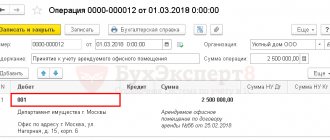

Tax agent – tenant of state property

In accordance with paragraph 3 of Art. 161 of the Tax Code of the Russian Federation, when leasing federal property, property of constituent entities of the Russian Federation and municipal property (hereinafter we will use the general term “state property”), you become a tax agent if the lessor is:

- A body of state power and administration or a local government body.

- A body of state power and administration (local self-government) and at the same time the balance holder of this property, which is not a body of state power and administration or a local government body. In this case, as a rule, a tripartite agreement is concluded between the owner of the property represented by the relevant body (lessor), the balance holder of the property (unitary enterprise) and the tenant (Resolution of the Federal Antimonopoly Service of the Ural District dated October 21, 2008 No. F09-7682/08-S2, dated June 25. 2008 No. Ф09-4562/08-С2 (left in force by the decision of the Supreme Arbitration Court of the Russian Federation dated November 26, 2008 No. VAS-12243/08)).

It doesn't matter:

- what tax regime do you apply: general or special (see letters of the Ministry of Finance of Russia dated September 24, 2015 No. 03-07-11/54577, dated December 30, 2011 No. 03-07-14/133, dated October 5, 2011 No. 03-07- 14/96);

- whether the rent is transferred in cash or offset by the performance of work or the provision of services to the lessor (letter of the Ministry of Finance of Russia dated April 16, 2008 No. 03-07-11/147).

If you sublease state property, you must calculate and pay VAT as a tax agent - on the basis of clause 3 of Art. 161 of the Tax Code of the Russian Federation, and as a taxpayer - from the sale of services for the provision of property for sublease (letter of the Ministry of Finance of Russia dated October 18, 2012 No. 03-07-11/436).

When the tenant's agent duties do not arise

There is no need to pay “agency” VAT:

- If the lessor is:

- government agency.

The fact is that the services provided by these institutions (including rental services) are not subject to VAT taxation (subclause 4.1, clause 2, article 146 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 17, 2014 No. 03-07-14/65191 , dated September 19, 2014 No. 03-07-14/46917, dated March 24, 2013 No. 03-07-15/12713 (sent for information and use in work by letter of the Federal Tax Service of Russia dated April 21, 2014 No. GD-4-3/7605) ;

See also the material “The Federal Tax Service reminded when the duties of an agent do not arise when renting government property.”

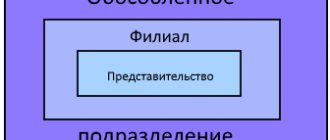

- balance holder of property that is not a body of state power or local government.

In such a situation, the amount of rent, including VAT, is transferred to the lessor-balance holder, who independently pays VAT to the budget (see letters of the Ministry of Finance of Russia dated May 12, 2017 No. 03-07-14/28624, dated July 7, 2016 No. 03-07-14 /39827, dated 05/06/2016 No. 03-07-11/30226, dated 12/28/2012 No. 03-07-14/121, dated 07/23/2012 No. 03-07-15/87, determination of the Constitutional Court of the Russian Federation dated 10/02/2003 No. 384-O, resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated March 11, 2012 No. A43-7468/2011). The balance holder pays VAT independently even if he rents it out free of charge (letter of the Ministry of Finance of Russia dated April 26, 2010 No. 03-07-11/147).

- When renting structural elements of buildings.

Individual structural elements of buildings, such as the roof or walls, cannot be leased, since they are not independent real estate objects (clause 1 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 11, 2002 No. 66). Therefore, when providing for the use of such parts of state real estate (for example, places on the roof for installing equipment or fragments of a wall for advertising), the rules of clause 3 of Art. 161 of the Tax Code of the Russian Federation do not apply. VAT on the sale of these services is paid by state authorities or local governments (letter of the Ministry of Finance of Russia dated October 22, 2012 No. 03-07-11/442).

Declaration form and filling procedure

Starting from the 1st quarter of 2021 until the report for 9 months of 2021, the tax agent must submit a VAT return on a form, the form of which was approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3 / [email protected] The same order of the Federal Tax Service contains a description procedure for filling out a VAT return (hereinafter referred to as the Procedure).

As of the reporting campaign for the 4th quarter of 2021, changes have been made to the declaration form. ConsultantPlus experts told us what changes the form has undergone. Study the review material by getting trial access to the K+ system for free.

Recent changes to the form are mainly due to code changes. They did not touch upon the specifics of filling out a report by tax agents, which we will consider further.

The title page of this document, as well as sections 1 and 2 (paragraphs 3, 8, 9 of clause 3 of the Procedure) are required to be completed in the VAT return for the tax agent. Plus, tax defaulters who act as tax agents and issue invoices fill out Section 12 (paragraphs 5–7, clause 3, clause 51 of the Procedure).

For more information about who may be a tax agent, read the article “Who is recognized as a tax agent for VAT (responsibilities, nuances)” .

Section 2, devoted to the VAT of the tax agent, in the VAT return is drawn up separately for each organization in respect of which the taxpayer is recognized as a tax agent. Examples of situations for filling out a VAT return by a tax agent include its execution for each foreign entity - a tax evader from whom goods (services) were purchased, for each lessor - municipal (state) body, seller of state property (clause 36 of the Procedure). That is, section 2 of the tax return can be completed on several pages if transactions took place with several partners.

The tax agent can reflect VAT deductions in the declaration after paying the tax to the budget - to do this, fill out line 180 in section 3 (clause 38.17 of the Procedure). Moreover, you can fill out sections 2 and 3 at once if the purchase of goods (for example, from foreigners) and the transfer of tax to the budget occur in the same period (letter of the Ministry of Finance of Russia dated October 23, 2013 No. 03-07-11/44418).

And although there is a position of the Federal Tax Service indicating that the right to deduction arises for the tax agent only in the reporting period following the payment of tax to the budget (letter dated 09/07/2009 No. 3-1-10 / [email protected] ), you can refer to judicial practice , which the letter of the Federal Tax Service dated September 14, 2009 No. 3-1-11/730 calls for. There are just such court decisions that confirm the taxpayer’s right to a deduction during the tax payment period (resolutions of the Federal Antimonopoly Service of the North-West District dated January 28, 2013 No. A56-71652/2011, No. A56-38166/2011 dated March 21, 2012, FAS Moscow District dated March 29, 2011 No. KA-A40/1994-11).

For more information about the procedure for obtaining a deduction by a tax agent, read the material “How can a tax agent deduct VAT when purchasing goods (work, services) from a foreign seller .

When drawing up a report, tax agents must rely on the rules for calculating the tax base specified in Art. 161 Tax Code of the Russian Federation. The declaration is drawn up on the basis of books of purchases, sales and information from the accounting registers of the tax agent.

Tax returns are submitted by tax agents in electronic format. However, there is an exception. Thus, those exempt from paying tax (or VAT defaulters) who have become tax agents can submit a declaration in person or send it with a list of attachments by mail (letter of the Federal Tax Service dated January 30, 2015 No. OA-4-17 / [email protected] ).

Read more about the conditions when persons exempt from paying tax (or VAT evaders) who become tax agents may not fall under this exception.

All tax agent registration details are indicated on the title page. The declaration is signed by an authorized person of the enterprise. When submitting a declaration by a representative on behalf of the taxpayer, the data of this representative (position, full name and power of attorney number) are indicated on the title page and his signature is affixed.

Tax agent – buyer of treasury property

When purchasing state or municipal property, the duties of a tax agent arise only if the following conditions are simultaneously met (paragraph 2, paragraph 3, article 161 of the Tax Code of the Russian Federation):

- the seller (transferring party) is a state authority or local government authority;

- the property constitutes the treasury of the Russian Federation, a constituent entity of the Russian Federation or a municipal entity, i.e. is not assigned the right of economic management or operational management to a specific state or municipal institution (enterprise);

- This operation is recognized as an object of VAT taxation in accordance with paragraphs. 1, 2 tbsp. 146 Tax Code of the Russian Federation;

- the buyer is a legal entity or an individual entrepreneur (letters of the Ministry of Finance of Russia dated August 2, 2010 No. 03-07-14/55, dated December 14, 2009 No. 03-07-14/114). Individuals who are not engaged in entrepreneurial activities are not assigned the duties of tax agents, and VAT is paid to the budget by sellers of the specified property (decision of the Constitutional Court of the Russian Federation dated July 19, 2016 No. 1719-O (given in paragraph 14 of the Review of Legal Positions sent by a letter from the Federal Tax Service of Russia dated 12/23/2016 No. SA-4-7/ [email protected] ), letters of the Ministry of Finance of Russia dated 11/08/2012 No. 03-07-14/107, Federal Tax Service of Russia dated 07/13/2009 No. ШС-22-3/ [email protected] , Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 8, 2014 No. 17383/13).

Responsibility

Attention: if the tax agent transfers VAT to the budget later than the established deadlines, the tax inspectorate may charge penalties (Article 75 of the Tax Code of the Russian Federation). If failure to withhold (incomplete withholding) and (or) non-transfer (incomplete transfer) of tax to the budget is revealed as a result of an audit, the organization (its employees) may be brought to tax, administrative, and in some cases, criminal liability (Article 123 of the Tax Code of the Russian Federation, Article 15.11 of the Code of Administrative Offenses of the Russian Federation, Article 199.1 of the Criminal Code of the Russian Federation).

The tax inspectorate cannot fine a tax agent under Article 122 of the Tax Code of the Russian Federation. Only taxpayers can be held liable under this article. It is they who are entrusted with the obligation to pay legally established taxes (subclause 1, clause 1, article 23 of the Tax Code of the Russian Federation). The responsibilities of tax agents are to correctly and timely calculate the amount of tax, withhold it from the income of the counterparty (taxpayer) and transfer it to the budget (clause 3 of Article 24 of the Tax Code of the Russian Federation). For failure to fulfill these obligations, they may be held liable under Article 123 of the Tax Code of the Russian Federation. Any other classification of violations committed by a tax agent is unlawful (Article 106 of the Tax Code of the Russian Federation).

Bringing a tax agent to justice under Article 123 of the Tax Code of the Russian Federation does not relieve him of the obligation to transfer to the budget the amount of withheld VAT and penalties (clause 5 of Article 108 of the Tax Code of the Russian Federation). For information on the tax agent’s obligation to transfer amounts of unwithheld VAT to the budget, see What rights and responsibilities does a tax agent have?

If within a month the tax agent does not inform the tax office about the impossibility of withholding VAT, a fine may be collected from him either under Article 126 or under Article 129.1 of the Tax Code of the Russian Federation.

Results

Regardless of the taxation regime, organizations or individual entrepreneurs, when purchasing state property or leasing it, become tax agents. However, in order to acquire the status of a tax agent when making transactions with state property, it is also necessary to comply with certain conditions discussed in the article.

In what cases can an organization or individual entrepreneur be recognized as a tax agent and what obligations arise in this case, read the article “Who is recognized as a tax agent for VAT (responsibilities, nuances).”

You can learn about how a tax agent fills out a VAT return from the following articles:

- “How to correctly fill out a VAT return for a tax agent?”;

- “How can a tax agent fill out Section 2 of the VAT return correctly?”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.