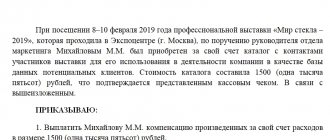

Documentation

What should be displayed The header of the document should contain the following: full name of the organization; date of,

Deferred income (FPI) is an important criterion taken into account when analyzing the economic and financial functioning of an organization. IN

The Social Insurance Fund of the Russian Federation (FSS RF) is one of the state extra-budgetary funds created

The COVID-19 pandemic has made adjustments to the procedure for issuing and processing certificates of incapacity for work. Previously already

Declaration of affiliation with small businesses is a form filled out by small business entities when

VAT is an indirect federal tax, the calculation of which is carried out by the seller when selling goods to the buyer, i.e.

One of the components of financial statements, in addition to the balance sheet and profit and loss account, is

Until April 1 inclusive, organizations must submit to Rosstat a report on fixed assets for

It is known that line 080 in the 6-NDFL declaration is not filled out very often, however, with the entry

For the convenience of filling out personal income tax returns 3-NDFL and 4-NDFL Federal Tax Service