Documentation

Form 1 personal income tax is used to reflect the income of individuals that the organization pays to employees as

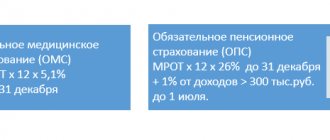

Since 2021, insurance premiums of individual entrepreneurs are paid to the tax office, and not to the Pension Fund as

In 2015, salaries were accrued, but not paid. There are many organizations and individual entrepreneurs who

Contents of the request for a refund When composing a letter for a return transfer of money, you should write down the details

The concept of employee length of service There are several types of work experience: General work experience, special insurance, continuous

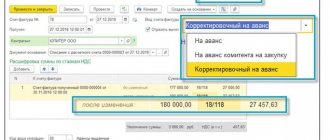

VAT for medical products during COVID-19 In accordance with the Decree of the Government of the Russian Federation dated

Who must submit the 4-OS report The report is submitted by all legal entities and individual entrepreneurs when

Introductory information Let us recall that the current RSV-1 form consists of six sections (see “New form

In the 2-NDFL certificate, the tax agent must reflect the income that he pays to employees. This is the salary

Determining the composition of the DAM The form of calculation and the procedure for working with it is introduced by the Order of the Federal Tax Service dated