Insurance premiums for individual entrepreneurs without employees: new calculation for 2021

This year, legislators have significantly adjusted Article 430 of the Tax Code of the Russian Federation, on the basis of which individual entrepreneurs and other self-employed persons calculate insurance premiums for themselves.

As we all remember, in 2021, as in previous years, the amount of insurance premiums for entrepreneurs directly depended on the minimum wage indicator and was calculated using the following formula:

(minimum wage * StStrVzn) / 12 months. * PeriodDay,

where the minimum wage is an indicator of the minimum wage valid in the reporting period; StStrVzn – fixed rate of insurance premiums for individual entrepreneurs working independently – 26%; Activity Period – the period of actual activity, determined from the moment of registration to the moment of deregistration as an individual entrepreneur (in months).

Calculation of insurance premiums for reporting periods from 2021 to 2021. is carried out on the basis of an established indicator, in proportion to the period of actual registration:

Fixed rate / 12 months * PeriodDay,

where FixRate is a fixed rate of insurance premiums based on Art. 430 Tax Code of the Russian Federation; Activity Period – the period of actual activity, determined from the moment of registration to the moment of deregistration as an individual entrepreneur (in months).

Art. 430 of the Tax Code of the Russian Federation determines a fixed rate in the following amounts:

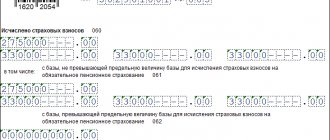

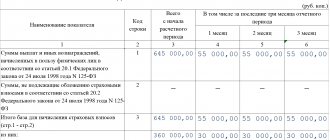

| No. | Type of insurance premium | 2021 | 2021 | 2021 |

| 1 | Insurance premium for compulsory pension insurance (OPI) | RUR 26,545 | RUR 29,354 | RUR 32,448 |

| 2 | Insurance premium for compulsory medical insurance (CHI) | RUR 5,840 | RUR 6,884 | RUB 8,426 |

Individual entrepreneurs without employees do not pay the insurance premium for compulsory social insurance.

Deadlines for filing tax returns

All individual entrepreneurs submit tax reports. But how often they should do this and what documents to send to the Federal Tax Service depends on the taxation system.

The financial result of an entrepreneur’s activities for the reporting period does not always affect the amount of tax due for payment. For individual entrepreneurs on OSNO, simplified taxation system and unified agricultural tax, if there is a zero or negative result of economic activity, the tax amount will also be zero. For businessmen on the patent system and UTII, the tax amount is calculated based on natural indicators and does not depend on the amount of income. The profitability factor does not affect the reporting procedure.

The law provides for five taxation systems for individual entrepreneurs:

- General (OSNO).

- Simplified (USN).

- Unified tax on imputed income (UTII).

- Patent taxation system (PTS).

- Unified Agricultural Tax (USAT).

Reporting requirements for businessmen working on one system or another are different.

The general rule is that declarations are submitted at the end of the reporting period (year or quarter). The deadline for quarterly reporting is the first month of the next quarter, and the annual reporting deadline is the end of March or April of the next year.

BASIC

The state collects the most taxes from individual entrepreneurs on the general system:

- For personal income (personal income tax).

- Value added (VAT).

- At a profit.

The deadline for filing a 3-NDFL declaration for individual entrepreneurs is the same as for individuals - until April 30.

They report VAT every quarter:

- until March 25,

- until June 25,

- until September 25,

- until December 25th.

They do not have to report property taxes, and the deadline for payment is December 15.

To work for OSNO, a businessman should get a competent accountant

simplified tax system

Individual entrepreneurs using the simplified form declare their income and, if applicable, expenses for the past year by April 30.

UTII

Individual entrepreneurs who pay “imputation” report quarterly.

In 2021 they have the following target dates:

- until April 20 for the first quarter of 2021,

- until July 20 for the second quarter,

- until October 22 for the third quarter,

- until January 21, 2021 for the fourth quarter of 2021.

PSN

There is no need to submit any reports at all, you only need to pay the cost of your patent on time. However, the situation changes as soon as the individual entrepreneur begins to use hired labor. He submits all reports for his employees on a general basis.

Unified agricultural tax

Entrepreneurs and peasant farms (peasant farms) paying the unified agricultural tax submit a declaration by March 31.

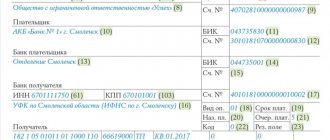

Reporting on insurance premiums for individual entrepreneurs without employees in 2021

In 2021, we retained a loyal procedure for entrepreneurs for compiling and submitting reports on insurance premiums. Below we will analyze whether an individual entrepreneur without employees needs to submit basic reporting forms to regulatory authorities - SZV-M, SZV-Stazh, RSV and F-FSS

SZV-M

The SZV-M report is the main element of individual personalized accounting and is used to calculate the insurance periods of persons recognized as insured under the compulsory pension insurance system.

The SZV-M report reflects the following information about the insured persons:

- FULL NAME;

- SNILS;

- TIN.

This report does not contain information on the amounts of paid income and accrued insurance premiums.

The SZV-M report form can be downloaded here ⇒ SZV-M form.

Based on current legislation, the SVZ-M report is filled out by employers who are insurers in relation to full-time employees or hired workers.

If an individual entrepreneur or other self-employed citizen works independently, then he does not need to submit a SZV-M report. Also, entrepreneurs do not submit the SZV-M report for themselves.

If, in the course of conducting business, an individual entrepreneur hired an employee under a contract for a certain period, then during the period of validity of the contract, the entrepreneur is obliged to submit an SVZ-M report to the Pension Fund of the Russian Federation. The report is submitted to the territorial body of the Pension Fund of the Russian Federation at the place of registration of the individual entrepreneur on a monthly basis before the 15th day of the month following the reporting month.

If there is a valid contract, the individual entrepreneur is required to submit a report monthly from the moment of conclusion of such a contract until the moment of termination (expiration). The procedure under which the individual entrepreneur makes payments under the contract does not affect the submission of the SZV-M report.

Reporting on other taxes

All individual entrepreneurs with employees must submit information on the average number of employees to the Federal Tax Service once a year. This must be done before January 20.

In addition to the listed types of taxes, an individual entrepreneur must pay taxes if there are certain objects. For example, property, transport, land. Declarations must also be drawn up for these objects and sent to the Federal Tax Service. Deadlines for reporting and paying taxes can be found in the relevant chapters of the Tax Code.

What kind of reporting an individual entrepreneur submits can be determined by the taxation system. Submitting individual entrepreneur reports on time will save the businessman from penalties.

What reports on insurance premiums are submitted by individual entrepreneurs with hired employees?

Entrepreneurs with employees or full-time employees submit the following forms of reporting insurance premiums:

- SZV-M monthly until the 15th day of the month following the reporting month. If an employee is hired and fired within a year, the individual entrepreneur submits a report to the Pension Fund on a monthly basis from the moment the employee is hired until the day of dismissal.

- SZV-Experience annually until March 1 of the year following the reporting year. The report includes all employees who were hired (dismissed) during the year under employment contracts or GPC agreements.

- 4-FSS quarterly until the 25th day of the month following the reporting quarter. The report is submitted only by those individual entrepreneurs who, during the reporting quarter, hired (dismissed) employees on the basis of employment contracts.

- EDV-1 within 3 days from the date of receipt of an employee’s statement of desire to retire.

The EFA-1 report form can be downloaded here ⇒ EFA-1 form.

Types of individual entrepreneur reporting

In 2021, individual entrepreneurs must report to the following organizations:

- Tax Inspectorate (FTS).

- Pension Fund (PFR).

- Social Insurance Fund (SIF).

- Statistical authorities (Rosstat).

But this does not mean that all individual entrepreneurs are required to submit reports to each of them.

All entrepreneurs are required to report only to the tax office

The number of government agencies to which a particular individual entrepreneur must report is determined by the characteristics of its activities.

Two factors play a key role:

- The taxation system used by the individual entrepreneur.

- The presence or absence of hired workers.

Let's sum it up

The activities of an individual entrepreneur require attentiveness and law-abidingness. Moreover, the Government of the Russian Federation, the tax department and funds are working to reduce the red tape for entrepreneurs with papers and reports.

Therefore, an individual entrepreneur without employees does not need to submit a report to the Pension Fund even for himself. It is enough to pay your fees on time to avoid extraordinary checks and fines. Individual entrepreneurs operating in the field of farming and agriculture attract the most attention. Only in this case is a report required to the Pension Fund for oneself in the RSV-2 form, relevant for 2021.

Accounting statements of individual entrepreneurs on a patent

The tax return under PSN is not submitted at all. The tax is calculated immediately upon payment of the patent. The patent itself is purchased for a period of 1 to 12 months.

At the same time, maintaining KUDIR is mandatory.

It is worth considering that the list of types of activities suitable for the patent taxation system is strictly limited, so if you have several areas of work and one of them does not fit under the PSN, you will need to additionally conduct accounting in another, suitable system.

The system is intended exclusively for entrepreneurs.

SZV-TD

According to the new form SZV-TD, information about the labor activity of a person registered in the compulsory pension insurance system is transmitted to the Pension Fund (Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p). They are necessary for the formation of so-called electronic work books. This is a new standard that is being implemented in Russia from 2021. Over time, it is planned to convert all personnel records into digital format.

Initially, it was established that in 2021 it will be possible to submit SZV-TD in the same way as SZV-M - until the 15th of the next month. But adjustments to this rule were made by the possible coronavirus pandemic.

The fact is that in order to remotely register citizens as unemployed and assign them benefits, up-to-date information about their work activity is required. Therefore, the Government of the Russian Federation, by its resolution No. 460 dated April 8, 2020, introduced temporary rules for registering the unemployed. Among other things, the deadline for submitting the SZV-TD was postponed: this report must be sent to the Pension Fund of Russia in 2021 no later than the next working day after the issuance of the order or instruction on the personnel event.

In other words, submitting a SZV-TD in 2021 is necessary on the next business day after the dismissal, transfer or hiring of an employee.

Fines for violations

If you do not submit reports to the Pension Fund or are late with the deadlines, a fine of 500 rubles will be imposed for each insured person. The same penalty applies for providing incomplete or unreliable information. The principle is this: forgot to submit a report for one employee - a fine of 500 rubles, for two - 1,000 rubles, and so on.

If you violate the presentation format, that is, send documents on paper if the number of insured people is more than 25, the fine will be 1,000 rubles. Another reason for imposing sanctions is violation of labor law (Article 5.27 of the Administrative Code). Upon dismissal, the employer must provide the individual with a number of documents, including an extract from SZV-M and SZV-STAZH. If they are not provided, the fine for the official and individual entrepreneur will be 1,000 - 5,000 rubles, for the organization - 30,000 - 50,000 rubles.

So, mandatory reporting to the Pension Fund in 2021 is presented in only a few forms, which, at first glance, is not much. However, you will have to report at least monthly, and even more often if there are personnel changes. This frequency makes submitting documents to the Pension Fund the most time-consuming part of all reporting work for each employer. Only individual entrepreneurs without employees are in an advantageous position - they do not have to report to the Pension Fund for their insurance premiums.

What is KUDiR

KUDiR ㅡ book of accounting of income and expenses, necessary for participants of the simplified tax system. Entries are made in the book in accordance with the requirements of Order of the Ministry of Finance of Russia No. 135 n dated October 22, 2012 (as amended on December 7, 2016). The document includes a title page and five sections, which reflect:

- sales revenue and costs of the enterprise;

- calculating the costs of purchasing and creating funds, which are taken into account when calculating the tax base;

- calculation of the loss in the total amount, which leads to a reduction in the duty;

- other expenses that reduce the amount of tax;

- a trade tax that reduces the tax that is calculated to be paid.

Depending on the type of “simplified” document, the entrepreneur fills out different departments of KUDiR. On “income” ㅡ 1 and 4, on “income minus expenses” ㅡ 1, 2, 3. The fifth is drawn up by entrepreneurs who are subject to the trade fee.

KUDiR is maintained electronically or on paper. Every year a businessman starts a new book, and prints out the old one, laces it and numbers it. On the final page, the end date is indicated, the entrepreneur puts a signature and, if any, a seal.