Form 6 of the balance sheet is an integral part of the financial statements for the year, used as one of the annexes to the main types of reporting: balance sheet and income statement. At the same time, it is an independent document that has its own rules for filling out and structure.

Mandatory reporting forms

In addition to these documents, the annual financial report includes several more appendices and independent reporting forms. Suffice it to say that there are as many as eight appendices to the above order, and this is only for those organizations that are not state, credit, financial or pension funds, since they have their own specific reports. The complete list of financial forms that business companies must fill out is as follows:

- accounting (financial) reporting form (KND 0710099);

- balance sheet (OKUD 0710001) No. 1;

- financial results report (OKUD 0710002) No. 2;

- statement of changes in capital (OKUD 0710003) No. 3;

- cash flow statement (OKUD 0710004) No. 4;

- report on the intended use of funds (OKUD 0710006) No. 5;

- explanations to the balance sheet and income statement;

- simplified accounting (financial) statements (KND 0710096, balance sheet - OKUD 0710001, financial performance report - OKUD 0710002, report on the intended use of funds - OKUD 0710006);

Nuances of filling out forms No. 3, 4 and 5 of the annual financial statements

The structure of financial statements is determined by Article 13 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, the norms of PBU 4/99 “Accounting statements of an organization” (1) and is specified in the order of the Ministry of Finance of Russia of July 22, 2003 No. 67n “ On the forms of financial statements of the organization."

Forms No. 3 “Statement of changes in capital”, No. 4 “Statement of cash flows” and No. 5 “Appendix to the balance sheet” are considered appendices to the balance sheet (Form No. 1) and the profit and loss statement (Form No. 2). Forms No. 3, 4 and 5 must be completed by all enterprises. Only the following organizations may not present them as part of annual reporting (2):

- small businesses (i.e. small and microenterprises) not subject to mandatory audit;

- small businesses subject to mandatory audit, in the absence of relevant data;

- non-profit organizations in the absence of relevant data;

- public organizations (associations), if they did not carry out entrepreneurial activities in the reporting period and did not have turnover in the sale of goods (works, services), except for disposed property.

Let's move on to consider the features of filling out these forms.

Form No. 3 “Report on changes in capital”

Form No. 3 discloses information on the movement of authorized, reserve and additional capital, as well as data on changes in retained earnings (uncovered losses) of the organization. In addition, this form indicates the amounts of reserves that have been generated or used by the organization. All information in Form No. 3 is provided for 2 years - the reporting year and the previous one (3). Of course, the exception is the case when reporting is generated for the first reporting period of the organization’s activities. If the organization has decided to disclose data for more than 2 years in its financial statements, Form No. 3 is supplemented with lines that reflect the indicators of earlier years.

Line “Changes in accounting policies”

For this line, you need to show the consequences of changes in accounting policies that entailed an adjustment in the amount of retained earnings (uncovered loss) of the organization during the inter-reporting period.

As is known, changes in accounting policies can be caused by:

- changes in legislation or regulatory legal acts on accounting;

- the organization's choice of new accounting methods;

- a significant change in the organization’s business conditions.

Let's look at examples of changes in legislation that, as of January 1, 2008, led to an adjustment in the amount of retained earnings (uncovered loss) of the organization and, therefore, influenced the filling out of this line of form No. 3.

One of these changes is associated with the implementation of starting from the accounting reporting 2008, new edition of PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (We wrote in detail about the changes in “Current Accounting” No. 3, 2008). Thus, as of January 1, 2008, all organizations had to recalculate in their accounting records the value of long-term securities (except for shares) expressed in foreign currency.

The amount of increase or decrease in the value of these securities resulting from the recalculation should have been charged at a time to account 84 “Retained earnings (uncovered loss)” (4). This amount must be shown in Form No. 3 in the line “Changes in accounting policies.” Another change is related to the entry into force of the 2008 financial statements of the new PBU 14/2007 “Accounting for intangible assets” (5). Thus, all organizations as of January 1, 2008 had to write off the amount of organizational expenses accounted for as part of intangible assets, minus accrued depreciation, to account 84 “Retained earnings (uncovered loss)” (6). This amount must also be shown in Form No. 3 in the line “Changes in accounting policies.”

Example

Promtorg LLC was founded in November 2007. One of the founders (in agreement with the others) made a contribution to the authorized capital of the LLC in the form of payment for expenses associated with the formation of this organization. The amount of paid organizational expenses amounted to 48,000 rubles, which corresponds to the nominal value of the founder’s share in the authorized capital of the LLC.

In 2007, PBU 14/2000 “Accounting for intangible assets” was in force (7). According to this provision, organizational expenses (expenses associated with the formation of a legal entity, recognized in accordance with the constituent documents as the contribution of a participant (founder) to the authorized capital of the organization) were taken into account as part of intangible assets (IMA). Following the requirements of this PBU, the accounting department of Promtorg LLC made the following entries in November 2007:

DEBIT 08 CREDIT 75-1

– 48,000 rub. — repayment of the founder’s debt on contribution to the authorized capital in the form of payment of organizational expenses is reflected;

DEBIT 04 CREDIT 08

– 48,000 rub. — organizational expenses are taken into account as part of intangible assets.

Depreciation charges for organizational expenses, according to the rules in force in 2007, were reflected in accounting by uniformly reducing their initial cost over 20 years (but not more than the life of the organization) (8). By order of the head of Promtorg LLC, the period for writing off organizational expenses was set at 20 years. In December, the accounting department of Promtorg LLC made the following entry in accounting:

DEBIT 26 CREDIT 04

– 200 rub. (48,000 rubles: 20: 12) - depreciation was accrued for organizational expenses for December 2007.

Since 2008, all organizations must be guided by the new PBU 14/2007 “Accounting for intangible assets”, according to which organizational expenses are not intangible assets (9). Organizational expenses recorded as part of intangible assets before January 1, 2008, as of this date should have been written off to account 84 “Retained earnings (uncovered loss)” (10). Following this rule, during the inter-reporting period, the accounting department of Promtorg LLC made the following entry in accounting:

DEBIT 84 CREDIT 04

– 47,800 rub. (48,000 – 200) - the residual value of organizational expenses is written off as a decrease in the company’s retained earnings.

In the annual reports for 2008, the accounting department of Promtorg LLC indicated the amount of 47,800 rubles. according to the line “Changes in accounting policies” of form No. 3.

Line 100 “Balance as of January 1 of the reporting year”

Using this line of Form No. 3, the accounting department must provide information on the amount of the organization’s equity capital as of January 1, 2008, that is, taking into account the adjustments made during the inter-reporting period (we described above how to reflect these adjustments in the statement of changes in capital). Please note: if the organization does not have its own shares (shares) purchased from shareholders (participants), the value of column 7 “Total” of line 100 of form No. 3 must correspond to the value of column 3 of line 490 “Total for section III” of the balance sheet (form No. 1 ).

Line 122 “[Increase in capital] by increasing the par value of shares”

If the report is filled out by the accounting department of a limited liability company, it is advisable to name this line “Due to an increase in the nominal value of shares.” Unitary enterprises on the same line can show an increase in their authorized capital by renaming it accordingly (11).

Cash flow statement (form No. 4)

Cash flow statement data should characterize changes in the financial position of the organization in the context of current, investing and financial activities (12). Thus, Form No. 4 reflects data on the actual receipt and expenditure of funds, that is, on debit and credit turnover in accounts 50 “Cash” (except for amounts in the sub-account “Cash Documents”), 51 “Settlement Accounts”, 52 “ Currency accounts" and 55 "Special accounts in banks".

First of all, we would like to draw your attention to this important point: in the profit and loss statement (form No. 2), the amounts of revenue and expenses are reflected without taking into account value added tax (if the organization is a VAT payer). In form No. 4, you must indicate all amounts received from buyers (customers) or paid to sellers (contractors), along with value added tax.

In addition, amounts written off from one account (sub-account) for cash accounting and credited to another account (sub-account) for cash accounting are not reflected in Form No. 4. For example, there is no need to show in Form No. 4 funds collected from the organization’s cash desk and credited to its current account, or funds transferred from one current account to another, etc.

Line 180 “[Funds allocated] for settlements of taxes and fees”

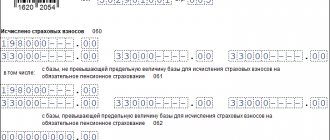

As a rule, accountants make quite a lot of mistakes when filling out this line. In line 180 you need to reflect the amount of taxes transferred to the budget that the organization paid as a taxpayer and as a tax agent. This indicator is determined by the debit turnover of accounts 68 “Calculations for taxes and fees” and 69 “Calculations for social insurance and security” (sub-account “Calculations for Unified Social Tax”) in correspondence with the credit of accounts 51 and 52.

Please note: debit account 68 can also correspond with the credit of account 19 “Value added tax on acquired assets.” These are the amounts of “input” VAT on purchased goods (works, services) accepted for deduction. Line 180 of Form No. 4 does not reflect these amounts. Only those amounts of taxes that were transferred to the budget from current accounts are indicated here.

Also, this line does not show the amounts of value added tax listed as part of payments to suppliers (contractors) (as practice shows, accountants often make this mistake). These amounts should be reflected in line 140 “[Money allocated] to pay for purchased goods, work, services, raw materials and other current assets.” If during the reporting period the organization paid fines to the budget for taxes and fees, penalties for late tax payments, these amounts must also be reflected on line 180.

The organization can show the amounts of paid contributions for compulsory pension insurance, insurance premiums for industrial accidents and occupational diseases on an additional line of form No. 4. It indicates the debit turnover in account 69 “Calculations for social insurance and security” (except for the subaccount “Calculations for UST") in correspondence with account 51. If the organization’s accounting department decides not to fill out an additional line, calculations for compulsory pension and social insurance are reflected in the line “For other expenses.”

Line “[Cash allocated] for other expenses”

This line reflects the amount of cash used to pay expenses for current activities that are not reflected in other lines of the section “Cash flow for current activities.” In practice, the question often arises: what could these costs be? These could be, for example, the following amounts:

- fines, penalties, penalties paid by the organization for violation of the terms of business contracts;

- funds issued to accountable persons;

- loans issued to employees;

- amounts donated free of charge (for example, as part of charitable activities);

- contributions for voluntary and compulsory insurance (if contributions for compulsory pension, medical and social insurance were not reflected on an additional line), etc.

Line 220 “Proceeds from the sale of securities and other financial investments”

This line reflects the amount of funds received from the sale of securities (bills, shares, bonds), excluding interest received. At the same time, many questions are raised by the reflection in Form No. 4 of cash flows from transactions with bills of exchange.

In practice, this situation often occurs. The buyer organization, in order to secure its obligations to the seller organization, issued it its own bill of exchange, and then, having transferred the payment, received it back. Such a bill of exchange is not a financial investment for the selling organization (bill holder). The return of this bill of exchange to the buyer (issuer) is not considered a sale of the security. Revenue received by the selling organization for such a transaction is reflected in the usual manner: as income from current activities (if the bill was received on a regular sale) or from the sale of non-current assets (if the bill was issued by the buyer to secure its obligations under the contract for the sale of fixed assets , intangible assets, etc.). Line 220 of Form No. 4 does not include such receipts. If the buyer paid with a third party bill of exchange, the selling organization takes this security into account as part of financial investments. Having sold such a bill and received cash for it, the organization includes this amount in the indicator of line 220 of Form No. 4.

Appendix to the balance sheet (form No. 5)

The appendix to the balance sheet (Form No. 5) discloses information about the property, liabilities and capital of the organization, the value of which is reflected in the balance sheet (Form No. 1).

Section "Intangible assets"

When filling out this section of form No. 5, you need to take into account that since the 2008 financial statements, a new Accounting Regulation has been in force - PBU 14/2007. According to this PBU, organizational expenses are no longer intangible assets. Consequently, they should not be reflected in this section of Form No. 5 (the line “Organizational expenses” when filling out Form No. 5 is crossed out or completely excluded from the report).

In addition, from January 1, 2008, when disclosing information about intangible assets in the financial statements, the organization’s accounting department must separately indicate information about assets created by the organization itself and about assets that have an indefinite useful life (13). The accounting department can fulfill this requirement by entering additional lines in the “Intangible Assets” section and reflecting the relevant information in them. When filling out standard form No. 5 for 2008, the accountant must put dashes in the “Other” line or completely exclude this line from this form (if the organization develops the form for this reporting form independently). The fact is that currently only intellectual property and positive business reputation can be taken into account as part of an organization’s intangible assets (14). Accounting rules do not provide for any “other” intangible assets (Read more about this in “Current Accounting” No. 3, 2008). Objects of intellectual property and business reputation are reflected in Form No. 5 on the corresponding lines.

Line “Real estate…” (section “Fixed Assets”)

This line of Form No. 5 provides information about actually exploited real estate objects, the ownership of which has not been registered (15). Please note: such objects can be accounted for in accounting both on account 08 “Investments in non-current assets” and on account 01 “Fixed assets” (16). Consequently, the decision on which line of Form No. 5 the organization will use to reflect the relevant objects depends on the provisions of its accounting policy.

Section "Collateral"

Completing this section also often raises questions among accountants. This section is filled out by organizations that received their own bills of exchange from buyers (customers), issued their bills of exchange to other organizations to secure accounts payable, received or transferred property as collateral. Thus, in the “Received” subsection they reflect data on buyers’ (customers’) own bills of exchange accepted as security for debt and property received as collateral. The value of the buyers’ own bills of exchange is the debit balance of account 62 (sub-account “Bills received”). The lines reflecting the value of the property received as collateral are filled in based on analytical accounting data for off-balance sheet account 008 “Securities for obligations and payments received.” Please note: the cost of bills of exchange that are included in financial investments does not need to be reflected in this section.

The “Issued” subsection reflects information about the organization’s own bills of exchange issued to suppliers (contractors, other creditors) and property pledged as collateral. Information about issued own bills of exchange is shown on the basis of the credit balance of account 60 (sub-account “Bills issued”). The lines reflecting the value of the property pledged are filled in based on analytical accounting data for off-balance sheet account 009 “Securities for obligations and payments issued.”

A.N. Prikhodko, Head of the Tax and Financial Consulting Department of the Audit and Consulting Group "Intercom-Audit"

Currently, the issues of preparing financial statements of organizations, as well as accounting policies, are regulated by several regulations. In accordance with paragraph 3 of Article 13 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, the forms of financial statements of organizations, as well as instructions on the procedure for filling them out, are approved by the Ministry of Finance of Russia. However, the financial reporting forms were approved with the caveat that they are only recommended.

In addition, paragraph 3 of Article 6 of the Law “On Accounting” establishes that the accounting policy must approve the forms of internal accounting reporting documents; the same requirement is contained in paragraph 4 of PBU 1/2008. The standards governing the procedure for the formation of accounting policies (PBU 1/2008) and the procedure for the formation of financial statements (PBU 4/99) do not contain requirements for the approval of external accounting statements in the accounting policy of the organization. There is no such requirement in the order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n. Therefore, if an organization prepares external financial statements in the forms recommended by the Russian Ministry of Finance, it is not obliged to consolidate their use in its accounting policies, since they are drawn up in accordance with all the requirements for these documents by regulations.

Accounting statements -2020: how, where and when to submit

Accounting reporting forms 2021 must be submitted to the territorial body of Rosstat at the location of the organization and its branches, if they maintain separate accounting and have the appropriate status, as well as to the Federal Tax Service inspection at the place of registration of the taxpayer.

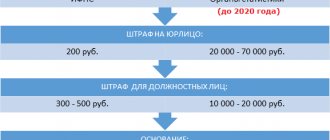

The set of documents for these two bodies is the same. Those organizations that are required by law to undergo an annual audit must submit an audit report along with their balance sheet. Although, by law, they have until December 31, 2021 to do this, it is better not to delay. After all, Article 18 of the Federal Law of December 6, 2011 No. 402-FZ defines the obligation of a legal entity to send audit documents to Rosstat within 10 working days from the day following the end date.

How to fill out a target spending report

The report is drawn up according to the uniform form No. 6 approved by the Ministry of Finance of the Russian Federation in Order 66n dated July 2, 2010 (OKUD code 0710006). Although, if desired, an enterprise has the right to draw up its own form, more suitable to the characteristics of its activities, but in accordance with the requirements of the law.

All items on the form are required to be completed. Filling out the report is quite simple; the name of each of its sections speaks for itself. First, you need to fill out the introductory part of the document; the details of the organization are entered into it. Next, the information is entered into sections.

Structure

The Form 6 report consists of the following items:

- "Opening balance". Targeted receipts in the form of cash or from the results of main activities that occurred at the beginning of the reporting period and at the end of the previous one are taken into account in full.

- “Funds have arrived.” This item requires you to enter data on: funds received from the main commercial activities of the enterprise;

- funds received from the sale of fixed assets;

- receipts in the form of government subsidies;

- all membership, admission or other fees.

- targeted expenses, for example, for charity events, meetings, seminars;

After filling out the form, it is certified by the signature of the chief accountant and the manager, and a seal is affixed. The date of preparation of the document must be indicated. It is then attached to the main package of reporting documentation. This form should be sent to the tax office along with the annual report, to the statistical authorities, and it can also be received by all interested parties, including those from whom the company received targeted funds.

This form was introduced to improve the regulatory side of accounting and reporting of organizations. This does not apply to credit, insurance or municipal organizations. It fully complies with the Regulations on the Ministry of Finance of the Russian Federation dated June 30, 2004.

This video will tell you about BO and its forms:

Forms and samples

Form 6 is an integral part of the financial report at the end of the year, if the enterprise has cash receipts from different persons and sources, as well as based on the results of its own commercial activities, which require control by the tax authorities. Information about the receipt of funds and their movement must be displayed not only in the balance sheet, but also as a separate appendix to it for a more complete explanation of the balance sheet items.

Sample of filling out form 6

Form 6 forms can be downloaded for free here.

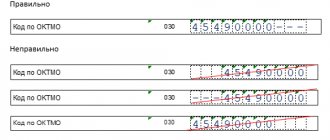

Linking accounting reporting forms for 2021

At this point you need to remember the basic principles and methods of accounting. It is well known that accounting must reliably reflect complete information about the obligations, state of property and capital of the organization and all changes that occur in them. Such control is carried out through a complete, continuous and documentary reflection of all business transactions in the organization on the basis of double entry. This means that each digit in the accounting data is posted to two different accounts, debit and credit. Thanks to this, a balance is achieved when the debit part is always equal to the credit part, if no errors were made. This method naturally concerns accounting results, so all forms of annual financial statements for 2021 are comparable and must be linked to each other. This is, first of all, checked by regulatory authorities when they receive documents from legal entities.

Samples of filling out financial statements in form No. 1 and 2

We will consider the procedure for filling out Form No. 1 “Balance Sheet” and Form No. 2 “Profit and Loss Statement” for accounting accounts.

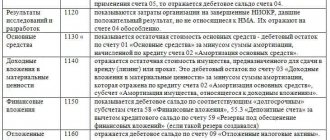

The figure below shows the procedure for filling out the balance sheet or form No. 1:

Let's consider the procedure for filling out the indicators of the report on financial results or form No. 2. The first section is devoted to income and expenses by type of activity:

The second section discloses information about other operating income and expenses:

Section three is non-operating income and expenses:

Who and when draws up Form 6 balance sheet

Form 6 is submitted as part of the package of general documents for annual reporting. It is presented by enterprises that are classified as non-profits. This document was approved by the 66th Order from the Ministry of Finance. The form must be submitted along with other reporting documents no later than three months after the end of the tax period for which the documentation is prepared.

The reporting form is classified according to OKUD 0710006. The Ministry of Finance on its official resources allows you to download the form and then fill it out by hand or by machine.

The form proposed by the Ministry of Finance is optional and can be adjusted to suit the needs of the enterprise. For example, some sections can be added to it if they are needed.

Structural design

The document contains four sections. Each of them must be filled out. The structural organization is worth taking a closer look at.

- The 1st part is called “Opening Balance.” It shows what funds the company has from the above sources at the beginning of this tax period, as well as what amount it had at the end of the previous period.

- The 2nd part indicates “Funds Received”. The name speaks for itself; here we display all the financial income of the company.

- The 3rd part is called “Funds Used”. It not only reflects how much was spent, but also the purposes for which the expenses were spent. The list of goals begins with the implementation of targeted types of events, such as charity events, and ends with the costs of retaining the management staff.

- Part 4 “Balance at the end of the year.” This section displays those funds that the company did not use in this reporting period. That is, which remained on the accounts.