The procedure for filling out payment orders in 2021

The payment order form remains the same; its form is contained in Appendix 2 to the Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P (OKUD 0401060). But the rules for filling out payment slips, approved by order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n, were amended in 2021.

Let us recall the basic requirements for how to fill out a payment order for 2021:

- Payer status (101) indicates the person making the payment: “01” - legal entity, “02” - tax agent, “09” - individual entrepreneur, etc.

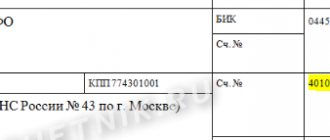

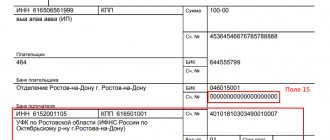

- When listing tax payments, in the fields provided for the TIN (60) and KPP (102) of the recipient, indicate the details of the Federal Tax Service, and in the field “Recipient” (16) - the region, and in brackets - the name of the specific Federal Tax Service. You should especially carefully fill out the Federal Treasury account number (17) and the name of the recipient's bank (13) - if there is an error in these details, the tax or contribution is considered unpaid and will have to be paid again, in addition, the Federal Tax Service will calculate penalties for late payment if the payment deadline has already passed. passed.

- The order of payment for taxes (21) is 5.

- BCC (104) must be valid at the time of payment and correspond to the transferred tax or contribution. Let us remind you that from January 1, 2017, insurance premiums, with the exception of contributions for “injuries,” should be transferred to the Federal Tax Service, therefore, the BCC for them has also changed.

- OKTMO code (105) is indicated at the place of residence of the individual entrepreneur, the location of the legal entity, or its property.

- Ground (106) when paying current payments is designated as “TP”, when filling out a payment order at the request of the Federal Tax Service in 2017, or FSS - “TR”, repayment of debt - “ZD”, debt under the inspection report - “AP”.

- The period for which the insurance premium/tax is paid (107): at the basis of “TP” and “ZD” the reporting (tax) period is indicated, for “TR” the date of the claim is indicated, and for “AP” - “0”.

- Payment type (110) – usually “0”.

An example of filling out the fields of a payment order in 2021.

Number of generated payments

Firms and businessmen have the right to combine tax on various incomes (salary, bonus payments, vacation pay, etc.) in one payment slip, if all these charges were made in one month.

If the income on which personal income tax is paid belongs to different months, filling out a personal income tax payment form in 2021 is required for each period. If this rule is not followed, discrepancies will arise between actual contributions to the state budget and the calculation in Form 6-NDFL. The tax office may require an explanation of the current situation in writing.

Filling out a payment order from April 25, 2021

The latest changes to the Rules came into force on April 25, 2017 (Order of the Ministry of Finance dated April 5, 2017 No. 58n). Let's look at what's new in the updated Instruction 107n when filling out payment orders for 2017:

- The issue with taxpayer status in field 101 of payment slips for the transfer of insurance premiums has been resolved. The position of the Federal Tax Service has changed on this matter more than once since the beginning of 2017, and now, finally, the tax authorities have decided - from April 25, 2021, in field 101 of the payment order the following should be indicated:

- code 01 – when the organization transfers contributions for employees,

- code 09 – when an individual entrepreneur transfers contributions for employees or for himself.

When transferring insurance premiums for “injuries” to the Social Insurance Fund and other budget payments not administered by the tax authorities, organizations and individual entrepreneurs indicate code 08 in the payment field 101.

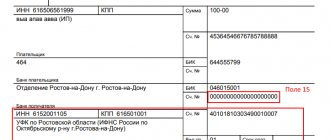

For example, for an individual entrepreneur paying insurance premiums for himself in 2017, filling out a payment order will be as follows:

Deadlines for payment of labor income tax

Personal income tax must be paid strictly within certain deadlines. Consider them:

- Salary Employers must pay their employees wages twice a month - in the form of an advance payment, as well as a final payment. The tax must be paid once a month - simultaneously with the final payment.

- Sick leave benefits and vacation pay. The tax on them must be paid no later than the last day of the month of their payment.

- Calculation of severance. When an employee resigns, the employer must pay him in full on his last day of employment. The tax must be paid on the same day.

Payment order sample 3

- A new filling out of payment orders has been approved in 2021 for making payments to the budget for third parties. The opportunity to pay off debts on taxes and state duties for other taxpayers appeared from November 30, 2016, and from January 1, 2017, you can pay insurance premiums for others, except for “injuries” in the Social Insurance Fund.

From April 25, 2017, when making payments for other persons, the following rules for filling out a payment order in 2021 must be observed:

- In the fields provided for the payer's TIN and KPP, the TIN and KPP of the person for whom the tax or insurance premium is being transferred is indicated. When paying for an individual who does not have a TIN, “0” is indicated instead.

- “Payer” in the appropriate field indicates the one who transfers funds from his current account.

- “Purpose of payment” - here you must first indicate the TIN/KPP of the person who is paying, and then, after the “//” sign, enter the taxpayer for whom they are paying.

- The payer status (field 101) is indicated according to the status of the person for whom the payment is made: 01 – legal entity, 09 – individual entrepreneur, 13 – individual.

Example. Payment for another organization (Alpha LLC for Yakor LLC) of transport tax - payment order (filling sample 2017):

KBK NDFL

Current for 2016-2017. For 2021, the BCC has not been changed.

| Payment | BCC for tax | KBK for penalties | BCC for fine |

| Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens registered as: – entrepreneurs; – private notaries; – other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

How to correctly fill out a payment order to transfer a fine?

A step-by-step algorithm for how to submit a payment for a fine to the tax office involves specifying the following information in the fields of the order:

Recipient details

The fine is paid to the same branch of the Federal Tax Service as the tax itself. This means that the name of the recipient, his BIC, correspondent account and current account will remain “standard”. If the transfer is made for the first time, the details can be clarified at the tax office or on its official website.

Purpose of payment

The type of transfer and a link to the base document are indicated. For example, an accountant writes: “Fine for failure to submit a VAT return in accordance with requirement No. 1 of 01/01/2019.”

It is important to take into account that different BCCs have been established for repaying arrears, paying penalties and fines. The difference lies in symbols 14-17, which show the subtype of payment. For fines, their combination is set as “3000”, for the “body” of the tax - “1000”. You can find the required code on the websites of information and legal systems; it is indicated in the request received from the Federal Tax Service.

Basis of payment

In field 106 an abbreviation is entered, depending on the document for which the fine is paid. “AP” is indicated if the basis was a decision of the tax inspectorate based on the results of an audit, or “TR” if the organization received a request.

The abbreviation “ZD” should not be indicated when listing fines. It is used in cases where the taxpayer voluntarily repays the identified debt.

Document number and date

In field 108 of the payment order, enter the number of the claim for which the fine is transferred. Field 109 indicates the date of this document.

In field 22, the UIN is written if it is indicated in the request received by the taxpayer. If this information is not in the document, “0” is entered.

OKTMO

The OKTMO corresponding to the tax office where the funds are sent is indicated. For example, if a company transfers money to the Federal Tax Service, where its separate division is registered, the code must be entered not at the registration address of the parent organization, but at the location of the branch.

The taxpayer’s responsibility is to remit the fine within the time limits specified in the request. If the funds are not received by the inspectorate in a timely manner, it will foreclose on the bank accounts of the business entity and its electronic wallets.

If you find an error, please select a piece of text and press Ctrl+Enter.

Payment order 2019: particularly important details

Certain payment order details must be filled out very carefully. After all, if you make a mistake in them, your tax/contribution will simply be considered unpaid. Accordingly, you will have to re-transmit the amount of tax/contribution to the budget, as well as pay penalties (if you discover the error after the end of the established payment period).

Such details include (clause 4, clause 4, article 45 of the Tax Code of the Russian Federation, clause 4, clause 7, article 26.1 of the Federal Law of July 24, 1998 N 125-FZ):

- Federal Treasury account number;

- name of the recipient's bank.

Errors in other details are not critical - the money will still go to the budget. And the error can be corrected by clarifying the payment (Clause 7, Article 45 of the Tax Code of the Russian Federation).

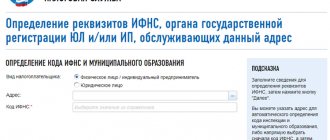

Service for drawing up documents in online form

If you don’t have time to fill out payment forms yourself, then you can use the online form on the PrintPay website.

This option is also convenient because you can create a document anywhere and at any time.

So, let's go to the site:

As you can see, a window for filling out immediately opens, but we advise you to read the filling rules again at the very beginning, which you can find at the bottom of the page:

The window that appears contains all the information that is necessary to correctly fill out the payment order.

Do not forget that in case of even one error, the bank will not be able to complete the transaction, which means there will be a delay in payment.

Therefore, even if you are already familiar with all the rules, do not be lazy to read them again.

In addition, legislation is now making changes and adjustments to this system, so it is very likely that you will have to deal with new rules.

All information in this section complies with government regulations.

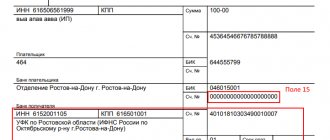

To make it easier to find the information you need, select the required field in the photo and look for the relevant information.

For example, we don’t know how to fill line 60:

We are looking for information for this line:

Now let's move on to filling out the document:

For convenience, the system offers an automatic search for the bank's BIC. Just enter the name of the bank you need:

After filling out all the fields, select the payment purpose:

After that, click “Generate” and in a new window your document will be available for you to save.

Check that the data is filled out correctly, and if you find errors, go back and correct them.

The system also offers a quick fill option:

In this case, you are offered a slightly different way of filling out the fields, but in the end you receive the same document. It is believed that the second method is a little simpler.

If you do not trust online systems of this kind, then you can fill out the document directly at the tax office or bank branch.

In this case, the procedure may be delayed, since, for example, to find out information on the BIC, you will need to seek help from one of the employees who may be busy at the moment.

This is the advantage of filling out online - all information is available without queues or waiting.

Every individual entrepreneur or company accounting department is faced with the preparation of the document in question, so it is necessary to constantly monitor all innovations in order to correctly process the payment.

back to menu ↑

What is a payment order in 2021

How to issue a payment order to pay a fine on contributions

The option for filling out a payment form to pay a fine on contributions depends on who issued the sanctions:

- Federal Tax Service, due to late submission of reports;

- FSS for late payment of accident contributions.

Let's take a closer look.

If a taxpayer fails to submit reporting on contributions on time, he or she will be subject to sanctions in the amount of 5% of the amount of contributions for each month of delay, but not more than 30% of this amount and not less than 1 thousand rubles.

The algorithm for filling out a payment form for a fine is similar to the procedure established for tax fines, with the exception of the KBK. In 2019-2020, the following codes should be indicated:

for compulsory pension insurance

for social insurance due to illness or maternity

182 1 0210 160

182 1 0213 160

182 1 0210 160

At the same time, the fine amounted to 1 thousand rubles. should be distributed among the KBK in proportion to the tariffs (letter of the Federal Tax Service dated 05.05.2017 No. PA-4-11/8641):

- to the Pension Fund of Russia 733.33 rubles. (22 / 30 * 1000);

- in FFOMS 170 rub. (5.1 / 30 * 1000);

- in the Social Insurance Fund 96.67 rubles. (2.9 / 30 * 1000).

The FSS also has the right to impose penalties for late submission of Form 4-FSS (5% of the amount of contributions, but not less than 1 thousand rubles and no more than 30%) or for violating the procedure for submitting the form (200 rubles).

The procedure for filling out a payment form is slightly different from that established for tax fines:

- Fields 106 – 109 are not filled in;

- KBK — 393 1 0200 160

For information on how to fill out a payment order to pay a fine to the Pension Fund, see the Ready-made solution from ConsultantPlus.

How to fill out a tax payment order

Please indicate the amount in full rubles. The rule applies: transfer taxes to the budget in full rubles, rounding kopecks according to the rules of arithmetic: if less than 50 kopecks, discard them, and if more, round to the nearest full ruble.

All fields are required. The date and amount of the write-off are indicated in numbers and in words. Payment orders are numbered in chronological order.

Each field is assigned its own number. Let's look at the rules in more detail.

Field 101 must indicate the payer status. When paying personal income tax, a budget organization is a tax agent, so we indicate code 02.

In the “Recipient” column, indicate “Federal Treasury Department for the corresponding region”, in brackets - the name of the tax office. In other columns, the TIN and checkpoint of the inspection are indicated.

Meaning

Correctly completing and submitting personal income tax reports is not enough if you need funds to pay the tax to be transferred in accordance with their purpose. To do this, you must fill out a payment order to the Federal Tax Service in accordance with all official requirements. Otherwise, the organization and the budget itself may simply not see the transferred funds. Then you will have to:

- clarify all payment details;

- check details;

- look for the mistake made.

The likelihood that money will disappear without a trace is extremely low. But in some cases, legal entities and individual entrepreneurs with staff as a safety net have to re-transmit the required amount in order to avoid troubles in the future.

Thus, paying personal income tax in 2021 with a payment order that is generated according to a specific model requires close attention to avoid mistakes.

The 2021 personal income tax payment order form has not received any important additions or changes. Therefore, it looks exactly the same as the 2021 model.

Also see “Payment order for the payment of taxes and insurance premiums in 2021: decoding of the fields.”

Fines and penalties for taxes and fees

If a request for payment of a fine or penalty is received, it may contain a UIN (unique accrual identifier), which must be indicated in the “Code” field. If there is no requirement with UIN, then 0 is entered in this field.

OKTMO is indicated as usual, as when paying taxes. In field 106, the basis for the payment is selected: if there is a requirement from the tax authority, put TR, if there is no requirement, then put ZD. The number and date of the request are indicated in fields 108-109 of the payment order; if there is no request, zeros are entered in the fields. In field 107 “Tax period indicator” the payment deadline specified in the request is entered. If there is no requirement, then this field is also set to 0.

KBK, if it is not specified in the requirement, you need to look for it yourself. Keep in mind that the BCC is taken not from the period for which you pay the fine or penalty, but from the BCC of the year in which you pay it. Those. when paying fines and penalties in 2015, you must take the KBK from the list of codes for 2015.

Tax payment order

We would also like to draw your attention to field 21 - this is the order of payment in the personal income tax payment order in 2021. In a standard situation - when the company has enough funds in bank accounts - the value “5” is entered in this field. Since taxes are the 5th priority after deductions for executive documents and salary payments, which must be made by the accounting department of the enterprise.

Thus, a value from 1 to 5 is entered in this field. Let us recall that banks execute payment orders as they are received from the organization. And when there are few funds in the account, the order plays a role.

The bank cannot refuse to accept a personal income tax payment if the order of payment is entered incorrectly (page 21). This conclusion follows from the letter of the Ministry of Finance dated January 20, 2014 No. 02-03-11/1603.

Deadlines for transferring personal income tax for yourself

Labor activity is not the only possible source of income for individuals. There are other types of transactions leading to the formation of material benefits:

- lottery winnings;

- sale of real estate owned for less than three years;

- rental of property;

- receiving prizes worth more than 4 thousand rubles, etc.

In all of the above cases, an individual must independently calculate and remit income tax. The deadline for payment is 15.07 next year.

Individual entrepreneurs and persons engaged in private practice (notaries, lawyers) pay personal income tax for themselves based on written notifications from the Federal Tax Service. The tax is transferred in three tranches: for the first half of the year - until July 15 of the current year, for nine months - until October 15, for the whole year - until January 15.