How to send a VAT adjustment

VAT adjustments are provided if errors were found in the primary VAT or all necessary data was not reflected. Information on sending updated VAT returns is in paragraph 2 of the Completion Procedure.

The adjusted VAT consists of:

- the declaration itself (even if the changes affected only the applications);

- applications that were previously sent to the Federal Tax Service, taking into account the changes made to them;

- other sections of the declaration and appendices to them, in case of amendments (additions) to them.

Correction number

The adjustment number in the declaration and the adjustment numbers in the VAT annexes must match. In Kontur.Extern, after clicking on the “Proceed to Send” button, the correction number from the declaration is automatically entered in the applications.

Sign of relevance

The field “Relevance indicator” is filled in only in VAT annexes. It appears if the “Adjustment number” field contains a value other than 0.

If in the corrective declaration it is necessary to submit to the Federal Tax Service a new version of the purchase book, sales book and other applications, then the Relevance Attribute must be equal to 0 - the information is not relevant. Relevance sign = 0 means that the information previously submitted to the Federal Tax Service is no longer relevant and a new version of the section is needed.

If you do not need to send a new version of the application, then the Relevance Sign should be equal to 1 - the information is current. Relevance indicator = 1 means that something other than this section is being adjusted in the adjusting declaration. The inspection already has correct information on this section.

Additional sheets

Additional sheets of the purchase book (Section 8.1) and sales book (Section 9.1) are attached only when sending adjustments.

If it is necessary to change the primary books of purchases or sales, then the changes are formalized by creating additional sheets - see Resolution 1137. For example, as part of a corrective declaration, information from the purchase book is presented with the sign of relevance = 1 - the information is current, and an appendix is added to the purchase book - section 8.1 , in which the relevance sign is set to =0 - the information is irrelevant. The sales book is adjusted in the same way.

Additional sheets are not attached if an error occurred when transferring data from the primary purchase book or sales book to information from the purchase / sales book - section 8 or 9 of the declaration. In this case, the books themselves are corrected (section 8 or 9) - you should indicate in them the correction number, which is different from zero, and the relevance indicator = 0 - the information is irrelevant. Then make all the necessary changes.

Work on mistakes

If, while keeping records or conducting an audit, the taxpayer suddenly discovered that in accounting for VAT for previous reporting periods, and therefore in the already submitted tax return, he missed important information or made errors that affected the amount of tax, then he:

- must immediately make the necessary changes and submit a corrected tax return to the Federal Tax Service. Adjusting the VAT return is especially important if the error led to an underestimation of the amount of tax payable to the budget: if the Federal Tax Service identifies such an error before the taxpayer, he will face a fine and penalty for the entire period of arrears;

- has the right to submit an amendment if the error did not lead to an underestimation of the amount of VAT payable to the budget.

The deadline for filing an updated VAT return is not regulated by law; it is submitted when the need arises.

You do not need to submit an update if:

- you used an adjustment invoice (issued yourself or received from a counterparty);

- The Federal Tax Service discovered an error during the audit and assessed additional tax.

It is very important to remember that the updated VAT return in 2020 must be submitted only in the form that was in force during the tax period in which errors were identified and changes were made. This is defined in paragraph 5 of Article 81 of the Tax Code of the Russian Federation. Therefore, according to the form approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] , corrected data can be submitted only starting from the 1st quarter of 2015. To correct errors identified in earlier periods, declaration forms approved by earlier orders of the Federal Tax Service should be used.

IMPORTANT!

An updated VAT return with an increased amount payable is submitted exclusively in electronic form.

If taxpayers are recognized as individuals

Individuals can act as taxpayers as ordinary citizens, as well as individual entrepreneurs.

The payment of a specific tax by individual entrepreneurs, as well as by organizations, depends on the applicable taxation regime.

Individuals who pay taxes as ordinary citizens (not individual entrepreneurs) are usually (if there are objects of taxation) taxpayers:

- personal income tax;

- property tax for individuals;

- land tax;

- transport tax.

Filling out an updated tax return

The procedure for filling out the clarification is regulated by an appendix to the order of the Federal Tax Service, which approves the reporting form for the corresponding tax period. Thus, by virtue of paragraph 2 of the Completion Procedure given in Appendix No. 2 to Order No. 558, the VAT clarification with additional tax payment is filled out taking into account only those pages of the primary report that the taxpayer previously sent to the Federal Tax Service. All other pages and appendices to them must be completed only if changes or additions have been made to tax accounting that affect the information to be displayed in them.

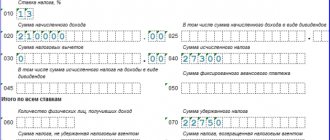

For sections 8–12 of the VAT tax return, there is even a special line 001. A sign of relevance in the updated VAT return is entered in column 3 of the information that the taxpayer shows in the corresponding section:

- if the previously submitted report did not contain information on the corresponding section or such information is being replaced, if errors were identified in the information submitted earlier, or the information was not fully reflected, it is necessary to enter the number “0”;

- if the taxpayer previously provided information under the section and it is current, reliable and cannot be changed, then it is necessary to put the number “1” and put dashes in lines 005, 010–190;

- if the report is primary for the reporting period, then a dash must be added.

A similar line is provided in the appendices to sections 8 and 9 of the tax return. It should indicate the relevance indicator “0” or “1” if this is a clarification for VAT. There is no need to put a dash, since these pages are only included in the clarified report.

What code to indicate

In the most common case, when real estate is registered as sole or common property (without children), 2 codes are used:

- the owner himself puts down taxpayer identification number 01;

- husband or wife of the owner - taxpayer sign 02.

The same codes mark the taxpayer’s attribute in 3-NDFL with common joint ownership.

Mikhail bought an apartment in 2021 and registered it in his name. Together with my wife, I decided to receive the deduction. The law allows this. When filling out the declaration, Mikhail will put code 01 in Appendix 7.

And his wife is 02.

Clause 6 of Article 220 of the Tax Code provides for the opportunity for parents to claim a deduction for minor children. When a parent bought real estate and registered it in the name of a child, he puts 03 or 04 in the declaration. Separate codes are provided for the taxpayer’s attribute in 3-NDFL for common shared property, if a person declares a deduction for himself and the child at the same time (codes 13, 14, 23, 24).

In 2021, Maria purchased a two-room apartment with her own money. She registered it for herself and her 10-year-old son Alexei in equal shares. When filling out the deduction in Appendix 7, Maria enters taxpayer attribute 13. If Maria’s husband and Alexey’s father apply for the deduction, he will indicate taxpayer attribute 23 in 3-NDFL.

An innovation in the 2018 declaration is special taxpayer identification codes for those people who want to exercise the right to transfer deductions to previous periods. This opportunity is provided to pensioners in accordance with clause 10 of Article 220 of the Tax Code. These are codes 04, 11, 12, 14, 24. They seem to duplicate the meanings of the other codes described above.

Formation of sections

The primary report must have a title page and section 1. The remaining sections 2–12 and appendices to 3, 8 and 9 must be completed and included in the report only if the corresponding transactions were carried out during the tax period. Therefore, if the primary report contained, for example, sections 1, 2, 3, 7 and 9, then the clarification submitted as part of the same transactions performed must contain them.

If it is necessary to make corrections to the purchase book, for example, to cancel an entry on an invoice, then he must be guided by the requirements of Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. It follows from it that all changes and amendments in the book of sales and purchases that need to be made after the end of the tax period should be made by inserting additional sheets. As follows from the legislation, the report in Appendix 1 to Section 8 and Appendix 1 to Section 9 is adjusted to reflect information from additional sheets of the sales book and purchase book. Correct the purchase book and fill out the indicated applications.

If the taxpayer made such amendments, then as part of the clarification, in addition to the main sections 1, 2, 3, 7 and 9, previously presented as part of the primary reporting form, it is necessary to submit Appendix 1 to Section 8 with additional sheets from the purchase and sale books.

In order to save taxpayers from duplicating data when correcting it, the Federal Tax Service allows the use of the relevance indicator. This permission is due to the huge volume of data transferred under sections 8–12. If there are no changes or clarifications, leave it blank. The relevance indicator is “1”. This means that the Federal Tax Service will automatically save the data from the previous reporting form for the same period. If there is a need to make changes to all sections, then the relevance indicator “0” is set for all sections, and then the updated data is uploaded, which will be used for tax control purposes.

Using the relevance sign allows taxpayers to independently generate the number of clarification sections, information on which will be changed in the Federal Tax Service database. This applies even to interrelated sections, provided that an error was made in only one of them in the previous tax period. In addition, the Federal Tax Service allows the taxpayer the right to refuse to correct the appendices to sections 8 and 9, even if they are marked “0” and the information is re-uploaded.

However, such permission from the tax authorities contradicts the rules for maintaining a purchase book and a sales book approved by the Government of the Russian Federation. Considering this approach of officials to the procedure for reflecting changes in tax accounting documents, it is recommended to completely unload corrections from the books rather than receive a punishment if suddenly, after an inspection by the Federal Tax Service, the case is considered in court.

It should be noted that it is almost impossible to find an example of filling out a clarification that is suitable for all situations, since everyone’s errors are different. Therefore, if explanations are needed for the updated VAT return, the sample can only be found in the instructions for the regular report form, by analogy.

If you generate reports in the “Taxpayer Legal Entity” program, we will briefly tell you how to make an updated declaration in the Taxpayer: after generating the main declaration, the “U” button is available, which offers various options:

- creating an adjustment;

- change of correction number;

- deletion of declaration.

Select “Add updated calculation”, enter the update number.

When it doesn’t make sense to fill out sheet D1

In some situations, even if the taxpayer's identification is entered correctly and the declaration is completed in accordance with all the requirements established by the current tax legislation, the income tax refund will still not be realized. This applies to the following cases:

- Receiving a property deduction. As a rule, a personal income tax refund for the purchase of any type of housing (or land), as well as for expenses associated with the repair work of these objects or their construction, is provided to individuals once.

- Buying a home from relatives. Those individuals who are relatives (namely spouses, parents of the owner of the property, children of the owner, as well as his brothers or sisters) and who carried out a transaction for the purchase and sale of property are not entitled by law to take advantage of an income tax refund. This restriction also applies to individuals connected by business relationships, for example, an employer-subordinate.

- Documents for deduction are not certified. As you know, a tax return is accompanied by a whole package of documentation confirming the accuracy of the information written in it. However, only some of them need to submit originals, and for most documents, copies must be made and submitted. However, if the copy is not certified, the document will not have legal force, so we strongly recommend that you do not forget about this.

[email protected] came into force. It is applied starting with reporting for 2021. The order approved a completely new declaration form. So even those citizens who have filled out 3-NDFL before may encounter some difficulties. In this article we will tell you how and on what sheet to correctly indicate the taxpayer’s attribute in 3-NDFL.

Errors that do not affect the tax amount

If a taxpayer discovers errors in tax accounting that do not affect the amount of tax payable, he has the right not to submit a corrected report. But, if errors were made in the invoice journal, which from January 1, 2015 organizations are required to keep when issuing and receiving invoices in cases of carrying out business activities in the interests of other persons on the basis of agency agreements or commission agreements and when performing functions developer, it is better to submit a clarification. The procedure for maintaining accounting logs is defined in Article 169 of the Tax Code of the Russian Federation.

It should be remembered that no fine is provided for by law for an updated VAT return, but its absence can lead the taxpayer to large fines for errors made and not corrected in a timely manner.

If the tax agent decides to clarify the information from sections 10 and 11 of the declaration, then the sign of relevance cannot be applied to it. It is necessary to re-upload all information from the section being changed. The possibility of changing the data of the invoice journal itself, provided to the Federal Tax Service in Decree of the Government of the Russian Federation No. 1137, is not provided. Providing updated data that does not affect the amount of tax is necessary to avoid a possible dispute with the Federal Tax Service if inconsistencies in accounting and reporting data are identified during an audit.

Taxpayer sign in 3 personal income tax

As is known, a property tax discount can be accrued not only to individuals who are owners of real estate, but also to individuals related to them by close forms of kinship - husband, wife, children, including those who have not reached the age of majority, as well as parents. In addition, a tax discount is provided even for those property objects that are owned in shared ownership.

Please note that legal regulations are subject to change. Last year there were only two signs of a taxpayer, while now there are more. In this regard, to obtain reliable information, you should refer to the primary source: the appendix to the relevant order of the Ministry of Finance of the Russian Federation.

New form 3-NDFL

- 01 - owner of the object;

- 02 - spouse of the owner of the property;

- 03 - parent of a minor child - owner of the property;

- 13 - a taxpayer claiming, according to the Declaration, a property deduction for expenses associated with the acquisition of an object in the common shared ownership of himself and his minor child (children);

- 23 - a taxpayer claiming a property deduction on the Declaration for expenses associated with the acquisition of an object in the common shared ownership of the spouse and his minor child (children).

Recommendations for users of 1C:Enterprise programs

- Carefully study all changes in the rules for issuing invoices and registering them in sales books and purchase books.

- Pay special attention to accounting for VAT on intermediary transactions, calculations of advances, and the formation of books of purchases and sales.

- Familiarize yourself with the procedure for filling out a new VAT return, understand for yourself which sections need to be submitted depending on the transactions performed.

- Organize interaction with the Federal Tax Service directly, without lengthy uploads and downloads to third-party applications directly in 1C: Accounting 8 and other programs that include the 1C-Reporting service.

- Use electronic document management systems (1C-Taxcom) built into the 1C:Enterprise programs. This will significantly reduce the risk of discrepancies in the purchase and sales books of interacting counterparties.

- Regularly carry out VAT reconciliation with counterparties using the new capability of the VAT subsystem for automatic reconciliation of invoices.

- Carry out a thorough check of counterparties in the Federal Tax Service databases using the 1C: Counterparty service: when including a new counterparty in the 1C: Accounting 8 directory, when preparing documents, when generating declarations.

- Keep track of the most significant changes in legislation regarding VAT.

- Keep abreast of news, receive up-to-date and reliable information on supporting the new order in the 1C:ITS information system, on the website buh.ru, in the magazine BUH.1C.

Taxpayer identification in 3-NDFL

- 01 - directly the owner of the apartment (house) for which the deduction is issued;

- 02 - the spouse of the person who bought the home, applying for a refund of personal income tax;

- 03 - one of the parents of a minor child in whose name the residential property was purchased;

- 04 - the premises are in common shared ownership of the applicant and his children under 18 years of age;

- 05 - a family member receives a refund for housing registered as the property of the spouse and children.