the code when drawing up the 3-NDFL declaration and other forms of fiscal reports and declarations. Please note that tax period 34 in the declaration for transport tax, according to the simplified tax system, unified calculation of insurance premiums, and so on is always a year.

Tax return submission method codes

| Code | Method name |

| 01 | On paper (by mail) |

| 02 | On paper (in person) |

| 03 | On paper with duplication on removable media (personal) |

| 04 | Via telecommunication channels with an electronic signature |

| 05 | Other |

| 08 | On paper with duplication on removable media (by mail) |

| 09 | On paper using a barcode (in person) |

| 10 | On paper using a barcode (by mail) |

Completing Section 7

Some transaction codes from other sections of the Transaction Codes Directory have been excluded, others have been added. In addition, amendments have been made to the names of individual codes.

When filling out column 1 of Section 7 of the declaration “Transactions not subject to taxation (exempt from taxation); transactions that are not recognized as an object of taxation; operations for the sale of goods (works, services), the place of sale of which is not recognized as the territory of the Russian Federation; as well as the amount of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), the duration of the production cycle of which is more than six months,” the following changes to the directory must be kept in mind.

1. From July 1, 2021, a number of transactions involving the transfer of property to the treasury and property of the Russian Federation have been removed from VAT taxation (Federal Law of April 15, 2021 No. 63-FZ, Federal Law of July 26, 2021 No. 211-FZ ).

In this regard, in the directory:

- for codes 1010802 and 1010829, the column “Name of operation” has been edited in accordance with the new edition of subclause. 2 p. 2 art. 146 Tax Code of the Russian Federation;

- new codes have appeared: 1011450 - transfer on a gratuitous basis to the state treasury of the Russian Federation of real estate objects and 1011451 - transfer on a gratuitous basis of property into the ownership of the Russian Federation for the purposes of organizing and (or) conducting scientific research in Antarctica.

2. In connection with the postponement of the UEFA European Football Championship due to the COVID-19 pandemic to 2021, a change was made to the column “Name of operation” under code 1010820 for a number of tax benefits (subclause 3, clause 2, article 146 of the Tax Code of the Russian Federation).

3. In 2021, transactions involving the gratuitous transfer of property to government bodies and (or) local self-government bodies, state and municipal institutions, state and municipal unitary enterprises to combat coronavirus are not recognized as objects of VAT taxation. Changes to the Tax Code of the Russian Federation were introduced by Federal Law No. 172-FZ of June 8, 2020 (subclause 5.1, clause 2, Article 146 of the Tax Code of the Russian Federation). To reflect such transactions, section 7 of the VAT return provides a new code - 1010831.

4. In 2019-2020, changes were made to the Tax Code of the Russian Federation, which led to the expansion of the list of non-VAT-taxable transactions (Article 149 of the Tax Code of the Russian Federation):

- clause 3 art. 149 of the Tax Code of the Russian Federation has been supplemented with subsection. 3.2 Federal Law of July 26, 2021 No. 212-FZ). Banking transactions specified in this subclause are not subject to VAT. This amendment served as the basis for supplementing the “Operation Codes” directory with a new code – 1011207;

- from 2021, transactions for the provision of services for the management of municipal solid waste provided by regional operators are not subject to VAT taxation (subclause 36, clause 2, article 149 of the Tax Code of the Russian Federation). This norm was introduced by Federal Law No. 211-FZ of July 26, 2021. For these operations the code 1011208 is provided.

5. In addition, the “Operation Codes” directory has been supplemented with new codes:

- 1011209 - free provision of services for the provision of air time and (or) print space in accordance with the Law of the Russian Federation on the amendment to the Constitution of the Russian Federation of March 14, 2021 No. 1-FKZ “On improving the regulation of certain issues of the organization and functioning of public authority”;

- 1011210 - sales of food products directly produced by canteens of medical organizations and sold by them in the specified organizations, as well as food products directly produced by public catering organizations and sold by them to the specified canteens or organizations;

- 1011211 - implementation of state (municipal) services in the social sphere, provided in accordance with agreements concluded based on the results of the selection of performers of state (municipal) services in the social sphere in accordance with the legislation of the Russian Federation on state (municipal) social order for the provision of state (municipal) services services in the social sphere (with the exception of an agreement on the provision of a subsidy for financial support for the implementation of a state (municipal) task);

- 1011212 - implementation of exclusive rights to inventions, utility models, industrial designs, topologies of integrated circuits, production secrets (know-how), as well as rights to use the specified results of intellectual activity on the basis of a license agreement.

6. The code names have been brought into compliance with the current provisions of the Tax Code of the Russian Federation: 1010232, 1010250, 1010262, 1010267, 1010256, 1010276, 1011206.

Read in the berator “Practical Encyclopedia of an Accountant”

Procedure for submitting a VAT return

Tax return submission place codes

| Code | Name of place |

| 120 | At the place of residence of the individual entrepreneur |

| 210 | At the location of the Russian organization |

| 215 | At the location of the legal successor who is not the largest taxpayer |

So, as you noticed, tax period codes are unique for each type of tax returns, including income taxes, corporate property taxes, the simplified tax system and UTII. Therefore, you should be careful when choosing them.

Section 1.2

Fill out Section 1.2 if your object is “income minus expenses.”

The principle of filling it out completely repeats the principle of filling out section 1.1.

Lines 010, 020, 060, 090 contain OKTMO.

Tax advances are recorded in lines 020, 040, 070. The timing of their payment does not depend on the object of taxation - it is always the 25th.

Entries are made in lines 050 and 080 if prior payments to the budget exceeded the advance for the current period.

The only difference between the described section and section 1.1 is line 120. In it you need to indicate the amount of the minimum tax (1% of income). For example, with an annual income of 10,000 rubles and expenses of 9,500 rubles, the tax payable by Elka LLC will be only 75 rubles ((10,000 - 9,500) x 15%). If you calculate the minimum wage, you get 100 rubles (10,000 x 1%). Elka LLC must pay exactly the minimum tax, naturally reducing it by the amount of advances. If the company had advances in the amount of 30 rubles, then in line 120 the accountant will indicate 70 (100 - 30).

If advances based on the results of three quarters of the year exceed the minimum tax, line 120 is crossed out.

Responsibility

For failure to submit a VAT return on time, liability is provided under Article 119 of the Tax Code of the Russian Federation. For each full or partial month of delay in the declaration, a fine of 5% of the tax not paid on time is collected. The maximum penalty is 30% of the tax not paid on time on a late return. If the company did not pay the tax on time or violated the deadline for submitting the “zero” declaration, then the fine will be collected in the minimum amount - 1000 rubles.

Do not forget that a declaration submitted on paper is considered not submitted.