Don't know how to return a product to a supplier ? Our article is devoted to describing this process and contains specific recommendations taking into account all the nuances.

When purchasing, it is better not to neglect concluding an agreement in which you will write down all the conditions, including the possible return of the goods to the supplier. In this case, you will not have to waste time substantiating claims and getting your money back.

It is convenient to make purchases and returns in MyWarehouse. With us you can keep records of goods, fill out all the necessary documents and print them, work with a database of counterparties, and plan the state of the warehouse. Our service is easy to learn, there are simple video instructions. Register and try it now: it's free!

Try MySklad

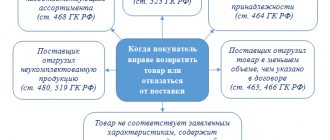

The Civil Legislation of the Russian Federation establishes several grounds on which goods can be returned. These are cases of non-compliance:

- quality;

- assortment;

- set;

- containers and packaging.

In some of these cases, you need to understand that you may not need to return the goods if the supplier can replace, complete, or repackage something. There is no need for any paperwork here. But in other circumstances, you need to know what documents are used to document the return of goods to the supplier.

Please be aware that the buyer’s refusal to accept the goods for the reasons listed in the list means that the sales contract is terminated. Even if the contract did not specify the reasons for termination or was not drawn up in paper form at all, the buyer can still exercise this right, because this is provided for by Civil Law. Without a contract, you will simply spend more time arguing and protecting your rights if the supplier does not consider himself to be at fault and does not want to accept the goods.

Return of defective goods from the buyer

In the buyer's accounting, the procedure for recording the return of low-quality goods depends on whether the defect was discovered immediately upon acceptance of the goods or after it was accepted for accounting.

When returning goods before they are accepted for accounting, the contract is terminated unilaterally, the goods are not accepted for registration by the buyer, and the ownership of it is retained by the seller. The buyer notifies the seller of the violation of the terms of the contract (Article 483 of the Civil Code of the Russian Federation) and accepts the goods for safekeeping. Defective goods are accepted for accounting in off-balance sheet account 002 “Inventory assets accepted for safekeeping” in the assessment according to shipping documents (by a simple debit entry to account 002). When the goods are returned to the supplier, the cost of the goods is written off from off-balance sheet accounting by a simple entry on the credit of account 002.

A separate transaction reflects the receipt of funds from the supplier for the submitted claim:

DEBIT 51 CREDIT 76 subaccount “Settlements for claims”

- funds received from the supplier for a claim.

Accounting for the return of goods before acceptance for accounting and receipt of funds requires the completion of only three business operations:

- an invoice for receipt of goods is registered;

- an invoice for writing off the goods is registered;

- The bank statement showing the receipt of funds is reflected.

If a defect is discovered after acceptance of the goods, the buyer makes a claim to the supplier for the value of the defective goods. Settlements on claims are recorded in account 76.6 “Settlements with various debtors and creditors”, subaccount “Settlements on claims”.

Typically, examples are used to consider operations for returning goods with payment after receipt of the goods.

We will look at an example of returning a product, complicating it by paying an advance to the supplier. Example 1

Riviera LLC bought a batch of nails from StroyBarier LLC (120 boxes of 3 kg each) for 25,000 rubles.

Before accepting the goods, Riviera transferred fifty percent of the cost for the goods in advance. After the goods arrived at the warehouse and were registered, it was discovered that almost all the nails were missing heads - the goods were rejected. The nails were returned to the supplier, and a claim was sent to him for the return of the previously paid advance. The accountant makes the following accounting entries: DEBIT 60 subaccount “Advances” CREDIT 51

- 12,500 rubles.

— paid to the supplier for goods (advance); DEBIT 68 CREDIT 76

- 1906.78 rub.

— VAT deduction on advance payment issued to the supplier is reflected; DEBIT 41 CREDIT 60

- 25,000 rub.

— goods received from the supplier are accepted for accounting; DEBIT 19 CREDIT 60

- 3813.56 rubles.

— input VAT is taken into account; DEBIT 60 CREDIT 60 subaccount “Advances”

- 12,500 rubles.

— the advance payment has been credited against the previously received prepayment; DEBIT 68 CREDIT 19

- 3813.56 rub.

— the supplier’s invoice is registered; DEBIT 76 CREDIT 68

- 1906.78 rub.

— VAT on advances issued has been restored; DEBIT 76 CREDIT 41

- 25,000 rub.

— goods are returned to the supplier; DEBIT 76 CREDIT 68

- 3813.56 rubles.

– VAT accrued is taken into account; DEBIT 51 CREDIT 76

- 12,500 rub.

— funds were returned according to the reconciliation report.

Return of defects from the supplier

Particular attention should be paid to accounting for the return of goods from the supplier, taking into account advance payments, because The situation under consideration is complicated by the accrual of VAT on the advance and the reflection of the deduction of VAT on advances received, which involves the implementation of the following business transactions.

Let's consider this as a continuation of example 1.

Example 2

The accountant of StroyBarier LLC makes the following entries:

DEBIT 51 CREDIT 62 subaccount “Advances”

- 12,500 rubles.

— received funds to the bank account from the buyer (advance); DEBIT 76 CREDIT 68

- 1906.78 rub.

— an invoice for the advance payment has been issued; DEBIT 62 CREDIT 90.1

- 25,000 rub.

— revenue from the sale of goods is reflected; DEBIT 90.3 CREDIT 68

- 3813.56 rub.

— VAT is charged on the shipment of goods; DEBIT 90.2 CREDIT 41

- 20,000 rub.

— reflects the cost of goods sold; DEBIT 62 subaccount “Advances” CREDIT 62

- 12,500 rub.

— the advance payment previously received from the buyer is offset; DEBIT 68 CREDIT 76

- 1906.78 rub.

— VAT deduction on advances received is reflected; DEBIT 62 CREDIT 90.1

- 25,000 rub.

— adjustment of sales (reversal); DEBIT 90.2 CREDIT 41

- 20,000 rub.

– adjustment of write-off of goods sold (reversal); DEBIT 90.3 CREDIT 19

- 3813.56 rub.

— adjustment of accrued VAT (reversal); DEBIT 62 subaccount “Advances” CREDIT 62

- 12,500 rub.

— adjustment of the offset advance (reversal); DEBIT 68 CREDIT 19

- 1906.78 rub.

— VAT has been accepted for deduction (registration of an invoice for refund); DEBIT 62 subaccount “Advances” CREDIT 51

- 12,500 rub. — money was returned to the buyer.

If the sale and return of defective goods are made in different tax periods

When a defective product is returned by the buyer, the procedure for recording transactions in the seller’s accounting differs depending on the period in which the defective product was returned (during the sales period or the next year after sale).

In accordance with paragraph 6 of PBU 9/99 “Income of the organization”, revenue is accepted for accounting in an amount calculated in monetary terms equal to the amount of receipts of cash and other property and (or) the amount of accounts receivable.

If the buyer returns a product of poor quality, the purchase and sale agreement is considered terminated in part of this product; it is considered that the ownership of the defective product has not passed to the buyer.

Based on clause 80 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, a decrease in revenue as a result of the return of low-quality goods identified in the next year is reflected as a loss identified in the reporting period. year (clause 12 of PBU 10/99 “Expenses of organizations”). In this case, corrections and (or) clarifications are not made to the financial statements of the previous year.

Let's consider the operation of returning goods sold in the previous reporting period from the supplier's perspective.

Let’s use the previous data and just imagine that the shipment and return of the defective items occur in different tax periods. Example 3

The accountant of StroyBariera must make the following entries:

DEBIT 91.2 CREDIT 62

- 25,000 rubles.

— the return of goods sold in the previous calendar year is reflected as other expenses of the reporting period; DEBIT 41 CREDIT 91.1

- 20,000 rub.

— the previously written-off cost of goods returned by the buyer was restored; DEBIT 68 CREDIT 91.1

- 3813.56 rubles.

— VAT has been accepted for deduction (registration of an invoice for return).

Reasons

Return of defects to the supplier is permitted if the defects are not indicated in advance in writing. This applies to both the entire product and individual parts. In reality, you can return it in different situations:

- products that do not meet quality standards, with visible flaws inside, on the container or box;

- differences in the amount of pieces, type, other features;

- the characteristics included in the contract do not work or are missing.

To determine discrepancies based on barcodes, volume and other parameters at the time of acceptance, it is worth installing special equipment. The use of a data collection terminal ensures that possible differences can be quickly identified - just scan the packaging to count it. After confirmation, the data will go into the database and be registered.

The presence of extra boxes, a lack of required packs, a different volume, color or similar appearance will be immediately determined by the technology. To install and configure the correct software and purchase suitable devices, you should contact Cleverence. The company will recommend quality equipment to help minimize costs and expenses due to unscrupulous contractors.

Returning goods from an individual

The procedure for returning goods purchased under a retail purchase and sale agreement is regulated by Chapter 30 of the Civil Code and the Law of the Russian Federation of February 7, 1992 No. 2300-1 “On the Protection of Consumer Rights.”

The list of goods that cannot be returned was approved by Decree of the Government of the Russian Federation of January 19, 1998 No. 55. Such goods include perfumes, textiles, jewelry, cars, etc.

In cases of lawful return of goods, the seller is obliged to accept the sold goods back and return the money to the buyer.

Example 4

Tekstil LLC sold a dress to citizen O.G. Ivanova.

at a price of 2500 rubles. The next day Ivanova returned the dress - a defect was discovered. The defective goods were returned to the store, and citizen Ivanova was reimbursed. The accountant makes the following entries in the accounting: DEBIT 76 CREDIT 90.1

- 2,500 rubles.

— revenue from the sale of goods returned by the buyer (reversal); DEBIT 90.2 CREDIT 41

- 2000 rub.

— the purchase price of the goods returned by the buyer (reversal); DEBIT 90.3 CREDIT 68

- 381.36 rub.

– VAT on the returned goods is taken into account (reversal); DEBIT 76 CREDIT 50

- 2500 rub.

— the buyer’s money was returned; DEBIT 41 CREDIT 76

- 2,000 rub.

— the goods are capitalized at the sales price; DEBIT 90.2 CREDIT 42,500

rub. — The trade markup has been restored.

What are the consequences of “reverse implementation”

Many entrepreneurs believe that since the legislation makes no mention of reverse sales as such, there is no reason to be concerned. But in practice, everything turns out completely opposite.

The consequences of such a “reverse implementation” do not look optimistic for either side. The buyer has turnover for the sale of goods and a tax base for income tax. And the seller can no longer reduce the initial sales turnover and the initial sales proceeds.

The result is that the goods remained with the seller (returned to his warehouse). In this case, both the seller and the buyer calculate VAT twice and take into account the proceeds from sales.

How to document the return of goods?

Peculiarities of document flow and exchange of goods can be enshrined in a purchase and sale or supply agreement. For example, the contract may stipulate that the return of goods is carried out on the basis of a claim, which is sent by email, fax or other accessible method; the contract may establish specifics of the costs of returning the goods, the accrual of penalties, etc.

Returning goods from the buyer requires the preparation of the following documents:

- act on the discovery of defects in the goods;

- claim.

Documents are drawn up in free form. You can use some standard acts that were previously approved by the State Statistics Committee - the form of an act on the established discrepancy in quantity and quality when accepting inventory items No. TORG-2 (for imported goods - form No. TORG-3).

If the act is drawn up in any form, then the mandatory details should be indicated in the act in accordance with Article 9 of Law 402-FZ “On Accounting”.

The act is signed by representatives of both parties (unilateral drawing up of the act is possible with the consent of the supplier or in its absence), it serves as the basis for filing claims and lawsuits. The claim to the product is signed by the buyer.

The seller must prepare the following documents:

- register the returned goods;

- issue an adjustment invoice to the buyer;

- transfer the invoice with corrections to the buyer.

If a product is returned, a correction invoice will be issued. In accordance with Article 169 of the Tax Code, it is issued when the cost of goods shipped (work performed, services provided) or transferred property rights changes. In particular, it is issued in the event of a change in price (tariff) and (or) clarification of the quantity (volume) of goods supplied (shipped) (work performed, services rendered), property rights.

The buyer must issue a delivery note to the seller for the shipment of goods received from him. This is stated in paragraph 2.1.9 of the Methodological Recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations, approved by the letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5 (hereinafter referred to as the Methodological Recommendations of Roskomtorg). It is advisable to make a note “Return of goods” on the delivery note (form No. TORG-12).

Basic Concepts

When purchasing a product for further sale (wholesale), the seller is called the supplier, and the buyer is called the counterparty. The role of the supplier can be directly from the manufacturer (manufacturer) of the product, a legal organization or an individual. In relation to the buyer, the supplier is obliged to:

- provide a certain number of purchased products of appropriate quality;

- fully satisfy legal claims regarding the acquisition from the counterparty;

- make deliveries within the terms specified in the contract, without delays.

The counterparty is obliged to accept the supplied objects and pay for everything provided to him in the manner specified in the contract: advance (preliminary) payment, upon receipt, upon sale (according to schedule).

If payment terms are violated, the seller has the right to file a payment claim against the consumer.

If the supplier fails to comply with the terms of the agreement, the buyer has the right to return the goods in whole or in part. Problems with return transfer often arise due to a lack of completeness of the delivery or non-compliance with quality parameters. The supplier and counterparty document the transaction by making the necessary accounting entries.

By the way! By agreement, it is possible to replace the purchase or eliminate violations within a specified time frame. If the seller evades fulfillment of claims, the counterparty has the right to send a statement of claim to the judicial authorities.

Documentation of goods from the seller in retail trade

When returning goods on the same day, that is, before the Z-report is taken at the checkout, the seller must:

- collect the cash receipt from the client and sign it from the manager;

- draw up a money return act in the KM-3 form;

- issue an invoice for the returned goods;

- return the money.

The invoice can be drawn up in the TORG-13 form (invoice for internal movement, transfer of goods, containers). The check signed by the manager is presented to the operating cash desk, and the money is returned to the buyer.

The check received from the buyer is attached to the act (in the KM-3 form) and submitted to the accounting department. Amounts paid for returned customers and unused cash receipts are reflected in the cashier-operator's journal in column 15. The amount of revenue for a given day is reduced by these amounts.

If the goods are returned to the seller later than the day the goods were purchased, the following documents are drawn up:

- the buyer draws up an application and attaches a cash receipt or sales receipt to it;

- the seller issues an invoice for the returned goods in two copies (one is attached to the product report, and the second is given to the buyer and is the basis for receiving a sum of money for the returned goods);

- the seller gives the buyer money and draws up a cash order;

- the seller makes accounting corrections.

Deadlines

A buyer who discovers that a purchased product is defective has the right by law to have it exchanged or fully refunded with the return of the money deposited at the checkout for the purchase. After all return documents have been completed, the buyer will write a corresponding application, and the money will be issued within 10 days.

IMPORTANT! No more than 45 days are given for repairs.

It should be remembered that when accepting the product for repair, the technician will carefully check the nature of the damage. If he discovers that the breakdown was caused by the consumer, you should not expect free repairs, and a return or exchange will also not be possible.

VAT accounting for the seller

According to the Russian Ministry of Finance, when returning goods that were not accepted for registration by the buyer, the seller issues an adjustment invoice for a decrease in value due to a decrease in the number of goods shipped. He registers this invoice in the purchase book during the period when the right to deduction arises (clause 12 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). Adjustment invoices are applied only if the buyer returns to the seller part of the goods not accepted by him for accounting. If the buyer refuses to accept the entire shipment, then the seller, in order to claim a tax deduction, registers in the purchase book his own invoice issued upon shipment of goods (see letter of the Federal Tax Service of Russia dated April 11, 2012 No. ED-4-3/6103) .

Expertise

The seller may doubt that the defect in the goods was not the fault of the buyer. In this case, he must conduct an examination and subsequently act on the basis of its results.

Initially, the seller pays for the expert’s work, since the inspection is carried out on his initiative. But when it is proven that the item was damaged by the consumer, he will have to pay for the examination. And there will be no talk of any return of such goods.

Accounting for VAT from the buyer

The buyer notifies the seller of the violation of the terms of the contract (Article 483 of the Civil Code of the Russian Federation) and accepts the goods for safekeeping. The return of goods not accepted for registration is not a sale, therefore the buyer does not prepare an invoice (clause 1 of Article 39, subclause 1 of clause 1 of Article 146, clause 3 of Article 168, clause 3 of Article 169 of the Tax Code of the Russian Federation) .

If the buyer refuses to accept the entire consignment of goods, then VAT on the invoice received from the seller is not claimed for deduction (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 7, 2007 No. 03 -07-15/29). The invoice received from the seller is not registered in the purchase book (clause 2 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

If the goods are returned partially, then the buyer claims VAT on the shipping invoice only for the part of the goods actually registered. The buyer receives an adjustment invoice from the seller for the change in price. Such an invoice is not registered by the buyer in the sales book, since there is no obligation to restore VAT under subparagraph 4 of paragraph 3 of Article 170 of the Tax Code.

T. Lesina,

accountant, for the magazine “Regulatory acts for accountants”

Help in solving practical situations

Since 2001, the Practical Accounting magazine has published articles with specific solutions and recommendations. The publication is now also available in electronic form. Get full access to all materials >>

If you have a question, ask it here >>

Ways for a client to protect his rights when a product is defective

Tax legislation relieves the consumer of the obligation to pay taxes for the purchase of low-quality goods.

The client has the right to receive justice no more than 2 years from the date of purchase of the defective product.

The decision of the trial provides for reimbursement of funds spent on goods, a lawyer, an independent examination and moral damages.

In addition to the court, Rospotrebnadzor considers the application in writing.

If the seller refuses to accept the application, send a letter acknowledging receipt and keep the postal receipt.