Since 2021, insurance premiums of individual entrepreneurs are paid to the tax office, and not to the Pension Fund as before.

Individual entrepreneurs without employees pay insurance premiums on two bases: for compulsory pension insurance (OPI) and compulsory health insurance (CHI) in a fixed amount.

Changes

The main change since last year was that the responsibility for collecting fixed payments was transferred to the Federal Tax Service, i.e. By and large, this function was returned to them, because until 2013 it was they who collected all payments. So, when you pay contributions for yourself, be sure to change the details of the recipient and the KBK , otherwise you will send the money to the Pension Fund the old fashioned way.

You should get new details from your tax authority or update your accounting program through which you pay mandatory fixed payments.

For whom have the updated BCCs been introduced?

Private entrepreneurs are required to make insurance payments for themselves every year. The businessman pays a specific amount depending on the established minimum wage. For 2021, funds had to be sent before January 9, 2021 (the constant date is December 31, but due to the holidays it was shifted). If income exceeds the established limit, you have to send an additional amount from the amount exceeding 1%. For the previous year, they can be paid until April 3.

But where exactly should individual entrepreneurs’ fixed payments go in 2017? Which KBK administrator should he use? If a businessman managed to send money in 2021, then he had to make payments to the Pension Fund and the Federal Compulsory Medical Insurance Fund using the old codes. When transferring funds in the current period, he will have to enter new values, and the recipient of the contribution will be the Federal Tax Service. It is no longer possible to draw up and send payments under compulsory medical insurance and compulsory medical insurance in favor of the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund.

Fixed payments

Fixed payments are mandatory pension and health insurance premiums paid by sole proprietors and other private practice groups. You are required to pay them in any case, regardless of:

- whether you have employees;

- business activity is or is not carried out;

- the applied taxation system.

If you are an individual entrepreneur and an employee under an employment contract at the same time, then you still need to pay contributions for yourself as an individual entrepreneur, even if your employer paid the contributions for you. Many people mistakenly believe that since they have already paid for them, they have the right not to transfer insurance premiums.

More on the topic: How to make good money selling used cartridges.

Fixed payments for yourself for individual entrepreneurs consist of two parts:

- contributions for compulsory insurance to the Pension Fund and the Federal Compulsory Medical Insurance Fund;

- contributions to the Pension Fund of the Russian Federation, which are paid by individual entrepreneurs who have received an income of over 300 thousand rubles.

Why is this necessary?

Individual entrepreneur status is expensive for small entrepreneurs. Especially in the provinces. But having an individual entrepreneur gives many advantages. For example, when you are registered as an individual entrepreneur and pay contributions, you have an insurance period. In addition, an individual entrepreneur has more opportunities to work with legal entities, and also has the opportunity to take out a loan from a bank, because he has an income document. Having the IP seal makes it possible to take on students for internships.

However, if you suddenly stop operating, then you need to close the individual entrepreneur and not wait until you accumulate serious debts.

Calculation of the amount of contributions paid

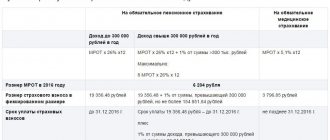

The amount of fixed payments he pays depends directly on the minimum wage and the interest rate of insurance contributions to extra-budgetary funds.

As of January 1, 2021, the minimum wage remained the same as in 2021 (Law No. 82-FZ as amended by Federal Law No. 164-FZ dated June 2, 2016) and is equal to seven thousand five hundred rubles (7,500 rubles). The increase in the minimum wage is planned to take place on July 1, 2021 and will be 7,800 rubles (Federal Law dated December 19, 2016 No. 460-FZ).

Insurance rates:

- Pension Fund - 26%

- FFOMS - 5.1%

So the final calculation will look like this:

- Contributions for yourself to the Pension Fund: 7500 × 0.26 × 12 = 23,400

- Contributions to the FFOMS: 7500 × 0.051 × 12 = 4,590

- Total for 2021: 23400 + 4590 = 27,990

In total, for the entire 2021, individual entrepreneurs must pay 27,990 rubles . To determine the quarterly amount, simply divide by 4:

- 23400 / 4 = 5850 rubles per pension for one quarter;

- 4590 / 4 = 1147.5 rubles for health insurance per quarter.

Please note: the minimum wage for calculations is the one that was at the beginning of the year. Those. Even if the minimum wage changes in July 2021, then by the end of the year exactly 7,500 rubles will be charged when paying insurance premiums. The new minimum wage in calculations will be applied only from next year, unless it changes on January 1, 2021.

How to get receipts for paying taxes for individual entrepreneurs in 2017?

You can make payments for contributions with the correct KBK through the service on the tax website https://service.nalog.ru/payment/payment.html You can find it on the main page of the site https://www.nalog.ru/ in the “Electronic” section services" -> "Pay taxes".

On the page that opens, select the type of taxpayer - individual entrepreneur and the type of document for payment. To generate a payment order for non-cash payment from your current account, select the “Payment order” item. If you need to make a receipt for payment at a bank branch in cash (As a regular payment by an individual), then select “Payment document”.

Click the “Next” button. The “KBK” field will be filled in automatically after selecting the payment type. Select the type of payment “Insurance premiums”.

For contributions to compulsory pension insurance for 2021, select in the name of the payment “Insurance contributions for compulsory pension insurance in a fixed amount , credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension.”

In the payment type, select “Payment amount for billing periods starting from January 1, 2021”

Click “Next” and fill in the IP registration address. Tax details will appear automatically.

Again “Next” and fill in the payment details: - payer status - “09 IP”, - in the basis of the payment select “TP - current year payments”, - tax period “Annual payments 2017”, - the amount of the fixed payment for compulsory pension insurance contributions for 2021 year 23,400 rub. If the individual entrepreneur had income over 300 thousand rubles. then an additional 1% of such income is paid for the same details. You can generate one receipt for a total amount of 23,400 + 1% of income over 300 thousand rubles.

Click “Next” and fill in the payer details.

At the last step, click the “Next”, “Pay” and “Generate payment document” buttons. A receipt for payment will open in a new window. You can print it out and pay at a bank branch. Or through the online bank of an individual using the document index indicated at the top of the receipt.

That's not all. Now you need to make a second payment for health insurance premiums.

To generate a receipt for compulsory medical insurance contributions, you need to repeat all the steps from the beginning, but in the “Name of payment” field, select “Insurance contributions for compulsory health insurance of the working population in a fixed amount , credited to the budget of the Federal Compulsory Health Insurance Fund.”

In the type of payment for compulsory medical insurance, select “ Insurance contributions for compulsory health insurance of the working population for billing periods starting from January 1, 2017. ”

In the amount of payment for compulsory medical insurance contributions, we indicate 4,590 - this is a fixed amount for all individual entrepreneurs in 2021 (and for those who did not have income, and for those who did, and for those who have over 300 thousand)

We continue to do all the steps as last time - “Next”, “Pay” and “Generate a payment document” and receive a second receipt for health insurance premiums.

Calculation of contributions for individual entrepreneurs’ income over 300 thousand rubles.

If the annual income of an individual entrepreneur exceeds three hundred thousand rubles, and I hope that this will be the case for you, then he will have to pay an additional 1% of the income exceeding 300 rubles to the pension fund.

More on the topic: Step-by-step instructions on how to open an individual entrepreneur in 2021 on your own without intermediaries

Don’t get confused, you will need to pay 1% not of your total income, but of the difference between your actual income and 300,000.

Let's look at an example:

If in 2021 an individual entrepreneur earns 700,000 rubles, then in addition to the fixed 23,400 rubles to the Pension Fund, he will have to pay another 4,000 rubles on top.

1% in the Pension Fund: (700,000 - 300,000) × 0.01 = 4,000

In total, our individual entrepreneur will pay 27,400 (23,400 + 4,000) rubles to the Pension Fund. And the total amount of his insurance premiums will be equal to 31,990 (27,400 + 4,590) rubles.

Please note that insurance premiums to the Federal Compulsory Medical Insurance Fund remain unchanged regardless of annual income.

There is a maximum amount of the contribution paid to the Pension Fund; its size also depends on the minimum wage and is calculated using the formula:

8 × minimum wage × 0.26 × 12

Thus, the maximum contribution to the pension fund in 2021 will be 187,200 rubles (8 × 7500 × 0.26 × 12)

For example, you earn 30 million rubles in 2021, then your contribution to the Pension Fund could be equal to:

(30,000,000 - 300,000) × 0.01 + 23,400 = 320,400 rubles.

But since there is a limit on the contribution, you will in any case pay 187,200 rubles.

The income of an individual entrepreneur is determined depending on the chosen taxation system.

How to calculate income for an additional contribution

Starting from 2021, the procedure for calculating income for the calculation of 1% contributions on amounts over 300,000 rubles has changed for entrepreneurs working on OSNO. Previously, all income received was taken into account without taking into account expenses incurred (the so-called business deductions).

▼ Try our bank tariff calculator: ▼

Move the “sliders”, expand and select “Additional conditions” so that the Calculator will select for you the optimal offer for opening a current account. Leave a request and the bank manager will call you back: he will advise you on the tariff and reserve a current account.

Changes had to be made after the Constitutional Court declared this procedure illegitimate at the end of last year. Unfortunately, for individual entrepreneurs on the simplified tax system Income minus expenses there have been no positive changes yet, however, this year the Supreme Court sided with the entrepreneur who refused to pay contributions on all income excluding expenses (Determination dated April 18, 2017 No. 304-KG16-16937) . But the Ministry of Finance still stands its ground - the additional contribution must be calculated from all income of individual entrepreneurs on the simplified tax system.

We provide in the table the basis for calculating the additional 1% contribution over 300,000 rubles for different modes.

| Tax regime | Basis for calculating contributions |

| PSN | Potential income for the year |

| UTII | Imputed income according to the formula |

| BASIC | Income minus individual entrepreneur deductions |

| Unified agricultural tax | All income excluding expenses |

| USN Income | All income received |

| USN Income minus expenses | All income excluding expenses |

| ✏ If an entrepreneur combines modes, then the income on them is summed up. For example, on the simplified tax system Income received for the year is 1,500,000 rubles, and on UTII - 380,000 rubles. This means that the calculation of the additional 1% contribution will be ((1,500,000 + 380,000) – 300,000) * 1% = 15,800 rubles. |

New KBK for payment of contributions

When paying insurance premiums, you must be careful with the KBK codes, as they have changed. Also, as of 2021, there is no separate BCC for paying 1% to the Pension Fund of the Russian Federation on income exceeding 300,000, which you will pay in 2021.

- 182 1 0210 160 - fixed contributions to the Pension Fund of Individual Entrepreneurs for themselves (according to this BCC you will pay 1%);

- 182 1 0213 160 - fixed contributions to the FFOMS for individual entrepreneurs for themselves.

More on the topic: Ideas for business with minimal investment 2021 - small business for beginners

Who does not need to pay fees?

Grace periods during which individual entrepreneurs’ contributions for themselves are not accrued:

- Leave to care for a child up to one and a half years old, an elderly person over 80 years old, a disabled person;

- Conscription;

- Living outside the Russian Federation with a military spouse or diplomatic worker.

| ✏ Please note that maternity leave does not apply to grace periods for non-payment of contributions, even if you did not conduct any real activities during this time. |

The grace period itself does not automatically suspend the accrual of contributions, because the lack of activity during this period must be documented. The Federal Tax Service calls the zero income declaration one of these documents, but it is better to check with your inspectorate in advance how to confirm the absence of activity during one of these periods.

Another option is if you are guaranteed to know that you will not be in business for a year or two, then it is easier to deregister as an individual entrepreneur and, if necessary, re-register.

Reduction of tax on the amount of contributions

The good news is that even during the crisis, the government did not cancel the opportunity to reduce insurance premiums by no more than 50% of the tax. All individual entrepreneurs can take advantage of this opportunity, except those who use the patent tax system.

For example, let’s take an individual entrepreneur on the simplified tax system “Income” with a total turnover of 2 million rubles per year, then he will be able to reduce his tax by the amount of contributions paid:

- amount of mandatory contributions: 27,990 + ((2,000,000 - 300,000) × 0.01)) = 44,990 rubles

- tax on the simplified tax system “Income”: 2,000,000 × 0.06 = 120,000 rubles.

In this case, our individual entrepreneur will actually pay tax0 = 75,010 rubles.

But in the end, for the year he will pay the same 120,000 rubles (tax + contributions);