Calculation period for vacation

The length of the calculation period for vacation depends primarily on how long the employee has worked for the organization. But in any case, this period cannot be more than 1 year.

For example, an employee started working for the organization more than a year ago. The billing period will then be equal to 12 months before he goes on vacation. The month is taken into account as a calendar month, complete, from the 1st to the last day.

When an employee is going on vacation after working for less than 1 year, then the entire time that he worked in the organization is taken as the billing period.

And the period is included in the calculation as follows: from the first working day to the last day of the month that precedes the start of the vacation.

The organization also has the right to independently set the billing period. This needs to be written down in a local document of the organization, for example, in a collective agreement. For example, an employer can set a pay period of 6 months rather than 12 months. This is not prohibited by the Labor Code, but if the following condition is met: Vacation pay calculated on the basis of such a calculation period should not be less than calculated according to the general rules.

Procedure for granting leave

When granting an employee regular leave, the following must be taken into account:

- the duration of vacation must be at least 28 calendar days, excluding holidays and non-working days;

- upon dismissal, the employee is entitled to monetary compensation for unused vacation;

- after one continuous year of work, an employee can be granted leave without having to take the six months required by law;

- accrued vacation pay is issued to employees no later than three days before the start of the vacation;

- if an employee refuses to take leave, he is entitled to compensation (issued upon the employee’s written application). It can be accrued over several calendar periods. It is prohibited to replace the main regular leave with monetary compensation , but additional leave is possible - in cases established by the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation);

3 cases when replacing vacation with compensation is unacceptable (Article 126 of the Labor Code of the Russian Federation):

- the employee is a pregnant woman;

- minor;

- engaged in work with harmful or dangerous working conditions.

- leave may be granted compulsorily every six months based on a written application from the employee;

- at the request of the employee, vacation can be postponed, but no more than 2 times in a row;

- vacation can be divided into several parts with the condition that one part in any case will be at least 14 calendar days in a row.

The right to the first annual leave at a new place of work arises for an employee after six months of continuous work in the company (Part 2 of Article 122 of the Labor Code of the Russian Federation). However, by agreement with management, leave may be granted in advance.

Note!

The right to leave for a duration of employment of less than 6 months must be granted to:

- minors (Articles 122, 267 of the Labor Code of the Russian Federation);

- women before maternity leave or immediately after it or at the end of leave related to child care (Articles 122, 260 of the Labor Code of the Russian Federation);

- working people who have adopted a child under 3 months of age;

- in other cases provided for by law.

Vacations are granted based on the vacation schedule. In accordance with legal requirements, the vacation schedule indicates the procedure and time for granting vacations to employees for the next year. It must be approved no later than December 17 annually.

The employee must be notified of the start time of the upcoming vacation against signature no later than two weeks before its start (Part 3 of Article 123 of the Labor Code of the Russian Federation).

What to exclude from the billing period

The following days should be excluded from the calculation period when:

- The employee was paid the average salary. By such days I mean periods of paid vacation, business trips (with the exception of the period of feeding a child);

- The employee was on sick leave or maternity leave;

- The employee took leave at his own expense (without pay);

- The employee took additional paid time off to care for people with disabilities;

- The employee, for reasons beyond the control of the employer or the employee himself, did not work. For example, days of power outages;

- The employee was released from work.

| ★ Collection and directory of all personnel documents (forms and documents in word format) > 1200 books purchased |

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

| ★ Author's course “Automation of personnel records using 1C Enterprise 8” (more than 30 step-by-step video lessons for beginners with instructions) purchased > 2000 practical courses |

Vacation pay - what is it?

The procedure for granting leave is discussed in Chapter 19 of the Labor Code of the Russian Federation. Vacation is 28 calendar days (for certain categories of citizens the duration of vacation may be longer), half of which must be used inseparably. Before going on vacation, a citizen receives a certain amount of money (vacation pay). The size of this amount depends on the employee’s salary, the number of days he plans to use as vacation, and other factors.

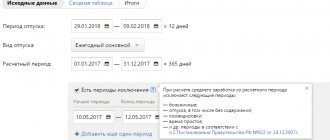

Example of defining a billing period

Accountant Petrova O.P. has been working at LLC Continent for four years. She wrote an application for the paid leave she was entitled to from November 6, 2021.

Determine the billing period:

November 1, 2021 – October 31, 2021.

Let's determine the days excluded from Petrova's billing period:

- The vacation period at your own expense is December 12 – December 25, 2016;

- Business trip period – April 1 – April 16, 2021;

Thus, we exclude 30 days from the calculation period (Read also the article ⇒ How to calculate vacation pay 2021, an example of calculating vacation pay).

By map

Let's discuss in more detail what a card's billing period is. This is especially true for those clients who use a credit card. When using borrowed bank funds, you need to make payments on time in order to avoid delays and thus avoid interest charges.

So, with the active use of a credit bank card, the client makes many transactions, from non-cash payments at retail outlets to cash withdrawals.

The billing period in this case is a period of time after which a report on the card is compiled, which takes into account all expenses and top-ups. In the case of a credit card, this is necessary for the correct calculation of interest accrued by the bank.

When all days are excluded from the billing period

There are also frequent cases when all days need to be excluded from the billing period. In this case, the calculation period must be replaced by the one that precedes the excluded one.

The calculation also takes a period of a full 12 months.

If the employee also did not have days worked before the required billing period, then the days that the employee worked in the month of going on vacation, immediately before its onset, are taken into account. The same is done if the employee is given vacation in advance during the month of employment (Read also the article ⇒ When to pay personal income tax on vacation pay 2021).

Let's take a closer look at an example:

Accountant Petrova O.P. has been working at Continent LLC since July 24, 2017. Petrova wrote her leave application on November 6, 2017.

Since Petrova worked in the organization for less than a year before her leave, we take the following as the billing period:

July 24, 2021 – October 31, 2021.

The following days should be excluded from this period:

- Business trip days – July 24 – 31, 2021;

- Study leave – August 1, 2021 – December 31, 2017.

Since Petrova’s entire payroll period consists of excluded time, and the preceding payroll period Petrova has not yet worked in the organization, then to calculate vacation pay we will take the days of the month of going on vacation, that is:

November 1 – 5, 2021.

Determining the amount of vacation pay for salary increases

A salary increase affects the calculation of vacation pay if this happens:

- before or during vacation;

- in the billing period or after it.

If the salary was increased for all employees of the institution, then before calculating the average salary, its rate and all allowances should be indexed to the rate that was set at a fixed amount.

The period of salary increases affects the indexation order. Payments are usually indexed by an increase factor. To determine the amount of vacation pay, we find the coefficient (K):

K = Salary of each month for the billing period / Monthly earnings on the date of going on leave.

If the salary increased during the vacation, only part of the average income needs to be adjusted, and it must fall on the period from the end of the vacation to the date of the increase in earnings; if after the calculated period, but before the start of the vacation, the average daily payment should be adjusted.

Situation 5. The salary was increased after the pay period, but before the start of the vacation.

Chemist-expert E.V. Deeva was granted the next main leave from 08/10/2015 for 28 calendar days. Monthly salary - 25,000 rubles. The billing period - from August 2014 to July 2015 - has been fully worked out.

Let's calculate the amount of vacation pay:

(RUB 25,000 × 12) / 12 / 29.3 × 28 calendars. days = 23,890.79 rub.

In August 2015, all employees of the institution received a 10% salary increase, therefore, the salary increased taking into account indexation:

(25,000 × 1.1) = 27,500 rubles.

The amount of vacation pay after adjustment will be:

RUB 23,890.79 × 1.1 = 26,279.87 rub.

Situation 6. Increase in salary during the billing period

Technician I.N. Sokolov goes on regular leave of absence lasting 28 calendar days from 10/12/2015. The calculation period for calculating vacation pay is from 10/01/2014 to September 2015 inclusive.

The technician’s salary is RUB 22,000. In September it was increased by 3,300 rubles. and amounted to 25,300 rubles. Let's determine the increase factor:

RUB 25,300 / 22,000 rub. = 1.15.

Therefore, salaries need to be indexed. We calculate:

(RUB 22,000 × 1.15 × 11 months + 25,300) / 12 / 29.3 × 28 = RUB 24,177.47

We determine the amount of compensation for unused vacation days paid upon dismissal

Upon dismissal, an employee has the right to receive compensation for days of unused vacation.

To determine the number of unused calendar days of vacation, the following data is required:

- duration of the employee’s vacation period (number of years, months, calendar days);

- the number of vacation days that the employee earned during the period of work in the organization;

- the number of days used by the employee.

The only current regulatory document explaining the procedure for calculating compensation for unused vacation remains the Rules on regular and additional vacations, approved by the People's Commissar of the USSR on April 30, 1930 No. 169 (as amended on April 20, 2010; hereinafter referred to as the Rules).

Determining the vacation period

The first working year is calculated from the date of entry into work for a given employer, subsequent ones - from the day following the end of the previous working year. If an employee is dismissed, his vacation period ends. When an employee gets a new job, he begins to earn vacation leave again from the first day of work.

Calculating the number of vacation days earned

The number of vacation days earned is determined in proportion to the vacation period as follows:

| Number of vacation days earned | = | Duration of vacation in calendar days | / | 12 months | × | Number of months of employee's vacation period |

For your information

Usually the last month of vacation period is incomplete. If 15 calendar days or more were worked in it, then this month is rounded up to the whole month. If less than 15 calendar days have been worked, the days of this month do not need to be taken into account (Article 423 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation)). (clause 35 of the Rules)

The number of vacation days allotted for each month of the year is calculated depending on the established vacation duration. Thus, for each fully worked month, 2.33 days of vacation are due, for a fully worked year - 28 calendar days.

Cash compensation for all unused days of annual paid leave that the employee has acquired since starting work in the organization is paid only upon the employee’s dismissal (Article 127 of the Labor Code of the Russian Federation).

Question on topic

How to compensate unused vacation days for an employee who quits without working the accounting period?

An employee who has not worked in the organization for a period giving the right to full compensation, upon dismissal, has the right to proportional compensation for calendar days of vacation. Based on clause 29 of the Rules, the number of days of unused vacation is calculated by dividing the duration of vacation in calendar days by 12. This means that with a vacation duration of 28 calendar days, 2.33 calendar days must be compensated. days for each month of work included in the length of service giving the right to receive leave (28/12).

__________________

Unlike regular vacation, which is granted in whole days, when calculating compensation for unused vacation, vacation days are not rounded.

Absenteeism, vacation granted without pay, exceeding 14 days, reduce the vacation period (Article 121 of the Labor Code of the Russian Federation).

Note!

Employees with whom civil law contracts have been concluded are not entitled to compensation for unused vacation, since the norms of the Labor Code of the Russian Federation do not apply to them.

We determine the period for payment of compensation for vacation upon dismissal

Borisov P.I. was accepted into the organization on December 8, 2014, dismissed on September 30, 2015. In June 2015, he was on leave for 14 days, and in July 2015, he was on leave without pay for 31 calendar days. The period of work in the organization was 9 months 24 days. Since the duration of vacation at one’s own expense exceeded 14 calendar days per working year, the total length of service must be reduced by 17 calendar days (31 – 14). This means that the vacation period will be (9 months 24 days - 17 days).

Since 7 calendar days are less than half a month, according to the rules they are not taken into account. It follows from this that only 9 whole months will be counted towards the length of service giving the right to leave.

The employee used two weeks of the main vacation; he does not have to pay compensation for them. In this case, the employee is entitled to compensation for 6.97 calendar days (9 months × 2.33 – 14 days).

If an employee extends his leave due to illness

When an employee on vacation falls ill, he is forced to extend it for the period of illness. In such a situation, sick time should be excluded from the calculation period. That is, initially, when calculating vacation pay, the billing period is calculated based on the employee’s time working in the organization. And then sick days are excluded from this period.

More details with an example:

The accountant of Continent LLC wrote an application for leave from October 17 to October 31, 2021. She was sick all the days of her vacation and rescheduled it for the period from November 1 to November 15, 2021. The billing period will be as follows:

From November 1, 2021 to October 16, 2021, while days from October 17 to October 31, 2021 should be excluded from the calculation period.

In the bank

A credit institution is one of the organizations through which colossal financial flows pass every day. It is not surprising that the term “billing period” is actively used here.

You may be interested in: Technology for installing foundation piles: features, instructions

Banks, in particular, take out loans. In this case, it is very important to discuss the terms and conditions of repayment with clients. This is where the term “billing period” comes in handy. The contract must indicate what period of time will be used as it. As a rule, this is one calendar month, at the end of which the client must make the next payment.

It is important to know not only what a “settlement period” is in a bank, but also what it is used for. In addition to the above-mentioned loans, many other financial transactions are carried out, for each of which a different period of time can be set for summing up the results.

For example, even when using debit cards, the client is faced with the concept of “billing period” if he orders an account statement. It will display financial transactions completed during a specified period of time.

The legislative framework

| Legislative act | Content |

| Article 139 of the Labor Code of the Russian Federation | "Calculation of average wages" |

| Decree of the Government of the Russian Federation No. 922 of December 24, 2007 | “On the peculiarities of the procedure for calculating average wages” |

| Article 75 of the Labor Code of the Russian Federation | “Labor relations when changing the owner of the organization’s property, changing the jurisdiction of the organization, its reorganization, etc.” |

| Article 114 of the Labor Code of the Russian Federation | "Annual paid holidays" |

Calculation of vacation pay in 2021 (in working days)

The amount is calculated using the formula:

Amount of vacation pay = average daily earnings × number of working days of vacation

The average daily earnings is equal to (clause 11 of the Regulations):

Average daily earnings = actual accrued wages / number of working days according to the calendar of a 6-day working week

REFERENCE. Vacation in working days is granted to seasonal workers (Article 295 of the Labor Code of the Russian Federation) and to those who have signed an employment contract for a period of up to two months (Article 291 of the Labor Code of the Russian Federation). In this formula, the actually accrued salary means the amount accrued from the first day of seasonal work (or a short-term contract) until the start of the vacation (read more about this in the article “Vacation for a fixed-term employment contract: when to provide it and how to pay”).

How to calculate the duration of rest

The employer is obliged to provide the employee with the number of days she needs within the annual duration of the paid period. Calculation is needed to understand what part of this rest is provided on account of the existing experience, and what part is provided in advance.

Here are instructions on how to calculate the vacation period after maternity leave:

- Determine the total duration of the employee’s work in the organization.

- Establish periods that allow you to rest - they are listed in Art. 121 Labor Code of the Russian Federation.

- Calculate the number of days that the employee purchased for each of these periods and add them together.

An employee is given the right to paid rest: periods of direct work, including periods of regular vacations and sick leave, and labor and employment. Parental leave is not counted towards the length of service for receiving annual rest, except in cases where the employee works part-time without leaving the UM.

With a standard annual rest period of 28 days, a full month gives 2.33 days. If less than two weeks are worked in a calendar month, it is not counted towards the length of service; if more, it is counted.

How to write a statement

The application does not have a strictly regulated form; its text must reflect:

- FULL NAME. and the position of the addressee - the head of the organization;

- Full name, position, personnel number of the applicant;

- intention to receive annual paid leave immediately after CLEAR;

- how many days of vacation are due after maternity leave;

- date and signature.

The application should be submitted in advance - a few days before the end of OPUH.

How vacation pay is calculated - calculation formula

This is when you have never taken sick leave, worked every day and exactly a year has passed since your previous vacation.

Average Daily Earning = Salary for the Year / (12 months * 29.3)

Salary for the Year – salary received for the full pay period

12 months – number of months in the billing period

29.3 is the average number of days in one month.

The average monthly number of calendar days is 29.3 from 2021

2. If the billing period is not fully worked out

Average Daily Earning = Salary for the Year / (KPM*29.3 ∑KNM)

KPM – the total number of months worked by the employee.

∑КНМ – the total number of calendar days in months not fully worked.

KNM = 29.3/KD * OD

CD - the total number of days in a month (for example, in January 31, and in February 28)

OD – the total number of days that were worked.

Consideration of special cases

In order to correctly calculate the period that will be taken into account to determine the amount of monetary compensation, it is necessary to take into account all the nuances of accrual, especially if you have to consider a non-standard situation, unlike the one when the employee, as expected, worked the entire period and took the payment. Among the most common cases, it is worth highlighting the following cases:

- Complete absence of days worked for the last period coinciding with the calculated period.

- The calculation occurs immediately after the end of the leave provided for child care.

- The calculation of severance pay should include payment for unused vacation of various types.

- Determination of monetary compensation for late paid wages, severance pay, vacation pay for used and unused vacation, as well as any other type of payment that is due to an employee by law.

Force majeure is also possible, despite the fact that controversial situations can be resolved individually in full compliance with all current regulations.

If the issue could not be resolved amicably, then the employee has the right to defend his interests in court, having first filed a complaint with the relevant authorities (labor inspectorate).

No days worked

If the entire payroll period of an employee consists of periods that are not subject to accounting, and it is not possible to use the previous period, since there are no or not enough days worked, then only the days of the last month in which the application for payroll was submitted should be taken into account .

As a clear example,

the following situation can be cited:

Given: economist Andrienko worked at the enterprise from August 20, 2021 to April 30, 2021. This period included: a business trip paid according to average earnings (from 08/20/2017 to 12/16/2017), three-month advanced training courses (from 12/17/2017 to 03/16/2018) and a 28-day vacation at the expense of the organization (from 03/17/2018 to 04/13/2018).

Determine: r/p for further calculation of severance pay.

Since during the New Year holidays the employee was on courses paid for by the company, specialists cannot take them into account for further calculations. Wages and vacation pay were paid on time, so compensation for delays or unused vacation was not due. This means that the calculation period will be determined from April 14 to April 30 inclusive, since there is no other data to determine it.

Dismissal after maternity leave

The situation when an employee takes payment immediately after the end of the leave provided to her by the company to care for a child is quite common. However, it is also fraught with many pitfalls, which you should definitely familiarize yourself with in advance.

Due to the fact that the employee did not work a single day after maternity leave, even before its end she submitted an application for payment, it is necessary to take into account the 12 months that preceded the maternity leave.

If some periods from the calculation period are not subject to accounting, then it is recommended to take the months preceding them. For completeness of understanding, you can provide a sample definition of the billing period .

Given: employee Kuznetsova worked at the company for 5 years and 4 months, resigning on August 10, 2021. Before dismissal, three types of leave were used: planned (from 08/12/2015 to 09/09/2015), for pregnancy and childbirth, which turned out to be pathological (from 09/10/2015 to 02/11/2016), and for child care (from 02/12/2016 to 08/10/2018).

Determine: r/p for calculating dismissal benefits.

Since the last 12 months are not included in the calculated length of service, as well as the periods preceding them, it is necessary to take into account the year that the employee worked before going on basic leave. We are talking about the period from 08/13/2014 to 08/12/2015, since during this time Kuznetsova fully performed her job duties, without using vacation at her own expense and without going on paid sick leave.

How to use the calculator

The calculator will help you find out when and for how long an employee has the right to take a new annual leave after maternity leave. The instructions are simple:

Step 1. Indicate the number by which the woman was hired.

Step 2. Enter the date from which the employee went on maternity leave.

Step 3. Indicate the date when she returned back to the workplace.

Step 4. When all fields are filled in, click on the “Calculate” button.

If the employee’s existing experience does not entitle him to such a number of days, the missing days are provided in advance. Understanding how leave is calculated after leaving maternity leave will allow the employer to determine which part of the rest received by the employee is provided against the existing length of service, and which part is provided in advance.

Calculation example

Let's look at the calculation of leave after maternity leave using an example: citizen Sokolova got a job on 07/01/2016, actually worked for two months and went on maternity leave from September 1 of the same year. The two months she worked gave her 4.66 days.

Citizen Sokolova’s pregnancy was singleton, the birth was natural and uncomplicated, so the sick leave in connection with pregnancy and childbirth lasted 140 days - until January 18, 2017 inclusive. 140 days is more than four and a half months. During this period, Sokolova gained experience for a full five months: 2.33 × 5 = 11.65 days.

Immediately after taking sick leave due to pregnancy and childbirth, Sokolova went to the OUCH and stayed there until July 31, 2018 inclusive. Shortly before graduation, Sokolova announced her intention to go on vacation for a full 28 days.

Since Sokolova did not work part-time while caring for her child, this period did not give her any experience.

The total duration of the period earned by Sokolova was: 4.66 + 11.65 = 16.31.

11.69 days provided in advance.

When is it necessary to give the required amount to an employee?

The legislation clearly defines the period within which, namely, how many days for the start of the vacation, the employee is paid vacation pay. Their payment to the employee is made no later than 3 days before going on vacation . If these 3 days fall on holidays or weekends, funds must be paid on the business day preceding these days.

What to do if an employee goes on vacation, but they still haven’t given him the money?

If vacation pay is not paid on time, the employee has the right to postpone the start of the vacation or contact an organization that protects his rights.

Where to go if labor rights are violated:

- Trade union.

- Court.

- Prosecutor's office.

- Labour Inspectorate.

The inspection, based on a written request, verifies the employer’s compliance with labor legislation. She also takes measures to ensure that violated rights are restored.

When is it allowed to take after maternity leave?

It is necessary to distinguish between the following types of rest periods that an employee is entitled to count on under current labor legislation:

| Paid annually | Every employee, regardless of gender, profession and family circumstances, has the right to an annual vacation, during which he retains his average earnings. The standard duration is 28 days annually, for some groups of workers it is longer. |

| Unpaid | Provided at the request of the employee without retaining his earnings. |

| For pregnancy and childbirth - BiR | It is provided to pregnant women in the last stages of pregnancy and lasts from 140 to 194 days, depending on the complexity of the birth and whether the citizen gave birth to one or more children. Issued with a sick leave certificate. |

| Child care - Swelling or maternity leave | Provided to an employee, male or female, in connection with the need to care for a newborn until he reaches three years of age. Premature exit from Swelling is allowed. |

Article 260 of the Labor Code of the Russian Federation resolves the question of whether it is possible to take leave immediately after maternity leave: yes, immediately after leaving parental leave, an employee has the right to take annual paid leave. For its provision, work experience is not taken into account - six months of experience is not mandatory. Speaking about when leave is due after leaving maternity leave, it is important to remember that the employee will receive such leave provided that he did not use it before or after sick leave for pregnancy and childbirth.

In addition to the freedom to choose when to take leave after maternity leave, the employee has the right to independently determine the duration of such rest she needs: she has the right to use the full duration established by the employer, which is usually 28 days.