It is known that line 080 in the 6-NDFL declaration is not filled out very often, however, almost every tax agent is faced with entering data into it one way or another. To understand the specifics of filling it out, you will need to carefully focus on the rules stipulated by law. Otherwise, you will have to correct errors, which may result in real liability.

- 2 Entering data into line 080 of the 6-NDFL declaration

2.1 Example of filling out line 080 - 2.2 When line 080 is empty

2.2.1 Table: allowed cases of blank lines

- 3.1 How to fix an error when filling out line 080

3.1.1 Table: error correction options

- 3.2.1 Video: when filling out the eightieth line of the 6-NDFL calculation

What is page 080 for in 6-NDFL?

Line 080 6-NDFL is called “Tax amount not withheld by the tax agent.”

Such a wording may lead a businessman inexperienced in tax reporting to think that personal income tax may not be withheld and that the tax authorities can fairly honestly report this on page 080 of the 6-NDFL report. However, one should not be mistaken about this. The duties of a tax agent, such as timely calculation, withholding from income paid to individuals and transferring personal income tax to the budget, have not been canceled (clause 1 of Article 226 of the Tax Code of the Russian Federation).

For details for transferring personal income tax by tax agents, see this material.

The main purpose of line 080 6-NDFL:

- disclose the fact of non-withholding of personal income tax by the tax agent in the presence of income paid to individuals;

- show the amount of unwithheld personal income tax.

This situation, for example, may arise if the employer:

- paid the “physicist” income in kind (for example, donated something), but did not make any other monetary payments to him during the year;

- failed to withhold (in whole or in part) personal income tax from the income of the employee who received income in the form of material benefits (due to the absence or insufficiency of cash payments to this employee).

NOTE! Do not show personal income tax from a “carrying forward” salary (for example, payments for September issued to employees in October, that is, the next reporting period for calculating 6-personal income tax) as not withheld in line 080. This is an error that can only be corrected by submitting a clarification ( letter of the Federal Tax Service of the Russian Federation dated May 24, 2016 No. BS-4-11/9194).

A separate section of our website, “Personal Income Tax on Material Benefits (Features),” will help you correctly calculate material benefits and learn more about their types.

How to fill out the remaining lines of the report is discussed step by step in ConsultantPlus. See the authoritative opinion of K+ experts in the Ready-made solution by getting free trial access.

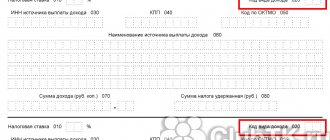

Income certificate 2-NDFL

The tax office also provides information on the income of individuals 2-NDFL. In this certificate, in the “Characteristic” field, you will need to indicate two or four, and in the fifth section, fill in the corresponding line reflecting the amount of unwithheld tax.

Also note that this certificate, which includes sign “1”, must be filled out and sent to the tax office. After all, if the tax agent reported the impossibility of withholding tax, this does not negate his important obligation to provide the tax certificate with the certificate we are considering.

Sample of the form in question

Rules for filling out page 080 in 6-NDFL

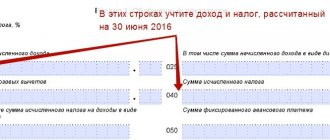

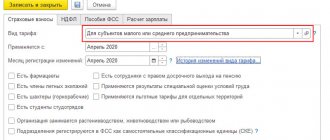

In the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] , which describes the line-by-line filling out of the 6-NDFL report, the following is said in relation to page 080:

- the line shows the total amount of personal income tax not withheld by the tax agent;

- it is filled in with a cumulative total from the beginning of the tax period.

It follows from this that line 080 combines unpaid personal income tax for all individual income recipients regardless:

- from their number;

- the amount of income received;

- the period of its payment by the tax agent (letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11/13984).

Let's look at the example of the procedure for filling out 6-NDFL (line 080).

Example

The collective agreement of Tekhnopromservice LLC contains a condition on the possibility of rewarding retired former employees who have worked for the company for at least 15 years with valuable gifts for major anniversaries.

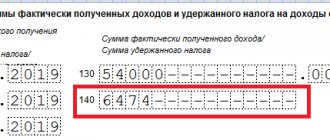

In January and February 2021, 3 retired former employees of the company were given imported washing machines worth 13,900 rubles for their anniversaries. each (total amount of gifts issued - 41,700 rubles). Pensioners did not receive any money from the company during the reporting period.

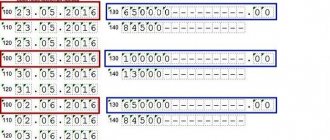

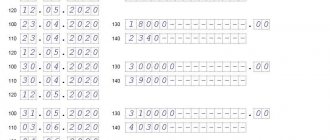

The fact of issuing a gift in 6-NDFL for the 3rd quarter will be reflected:

- on line 020 (amount of accrued income) - 41,700 rubles;

- on page 030 (tax deductions) - tax-free amount of 12,000 rubles. (4,000 rubles × 3 people);

- on line 040 (amount of calculated personal income tax) - 3,861 rubles. ((41,700 – 12,000) × 13%);

- on pages 100 and 130 of the second section - the dates and amounts of “gift” income;

- pages 110, 120 and 140 (intended to reflect the date of tax withholding, its amount and the date of transfer to the budget) are filled with zeros.

If by the end of the year pensioners do not receive any cash income from their former employer, it is necessary to fill out page 080 in the annual report 6-NDFL, recognizing the impossibility of withholding personal income tax.

We will discuss what other actions a tax agent needs to take if a completed page 080 appears in his report in the next section.

What to do if the tax office finds an error in line 080

A fairly common mistake associated with line 080 of 6-NDFL is the demonstration of tax on carry-over wages as unwithheld. It is necessary to familiarize yourself with the procedure for filling out form 6-NDFL and the items associated with filling out (described just above) and correct the generated reports in accordance with them.

Submit a corrected and correct invoice

If an error is discovered after submitting the 6-NDFL report (for example, the amount of non-withheld personal income tax is indicated incorrectly or not indicated at all), it will be necessary to correct the typo. Then you will need to submit an updated and correct calculation to your tax office.

Subsequent actions of the tax agent

Line 080 filled out in the annual report 6-NDFL will require one more action from the tax agent - prepare and send a message about the impossibility of withholding personal income tax (clause 5 of Article 226 of the Tax Code of the Russian Federation).

These messages are sent:

- tax authorities;

- to all individuals who were paid income during the year from which personal income tax was not withheld (letter of the Federal Tax Service of the Russian Federation dated November 16, 2016 No. BS-4-11 / [email protected] ).

When performing this duty, you must adhere to the following rules:

- for the message, use a special form - to do this, issue a certificate of income of an individual in form 2-NDFL (approved by order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11 / [email protected] );

- in the certificate of form 2-NDFL, enter the number 2 in the “Sign” field and in section 5, fill in the line intended to reflect unwithheld personal income tax;

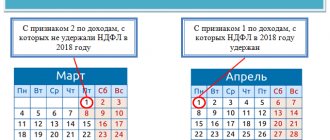

- do not be late with the message - it must be sent to the specified addresses no later than March 1 after the end of the calendar year (clause 5 of Article 226 of the Tax Code of the Russian Federation).

2-NDFL with sign 2 for 2021 must be sent no later than 03/02/2020, because 03/01/2020 - Sunday. For a sample form, see here.

And do not forget that the Federal Tax Service and the Ministry of Finance recommend duplicating 2-NDFL certificates with sign 2, but with sign 1 at the same time - no later than March 1 of the next year.

Attention! Tax officials compare the indicators of forms 2-NDFL and 6-NDFL. Find out what the amount of line 080 should be in ConsultantPlus by getting trial access to the system for free.

How the deadlines for submitting 2-NDFL and 6-NDFL have changed can be found here.

If you fail to send messages on time, tax authorities may punish:

- manager - a fine of 300 to 500 rubles. (Article 15.6 of the Administrative Code);

- company - a fine of 200 rubles. for each overdue message (Article 126 of the Tax Code of the Russian Federation).

How to correct an error when the tax amount is not withheld by the tax agent

In accordance with the procedure for filling out the form we are considering, line 080 is filled out from the beginning of the tax period (usually a year) with a cumulative total. It displays the total amount of tax calculated, but not withheld by the tax agent, for all individuals in question - recipients of income.

The line we are considering is filled in in a situation where an individual received income expressed in kind from a tax agent. And also if a situation arises when an individual somehow received income in the form of material benefit.

Income in kind

If the individual has not received monetary income from the tax agent on which tax can be withheld, or the amount of income received by the individual does not allow the tax to be withheld in full, then the tax agent must calculate the tax. Before the first of March following the tax year, it will be necessary to inform the individual and the Federal Tax Service in writing at the place of their registration about the impossibility (inability) to withhold the required tax. It will also be necessary to indicate the amount of income from which tax was not withheld, and also the amount of tax not withheld.

It will be necessary to provide relevant data

Line 080 remains empty if 2.6 personal income tax was withheld from all available income paid by individuals in the current tax period. And also in a situation where the tax agent did not pay income. This will help correct the filling error.

Line 080 will need to be left blank

When page 080 remains zero and what to do if errors are detected in it

Page 080 will not contain numeric values if:

- the tax agent managed to withhold personal income tax from all income paid to the “physicists”;

- during the year, income from which it is problematic to withhold tax was not paid;

- in other cases (when paying amounts not subject to personal income tax, etc.).

If, on page 080, after submitting the 6-NDFL, an error was discovered - failure to indicate unwithheld personal income tax or an incorrect reflection of its amount - you must submit an updated calculation using the following rules:

- put the adjustment number on the title page of 6-NDFL;

- In the incorrectly filled lines, indicate the correct amounts.

What punishment may follow if erroneous data is reflected in the 6-NDFL form, and the tax authorities have not received an updated calculation, the material “How to correctly fill out the clarification on form 6-NDFL?” .

Benefits of line 080

The obligation to pay personal income tax to the state budget is assigned to tax agents by law. But this is not possible in all situations. For example, if former employees were given gifts (the amount of which exceeds the tax-free amount), it will not be possible to deduct tax on their value. Another situation is when, for example, payments are not made in cash equivalent:

- wages are paid in goods produced;

- the employer paid for the vacation;

- employees were awarded prizes for participation in contests, competitions, and gifts;

- payment for housing and communal services was made;

- the interest rate for the loan provided was reduced;

- securities were purchased at a price below market value;

- purchased goods and services from partner companies.

We recommend additional reading: What does income code 2000 mean in personal income tax certificate 2?

In such cases, when an individual makes a profit, but personal income tax deductions cannot be made, line 080 is filled out in personal income tax form 6 in order to report to the tax service.

Thus, the usefulness of line number 080 is to indicate the fact of non-withholding of personal income tax and to reflect a specific amount.

Results

Page 080 of the 6-NDFL report is intended to reflect personal income tax, which the tax agent failed to withhold from the income of an individual. Such situations are possible when the “physicist” received a gift or other income in kind.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected]

- Letter of the Federal Tax Service of Russia dated 08/01/2016 N BS-4-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 2, 2018 N ММВ-7-11/ [email protected]

- Code of Administrative Offenses of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Subsequent actions after filling out line 080 of the 6-NDFL declaration

After entering the data, the organization must notify the local authorities of the Federal Tax Service and explain for what reasons the withholding of personal income tax is impossible. At the same time, an individual who has received any type of income with tax not deducted from it is also notified. A special notification must be sent in the form of a 2-NDFL certificate indicating sign 2.

The period is determined by the tax period established by law (Article 216 of the Tax Code of the Russian Federation) - this is a calendar year. This means that tax that was not withheld in 2021 is reported until the end of January 2021.

If the time limits specified by law are violated, the enterprise is punished with a fine of 200 rubles. for each document not submitted on time (Article 126 of the Tax Code of the Russian Federation).

How to fix the error when filling out line 080

An error made in 6-NDFL can be corrected in two ways.

Table: error correction options

| Type of correction | How to do it | Feature of the method |

| Correct the error in the half-year calculations. | Line 080 data is placed in 070. | The tax from line 080 must be placed in line 070, showing it already withheld. |

| Submit updated calculation. | Submitted to the tax office. | A safer way. |

An updated calculation will be submitted as soon as possible after incorrect data is found. This document will require:

- When preparing the title page of the declaration, be sure to indicate the correction number;

- In the lines with previously indicated incorrect amounts, leave the correct indicators.

The entire procedure for entering data is not particularly difficult; the main thing is to clarify the calculation of taxes. Otherwise, incorrect amounts may appear.

It is important to carefully check the records and correct errors made when filling out form 6-NDFL

What is the liability for a mistake?

For submitting false information in the 6-NDFL declaration, tax officials have the right to fine the company in the amount of 500 rubles. (Article 126.1 of the Tax Code of the Russian Federation). The chance to avoid punishment can only arise if the error is quickly detected and corrected - before it catches the inspector’s eye.

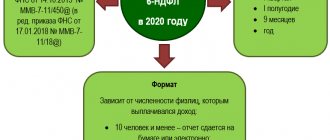

Deadlines and procedure for submitting calculations

The calculations are submitted by tax agents (clause 2 of Article 230 of the Tax Code of the Russian Federation).

A zero calculation is not submitted if income subject to personal income tax was not accrued or paid (letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11/ [email protected] ).

If a “null” is nevertheless submitted, then the Federal Tax Service will accept it (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11 / [email protected] ).

Calculations for the first quarter, six months and 9 months are submitted no later than the last day of the month following the specified period - clause 7 of Art. 6.1, clause 2 of Art. 230 Tax Code of the Russian Federation. This year, it remains to submit a report for 9 months - no later than October 31.

The annual calculation is submitted in the same way as 2-NDFL certificates - no later than April 1 of the following reporting year.

Calculation of 6-NDFL is submitted only in electronic form according to the TKS, if in the tax (reporting) period income was paid to 25 or more individuals, if 24 or less, then employers themselves decide how to submit the form: virtually or on paper (clause 2 of Art. 230 of the Tax Code of the Russian Federation).

As a general rule, the calculation must be submitted to the Federal Tax Service at the place of registration of the organization (registration of individual entrepreneurs at the place of residence).

If the employer discovers that last year he made a mistake and did not withhold personal income tax from payments to an employee who is still working in the organization, the tax must be withheld when paying income in the current year. There is no requirement to report your inability to do this last year. In addition, it will be necessary to clarify 6-NDFL and adjust 2-NDFL.

Letter of the Federal Tax Service of the Russian Federation dated April 24, 2019 No. BS-3-11/ [email protected]

If there are separate subdivisions (SP), the calculation in form 6-NDFL is submitted by the organization in relation to the employees of these subdivisions to the Federal Tax Service Inspectorate at the place of registration of such subdivisions, as well as in relation to individuals who received income under civil contracts to the Federal Tax Service Inspectorate at the place of registration of the subdivisions that entered into such contracts (clause 2 of article 230 of the Tax Code of the Russian Federation).

The calculation is filled out separately for each OP, regardless of the fact that they are registered with the same inspection, but in the territories of different municipalities and they have different OKTMO (letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS-4-11 / [email protected] ) .

Form 6-NDFL, completed for each OP, must be submitted to the place of registration of each unit. Moreover, if the organization is registered with the Federal Tax Service at the location of each OP, then taxes on income from employees of the “separate unit” must be transferred to the budget at the place of registration of each of them.

Letter of the Federal Tax Service of the Russian Federation dated April 25, 2019 No. BS-4-11/ [email protected]

If the OPs are located in the same municipality, but in territories under the jurisdiction of different Federal Tax Service Inspectors, the organization has the right to register with one inspectorate and submit calculations there (clause 4 of Article 83 of the Tax Code of the Russian Federation).

The employee worked in different branches . If during the tax period an employee worked in different branches of the organization and his workplace was located at different OKTMO, the tax agent must submit several 2-NDFL certificates for such an employee (according to the number of combinations of TIN - KPP - OKTMO code).

Regarding the certificate, the tax agent has the right to submit multiple files: up to 3 thousand certificates in one file.

Separate calculations are also submitted in form 6-NDFL, differing in at least one of the details (TIN, KPP, OKTMO code).

If the company has changed its address , then after registering with the Federal Tax Service at the new location, the company must submit to the new inspection 2-NDFL and 6-NDFL:

- for the period of registration with the Federal Tax Service at the previous location, indicating the old OKTMO;

- for the period after registration with the Federal Tax Service at the new location, indicating the new OKTMO.

At the same time, in the 2-NDFL certificates and in the 6-NDFL calculation, the checkpoint of the organization (separate division) assigned by the tax authority at the new location is indicated (letter of the Federal Tax Service of the Russian Federation dated December 27, 2016 No. BS-4-11 / [email protected] ).