For the convenience of filling out personal income tax returns 3-NDFL and 4-NDFL, the Federal Tax Service has released a special “Declaration” program. These forms are filled out in accordance with the Order of the Federal Tax Service No. ММВ-7-11/822 dated October 25, 2017. Filing personal income tax returns to the Federal Tax Service begins in January 2021 and ends on 05/03/2018.

From January 1, 2021, a new personal income tax return form is in effect.

for 2021, which must be filed in 2021

Who must submit 3-NDFL and 4-NDFL declarations

By April 30, citizens must report income received in 2021. The personal income tax calculated in the declaration must be paid by July 15, 2021.

Declaration 3-NDFL is submitted to the Federal Tax Service by individuals and individual entrepreneurs who received income from their activities in the previous calendar year, from the sale of property, receiving property or shares as a gift, receiving lottery winnings, as well as when receiving income from sources outside RF. 3-NDFL is also taken by specialists engaged in private practice - lawyers, notaries, heads of farms. 4-NDFL is a form of declaration of the expected receipt of income. It must be submitted by individual entrepreneurs located on OSNO and specialists engaged in private practice. Filing a declaration is required in two cases:

- after receiving the first income from a recently started business activity;

- in case of a possible change in the amount of income in the new year - for the correct calculation of advance payments.

What is a tax deduction

According to the law of the Tax Code of the Russian Federation, Article 207, Russians must give the state 13% of their earnings in the form of personal income tax.

However, in some cases, the money can be returned if you apply for a tax deduction. To do this, you must submit a 3‑NDFL declaration to the tax office and send documents confirming the right to the deduction. Previously, I had to go to the Federal Tax Service in person. Then, different methods of submitting papers electronically were tested, including filling out the declaration in special programs. Now everything can be done quickly and quite simply through your personal account on the tax office website.

Program installation

To install this program, your computer must have the Windows 7, Windows 8 or Windows 10 operating system, at least 14.5 MB of free disk space, and a Microsoft Mouse. The program can run on Windows XP or Vista operating systems, but technical support for these systems is not provided. A printer must also be connected to the computer. Installation algorithm (it can also be found in the install.doc file, which is downloaded along with the program):

- download the program installation file from the Federal Tax Service website (section “Software”) - the latest version of the program is always posted there;

- run the installation (file name InsD2017.msi) - the launch must be carried out under an administrator account, Russian regional standards must be installed on the computer;

- in the first welcome window that appears, click the “Next” button;

- in the second window (License Agreement) select “I Accept” and then click “Next”;

- in the “Select folder for installation” window, select the folder on the computer in which the program will be located (by default it is installed in the Program Files (x86) folder, and also check the box to select access to the program “For all users” or “Only for me” ;

- in the last window “Install the print module” select “Next” and after installation click “Close”.

The “Declaration” program is installed, and now you can generate and print personal income tax declarations without any problems!

You can download the program here https://www.nalog.ru/

About the development

Individuals often decide to return part of their tax funds. It is necessary to fill out the appropriate documents that are submitted to the tax authority. The free application “Declaration” can help with this.

The program is equipped with a function to check the correctness of the 3-NDFL and 2-NDFL documents. The finished form can be downloaded to a PC, printed, or saved to a flash drive. The last option is especially interesting for those who are afraid of administrative violations. This opportunity allows you to bring a sample document to the Federal Tax Service, where the inspector will tell you where errors were made or how to fill out one of the lines correctly.

“Declaration 2015” programto fill out the 3-NDFL declaration for 2015

Program “Declaration 2015”, version 1.5.0 dated 06/09/2019.

(download a free program for filling out (preparing) a tax return in 2016 in form 3-NDFL for 2015):

1) InsD2015.exe – installation file

2) Installation instructions (install)

3) Abstract to the program (readme)

Computer requirements

and software

Minimum hardware requirements:

- RAM of at least 512 MB and 20 MB of free disk space for installing task software.

- Processor class Intel Pentium II 400 MHz.

- Microsoft Mouse or compatible.

- SVGA video adapter with a resolution of 1024x768 with 16-bit color depth.

- Printer (or virtual printer)

Windows operating system:

Operating system Windows XP, Windows Vista, Windows 7, Windows 8 (with Russian regional settings).

About the “Declaration 2015” program

GNIVTS Federal Tax Service of Russia annually develops and offers free programs for filling out (preparing) the 3-NDFL declaration.

The “Declaration 2015” program is designed for automated completion (preparation) of personal income tax returns (form 3-NDFL and form 4-NDFL) for 2015 in 2021.

Declaration 3-NDFL for 2015 is filled out in accordance with the order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/ [email protected] (as amended on November 25, 2015). As amended by Order of the Federal Tax Service of Russia dated November 25, 2015 No. ММВ-7-11/ [email protected]

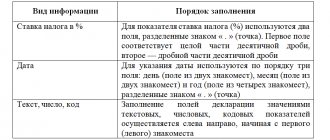

This order contains a section devoted to the procedure for filling out (preparing) a declaration in form 3-NDFL (Appendix No. 2 to the order).

The program automatically generates 3-NDFL declaration sheets based on the data entered by the user:

- for all taxable income received from sources in the Russian Federation and received from sources outside the Russian Federation;

- on income from business activities and private practice;

- data for calculating professional tax deductions for royalties and civil contracts;

- property tax deductions;

- data for calculating the tax base for transactions with securities, financial instruments of futures transactions and taxable income from participation in investment partnerships;

- for calculating standard, social and investment tax deductions.

Instructions for filling out the 3-NDFL declaration

in the program "Declaration 2015"

To launch the application, select the appropriate icon on the desktop or in the Start

->

Programs

->

Declaration 2015

.

When you select File

The following submenu will appear:

Create

– Create a new declaration. In this case, if unsaved changes were made, a dialog will be displayed asking you to save the changes. Each start of the program leads to the creation of a new declaration, i.e. you can enter and change data.

Open

– A standard dialog appears, allowing you to open the declaration file that was previously entered and saved. If unsaved changes have been made to the active declaration, then before the dialog to open the file, you will be prompted to save the changes.

Save

– Allows you to save the active declaration to a file.

If after selecting Create

,

Open

the request to save changes was confirmed, but the file name was not entered, a dialog box will appear asking for the name and location of the new file.

The same applies to the Save

Save as…

— Displays a dialog asking for the name and location of the saved file.

Exit

– allows you to exit the program.

Navigation bar

The navigation panel is used to display a thematic section in the main window, which can be activated by clicking on the corresponding button in the panel. Some navigation bar buttons may not be available depending on how the Setting Conditions section is filled out.

When you start the program, an “empty” declaration is automatically created. At any time, you can save the entered data to disk, load a previously saved declaration, or create a new one. In this case, the name you assigned to the file is displayed in the header. The program has built-in control of the entered data for their presence, if details are required, and their correctness.

Setting conditions

On this screen, you enter the conditions for filling out the 3-NDFL declaration.

If you are not a tax resident of the Russian Federation or you need to submit a declaration in Form 4-NDFL, then select the appropriate item in the Declaration Type panel.

If you are submitting an initial declaration, in the field Corr. No.

. 0 is indicated. If you submit a clarifying declaration, then in this field you need to indicate the number of times you do this.

Panel Income Available

contains items that divide the declaration entry into logical sections:

— if the user is going to enter information about income from income certificates, income from civil contracts, royalties, from the sale of property, etc., i.e. information on income taxed at rates of 13, 9, 35% (in the case of a non-resident - 13, 15 and 30%), with the exception of income in foreign currency and income from business activities and private practice.

— if you have income in foreign currency, then accordingly you need to check the box next to In foreign currency

.

- if you have income from business activities, then you need to check the box next to From business activities

.

— if you have income from participation in investment partnerships, then you need to check the box next to Invest. partnership

.

Each of these points allows/denies access to entering information of the corresponding type. If none of the items is activated, then only windows with information on the payer are available for entry.

Information about the declarant

On these two windows, information about the taxpayer is entered, corresponding to the title page of the declaration form. Switching between these two screens is done using the buttons at the top of the main window.

The country code is indicated according to the All-Russian Classifier of Countries of the World (OKSM). If the taxpayer does not have citizenship in the Country Code

The code of the country that issued the identity document is indicated.

TIN field

mandatory for individual entrepreneurs, private notaries, lawyers and heads of farms. Other individuals may not fill it out.

OKTMO field

introduced starting in 2013 instead of the

OKATO

. The meaning of this field can be found in your inspection.

Income received in the Russian Federation

Input is carried out on three screens. Switching between screens is done using the buttons at the top of the main window. The screens are divided by tax rates: 13, 9, 35%.

For each rate, the corresponding types of income are entered. A different set of tax rates is available for non-residents: 30%, 15% and 13%

Investment partnerships

Screen for entering income from participation in investment partnerships (corresponds to sheets A and 3 of the 3-NDFL declaration form for 2015)

Entrepreneurs

The screen for entering income from business activities corresponds to sheet B of the 3-NDFL declaration form for 2015.

Switch There are documented expenses

sets the mode for entering expenses. This is either entering documented expenses, or calculating expenses at a standard (20%) rate relative to income.

For entrepreneurial activities, you must indicate the OKVED code by selecting it from the directory. When searching for the code you need, keep in mind that some nesting sublevels for your activity may be empty.

Income received outside the Russian Federation

The screen for entering income in foreign currency corresponds to sheet B of the 3-NDFL declaration form for 2015.

Buttons open directories. You can also enter the currency code manually, however, if it is not in the directory, you will not be able to use the ability to automatically enter the exchange rate. The currency directory is optional, and in manual installation mode you can cancel its copying, however, this will eliminate the possibility of automatically setting the currency rate if it is in the directory.

If the switch is opposite Automatic heading determination

is available, which means for a given currency there is information about the exchange rate against the ruble. If you activate this feature, the program itself will substitute the rate declared at the last auction known to the program, preceding the date of receipt of income, or directly on the specified date.

The exchange rate is entered in two fields and represents the proportion of X currency units. for Y rubles. That is, for example, on the date 04/09/2015 for the Euro currency (code 978) the rate was 100 USD for 5870.03 rubles.

In addition, a similar button opens a directory of income (deductions, if a deduction is provided for this income, otherwise this button is not available).

Deductions

Input is carried out on four screens. Switching between screens is done using the buttons at the top of the main window. The screens are divided by type of deduction. On the first screen, standard tax deductions are entered, on the second - social tax deductions, and on the third - property tax deduction for new construction, or the purchase of a residential building or apartment. The fourth screen is used to enter data on losses on transactions with securities of previous tax periods. Other deductions (for example, royalties or property deductions for income from the sale of property, securities are entered along with the corresponding income - see “Income taxed at the rate of 13%”)

Standard deductions

The screen for entering standard deductions corresponds to sheet E1 of the 3-NDFL declaration form for 2015.

In the standard deduction section, select the type of deduction and enter the number of children. At the same time, records of the first or second child and all subsequent ones starting from the third are kept separately, because They provide excellent deduction amounts. Data about children with disabilities of groups I and II are entered into the program twice: both when filling out the appropriate field, and when indicating the total number of children.

If the number of children has not changed during the year, then their number can be entered in one digit. Otherwise, you need to uncheck “the number of children (of the corresponding category) has not changed” and enter their number monthly.

Calculation of standard deductions is carried out based on income from the source of payments, when entering which in the section “Income taxed at the rate of 13%” you checked the box “Calculate standard deductions using this source”

If you want the standard deductions to be calculated based on business income, then you need to enter the amounts of income and expenses for each month, and check the boxes for the months in which you were in the corresponding status.

Social deductions

The screen for entering social deductions corresponds to sheets E1 and E2 of the declaration form

The top list is for entering amounts paid for children's education. In this case, as many amounts are entered as for how many children were paid, i.e. These are the totals for each child.

The lower one is intended for entering data under pension insurance and non-state pension agreements.

Property deduction for construction

Screens for entering property deductions for construction correspond to sheet D1 of the declaration form.

The button present on the panel allows you to add a new object and may become unavailable depending on the data already filled in for the first object. Deduction for previous years depends on the object data.

and

Amount carried over from the previous year

.

Please note that the field value is the Total cost of all objects

and

Interest on loans for all years

is not filled in on this screen.

Field value The total cost of all objects

is calculated automatically as data about objects is filled in. At the same time, the program itself takes into account the specifics of providing a deduction depending on the values of the date fields in the information about the object.

In the fields Deduction for previous years

the amounts of property deductions for construction and loan repayment are indicated from the Declarations for previous years. If in 2015 you are filing a return for deduction for the first time, then these fields are not filled in. If you receive a property deduction for construction and loan repayment for several years, then you will have to add up the corresponding amounts, taking them from sheet D1 of the Declaration for 2014 and, if necessary, from sheet I of the Declarations of earlier years, and enter the total in the appropriate field in the program.

In the fields Amount transferred from the previous year

Amounts from the Declaration for 2014 are transferred. If in 2015 you are applying for a deduction for the first time, then these fields are not filled in. According to the Procedure for filling out the Declaration, the values of these fields are not included in the calculation; the data is used by tax authorities as reference information. The entire calculation is based on the data in the fields total cost and deductions from previous years.

In the Object cost

costs incurred are indicated, and it must be borne in mind that in the final calculation on sheet D1 the program will indicate an amount of no more than 1,000,000 rubles (multiplied by the share of ownership) for a property registration date before 2008, no more than 2,000,000 rubles (multiplied by the share of property) with the date of registration of ownership in 2008-2013 and no more than 2,000,000 rubles, regardless of the share, with the date of registration of ownership (date of transfer act) in 2014 or 2015.

In the Interest on loans for all years

The amounts spent on paying interest on targeted loans are indicated.

Deductions from the tax agent, both for the reporting year and for previous ones, are taken from 2-NDFL certificates. If they are not indicated there, then these deductions were not provided to you by the tax agent.

Please note that for loans received after 01/01/2014, the law provides for a limit on interest accepted for deduction in the amount of 3,000,000 rubles. But, because the program does not have information about the dates of loans, the value of this field is not automatically controlled. You must do this yourself when filling out the Interest on loans for all years field.

Option I am a pensioner

allows you to bypass the date control implemented in the program. Taxpayers who fall under clause 10 of Art. have the right to take advantage of this opportunity. 220 Tax Code of the Russian Federation.

Investment deduction and accounting for losses on transactions with securities of previous years

Persons who have received profits from transactions with securities and (or) from transactions with financial instruments of futures transactions can deduct losses from previous tax periods (received no earlier than 2010, when the corresponding norm was introduced), which are entered on this screen.

Data on the investment deduction provided for in subparagraph 2 of paragraph 1 of Article 219.1 is also entered here.

Preview and Print

In the main program window, on the toolbar, click the View button. You will see the sheets of the created Declaration 3-NDFL for 2015.

Entrepreneurs

The next stage of filling out the document in the “Declaration” program is entering data in the “Entrepreneurs” block:

Click on the “+” icon, after which a window appears indicating the type of activity. Here you need to indicate that the activity is entrepreneurial, and also select the code for the type of this activity:

Let's say IP Shapovalov I.P. engages in the retail sale of auto parts. To indicate the main activity code, he must select at least 4 characters in the drop-down window. In each line you need to select the type that suits the individual entrepreneur’s activities:

Particular attention should be paid to the line “There are documented expenses.” A check mark is placed in front of this line provided that the paid expenses of the individual entrepreneur are used for professional activities and are confirmed by invoices, invoices or acts. If such documents are missing, the individual entrepreneur can take advantage of a professional deduction of 20% of the amount of income received.

In 3-NDFL for an entrepreneur, in this block you need to fill in the lines indicating the amount of income for the year and expenses. Costs may include:

- Costs for the purchase of materials, works, services;

- Expenses for paying employees, including personal income tax amounts transferred to the tax office from their wages.

Accrued and actual payments include advance payments assessed by the tax service, even if they have not yet been paid.