In the 2-NDFL certificate, the tax agent must reflect the income that he pays to employees. This includes salary and other payments. Salary is reflected in the 2-NDFL certificate in the usual manner. At the same time, when paying some other income, there are features of filling out the certificate. For example, if you pay an employee income that is taxed at different rates, then in 2-NDFL you need to fill out section. 1, 2, 3 (if necessary) and Appendix to the certificate separately for each rate. Let's look at how to correctly fill out a 2-NDFL certificate in various situations.

How to reflect vacation pay in 2-NDFL

The amount of vacation pay is reflected in the Appendix to the 2-NDFL certificate.

Vacation pay is reflected on the date of their actual receipt, that is, in the month in which they were paid to the employee (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, clause 6.1 of the Procedure for filling out the 2-NDFL certificate).

The income code that must be indicated when recording vacation pay is “2012”.

Information about paid vacation pay and personal income tax on it is included in the total amounts of income and tax reflected in section. 2 certificates 2-NDFL.

How to reflect rolling leave in 2-NDFL

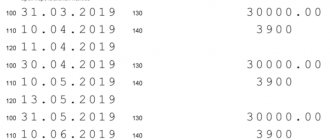

Rolling leave usually means an employee's leave that begins in one month and ends in another. The vacation pay amounts accrued in such a situation are reflected in the Appendix to the 2-NDFL certificate, indicating the month in which they were actually paid to the employee (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, clause 6.1 of the Procedure for filling out the 2-NDFL certificate).

An example of filling out a 2-NDFL certificate when paying for rolling leave

Employee of the organization V.V. Fedorov paid leave was provided from March 27 to April 9, 2021. The amount of accrued vacation pay was 21,000 rubles. No deductions are provided to the employee. On March 21, 2021, vacation pay was transferred to the employee.

When filling out the Appendix to the 2-NDFL certificate, the organization reflected the amount of vacation pay paid as follows (clauses 1.11, 1.16, Chapter VI of the Procedure for filling out the 2-NDFL certificate):

- in the “Month” field – 03 (the serial number of the month);

- in the “Income code” field – 2012;

- in the “Income amount” field – 21,000 rubles;

- in the “Deduction code” field – a dash;

- in the “Deduction amount” field – 0.

Financial assistance, bonuses, other payments

Let's start with bonuses . There are no preferences regarding the taxation of premiums with income tax. They are subject to a standard rate of 13%. If the bonus is included in the wages (that is, salary = Salary + Bonus), then personal income tax on this payment is already included in the tax calculated on wages. If the bonus is paid separately from the salary, for example, for an anniversary or based on the results of work for the year, it is included in the employee’s income on the date of receipt. In this case, the employer must calculate and withhold personal income tax on the day when it issues the bonus to the employee, and transfer it to the budget no later than the next day.

As for material assistance , it is not subject to personal income tax in the amount of up to 4,000 rubles per year . Anything above this amount is taxed at 13%. In addition, amounts of one-time financial assistance issued to an employee in special cases are not subject to personal income tax. For example, to pay for treatment, in connection with the death of a family member, in connection with the birth of a child, and others. These amounts are completely excluded from the base when calculating personal income tax.

Temporary disability benefits are included in the employee's income, which is subject to taxation. It is necessary to withhold personal income tax from sick leave immediately when it is paid, and transfer it to the budget no later than the last day of the month in which this benefit was paid.

How to reflect in 2-NDFL income that is taxed at different rates

If during the year an individual was paid income taxed with personal income tax at different rates, for each of them it is necessary to fill out a separate page of the certificate, as well as the Appendix to it (clauses 1.19 and 4.2 of the Procedure for filling out the 2-NDFL certificate).

On the second and subsequent pages of the help you need to fill out:

- fields “TIN”, “KPP”, “Page number”, “Certificate number”, “Reporting year”, “Characteristic”, “Adjustment number” and “Submitted to the tax authority (code)”;

- section 1;

- section 2;

- section 3 – when reflecting standard, social and property deductions, by which income taxed at a rate of 13% was reduced.

In empty fields you need to put a dash.

| See also: How to fill out a 2-NDFL certificate |

Instructions for filling

The certificate is filled out by a tax agent, namely, an employer represented by an accountant of a company or organization. It is filled out in three cases:

- When submitting a report to the tax service for the past year, which contains information on the amount of tax accrued for the entire reporting period.

- When it is impossible to withhold personal income tax, for example, in the event of dismissal of an employee.

- At the request of an employee of the organization to provide a certificate.

Heading

| Count | Content |

| Year | The year for which the certificate is provided is indicated. |

| Number | The number assigned by the person filling out the certificate. *They are assigned in each reporting period. Next year the numbering will be new. *If a certificate is drawn up to correct or cancel a previous one, the number of the original certificate is indicated. |

| date | Date in the format HH.MM.YYYY *If a certificate is drawn up for correction or cancellation, then their date is indicated, not the date of the original certificate. |

| Sign | Number 1, if the certificate indicates personal income tax, which was withheld from the employee’s earnings throughout the reporting period. Number 2, if the certificate is issued to notify the tax service of the impossibility of withholding tax. |

| Correction number | 00 – this number is indicated when drawing up a reporting document for the first time; 01, 02, 03, 04, etc. – with each adjustment; 99 – indicated when filling out a certificate to cancel information already submitted. |

| Federal Tax Service code | Code of the organization in which the enterprise is registered for tax purposes. Consists of four digits. The first two are the regional code, the second two are the tax service department code. |

Tax agent information

| Count | Content |

| 1 | Code of the territory in which the organization is directly located. Determined according to OKTMO. *If during the reporting year an employee worked in several organizations that have different OKTMO codes, then it is necessary to draw up different certificates from each place of work and indicate the corresponding codes. *You can enter 11 numbers. If the code consists of fewer characters, then empty fields are left blank. *Individual entrepreneurs and other persons carrying out work activities indicate the code at the place of registration. *Organizations using other taxation systems indicate a code reflecting the address of the company. |

| 2 | The mobile and landline (if any) telephone number of the organization represented by the tax agent is indicated. |

| 3 | The tax number of the organization or private entrepreneur is indicated. |

| 4 | This column can only be filled in by organizations. *If during the last reporting period an employee worked in several places, then you need to prepare as many certificates as the number of places the employee changed during the year, indicating for each organization its own checkpoint. |

| 5 | The abbreviated name of the organization is indicated (if it is not there, then the full name is indicated). *Entrepreneurs enter their full name according to their passport. No abbreviations can be used here. |

Information about the person who receives the income

| Count | Content |

| 6 | A number that confirms registration with the Federal Tax Service. If the TIN is missing, then the column is not filled in. |

| 7 | Tax number of the payer who is a citizen of another country. |

| 8 | The information is filled in according to the passport. *If the payer is a citizen of another country, then it is possible to write down this data in Latin letters. If there is no middle name, the column remains blank. |

| 9 | 1 – for a person who is a resident of the Russian Federation. 2 – for a person who is not a resident. 3 – for a person who is not a resident, but is recognized as a highly qualified specialist. 4 – for persons participating in the program for the resettlement of compatriots to our country who live abroad and are not residents. 5 – for persons who are refugees or have received asylum in the territory of the Russian Federation and are not residents. 6 – for citizens of other countries who work in the Russian Federation under an employment contract. |

| 10 | The payer's date of birth is indicated in the format HH.MM.YYYY |

| 11 | The code of the country of which the payer is a resident is indicated. *Registered in OKSM. *If a person does not have citizenship, then the code of the country that issued the passport is indicated. |

| 12 | The numerical code of the document is entered in the column, which confirms the identity of the payer. *You can find it out in the directory with document codes that establish identity. |

| 13 | The series and number of the identity document are filled in. *Only numbers are entered, other characters are not allowed. |

| 14 | The payer's residential address is indicated, the entry is made on the basis of a document that serves as proof of identity. *For a citizen of another country, enter the address at the place of residence or immediate stay. |

| The postal code of the branch to which the payer's residential address belongs is recorded. | |

| The code of the region in which the individual is registered is indicated. *The entry is made in accordance with the directory with codes of regions of Russia. | |

| Information about the area of registration of the taxpayer is entered. | |

| The city in which the individual is registered. | |

| For example, for the village of Vasilkovo, “Vasilkovo village” is indicated. | |

| Full information about the place of registration. | |

| 15 | The code of the country in which the person directly lives is indicated. *Can be left blank if the “Residence address in Russia” column is filled in. |

| 16 | The address at the place of residence in the country in which he directly resides is recorded. *Can be left blank if the column “Residence address in Russia” is filled in |

Income that is taxed at the rate

The name of the subsection indicates the rate at which a certificate is submitted to the supervisory authority. If during the reporting tax period the employee’s earnings were taxed at different rates, then for each of them it will be necessary to fill out this section.

| Count | Content |

| 17 | The serial number of the month in which payments were made to the employee is recorded. |

| 18 | The required code is indicated, which is indicated in the directory. |

| 19 | The full amount of earnings is deposited, from which no deductions were made. *If any deduction was made from income, its code is placed opposite this amount. *When filling out the document, income from which personal income tax was not withheld is recorded. |

| 20 | To be completed only if various types of deductions have been made from income. *The meanings of each code are taken from the corresponding reference book. |

| 21 | Indicated only when a tax deduction has taken place. |

Standard, social, investment and property tax deductions

In the event that a certificate for cancellation is completed, this subsection is not completed.

| Count | Content |

| 22 | Indicated based on the corresponding reference book. |

| 23 | The amount of deduction for each code is recorded. |

| 24 | The date of issue and the serial number of the notification and tax code that issued it are recorded. |

| 25 | The date and number of the notification, as well as the code of the tax office that issued it, are indicated. |

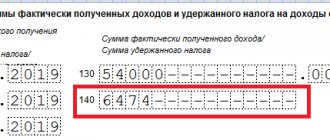

Total tax and income amounts

| Count | Content |

| 26 | The full amount is indicated without all possible deductions and personal income tax withholding. |

| 27 | The tax base from which personal income tax was calculated and withheld. |

| 28 | The total amount of the assessed duty. |

| 29 | The amount by which the assessed duty is reduced. |

| 30 | The total amount of the withheld duty. |

| 31 | The amount of the transferred fee. |

| 32 | The amount of duty that was excessively withheld and not returned to the payer. |

| 33 | The amount of duty that was not withheld in the reporting period. |

| 34 | To be completed if the payer has a corresponding notification. |

Conclusion

| Count | Content |

| 35 | If the certificate is issued by an agent – 1. If issued by an authorized person – 2. |

| 36 | Details of the person issuing the certificate. |

| 37 | Signature of the person issuing the certificate. |

| 38 | It is indicated when the certificate is issued by the agent's representative. |

Documents for download (free)

- New form 2-NDFL in Excel

- Sample of filling out 2-NDFL

When to pay personal income tax on vacation pay in 2021 (payment deadline, payment order)

To determine the amount of vacation pay due to the employee during the next vacation, you need to calculate the average daily earnings and multiply it by the number of vacation days. The most difficult thing here is to accurately determine the average daily earnings:

The employee took leave from 01/01/2021. for 28 calendar days. The employee’s salary is 10,000 rubles. Plus he has a monthly bonus of 5,000 rubles. He worked for 10 months. 2 months is not complete, since I was sick for 4 days in March and 10 days in June. For March, 12,140 rubles were accrued. for June 7860.

Leave without pay

Based on the current legislation, there is no such thing as forced leave at one’s own expense in the legal code. Management does not have the right to send employees on vacation under such conditions.

The employer can remove from office, but for this there must be compelling reasons:

- alcohol intoxication of the employee;

- failure to pass certification;

- lack of routine medical examination;

- emerging contraindications for the position held.

The period of suspension of an employee from fulfilling his obligations is not paid, so there is no need to fill out and submit 2-NDFL.

Income code for compensation for unused vacation upon dismissal in 2021

The Federal Tax Service issued an order dated October 24, 2021 No. ММВ-7-11/ [email protected] , on the basis of which changes are made to Appendix No. 1 of the order dated 09/10/2021 No. ММВ-7-11/ [email protected] From the moment of entry into force By virtue of this order, income code 2021 is used to compensate for unused vacation .

The income code for compensation for unused vacation upon termination of employment in 2021 is used to compensate for unused vacation. There is a new income code for these payments in 2021, don’t get confused!

Leave compensation upon dismissal personal income tax code 2021-2021

If an employee worked for less than half a month, he is not included in the calculation of compensation for vacation - clause 35 of the Rules on regular and additional vacations, approved by Decree of the People's Commissariat of Labor of the USSR dated April 30, 1930 No. 169. The laid-off employee must be paid full compensation for all 28 calendar days of vacation , if in a working year he worked for the company for at least 5 months and 15 days (clause

Government of the Russian Federation dated September 24, 2021 No. 1017)); further within the following periods: for six months - no later than August 1, 2021, for 9 months - no later than October 31, 2021, for 2021 - no later than April 3, 2021. The format for submitting form 6-NDFL is electronically according to the TKS, but if the number of individuals who received income in the tax period is up to 25 people, it is possible to report on paper. Failure to submit within the established period of time the calculation of the amounts of personal income tax calculated and withheld by the tax agent entails the suspension of transactions on the accounts of the tax agent (clause

This is interesting: Form 4 FSS average headcount of a newly created organization