In this article, 1C experts talk about setting up in “1C: ZUP 8” edition 3 types of calculation of bonuses - codes for types of personal income tax income and categories of income in the case of payment of a monthly bonus, one-time bonus and anniversary bonus (paid from the company’s profits) for correct reflection in personal income tax reporting.

How to set up “1C: Salary and Personnel Management 8” edition 3 so that the calculation of 6-NDFL correctly reflects different cases of an employee receiving a bonus, taking into account standard deductions for personal income tax, read here.

Where to get codes from

The required bonus code in the 2-NDFL certificate, as well as for the bonus for length of service, is taken from Appendix No. 1 to the order of the Tax Service of Russia dated September 10, 2015 No. MMV-7-11/387.

It is important to note that the tax department periodically reviews this regulatory document. Thus, the bonus code in 2-NDFL 2017 and bonuses for length of service should be indicated according to the edition dated December 26, 2016 (Federal Tax Order No. ММВ-7-11/63 dated November 22, 2016).

For more information, see “New income and deduction codes for 2-NDFL certificates from December 26, 2021.”

One-time bonus (amount as per order)

The size of the one-time bonus can be determined in two ways: as a share of earnings or as an amount by order. If both cases of calculation are possible, then select the last option “apply both methods”.

Next, you need to choose when we will calculate this bonus: during the month or when calculating salaries, and also indicate the personal income tax income code. Specify the duration of the calculation interval for which the data will be taken.

The program will create a one-time bonus (amount), where there will be a formula for the amount and the document “Premium”.

Personal income tax income codes change periodically, so as not to miss the latest configuration update and submit your reports without errors and on time, enter into a support agreement with the First Bit company.

Help 2-NDFL: what is the bonus code?

In a letter dated August 7, 2021 No. SA-4-11/15473, the Russian Tax Service explained which bonus code to put in the 2-NDFL certificate for 2021, as well as the long-service allowance. This letter is especially valuable because both bonus codes are completely new. They appeared in the Federal Tax Service order No. ММВ-7-11/387 only from December 26, 2016. And the length of service code is valid in the new edition from the same date.

As is known, the employer has the right to issue bonus amounts both for the results of the work of a particular employee over a certain period of time, and not directly related to this. For example - on some holidays, as a financial incentive, etc. It is necessary to pay attention to the basis for calculating bonuses, since the income code - bonuses - in the 2-NDFL certificate is differentiated depending on the reason for its issuance.

The table below sets out the position of the Federal Tax Service of Russia regarding the income code for bonuses in 2-NDFL.

| What is the award code in the 2-NDFL certificate? | What does it mean | Explanation of the Federal Tax Service of Russia |

| 2002 | Bonus payments for production achievements and other similar indicators provided for: · by law; · employment agreements (contracts); · and/or collective agreements. A prerequisite is that the source of such bonuses is not: · profit of the enterprise; · special purpose equipment; · target revenues. | This income code reflects: · bonuses based on work results for the month/quarter/year; · one-time bonuses for particularly important tasks; · prizes dedicated to the awarding of honorary titles, state and departmental awards; · bonuses for production achievements in work. |

| 2003 | Remuneration due to: · enterprise income; · special purpose equipment; · targeted revenues. | This income code shows: · bonuses for anniversaries and holidays; · additional financial incentives; · other bonuses not related to the performance of job duties. |

Also see “Table with a breakdown of income codes for 2-NDFL in 2021.”

The Federal Tax Service believes that the monthly bonus for an employee’s work performance should be reflected using the income code “2002”.

How to set up types of bonus calculations in “1C: ZUP 8” ed. 3

Starting with version 3.1.5.170 in the 1C: Salary and Personnel Management 8 program, edition 3, the settings of calculation types for which Bonus is selected as the Accrual Purpose have been changed. The date of actual receipt of income for the bonus is determined depending on the Income Category. The income category is indicated in the calculation type card on the Taxes, contributions, accounting tab and can take the following values:

- Salary;

- Other income from employment;

- Other income.

For an accrual with the income category Remuneration, the last day of the month for which this accrual was made is set as the Date of actual receipt of income in the 6-NDFL report.

For other accruals, the date of actual receipt of income in the 6-NDFL report is the day of actual payment of income to the employee.

The categories available for selection are determined by the Income Type settings for personal income tax. If the Income Type card for personal income tax has the Corresponds to wages flag selected, then the Income Category can be selected:

- Salary;

- Other income from employment.

If the type of income for personal income tax does not correspond to wages (the flag is not checked), then the following categories are available for selection:

- Other income from employment;

- Other income.

Setting up personal income tax types

It is recommended in the Types of Personal Income Tax directory to set the flag Corresponds to wages for income with the code “2002” and not to set it for income with the code “2003” (Fig. 1).

Rice. 1. Setting up personal income tax income types

Rice. 2. Setting up a bonus for production results

Setting up income categories

For bonuses for production results, you should set the Income Code to “2002” and, depending on the frequency of the bonus, select the Income Category from the options:

- Salary;

- Other income from employment (see Fig. 2).

Rice. 3. Setting up a bonus paid from the organization’s profits

For bonuses paid from the organization’s profits, special-purpose funds or targeted income, the Income Code 2003 should be set.

You are given a choice of Income Category from the following options:

- Other income from employment;

- Other income (see Fig. 3).

Rice. 4. Document “Award”

Both categories register the date of actual receipt of income in the 6NDFL report on the day of actual payment of income to the employee.

Please note that clarifying the category in this case is important for choosing the personal income tax rate for non-residents. A tax at a rate of 13% on such a premium for non-residents in accordance with paragraph 3 of Article 224 of the Tax Code of the Russian Federation is calculated in the program if the categories of income are Other income from labor activities.

Let's look at examples of setting up bonuses in the 1C: Salaries and Personnel Management 8 program, edition 3, and how they are reflected in the calculation of 6NDFL.

Example 1

| A monthly bonus for January in the amount of 10,000 rubles, configured in accordance with the above recommendations, was accrued and paid to the employee during the interpayment period on February 15, 2018. |

The monthly bonus with the Income Code “2002” and the Income Category “Wages” is calculated according to a separate document. The bonus is stated as monthly. The month based on the results of which it is calculated, in order to determine the Date of actual income - January 2018, is indicated in the Month field (Fig. 4).

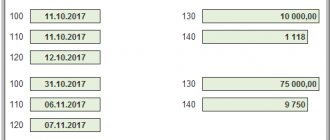

Consequently, in Section 2 of the 6NDFL report for the first quarter of 2021, the monthly premium for January is displayed in the lines:

100: 31.01.2018

110: 15.02.2018

120: 16.02.2018

130: 10,000 rub.

140: 936 rub.

Example 2

A one-time bonus with Income Code “2002” and Income Category “Other income from employment” is accrued according to a separate document, similar to Example 1. In Section 2 of the 6NDFL report for the first quarter of 2021, the one-time bonus for January is displayed in the lines: 100: 15.02.2018 110: 15.02.2018 120: 16.02.2018 130: 10,000 rub. 140: 936 rub. |

One-time bonus (share of earnings)

In addition, the initial setup assistant, if you select two calculation options, will immediately create a second type of bonus, “One-time bonus (percentage).”

Let's look at the formula that the program generated. Percentage of one-time bonus/100*Calculation base, where “percentage of one-time bonus” is an indicator that is set when calculating for an employee, “calculation base” is the amount from which the bonus percentage will be calculated.

The composition of the calculation base can be edited.

Payment for fitness

According to ITS recommendations

https://its.1c.ru/db/answerstax#content:2557:hdoc:_top:%D0%BE%D0%BF%D0%BB%D0%B0%D1%82%D0%B0%20%D1 %84%D0%B8%D1%82%D0%BD%D0%B5%D1%81%D0%B0

if you want to include them in expenses that reduce the tax base on profit, it is better to include them in the collective and employment agreement, refer to the employer’s obligation under the Labor Code of the Russian Federation

“The costs of implementing measures to improve conditions and labor protection should be at least 0.2 percent of the amount of costs for the production of products (works, services) per year”

and take them into account as labor costs and the main constant accrual, according to clause 25 of Art. 255 Tax Code of the Russian Federation

But it is better, in order not to get into a dispute with the tax authorities, to take them into account as expenses for a non-core activity and for this purpose register them as “Accrual of other expenses”

Earnings share bonus (for the past quarter)

If you plan to charge a quarterly bonus, mark the appropriate step in the initial program setup assistant window.

As a standard, there are two methods of calculation: a share of earnings or the amount according to the order; you can choose one or specify both.

The quarterly bonus can be calculated when the bonus percentage is entered during the final calculation of the salary; the premium can be considered as a “Premium” document and paid in the middle of the month; the premium can be accrued as a constant accrual in predetermined months. These settings are specified further in the assistant window.

Determination of the premium amount for the quarter in the listed months

Now let's look at an example when a quarterly bonus is calculated automatically when calculating salaries. A very convenient option, the program remembers for us when we need to calculate the premium.

To do this, in the start setup assistant, we marked the periods in which it will be calculated.

Let’s fill out the “Payroll” document for April. The bonus for the quarter will be automatically increased.

Please note that the bonus accrual interval is from January 1 to January 31, 2019.

Calculation document Premium

Let's look at an example of payment within a month. Let's check the accrual type settings. Go to the menu “Settings” - “Accruals”.

Purpose – quarterly bonus, select the document “Bonus”, composition of accruals – for the previous quarter.

Next, we create the “Bonus” document, indicate the accrual month of April 2021, the document date is April 25, 2021, select “Quarterly Bonus”, the period is automatically displayed from March 1 to March 31, 2021. Select the employee and fill in the bonus percentage. Payment in the middle of the month on April 25, 2021. The program itself will calculate the base, the amount of the premium and the amount of personal income tax.

The premium can be paid in a separate document, in cash or by bank transfer. The non-cash method can be through a salary project or to each employee’s own account. We choose April 2021, “Bonus” type. Or you can create a statement directly from the “Bonuses” document by clicking on the “Pay” button and the program will automatically create a payment document.

Premium shares of income (per month of calculation)

In the initial program settings window, you can indicate the need to use a monthly bonus and indicate the option of how we will calculate it.

The program will create the accrual type “Monthly bonus (percentage)”.

In the base calculation, let's select the calculation interval “current month”. When we calculate wages for January 2019, the bonus calculation period will also be January 2021.

A monthly bonus is a permanent accrual assigned to an employee upon employment or by personnel transfer, indicating a new accrual. The program will ask you to indicate the portion of the monthly premium that will be used continuously in the calculation.