Determining the composition of the RSV

The calculation form and the procedure for working with it are introduced by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected]

The number of calculation sheets to fill out depends on certain circumstances:

| Composition of the RSV | Payer category | Base |

Required sections:

| Payers making payments and other remuneration to individuals. If there were no payments to employees during the reporting period, a zero calculation is submitted. The Ministry of Finance in Letter No. 03-15-05/77364 dated 10/09/2019 reports that for a zero DAM, it is enough to fill out the title page, Section 1 without appendices and Section 3 | Clause 2.2 of the filling procedure (Appendix No. 2 to Order No. ММВ-7-11/ [email protected] ) |

In addition to the required sections:

| Heads of peasant farms | Clause 2.3 of the filling procedure (Appendix No. 2 to Order No. ММВ-7-11/ [email protected] ) |

In addition to the required sections:

| Payers applying additional or reduced contribution rates | Clause 2.4 of the filling procedure (Appendix No. 2 to Order No. ММВ-7-11/ [email protected] ) |

In addition to the required sections:

| Payers who paid VNIM benefits from their own funds. In fact, with the participation of all regions of the Russian Federation in the pilot project “Direct Payments” in the second half of 2021, Annexes 3 and 4 of the DAM are losing relevance | Clause 2.5 of the Filling Out Procedure (Appendix No. 2 to Order No. ММВ-7-11/ [email protected] ) |

How to check the report

Before sending to the Federal Tax Service, check the RSV with form 6-NDFL. Tax officials will do the same during a desk audit. And if the values do not agree, they will ask for explanations about the reasons for the discrepancies.

For self-control, check the amount of income, excluding dividends, in 6-NDFL with the indicators on page 050 of subsection 1.1 to section 1 of the DAM form. According to the explanations of the tax authorities, the base subject to personal income tax must exceed or be equal to the base subject to insurance contributions. The formula that tax authorities rely on is given in the control ratios (CR) approved. by letter of the Federal Tax Service dated December 29, 2017 No. GD-4-11/27043

If the COPs do not agree, tax authorities may decide that the base in 6-NDFL is underestimated and the tax has not been paid in full.

But there are situations when income tax and contributions are recognized in different reporting periods, for example, if the payment is carryover.

Let's explain with an example.

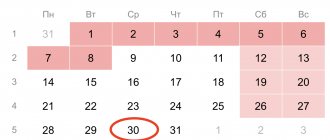

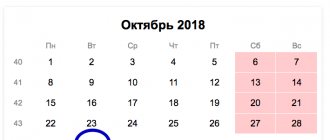

The employee was paid vacation pay on Monday, October 1, and accrued on Friday, September 28. The amount of vacation pay should be included in page 050 of subsection 1.1 of section 1 of the DAM form for 9 months of 2018 (clause 1 of article 424 of the Tax Code of the Russian Federation).

In turn, the date of receipt of income in the form of vacation pay for the purpose of calculating personal income tax is the day of payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Since the tax was withheld already in the 4th quarter, the amount of vacation pay will fall into the annual 6-personal income tax.

If you have a similar situation and the tax authorities ask for clarification, write a letter that there is no error, since the payment for contributions was recognized in the 3rd quarter, and for personal income tax - in the 4th.

A similar situation arises with the payment of holiday, annual and quarterly bonuses. Contributions are calculated on the day the premium is calculated, and the date of payment does not matter (letter of the Ministry of Finance dated June 20, 2017 No. 03-15-06/38515).

But for personal income tax, the date of withholding tax on bonuses (except for monthly ones) is the day of payment to the employee (letter of the Federal Tax Service dated October 6, 2017 No. GD-4-11/20217). Therefore, if a bonus is assigned in the 3rd quarter and paid in the 4th, then it will appear in the reports in different periods.

The situation is different with the monthly bonus. It is recognized as income for personal income tax on the last day of the month (clause 2 of article 223 of the Tax Code of the Russian Federation). Therefore, even if it was paid in the 4th quarter, it should be recorded in the RSV and 6-NDFL for 9 months.

Payments to “physicists” under the GPC agreement are also recognized as transferable. For contributions, the date of accrual of remuneration is important, and for personal income tax - the day of payment. They may fall on different reporting periods and, therefore, be reflected in different reports.

The difference may also arise due to different approaches to calculating personal income tax and contributions.

For example:

| Type of income | Personal income tax | Contributions |

| Cash gifts | Personal income tax is calculated on amounts exceeding 4 thousand rubles. (Clause 28, Article 217 of the Tax Code of the Russian Federation) | Gifts for the purposes of calculating insurance premiums are not considered income, regardless of the amount, and are not reflected in the DAM (letter of the Ministry of Finance dated January 20, 2017 No. 03-15-06/2437) |

| Compensation for delayed wages | Not subject to personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation) | It’s safer to charge contributions: officials insist on this (letter from the Ministry of Finance dated March 21, 2017 No. 03-15-06/16239) |

If the tax authorities ask questions, in an explanatory letter write down a list of payments from which contributions and income tax were calculated differently. To exclude possible claims, we recommend providing a detailed justification with references to letters from officials and norms of the Tax Code of the Russian Federation.

We take into account the general requirements for filling out the DAM

The basic requirements for report preparation are established in clauses 2.8-2.19 of Appendix No. 2 to Order No. MMV-7-11/ [email protected] :

- continuous page numbering;

- text fields are filled in capital block letters from left to right;

- When writing a report manually, black, blue or purple ink is used;

- corrections are not allowed;

- Double-sided printing of calculations is not permitted;

- total indicators are indicated in rubles and kopecks;

- in the absence of quantitative or cost indicators, zeros are entered in the cells; in other cases, the cells are crossed out;

- When using programs to prepare calculations, it is allowed that there are no dashes when printing the document.