In 2015, wages were accrued but not paid

There are many organizations and individual entrepreneurs who find themselves in a difficult financial situation and cannot pay salaries on time.

The accountant has a question: is it necessary to reflect accrued but not issued wages in the 2-NDFL certificate? And, if necessary, what fields should be filled in? At first glance, it may seem that you will not need to fill out 2-NDFL until the employer pays off the debt to the employee. Indeed, sections 3 and 5 of the certificate indicate information about income accrued and actually received by an individual. This is stated in the order of filling out the income information form, approved by order of the Ministry of Finance of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] Whereas in our case we are talking about income that is not actually received.

However, accrued wages must be included in the certificate, regardless of whether it is issued to the employee. This is explained by the fact that the date of receipt of income in the form of wages is considered to be the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). This means that the accrued salary is considered received, even if the money has not been received by the employee. As a result, the 2-NDFL certificate should reflect the accrued but not issued salary.

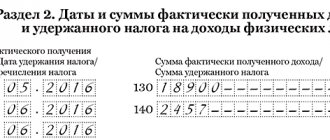

The accrued amount must be indicated in section 3 in the “Amount of Income” field for the month for which it was accrued. Next, the accrued salary will be included in the final indicator reflected in section 5 in the “Total income” field. The same amount, minus deductions, will be included in the final indicator reflected in Section 5 in the “Tax Base” field.

Tax on accrued but not paid wages will be shown as part of the final indicator in section 5 in the “Calculated tax amount” field. The fields “Tax amount withheld” and “Tax amount transferred” in section 5 are not filled in. Let us add that the accountant must only fill out a certificate with attribute “1”. The obligation to submit a certificate with attribute “2” arises in connection with the impossibility of withholding personal income tax (clause 5 of Article 226 of the Tax Code of the Russian Federation). And when wages are delayed, there is no talk of tax withholding.

2-NDFL for 2015

In order to increase the responsibility of tax agents for failure to comply with the requirements of the legislation on taxes and fees, a number of changes came into force on January 1, 2016, which affected the procedure for calculating and paying personal income tax. Art. Art. was directly amended. 223, 226, 230 and 231 of the Tax Code of the Russian Federation. In addition, a new form of income certificate has been introduced this year.

So, Art. 223 of the Tax Code of the Russian Federation has finally determined the actual dates for the receipt of some additional income for the purpose of calculating personal income tax. New edition of paragraphs. 3 clause 1 of this article is supplemented by paragraphs. 4–7. Let us designate the tax dates of some additional income of taxpayers, which have often caused controversy:

- day of offset of counterclaims of the same type;

- the day the bad debt is written off from the balance sheet in accordance with the established procedure;

- the last day of the month in which the employee’s advance report is approved after returning from a business trip. Here we can also talk about income in the form of exceeding the daily allowance established by clause 3 of Art. 217 Tax Code of the Russian Federation;

- the last day of each month for the entire period for which the borrowed funds were provided. Here income can be defined in the form of material benefits received from savings on interest. Thus, if an employee repays an interest-free loan in parts, then the tax base for personal income tax should be calculated based on the amount of repaid borrowed funds (letter of the Ministry of Finance of the Russian Federation dated December 25, 2012 No. 03-04-06/3-366).

GOOD TO KNOW

When issuing an interest-free loan to an employee, the date of actual receipt of income in the form of material benefits, starting from 2021, is considered the corresponding date of actual repayment of the borrowed funds.

Calculation of personal income tax by tax agents

Until 2021, the date of transfer of personal income tax to the budget depended, for example, on the day the tax agent received funds from the bank, or transferred them to the account of an individual, or received funds by an individual. Especially many questions arose regarding the determination of the moment of transfer of personal income tax withheld from vacation pay.

As a result, tax calculation for each individual who received income can now take place several times a month, for example, when paying wages and sick leave or issuing vacation pay.

When paying income in kind or when a taxpayer receives income in the form of a material benefit, the tax amount is calculated by the tax agent at the expense of any income paid to the taxpayer in cash. Moreover, in accordance with paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, the withheld amount of tax cannot exceed 50% of the amount of income paid in cash.

The tax agent may find itself in a situation where it is impossible to withhold tax from the taxpayer's income. According to the new edition of paragraph 5 of Art. 226 of the Tax Code of the Russian Federation, the tax agent is obliged to notify the tax authority about the amount of income of the taxpayer and the amount of tax not withheld during the tax period no later than March 1 of the year following the expired tax period.

In addition, according to the current rules, it is necessary to notify the inspectorate and the taxpayer of the impossibility of withholding tax within a month after the end of the year (letter of the Federal Tax Service of Russia dated October 19, 2015 No. BS-4-11/18217).

IMPORTANT IN WORK

The tax agent calculates, withholds and transfers personal income tax from wages to the budget once a month during the final calculation of the employee’s income based on the results of each month for which the income was accrued to him.

Tax reporting for personal income tax

From 2021, paragraph 2 of Art. 230 of the Tax Code of the Russian Federation establishes two types of tax reporting for a tax agent:

1) a document of the established form containing information on the income of individuals of the expired tax period and the amount of tax withheld and transferred to the budget system for this tax period for each individual - annually, no later than April 1 of the year following the expired tax period;

2) calculation of personal income tax amounts calculated and withheld by the tax agent for the first quarter, six months and nine months - no later than the last day of the month following the corresponding period, and for the year - no later than April 1 of the year following the expired tax period.

GOOD TO KNOW

What fundamentally distinguishes the new 6-NDFL form from the usual 2-NDFL certificates is that it must be filled out in general for all individual taxpayers who received income from a tax agent. At the same time, the submission of 2-NDFL certificates for each taxpayer is still required.

As a result, from 2021, instead of one reporting form, previously submitted once a year, two forms must be submitted to the tax authority, since starting from the current year, along with annual quarterly reporting on personal income tax, it is provided: no later than April 30, July 31, October 31 and April 01.

In addition, tax agents - Russian organizations with separate divisions, in relation to individuals who received income from such divisions, submit reports to the tax authority at the location of the separate divisions. Tax agents - individual entrepreneurs registered with the tax authority at the place of activity in connection with the use of UTII and (or) PSN, in relation to their employees, submit personal income tax reports to the tax authority at the place of registration in connection with the conduct of such activities.

GOOD TO KNOW

From January 1, 2021, for each 2-NDFL certificate containing false information, a fine of 500 rubles may be charged. (Article 126.1 of the Tax Code of the Russian Federation), therefore, the completeness and reliability of information in form 2-NDFL will be the subject of close attention from the tax authorities. In this regard, tax agents are recommended to take measures to update the personal data of individuals who are recipients of income.

Responsibility of tax agents

From 2021, the responsibility of tax agents has increased, namely:

- in case of failure to provide a calculation of personal income tax amounts - suspension of transactions on accounts (Article 76 of the Tax Code of the Russian Federation);

- in case of violation of the deadline for submitting the calculation of personal income tax amounts - a fine of 1000 rubles. for each full or partial month from the day established for submitting the calculation (Article 126 of the Tax Code of the Russian Federation);

- in case of providing false information - a fine of 500 rubles. for each submitted document containing false information (Article 126.1 of the Tax Code of the Russian Federation). In this case, the tax agent is released from liability under Art. 126 of the Tax Code of the Russian Federation, if he independently identified errors and submitted updated documents to the tax authority before the moment when the tax agent learned that the tax authority had discovered false information contained in the documents submitted to him.

GOOD TO KNOW

From January 1, 2021, tax agents - Russian organizations with separate divisions - submit a document containing information on the income of individuals for the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax calculated and withheld by the tax authorities. agent, in relation to the employees of these separate divisions, to the tax authority at the place of registration of such separate divisions, as well as in relation to individuals who received income under civil law contracts, to the tax authority at the place of registration of the separate divisions that entered into such agreements.

Filling out a certificate of income for 2015

Organizations must submit information on employee income for 2015 to the tax authority using a new form approved by Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ [email protected] In this case, the tax agent is required to fill out a certificate of income for each individual based on data contained in tax registers.

The certificate form includes, along with the title, the “Adjustment number” field. It should indicate:

- 00 – when preparing the initial certificate;

- 01, 02, etc. – when drawing up a corrective certificate;

- 99 – when drawing up a cancellation certificate.

There are five more sections in the help.

Thus, in section 1 information about the tax agent is indicated.

Section 2 is intended to reflect data about the recipient of the income - an individual.

Section 3 should present income taxed at the appropriate rates.

The fourth section of the form indicates the amount of deductions available to each individual individual - not only standard, but also social, investment, and property.

The fifth and final section displays the taxable amount of income and the amount of tax.

IMPORTANT IN WORK

Certificates submitted by tax agents in form 2-NDFL are neither tax returns nor calculations in the sense of Art. 80, 88 of the Tax Code of the Russian Federation, since they contain only information about income paid to individuals and the amounts of accrued and withheld tax. Therefore, they cannot be the subject of a desk tax audit.

The certificate (form 2-NDFL) is filled out in accordance with the Procedure for filling it out, presented in Appendix No. 2 to the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] We draw attention to some of the main points set out in this document :

1. The TIN of a taxpayer - an individual is indicated in accordance with the certificate of his registration with the tax authority at his place of residence in the territory of the Russian Federation.

2. If an organization has a separate division, along with the organization’s TIN, the checkpoint at the location of its separate division is also indicated.

3. If there is no value for the total indicators, zero is indicated.

4. When recalculating tax for previous tax periods in connection with the clarification of the tax, a corrective certificate is issued.

5. If a taxpayer - an individual during the tax period had income taxed at different tax rates, then sections 3–5 are completed for each of the rates.

6. In case of cancellation of a certificate that has already been submitted, the title and indicators of sections 1 and 2 specified in the previously submitted certificate are filled in.

POSITION OF THE FTS

The legislation of the Russian Federation does not contain a norm obliging tax authorities to issue taxpayers with certificates of income of individuals and amounts of personal income tax paid. At the same time, an individual has the right to apply in writing to the tax authority at the place of registration of the tax agent (former employer) in order to obtain information about the amount of income received by him and personal income tax withheld from them based on the information available to the tax authority and provided by the tax agent.

— Letter dated 03/05/2015 No. BS-3-11/ [email protected]

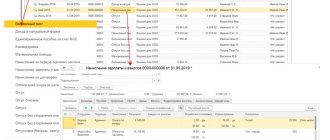

Example 1 (all data and all indicators are conditional).

Standard LLC (TIN 6316054352; OKTMO 36701000) operates in the Samara region. The organization applies the simplified tax system and is a tax agent for personal income tax. The organization has 15 employees, five of whom work in a separate division - KPP 631605001.

Ivan Sergeevich Petrov, born April 15, 1978, TIN 631605789012, is a full-time employee of a separate division of the organization and lives at the address: Russian Federation, Samara, 443052, 4th Radialnaya Street, building 65, apt. 40.

In 2015, he was paid income taxed at a rate of 13%, including: remuneration received in the performance of work duties in the form of salary paid for January - June and August - December of the reporting tax period, the monthly amount of which was 20,500 rub.

In July 2015, I. S. Petrov was paid temporary disability benefits, which amounted to 3,600 rubles, and he was also paid vacation pay in the amount of 16,500 rubles. In December 2015, a fee was paid for renting vehicles in the amount of 2,000 rubles.

At the same time, during the tax period, a deduction for a child was provided in the amount of 16,800 rubles. and a property tax deduction for new construction according to notification dated October 30, 2015 No. 3752/07, presented by I. S. Petrov, in the amount of RUB 35,600.

The total amount of income was: RUB 247,600. = ((20,500 rub. x 11 months) + 3,600 rub. + 16,500 rub. + 2,000 rub.).

The total amount of tax deductions was: RUB 52,400. = (RUB 16,800 + RUB 35,600).

The tax base was: 195,200 rubles. = (RUB 247,600 – RUB 52,400).

Let's calculate the amount of tax: 25,376 rubles. = (RUB 195,200 x 13%), which is withheld from the income of I. S. Petrov and transferred to the budget.

Appendix No. 1 to the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485

As we can see from the example, each type of income and each type of tax deductions are assigned individual codes.

At the same time, we note that for some incomes the Directory does not provide a separate code. For example, for compensation for unused vacation, both related and not related to dismissal. In this case, code 4800 “Other income” is used. At the same time, we will make a reservation that it would be a serious mistake if the accountant indicates code 2000. In addition, if the accountant adds this compensation to the salary, then in this case the deadline for paying personal income tax on this amount will be violated.

POSITION OF THE FTS

If the taxpayer has had personal income tax withheld excessively and the amount of tax to be transferred by the tax agent to the budget is not enough to refund the overly withheld and transferred amount of tax, the tax agent, within 10 days from the date the taxpayer submits the corresponding application to the tax authority at the place of his registration an application for a refund to the tax agent of the amount of tax withheld in excess.

— Letter dated August 13, 2014 No. PA-4-11/15988.

Example 2.

Let's imagine a situation that occurs quite often in practice. Let’s assume that an employee of an organization’s next vacation began in December 2015 and ended in January 2021. For the purpose of personal income tax taxation, vacation pay is actually received on the day of its issuance, since it does not relate to income related to the employee’s performance of his work duties (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). This means that in this case the entire amount of vacation pay should be included in the tax base for December 2015.

If vacation pay was accrued in December 2015 and paid to the employee in January 2021, then they should not be included in personal income tax reporting for 2015.

This approach is also typical for other non-salary income. This could be, for example, non-production bonuses, dividends, payments under civil contracts, etc.

Income in the form of bonuses

Of course, all bonuses paid can be reflected in section 3 of the certificate with code 4800 “Other income”. However, it is better to use the following principle. If there are difficulties in assigning a code to a particular bonus paid to an employee, you need to pay attention to its economic meaning. Thus, if a bonus paid to an employee was accrued for the production results of his activities, then it should be classified as remuneration for the performance of his job duties. In this case, code 2000 is applicable.

If a bonus paid to an employee was accrued, for example, for a holiday or anniversary, then it must be shown in the 2-NDFL certificate as “Other income”, using code 4800.

IMPORTANT IN WORK

If during the tax period the tax agent paid an individual income taxed at different tax rates, for example, 9%, 13%, 15%, 30%, 35%, then sections 3–5 of the 2-NDFL certificate should be completed for each of them .

Reflecting deductions

Do not confuse the deductions provided for in sections 3 and 4 of the certificate, because they are different. Section 3 should show professional tax deductions and amounts partially exempt from personal income tax in accordance with Art. 217 Tax Code of the Russian Federation. For example, financial assistance in the amount of 4,000 rubles. or a gift within this amount. Section 4 of the certificate reflects the tax deductions that the tax agent provided to the employee in accordance with Art. 218, 219, 220 of the Tax Code of the Russian Federation (respectively: standard, social, investment, and property).

If the tax deductions provided to the employee are not named in Appendix 2 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387, then we recommend indicating code 620 “Other amounts that reduce the tax base in accordance with the provisions of Chapter 23 “Income Tax individuals."

GOOD TO KNOW

If the number of individuals who received income in the tax period is up to 25 people, tax agents can submit information on paper. The named number for the purpose of submitting a certificate in form 2-NDFL takes into account all individuals who received income from the tax agent during the tax period, and not just its employees.

Salaries were calculated in 2015 and paid in 2021

Many employers issue December salaries in January. In addition, there are companies and individual entrepreneurs who, in the new year, pay off wage arrears for several months of last year. At the same time, the accountant withholds and transfers income tax to the budget. How to reflect this in the 2-NDFL certificate?

According to specialists from the Federal Tax Service of Russia, any information related to last year’s income must be shown in the certificate for last year. This rule also applies if the tax from last year’s salary is transferred in the new year. If 2-NDFL for the previous year has already been submitted, the employer will have to submit an adjustment. This opinion is expressed in letter dated 03/02/15 No. BS-4-11/3283. (see “The Federal Tax Service has clarified how to reflect last year’s salary paid in 2015 in 2-NFDL”).

In the corrective certificate, you should duplicate the data of the original document and, in addition, indicate the amount of personal income tax that was withheld and transferred after the New Year. This figure will be included in the totals reflected in section 5 in the fields “Amount of tax withheld” and “Amount of tax transferred.”

Tips for filling

To obtain a certificate, you can contact an accounting or legal office, but this service is paid. It is much easier to download sample 2 personal income tax at the end of the article and draw up your own document using the template. Naturally, when the staff consists of several dozen or even hundreds of people, it is problematic to issue certificates manually.

In this case, it is advisable to install a computer program that will help prepare documents quickly. It is enough to fill out all the fields once, then you will only have to change the numbers and last names, the rest of the statements will remain in the program’s memory.

If you decide to use a computer assistant, purchase paid software. It is constantly updated to keep up with changes in legislation.

Sample form of form 2 personal income tax 2015

Sample of filling out form 2 personal income tax 2015

Personal income tax was withheld correctly, but transferred unnecessarily

Some difficulties arise when the tax is calculated and withheld correctly, but an inflated amount of tax is erroneously transferred to the budget. To correctly fill out form 2-NDFL, you need to be guided by the following statement: the overpaid amount is not a tax. Therefore, it should not be reflected in the income certificate. Thus, in section 5, the fields “Amount of tax calculated”, “Amount of tax withheld” and “Amount of tax transferred” must be filled in as if there was no overpayment.

Let's give an example. Let’s say an employer accrued and withheld personal income tax in the amount of 10,000 rubles, but mistakenly transferred 15,000 rubles to the budget. In the income certificate, the accountant must enter the figure 10,000 in the appropriate fields of Section 5. As for the overpayment, it can be offset or returned. To do this, you need to reconcile with the budget, and then write an application to the Federal Tax Service.

Who must report on Form 2 personal income tax?

Any entrepreneur who has officially employed employees must annually submit a tax report in Form 2 of personal income tax. This must be done before April 1 of the year following the reporting year. In this case we are talking about 2015. The Tax Code provides for penalties for late filing. The amount is symbolic, 50 rubles. for each form. In addition, the head of the enterprise bears an administrative penalty in the form of a fine of 300-500 rubles. However, one should not relax, since systematic violation of tax reporting entails criminal liability with more severe sanctions.

The employee's standard deduction amount exceeded his income

It happens that the amount of an employee’s standard deductions turns out to be greater than his income. This happens, in particular, when an employee with a small salary receives a deduction for several children at once.

Under such circumstances, filling out form 2-NDFL is not easy, since accounting programs usually do not allow you to indicate the excess of deductions over income. The reason is that the tax base for income tax can be positive or zero, but not negative.

To solve the problem, section 4 of the certificate must be filled out so that the sum of deductions for all codes is equal to the amount of income. Simply put, the amount of deductions should be “adjusted” to the amount of income so that the taxable base takes on a zero value. In section 5, in the fields “Tax base”, “Tax amount calculated” and “Tax amount withheld” you should enter zeros.

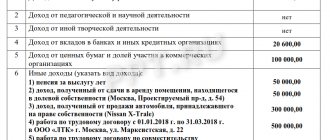

Example

During the year, the employee received “children’s” deductions for the first, second and third child (deduction codes 114, 115 and 116, respectively). The total amount of deductions under code 114 for the year was 16,800 rubles. (RUB 1,400 x 12 months). The total amount of deductions under code 115 also amounted to 16,800 rubles for the year. The total value of codes for deduction 116 amounted to 36,000 rubles for the year. (RUB 3,000 x 12 months). Total for the year, the amount of all “children’s” deductions reached 69,600 rubles (16,800 + 16,800 + 36,000). The employee's salary was 4,500 rubles. per month, and at the end of the year amounted to 54,000 rubles. (RUB 4,500 x 12 months). When filling out Form 2-NDFL, the accountant “adjusted” the total value of deductions to the amount of income. To do this, in section 4 of the certificate, under code 114, he indicated the deduction amount 16,800, under code 115, the deduction amount 16,800, and under code 116, the deduction amount 20,800 (54,000 - 16,800 - 16,800).

Please note: the employer must not submit a certificate with attribute “2”. The fact is that this attribute is assigned to certificates that are submitted due to the impossibility of withholding personal income tax. But if deductions exceed expenses, there is no need to withhold tax at all. This means that the accountant only needs to issue a certificate with attribute “1”.

Who needs to be indicated in Form 2 of Personal Income Tax?

It is necessary to fill out certificates for all employees. In addition, for persons who are not on staff, but received income from the enterprise. Income should be understood not only as monetary remuneration, but also as payment in kind (food, clothing, equipment, etc.), as well as bonuses and gifts. In some cases, one employee needs to fill out 2 or more personal income tax forms:

- if the person received income at different tax rates;

- if the person carried out activities in several branches of the enterprise located in different regions of the country.

The inspection did not accept the certificate the first time

It often happens that the inspectorate accepts some 2-NDFL certificates immediately, but finds errors in others and “returns” them for revision. Accountants are unsure what to do after correcting the deficiencies: resubmit all the certificates, or submit only those with deficiencies? In addition, ambiguities arise as to whether the corrected certificate is considered an adjustment and what number to assign to it.

There is no need to resubmit all certificates; it is enough to submit the corrected ones. Such forms are not correctional, so you should put “00” in the “Adjustment number” field in the title. The corrected certificate remains the same number as the original one, but the date changes - when resubmitting Form 2-NDFL, the accountant must enter the date when the corrections were made.

Form 2 personal income tax cap

Personal income tax certificate header 2, a sample of which requires mandatory entries, should look like this:

- in the upper right corner the name of the application (Appendix 1 to the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/611) and indicating the number and date of the last edition;

- under this data the name of the document, its attribute and the code of the federal tax system inspection are placed;

- Next, it is indicated for what period the certificate is issued, its serial number and the date of issue.

If most of the details are clear, then a few words should be said about the sign and number of the Federal Tax Service. There are two signs No. 1 and No. 2. According to the first criterion, forms 2 of personal income tax are submitted if the enterprise collected tax from employees. They must be submitted by April 1 of the year following the reporting year.

According to the second criterion, as is obvious, forms are submitted when the company did not withhold taxes from wages. They must be submitted by January 31 of the year for which the report is required. The Federal Tax Service is the number of the regional tax office. In order to determine which numbers to indicate in the document, use a convenient automatic search engine for all regions of the Russian Federation. You need to enter the four-digit code that comes after the fraction in the field.

Remember: it is incorrect to enter a two-digit code, which is the serial number of the INFS branch in the locality.

Composition of form 2-NDFL

Form 2-NDFL consists of a title part and five sections. In the title part, when filling out, the year for which the reporting is submitted, the attribute, the date of preparation of the report, the adjustment number and the tax authority code are indicated. The first section is devoted to the data of the tax agent, the second - information about the taxpayer. The third section reflects income, the fourth - deductions, and the fifth - the total amount of tax and income. Please note that starting from 02/10/2018 they are submitted in the form approved by Order of the Federal Tax Service of Russia No. ММВ-7-11 / [email protected] dated 01/17/2018. However, according to information from the Federal Tax Service, tax agents have the right to submit a report for 2021 using the previous form.

The differences cannot be considered significant:

- in the second section, the field “Residence address in the Russian Federation” is excluded;

- the fields “Form of reorganization (liquidation) (code)” and “TIN/KPP of the reorganized organization” have been added to the first section.

Document header

Filling out any tax return begins with entering the date - the day, month and year when the document was prepared. Be sure to indicate the year - those 12 months for which the person’s income and withheld income tax will be presented.

Next, fill in the “Sign” field, in which we put:

- “1” - if in the certificate we report on the volume of financial receipts and the personal income tax calculated from them;

- “2” - if we inform the tax authorities about the impossibility of withholding tax from an individual.

In addition, we indicate the IFSN code in the certificate header. A complete list of addresses and details of local tax inspectorates can be found on the official portal of the Russian Tax Service.

Section 1

In the introductory part of the certificate we indicate the name of the legal entity (the name of an individual conducting private practice or an individual entrepreneur). Next we enter:

- contact number,

- taxpayer identification number (TIN),

- OKTMO code - it hides the name of the municipal entity (village, city, district, district or other entity).

An innovation is the field about liquidation or reorganization - it is filled out by successor enterprises, which, instead of the liquidated organization, prepare reports for the tax authorities.

Section 2

This part provides information about the individual whose income and tax deductions are reflected in this certificate. Registered:

- His last name, first name and patronymic;

- Citizenship;

- DD/MM/YYYY of birth;

- Taxpayer code.

In the “status” column, one is entered if the individual is a resident of the Russian Federation. Accordingly, his identity is verified by a passport, and in the empty field we enter the code of this document (“21”). Don't forget to indicate its series and number. Russians living abroad, foreigners and refugees should check their status and the coding of basic documents on the tax service website.

Sections 3 and 4

In the key part of the document we indicate all sources of financial income that are subject to taxation. The basic income tax rate for Russian citizens and residents of the country is always 13%. For non-residents, income in most cases is subject to personal income tax of 30%, and a more lenient rate is determined only for income from dividends - and it is 15%.

To reflect each source of a person’s financial income in the certificate, they resort to special coding. In accordance with it, each type of income is assigned a four-digit code. Below are examples of the most common codes:

- "2000" to indicate salary;

- “1400” to reflect additional earnings from renting or renting property;

- “2002” to record bonus payments.

Sections 3 and 4 also provide fields for deductions. They allow you to reduce the tax base and are due to the payer in cases stipulated by law. For example, the amount of personal income tax paid can be reduced by the holder of a mortgage loan or by a person who spends funds on charity. Each deduction is assigned its own coding and the amount by which the income tax was reduced.

Each deduction is accompanied by a document that certifies its legality. In 2-NDFL it is necessary to indicate the number of such document/documents, the date of its execution and the code of the inspection to which it was submitted.

Section 5

In this section, the final calculation of the withheld and transferred personal income tax is made, based on the total amount of income, taking into account the deductions due to the person. It is necessary to indicate separately:

- Total revenues;

- The tax base;

- The amount of calculated, withheld and transferred personal income tax;

- The amount of the excess withheld fee (it is returned to the payer if necessary);

- Amount not withheld by the withholding agent.

Finally, in the last block, information about the person filling out the declaration is written down: if he was the tax agent himself, put “1”; if the representative is “2”. Do not forget to indicate the full name of the person who prepared the document, as well as his details. We sign. At this step, the instructions on how to fill out 2-NDFL ends. The certificate can be safely submitted at the destination.

What to do if a mistake was made in 2-NDFL?

What to do if an error was made in the 2-NDFL declaration submitted on time? For example, it contained information that did not correspond to reality:

In this case, a 2-NDFL adjustment is submitted to the tax authorities. They have the same form as the standard declaration, but differ in how the “adjustment number” field is filled in: if the certificate is submitted for the first time, the number “00” is entered in it, if an adjustment is submitted for the first time, “01”, etc. It is important to notice incorrectly submitted information before tax officials do so - then the adjustment will not be subject to a fine.

Author: Mainfin.ru Team

Related terms

- How to fill out the 3-NDFL declaration - instructions, sample filling

- Taxpayer category codes in the 3-NDFL declaration

- Certificate 2-NDFL - what is it and why is it needed?

- How long is the 2-NDFL certificate valid?

- How to get 2-NDFL through State Services

- Income codes in personal income tax certificate 2 in 2021

10:00 10.04.2019

Credit cardCertificatesInstallment planDepositsLoansCurrent accountMicroloansBanksBenefitsSalariesMortgageDebit cardMoney transfersInsurance

Subscribe to Yandex.Zen