Legal entities in the process of carrying out business activities often encounter situations where there are not enough funds to cover debts to business partners, but at the same time they have counter outstanding obligations. In such cases, you can resort to offsetting mutual debt. The main document in this case will be an agreement on the offset of mutual claims (a sample for 2021 can be found at the end of this article). The transaction will be valid provided that the parties have complied with all the requirements imposed by law for debt offset.

Conditions under which offset can be carried out

Offsetting allows you to pay for goods or services received in return.

In difficult market relations, many enterprises in the small sector of the economy experience certain problems with finances - they are often in short supply, they are invested in turnover, goods, etc., and yet it is necessary to pay off with partners. This is where mutual offset fits perfectly.

Key conditions for implementing this method of calculation:

- the presence of at least two contractual obligations in relations between companies . Moreover, according to one of them, each organization must be a creditor, according to the second, a debtor: in this way, mutual “overlapping” of debts occurs. In some cases, several enterprises participate in mutual settlements at once - the law fully allows this.

- the homogeneous nature of the obligations (for example, in the form of finances); in addition, it is necessary that certain deadlines be allocated for the offset to be completed or the possibility of demand be stipulated.

Organizations can use offset not for the entire amount of obligations, but partially, in other words, they can offset in the amount of the smallest debt. The rest can be paid in monetary terms.

Mutual settlements for cash payments

You might be interested in:The most stable currency: a review of world currencies

Most often, non-cash payments are used between legal entities, since when paying for goods or services there is almost always a movement of large sums of money. Mutual settlements between organizations for cash have a number of features.

To pay in cash, you need to spend extra money on organizing payment security.

Another disadvantage of cash is that it is much more difficult to keep track of accounting accuracy.

In our legislation there is a restriction on cash payments in mutual settlements.

One of the rules for regulating money circulation between legal entities is Directive of the Central Bank of the Russian Federation 1843-U dated 06/20/07.

Based on paragraph 1 of the Instructions, the maximum allowable amount of cash payments between firms is 100,000 rubles under one contract.

This requirement does not apply to the following types of calculations:

- after payment of wages;

- when issuing accountable amounts.

A limit on the limit occurs when cash payments are made between:

- organizations;

- organization and individual entrepreneur;

- several individual entrepreneurs.

This limitation applies to payments under a single agreement.

For example, if two individual entrepreneurs have signed a contract for an amount of more than one hundred thousand rubles, it is impossible to pay cash in full; you will have to pay in two parts:

- one hundred thousand to pay in cash;

- pay the balance by bank transfer.

How to compose a paper

The netting agreement does not have a unified form, so representatives of enterprises and organizations can write it in any form or according to a model developed and approved within the company. The main thing is that the structure of this document complies with certain standards of office work; in addition, in terms of content, it must include some mandatory information.

This is important to know: How to transfer a share in an apartment to a relative

These include:

- the name of the organizations between which the agreement is being formed, their details;

- place and date of drawing up the form.

In the main part of the document it is necessary to record:

- the fact of an agreement reached;

- reference to the agreements under which it is carried out.

If there are any additional conditions or documents that are attached to this agreement, they must be noted as a separate paragraph.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Sample.

Agreement on Cooperation and Joint Activities” was useful for you, we ask you to leave a review about it. Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Nuances of drawing up an agreement between organizations

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

The execution of the agreement, as well as its content, is completely left to the employees of the companies. It can be written on an ordinary sheet of paper of any convenient format or on the letterhead of any organization, by hand or in printed form.

Next, the document is signed by the directors or their representatives on both sides. Signatures must be “natural”.

If organizations use seals and stamps in their activities, then the agreement form should be endorsed.

The agreement is made in two identical and equivalent copies - one for each of the interested parties. After the document is completed and endorsed, it must be registered in the document register of each company. In the future, the document serves as the basis for carrying out relevant accounting operations.

The agreement should be stored together with the contract in a separate folder for the period established by the legislation of the Russian Federation or internal regulations of companies (but not less than three years).

Order of conduct

So, the reason for the offset is mutual debt, but since each individual enterprise conducting active economic activity has many debtors and creditors, it follows:

- It is mandatory to maintain detailed analytical records of all debts on counterparties;

- clearly and timely identify emerging mutual debts for each counterparty separately.

Any enterprise can offset obligations; to do this, it is enough to send a corresponding application . The remote counterparty must send the document by registered mail, or use courier delivery, so the sender will have a notification of receipt of the document by the addressee. An offset carried out in this way is called one-sided .

A more reliable option is a bilateral offset, which involves the mutual signing of a document, which can be an act, a protocol or an agreement on mutual offset.

Any of the listed documents will be a sufficient basis for repaying the debt incurred in the accounting of enterprises conducting offsets.

A well-executed document will allow you to:

- reasonably carry out debt repayment operations in the accounting and tax records of your company;

- create the necessary records in the accounting of other entities participating in the test;

- respond to the counterparty’s claims if the offset was carried out unilaterally, and your opponent expresses a desire to recover the arrears through court proceedings.

By whom and when is the document drawn up?

We can say that this document is very popular among organizations that are representatives of medium and small businesses.

Experience shows that these are the companies that most often experience financial difficulties. It is the act of offset that is the best option for solving money-related problems.

The act is drawn up on the basis of a statement that can be drawn up by one of the parties. At mutual request, the document may allow you to repay all or part of the debt.

If the debt is not repaid in full, it is necessary to indicate what will happen next with the remaining part. For example, the debtor company undertakes to transfer the balance of the debt to the counterparty's current account within a certain period of time.

Before drawing up the act, responsible employees of the organization verify the documents. Then the chief accountant, with the help of other authorized employees, begins to draw up an act of offset. After this, the document must be signed by the director of the company.

However, you need to know that the main condition for drawing up this act is that the obligations between the counterparties are homogeneous. For example, you can offset only services rendered, only funds, or any work performed.

If the obligations are not homogeneous, drawing up the act loses all meaning, because the document will not have legal force.

A few illustrative examples

Imagine that you rent an office in a building. The lease agreement has come to an end and you have decided not to renew it. At the same time, the premises were renovated, a split system was installed, and parquet flooring was laid. All this was done at the expense of your company with the consent of the owner of the building. After termination of the lease, either the owner is obliged to reimburse your repair costs, or payment may be stipulated by offset in the agreement for part of the lease payments.

The contractor demanded money from the customer for the work performed. However, he had a loan from a bank, and this same customer acted as a guarantor. Since the contractor did not pay interest on the use of the money, the customer paid for it. As a result, it is possible to offset the cost of work and the amount of loan funds paid.

In the problem we have a borrower and a debtor, as well as a person who owes some money to the first debtor. They have no reciprocal demands. That is, the chain is vertical. The first person lent money to the second, the second to the third. There can be no talk of any netting agreement, since the opponent has no counterclaims.

What errors might there be?

In order for an act to have legal force, no mistakes must be made when drawing it up. The most common of them are:

- Not all numbers are indicated, or the column intended to indicate VAT is missing;

- The cost is indicated only in numbers, although words are also required;

- Lack of links to documents that confirm the occurrence of debts;

- The act does not indicate that the parties agree to repay the debt in this particular way;

- Many people forget to note whether all or part of the debt is repaid;

- If the debt is not fully repaid, the date by which the debtor undertakes to repay it in full is not indicated;

- Responsible persons are indicated without position;

- There are no transcripts of the signatures.

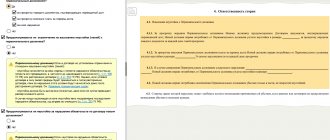

Sometimes counterparties are faced with the question of conducting mutual offset transactions. For example, if two legal entities have entered into agreements with each other (for example, agreements for the provision of legal services), according to which they are obliged to perform certain actions in relation to each other, then counter obligations can be offset.

This is important to know: Application for deduction from wages at the request of an employee: sample 2021

In accordance with Article 410 of the Civil Code of the Russian Federation, obligations can be terminated either in full or in part, taking into account a counterclaim of the same type, the time period for which has either already arrived, or its period is not specified or is determined by the date of demand. For offset, an application from one of the counterparties under the agreements is required.

If the other party agrees, then an act of offset of claims is drawn up.

Cases when offset of claims is not possible in accordance with the law

1. If, at the request of one person, the claim is subject to a statute of limitations and this period has expired.

2. When compensating for harm caused to the personal health or life of an individual.

If this does not contradict the existing agreements between the parties, then, in the event of an assignment of the right of claim, the debtor has the right to set off against the claim of the new creditor his counterclaim against the original creditor. This offset is made if the claim arose on the basis that existed at the time the debtor received the notice of assignment of the right of claim, and the term of the claim came before its receipt, or this period is not specified or is indicated by the moment of the claim.

Must be observed when drawing up the act

Firstly , obligations must be only between the parties to the agreements in question; if the demand is made by a third party that is not participating in these transactions (is not a party to the agreements within the framework of which offset is carried out), then drawing up this act is impossible.

Secondly , the act must indicate only homogeneous claims, for example, monetary claims and claims of a non-material nature are not subject to offset, since in this case the claims will be of a counter nature, and therefore cannot be offset in the act.

Thirdly , the parties have the right to make the necessary mutual offset only of those obligations (demands), the calendar deadline for fulfillment of which has already arrived in accordance with the contracts under study. Such a period must be specified in the contracts, otherwise the debt obligation of one party is recognized as arising from the moment when the other party fulfilled its obligation under the contract.

In this case, the deadline for fulfilling obligations must pass.

It must be remembered that in accordance with the legislation of our country, offset of both full mutual obligations of the parties and their partial repayment is allowed. In this situation, the act must indicate the smallest amount of claims of one of the parties and a similar amount of claims of the other party.

The entire form of the netting act is in the attached file.

Sometimes there are situations when mutual loan obligations arise between organizations that need to be repaid. For this purpose, a special document was invented that allows you to write off the obligations of both parties - an act of mutual settlement between organizations.

Found documents on the topic “cooperation agreement between organizations”

- Sample. Agreement on cooperation in organizing and conducting compulsory health insurance Agreement on joint activities → Sample.

Cooperation agreement on the organization and conduct of compulsory health insurance cooperation agreement " " 20 year medical insurance organization , (name) hereinafter referred to as "insurance... - Sample. Draft model agreement on cultural cooperation between subjects of the federation and cross-border partners

Agreement on joint activities → Sample. Draft standard agreement on cultural cooperation between federal subjects and cross-border partners...by both parties, seeking to promote the development of cultural, humanitarian and information ties between their regions in the spirit of the agreement between the Russian Federation and (name of a foreign state) dated "" 20, as well as the agreement between the govern...

- Sample. Draft Model Agreement between subjects of the federation and foreign partners about cultural cooperation

Agreement on joint activities → Sample. Draft standard agreement between federal subjects and foreign partners on cultural cooperation... understanding of national identity, culture, language, realization of spiritual and religious needs. Article 3 The parties agreed to assist in holding art festivals, tours of groups and soloists, staging music on stage...

- Agreement about organizations calculations between banks and the formation of a debit balance in the context of the transition to servicing on a correspondent account

Bank account agreement. Settlement and cash services → Agreement on the organization of settlements between banks and the formation of a debit balance in the context of the transition to servicing on a correspondent accountagreement on the organization of settlements between banks and the formation of a debit balance in the conditions of transition to correspondence services...

- Agreement about creative cooperation

Agreement on joint activities → Agreement on creative cooperationagreement on creative cooperation "" 20 (name of organization ) represented by (full name), acting on the basis of one...

- Agreement about cooperation and shared use of sports facilities

Agreement on joint activities → Agreement on cooperation and joint use of sports facilities premisesagreement on cooperation and joint use of the premises of sports facilities city "" 20, represented by (on…

- Agreement division of property between spouses

Protection of property rights → Agreement on division of property between spousesagreement on the division of property between spouses of the city (village) "" 20 we, gr. (full full name), resident, and gr. (full full name...

- Sample. Claim for agreement about correspondent relations between banks

Statements of claim, complaints, petitions, claims → Sample. Claim under an agreement on correspondent relations between banksclaim under an agreement on correspondent relations between banks (sample) (name of bank) claim no. from "" 20...

- Agreement exchange of shares (between legal entities)

Agreement for the exchange of real estate, securities → Agreement for the exchange of shares (between legal entities)contract no. exchange of shares "" 20, hereinafter referred to as (name of organization ) seller-buyer 1, in person...

- Agreement donation of shares (between individuals)

Agreement for the gift of real estate and other valuables → Agreement for the gift of shares (between individuals)contract no. donation of shares "" 20, hereinafter referred to as (last name, first name, patronymic) donor, on the one hand...

- Agreement between VTK members (employment agreement - option)

Employment agreement, contract → Agreement between members of the VTK (employment agreement - option)option contract (employment agreement) "" 20 (name of organization ), represented by (full name, position), acting on ...

- Agreement contract 2 (between legal entities or individuals)

Standard contract → Contract 2 (between legal entities or individuals)contract (hereinafter referred to as the customer) represented by the director, acting on the basis of, on the one hand, and the citizen (full name) (hereinafter referred to as the executive...

- Agreement loan between individuals

Money loan agreement → Loan agreement between individualsloan agreement between individuals No. "" citizen, passport (series, number, issued), living at the address...

- Agreement purchase and sale of a car (between individuals)

Property purchase and sale agreement → Car purchase and sale agreement (between individuals)contract for the sale and purchase of a car ( between individuals) place of conclusion of the contract ...

- Agreement contract (between legal entities or individuals)

Standard contract → Contract (between legal entities or individuals)agreement "" 20 (name of the enterprise or full name of an individual) acting on the basis of (the charter...

How to draw up an Act of Settlement?

The legislation does not define a strict form; it is drawn up in free form, taking into account certain requirements, in two copies for each of the parties involved. If more than two parties are involved in mutual settlements, then the number of copies must be equal to the number of participants in the act.

Each copy must contain the signatures of the managers or their substitutes of all parties involved.

If desired, managers can affix a seal (from 2021, all legal entities are exempt from the obligation to have a seal in their organization). But you need to know that many government organizations, including the Tax Service, still require certification of all documents.

In addition, the legislation establishes the presence of the following mandatory details:

- the reason for the occurrence of obligations (it is enough to indicate the details of the relevant documents);

- details of organizations that participate in the mutual settlement agreement;

- the amount of debt in digital and written terms;

- list of credit obligations that have arisen.

Copies of documents that indicate the debt has arisen must be attached to the act.

This is important to know: Request for evidence in arbitration proceedings: sample 2021

Characteristics of Sberbank bills

Let's take a closer look at what a Sberbank bill of exchange is for mutual settlements between organizations. Any bill of exchange, regardless of the purpose of its creation and the person who issued it, is primarily a valuable document. It acts as a significant fulfillment of an obligation, for which the debtor pays a certain amount of money to the creditor after a certain period of time.

The bill of exchange is used for mutual settlements between individuals and between organizations, including between financial institutions. Sberbank also belongs to them. Such bills act as a universal payment method. The bank issues them for quick payments for the supply, sale of goods or provision of services. In addition, the account can be used as collateral when obtaining a loan product from the bank. But the Sberbank bill of exchange is most often used for settlements between organizations.

Sberbank's bill of exchange for mutual settlements between organizations contains security that confirms the bank's obligation to the holder to pay a certain amount for a certain period. The bill of exchange is required for settlements; its registration can be carried out at any branch of Sberbank.

A bill of exchange is an A4 format document. It includes the amount that the client deposited. In addition, the city and date of issue are indicated.

A bank promissory note is a security that contains a written promissory note of a banking organization to the holder of the bill.

This tool provides the following benefits:

- convenient and fast payment for services, works and goods;

- profitable investments for profit;

- use as a guarantor when receiving credit funds or guarantees from a bank.

Promissory note programs provided by banks are similar to depository programs: the client invests funds, and in return receives something from the banking institution, similar to a promissory note. Thus, the bank confirms that the funds are accepted and undertakes to return them on the appointed day.

An interest-bearing bill means an indication of the interest that is charged on its amount. Nominal interest amounts can be expressed both in rubles and in other currencies. To obtain such a promissory note, you must deposit money, which is a nominal security promissory note.

This type of Sberbank bills is the most popular means because it is very similar to a deposit.

An ordinary discount bill does not specify the conditions for accrual of funds at face value, which can be used in rubles or foreign currency. To receive it, you need to deposit an amount equal to the value of the contract for the future sale of the security. The recipient's income is calculated as the difference between the sale price and the face value.

The bank account is paid by Sberbank units that are authorized to carry out such transactions. These may be branches of a banking organization.

Sberbank also provides other services for bills of exchange:

- Exchange of bills. Thus, the account holder can exchange one bill for several others that have a lower face value, or receive several bills for one higher face value

- Storage. Sberbank provides the opportunity for each recipient to store certificates of deposit and bank bills. The client determines the retention period.

- Delivery and issue of securities. To eliminate the risks associated with the self-movement of securities, you can entrust the bank with the issuance and delivery of purchased certificates of deposit and bills of exchange at your place of residence. This benefit can only be used by legal entities.

Homogeneous counterclaims

Homogeneous obligations are understood as obligations that are expressed in a single currency and require the same method of repayment . Homogeneous obligations include obligations related to the fulfillment of the terms of different contracts and involving the same methods of repayment.

These can be contracts and purchase and sale agreements that are concluded between the same organizations. For example, at the stage of signing contracts, a monetary form of payment was assumed, but since all the necessary conditions were met, companies can carry out mutual settlements.

In this case, the buyer's obligations will be offset against the customer's obligations.

Important! If under one agreement the obligations are expressed in kind, and under the second - in monetary form, then it will not be possible to recognize them as homogeneous. It will also not be possible to recognize claims as homogeneous, one of which is denominated in rubles, and the other in a different currency.

Settlement is possible if the counter-obligations have the same method of repayment and are expressed in a single currency.

Reflection in accounting

does not affect VAT .

There is no need to adjust either the amount of tax accrued for payment on the date of the transaction or the amount of deductions due. Also, when carrying out an offset there are no income tax consequences . Sales proceeds or expenses incurred as a result of the transaction will be reflected in accounting before offset.

For organizations subject to simplified taxation, income recognition occurs not only at the time of receipt of money, but also at the time of repayment of debt in another way. Since it is precisely this “other method” that will constitute offset, the enterprise will reflect the income from the sale of the subject of the transaction on the day of signing the offset agreement. And the goods (services, works) purchased by the organization will simultaneously be considered paid for the amount of the repaid debt, thus, the condition for recognition in accounting for expenses will be met.

In accounting, income from sales and expenses for the purchase of products (services, works) are reflected in the usual way. The purchasing organization has accounts payable (balance on account 60 (76)) to pay for the subject of the transaction. And upon sale, accordingly, receivables will arise (balance in account 62).

On the offset date, it is necessary to make an entry: Dt 60(76) Kt 62, reflecting the amount of the smaller debt, and thus repay partially or in full the receivables and payables.

When netting between legal entities is impossible

Offsetting mutual claims for the following obligations is not permitted:

- for which the statute of limitations has already expired;

- which are related to compensation for damage caused to health or life;

- related to the collection of alimony;

- which are associated with the lifelong maintenance of individuals.

It is also impossible to carry out offsets if this is directly provided for by law. Also, the legislation does not allow offset if one of the parties is in bankruptcy proceedings (411 of the Civil Code of the Russian Federation).

Features of the procedure

Offsetting obligations is possible subject to the following conditions :

- the object of offset is of a homogeneous nature (cash, equivalent services, identical products);

- the obligations of two organizations are mutual, thus, one and the same enterprise is simultaneously both a debtor and a creditor in relation to the other;

- the deadline for fulfilling the obligations specified in the contract has arrived, or the deadline was not initially determined by the terms of the transaction;

- the requirements presented do not create controversial issues and fully satisfy the competition participants.

The most common situation is the offset of obligations between two entities, although the law allows for multilateral offset.

It is not recommended to offset various penalties. In such a situation, it is difficult to determine the final amount of penalties, which often leads to protracted legal proceedings.

Usually, offsets liquidate obligations that arose between partners under two different agreements. But it is quite possible to offset obligations that have arisen within the framework of one contract. Let's say the principal has claims against the agent for improper fulfillment of the terms of the contract and demands compensation for damage by offsetting the counter-obligation to pay a commission.

Guided by the norms of the law (clause 1 of Article 314 of the Civil Code of the Russian Federation), if a demand must be fulfilled within a certain period of time, according to the terms of the agreement, then the debtor company cannot make such a demand for offset before the date of its fulfillment.

If the presented obligations are equivalent, then they are subject to repayment in full. But in practice, such obligations are often not equivalent, so they are partially repaid, based on the size of the smaller claim.

Thus, the obligations to fulfill the remaining part of the larger claim remain in full. Let's say the debt to the company is 200,000 rubles, and to the bank - 160,000 rubles.

As a result of the offset, the obligation is terminated completely, while the obligation remains for the remainder - 40,000 rubles.

In accordance with the law (Article 411 of the Civil Code of the Russian Federation), it is impossible to carry out offsets, under certain conditions:

- if we are talking about alimony payments;

- on compensation for harm of varying severity caused to health;

- about lifelong allowance;

- if the limitation period for the presented obligation has expired, etc.

Reconciliation report of mutual settlements

Before legal entities proceed to netting, they should draw up a reconciliation report for mutual settlements, which contains a breakdown of each agreement. Such an act will help to accurately determine the amount of debt that can be offset.

If in the future the parties have disagreements that can only be resolved in court, then the reconciliation act will serve as documentary evidence of the mutual amounts of debt. If such a document is missing, this may lead to the offset being declared invalid.