The sale of oil and products at AZM differs little from other types of trade. Organizations have the opportunity to conduct wholesale, retail or wholesale-retail trade. Peculiarities arise in connection with the classification of a number of petroleum products as excisable goods. The main document defining the features of accounting for oil and petroleum products are the Rules for the technical operation of gas stations, approved by Order of the Ministry of Energy of the Russian Federation dated August 1, 2001 No. 229. In the article we will talk about accounting at gas stations and give examples of postings.

Non-automated methods for accounting for petroleum products at gas stations

Quantitative accounting of petroleum products at gas stations is regulated by current regulatory documentation. The main regulatory document is the Instruction on the procedure for receipt, storage, accounting and dispensing of petroleum products at gas stations (hereinafter referred to as the Instruction).

It assumes that accounting and settlement operations are carried out in accordance with all current GOSTs, guidelines, rules and other standards.

According to paragraph 1.1 of this Instruction, the quantity of petroleum products at gas stations is recorded in liters.

This amount may vary depending on temperature fluctuations in the atmospheric air, and is associated with the physicochemical properties of petroleum products. In addition, products of the same brand, but manufactured by different manufacturers, differing in their grade and some associated technical and economic features, are often poured into the same container.

To organize an optimal system for recording the quantity of petroleum products at gas stations, it is necessary to determine:

- the procedure for accounting and its organization, including both the system itself and document flow, as well as the frequency of inventory;

- financially responsible persons from among gas station employees;

- persons whose responsibility will be to monitor the order and reliability of accounting;

- composition of the inventory commission.

Organizing competent quantitative accounting at gas stations involves determining the following indicators:

- quantity of petroleum products in tanks (for each tank - separately and by brand of petroleum products in total);

- presence of petroleum products in pipelines for technological purposes;

- quantity of products dispensed through fuel and oil dispensers.

For efficiency, such records at gas stations are kept in liters, but for control purposes it would not hurt to keep records in weight units (tons and kilograms). This is due to the fact that weight indicators (unlike volume and density) are constant in their quantitative value and do not depend on changes in external conditions or parameters.

According to the above-mentioned Instructions, the weight of petroleum product (hereinafter referred to as OP) is calculated as follows:

| № | Helpful information |

| 1 | when using the volume-mass measurement method - by multiplying the density of the product and its volume, measured at the same temperature and pressure, or reduced to the same values |

| 2 | when using the mass measurement method (both for containerized petroleum products and tank trucks) - by weighing on scales |

| 3 | if the volumetric method is used, only the volume of the product is measured |

| 4 | if the hydrostatic method is used, then the mass of the petroleum product is calculated by multiplying the difference between the initial and final pressure values of the product column (before and after the commodity operation) by the average cross-sectional area of that part of the tank from which the product was shipped. Then this product is divided by the acceleration of gravity, which is established by the formula described in paragraph 2.42 of the above-mentioned Instructions |

The most universal, and therefore the most popular of these, is the volumetric-mass method.

Organizing analytical accounting of petroleum products at gas stations implies dividing them according to the following criteria:

- brand;

- own petroleum products and products that are in safe custody (bailor’s products).

Organization of accounting when accepting petroleum products

Petroleum products can be supplied to gas stations in the following ways:

- railway tanks;

- automobile tanks;

- through pipelines;

- in a container.

The most common way to deliver products to a gas station tank is by tanker truck.

In the consignment note form number 1-T, suppliers (or depositors) indicate the following parameters of the goods:

- the exact name of the brand of petroleum product;

- the value of its temperature, volume and density measured during shipment;

- weight of petroleum product.

The volume-mass method of determining weight involves measuring density and volume indicators at the time of acceptance of the goods, subject to the same (or reduced to the same) values of pressure and temperature.

Read also:

The problem of the presence of petroleum products in water and how to deal with it

The volume of the resulting petroleum product is determined using special calibration tables, either by measuring the level of petroleum product in containers (reservoirs, railway tanks, tanks of oil tankers), or by the capacity of any of the listed containers. Alternatively, the volume can be measured using a liquid meter.

Density in vehicles and tanks is determined by sampling (in accordance with State Standard No. 2517-85) with subsequent laboratory measurements. The density of the sample can be determined both on site and in laboratory conditions (depending on the equipment available at the gas station).

Data on the actual amount of petroleum product received is entered during the process and upon completion of the discharge of the received goods into the tanks of the gas station in a special receipts journal, as well as in the shift report and in the invoice.

If the actual quantity of goods received (in tons) coincides with the supplier specified in the attached invoice, the gas station employee puts his signature on it, leaves one copy at the gas station, and gives the other three copies to the driver who delivered the goods.

If these values differ, it is necessary to draw up a deficiency report. It is drawn up in three copies, the first of which is attached to the shift report, the second is given to the driver who brought the disputed cargo, and the third is stored at the gas station itself. An appropriate note about such a shortage must be made on all copies of the consignment note accompanying the cargo.

The possibility of accepting a petroleum product when a quantitative shortage is identified, which may be the result of a delay in delivery of goods by tank truck to the gas station, underfilling at the supplier’s enterprise or any other reasons, is determined either by the management of the gas station or its owner, guided by the organization’s established quantitative accounting procedure.

Monitoring with capacitive fuel level sensor

How does the fuel level sensor work?

The FLS is installed (cuts) into the vehicle tank and records changes in the volume of fuel and lubricants. Based on their operating principle, they are also called capacitive-type sensors. The accuracy of the FLS is not inferior in accuracy to the flow meter (97-99%). But to obtain objective data, it is important to correctly calibrate the sensor and calibrate the tank at the installation stage. Therefore, installation of equipment should be trusted to professional installers.

As in the case of DRT, the monitoring system receives FLS readings from the tracker with which the sensor interacts. In the monitoring program, each change in the liquid level in the tank is displayed with a clear reference to time and place. There are sensor options that do not require connection to an on-board controller. Such sensors have their own GPS/GLONASS module and GPRS modem.

Along with obtaining highly accurate data on the fuel level in the tank, FLS allows you to:

- record fuel fillings and drains

- detect false and incomplete fillings

- recognize microplums

- identify facts of drainage from the return line

There is an opinion that using the FLS cannot detect fuel drainage from the return line. But from the graphs and reports in the monitoring program, you can understand that this most likely happened.

The fuel level sensor is a universal tool for monitoring diesel fuel and gasoline on all cars and special equipment. But this method of control still has its limitations:

- The sensor measuring tube can be cut to fit any height of the fuel tank, but if the height is less than 10 cm, then you will not get a normal picture of fuel consumption. Therefore, the method is not suitable for all passenger cars.

- When installing FLS on special equipment, difficulties may arise if the tanks on the vehicles are of non-standard shape and have kinks. Then you will need to install two sensors, or still resort to another method of control.

- In elongated tanks (trailers, road trains), there is a high probability of error due to fuel fluctuations at an angle. To obtain average readings, you will need to install two FLS. This will increase the cost of equipment, but guarantees stable measurement accuracy.

- Advantages: high accuracy, ability to track all manipulations with fuel

- Disadvantages: difficult installation on non-standard tanks

- Fuel consumption control efficiency: high

- Probability of fuel theft: low

- Where it can be used: any type of vehicle

Procedure for dispensing petroleum products at gas stations

The dispensing of petroleum products at gas stations can only be carried out through fuel dispensers (TRK) or oil dispensers (MRK), and only into the tank of the vehicle.

The total weight of all petroleum products dispensed during one shift at a gas station is calculated using the formula:

M=P x V,

where M is the total mass of petroleum products supplied per shift;

V is the volume of NPs issued per shift, according to the data of the counting mechanisms at the metering stations;

P – NP density measured at temperature at the time of shift transfer.

Switching to online gas station cash registers

For violation of the requirements of subparagraph 8 of paragraph 5 of Article 281 of the Code of Administrative Offenses of the Republic of Kazakhstan, liability is provided: - for individuals - a fine in the amount of one hundred and fifty, - for small businesses - in the amount of two hundred twenty-five, - for medium-sized businesses - in the amount of three hundred and fifty , - for large businesses - in the amount of eight hundred monthly calculation indices, with confiscation of petroleum products that are the direct subjects of the commission of an administrative offense, and (or) income received as a result of the commission of an offense.

The procedure for transferring shifts and compiling shift reports

At the moment of accepting/transferring a shift, both gas station operators (both the one transferring the shift and the one receiving it) together perform the following actions:

- take total readings from all meters of the metering station and all meters of dispensers and MRKs;

- jointly measure the volume of petroleum products sold during a shift (the volume indicator is determined using calibration tables after measuring the level of petroleum products residues);

- using the obtained volume and density values, as well as after measuring the temperature, the quantitative value of the mass of residues in each gas station tank is calculated;

- the balance of money and coupons, as well as other material assets, is transferred;

- carry out error monitoring at each fuel dispenser/MRK.

At the moment of shift handover, operators prepare a shift report. The report form is either number 25-NP, described in the Instructions, or an internal form that was developed in a specific organization on the basis of this document.

In addition to the basic indicators provided for in Form 25-NP, it is advisable to include in the shift report the results of temperature and density measurements taken during the shift.

This report also records the shortage or, conversely, surplus of petroleum products per shift, which are determined as the difference between the readings given by the dispenser meters (metering unit) and the data obtained by measuring the remaining petroleum products in the gas station tanks at the time of shift transfer.

The surplus/shortage of NP is indicated in weight units, taking into account the errors of the TRK/MRK measuring instruments, and is accepted by the enterprise accounting department for accounting for each individual shift. This accounting is maintained in the control and accumulative sheet during the entire interval between inventories. At the time of inventory, all such deviations are calculated in the total quantity for the entire inter-inventory period.

Every month, the accounting department of the enterprise generates a balance sheet reflecting the movement of NP in units of mass, divided according to the following criteria:

- brands of petroleum products;

- ownership of them (own or provided for storage by bailors).

Calculation of excise duty for different types of rates

Excise duty is paid in cases where excisable products produced by one’s own enterprise, obtained by a court decision or during operations for processing straight-run gasoline, are sold through a gas station (see → excise taxes on gasoline in 2021)

When calculating the amount of tax, different types of rates are used - fixed, set based on the volume, ad valorem in the form of a percentage of the cost of products sold, and combined, combining both calculation options. The tax amount is calculated as the product of the base and the rate. Each type of excisable product is calculated separately.

An example of the use of excise taxes in the cost of fuel

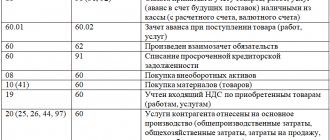

A gas station enterprise, which has the right to carry out retail trade on the simplified tax system, received for sale petroleum products of its own production in the amount of 190,000 rubles, the excise tax on which is 25,000 rubles. The trade margin is set at 10%. The following entries are made in gas station accounting:

- The formation of the cost of products is reflected: Dt 41 Kt 20(25, 26) in the amount of 190,000 rubles;

- The trade margin was accrued: Dt 41 Kt 42 in the amount of 19,000 rubles;

- The cost of excise taxes is taken into account: Dt 41 Kt 68 in the amount of 25,000 rubles;

- The transfer of the excise tax amount to the budget after the sale is reflected: Dt 68 Kt 51 for the amount received in the period.

From the amount of cost written off when selling products, markup and excise tax are excluded. When determining the cost, the balance of production at the end of the month is taken into account.

Carrying out an inventory

Inventory at a gas station should be carried out monthly.

In its process, actual balances are removed in volumetric units on the first day of the month. After measuring the density of stored residues, based on data on their volumes, the actual amount of remaining products (for each brand) is calculated in weight units. After this, the received data is reconciled with the data of accounting documents. After this, either a shortage or a surplus of NP is determined.

Read also:

The main reasons why oil prices are rising

The results of the inventory are recorded in the so-called comparison sheet, taking into account the errors of the measuring instruments.

Regulation of the identified shortage can occur in the following context:

- the loss of material assets that does not exceed the established standards and the shortage of petroleum products within the limits of measurement errors of fuel dispenser devices are distributed among the owners in proportion to the shares of petroleum products sold by the organization and given to depositors for the reporting period;

- the shortage of NP in excess of the standards listed above and the shortage that goes beyond the errors of the gas station's measuring instruments is covered by the financially responsible persons of the enterprise - the owner of the station.

Identified surpluses are distributed according to the same principle as shortages within acceptable standards (see above).

The distribution of loss within normal limits is carried out in weight units.

Economic aspect of NP density

At the moment, some gas stations practice using such an indicator as the average density of petroleum products.

This makes it possible to significantly simplify accounting accounting procedures if the enterprise uses their manual versions.

The average density is calculated either for the past reporting period, or it is established by internal documents for the future reporting period (for example, for the entire season). Based on the results of the inventory carried out at the end of such a period, the accounting balances of petroleum products, calculated according to the average density indicator, are compared with the actual ones, which are calculated according to the density measured during the inventory process.

In this case, the average density is calculated as the arithmetic mean.

As mentioned above, at a gas station the volume and density with the subsequent calculation of the weight of petroleum products is produced:

- at the time of admission;

- when handing over a shift;

- during inventory.

In this case, the density value is obtained by calculation, and it depends on the specific moment of measurement. These values differ at different temperatures, and the final result is obtained using density conversion tables that bring the measured value to a temperature of +20 degrees Celsius.

In this regard, density, as a constantly changing value, cannot be correctly used for accounting purposes in its average value, since this leads to a distortion of the results of quantitative accounting of petroleum products in the period between inventories.

These distortions appear due to the fact that the inventory produces results that take into account not only actual surpluses/shortages, but also deviations of the calculated density values from the established averages.

Average density can be used in management accounting when it is necessary to obtain quick results for decision making.

It is worth saying that an artificial increase in the value of surpluses due to deviation of the calculated values from the established average is unprofitable from an economic point of view for excise tax payers, since the surpluses are included in the tax base when they are calculated.

On the other hand, the Tax Code does not provide for any tax deductions in terms of excise duties when identifying a shortage of NP.

Therefore, the use of average density in quantitative accounting is also unprofitable from the point of view of excise payments.

Monitoring fuel consumption using a flow meter (DRT)

How does a flow meter work?

This sensor is installed in the vehicle's engine system on the fuel line.

The principle of operation of the flow meter is to determine the volume of incoming fuel and take into account the time of its consumption, which is why fuel consumption sensors (FFC) are also called flow sensors.

Some models of flow meters can determine engine operating time and fuel temperature.

The readings recorded by the flow meters are transmitted to the on-board controller (GLONASS/GPS tracker) and entered into the monitoring system. The accuracy of the readings is very high: the error varies by only 1-3%. This allows you to accurately keep actual records of fuel and lubricants and calculate real fuel consumption rates for specific vehicles. But there are several significant disadvantages:

- the cost of fuel consumption sensors, the costs of their installation and maintenance are more expensive than every other method from this review;

- flow meters are susceptible to contamination and require periodic cleaning, otherwise they can lead to damage to the fuel system;

- to control discharges through the “return”, you need to install a second flow meter, or a more expensive differential sensor, which controls the fuel directly in the supply and return lines;

- Flow sensors do not allow you to control the filling and draining of fuel from the tank.

Let’s again compare the readings from different sensors that simultaneously monitored fuel on the same vehicle. The blue graph is data received from the DRT, and only the flow rate is visible here. The red graph is the readings recorded by the capacitive fuel level sensor, and here you can see when there were refuelings and drains. At the same time, the difference in the accuracy of flow readings is only 100 ml.

Despite these disadvantages, flow meters are often the best option for monitoring fuel on special equipment. Firstly, the shape of the tank of many road, construction and agricultural vehicles is not always suitable for the installation of mortise-in FLS (method No. 5). Secondly, high-quality flow meters are useful in that they transmit information about engine hours and the state of the fuel system to the monitoring program - that is, car owners do not need to spend money on installing other sensors to monitor parameters important for special equipment.

- Advantages: high accuracy, control of engine hours and additional parameters

- Disadvantages: high cost of equipment, as well as its installation and maintenance; do not track fuel drains from the tank

- Fuel control efficiency: average

- Probability of fuel theft: average

- Where it can be used: special equipment with tanks not suitable for installation of FLS

Features of excise taxation

Payers of excise taxes on petroleum products are organizations that have a certificate of registration of an organization (or private entrepreneur) that carries out transactions with NP. In addition, persons who do not have such a certificate are also required to pay excise tax if their activity involves the production of petroleum products from customer-supplied raw materials.

It is worth saying that the processor pays excise tax only when the owner of the customer-supplied raw materials does not have the above certificate.

On the other hand, such certificates are the basis for applying tax deductions in terms of excise payments. Since obtaining a certificate to conduct transactions with PE is not an obligation, but a right of the organization, it is worth considering the feasibility of obtaining it depending on the circle of partners of the enterprise.

Even with such a certificate, the right to a deduction may not be obtained if the goods are sold to buyers without certificates. It is necessary to make a decision after analyzing the existing contractual relations at the enterprise.

Free use of a car

An organization can enter into an agreement for the free use of a car.

Under an agreement for gratuitous use (loan), the borrower is obliged to maintain the item received for gratuitous use in good condition, including carrying out routine and major repairs, as well as bearing all expenses for its maintenance, unless otherwise provided by the agreement.

The organization's expenses for the maintenance and operation of a car received under a free use agreement reduce taxable profit in the generally established manner, if the agreement stipulates that these expenses are borne by the borrower.

Separate rules provided for lease agreements apply to gratuitous use (loan) agreements. Expenses for fuel and lubricants are taken into account in the same way as a rented car, since the organization manages it.

The transfer of property for temporary use under a loan agreement is, for tax purposes, nothing more than a service provided free of charge. The cost of such a service is included by the borrower in non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation). This cost must be determined independently, based on data on the market cost of renting a similar car.

How to get a tax deduction?

To receive a deduction for excise taxes already paid, the taxpayer is required to provide the following documents to the tax authority:

- agreement with a certified buyer;

- all shipping documentation;

- invoices bearing the mark of the tax authority with which the buyer of the NP is registered.

This mark is placed by the tax authority after checking the compliance of the data specified by the buyer in his tax return and the data reflected in the invoices.

The tax can be credited to everyone except the last seller, which is most often gas stations, so many such stations do not have a certificate that oil refineries pay the excise tax.

Read also:

Where is the deepest oil well?

Features of the sale of petroleum products to buyers without certificates

The excise tax paid at the time of receipt of petroleum products, in the case of their sale to persons without certificates (including retail sales at gas stations), is included in the price of the NP. At the same time, the excise tax amount does not appear separately on the price tags or on the labels of the goods sold, as well as on receipts or other documents issued to the final buyer.

All this makes the sale of petroleum products to persons without certificates economically unprofitable, since the taxpayer is forced to increase his revenue by the amount of excise tax, and this increases the base for calculating value added tax.

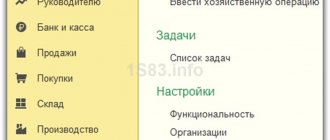

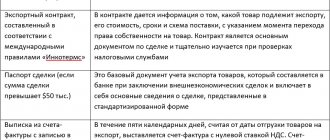

Retail and wholesale in gas station trading activities

Gas stations operate with wholesale and retail customers. The conditions for document flow of activities differ.

| Condition | Wholesale trade | Retail holiday |

| Agreement | Mandatory document drawn up for a long period of time | The form of a retail trade agreement is a check |

| Consumers | Organizations or individual entrepreneurs | Individuals |

| Documentary proof of shipment | Vacations are made using fuel cards, and an invoice is issued at the end of the month | Data on the issue are indicated in the KKM receipt issued at the time of shipment |

| Invoice | One document is issued based on the results of the month for all shipments (when maintaining OSNO at gas stations) | Not issued |

Enterprises can purchase fuel without concluding permanent contracts. The purchase of petroleum products is carried out through the company’s accountable persons. Cash receipts are confirmation of leave and are used for taxation of activities as part of the costs of operating transport.

The difference between wholesale and retail is the purpose of the fuel used for resale or for the needs of enterprises and individuals.