Documentation

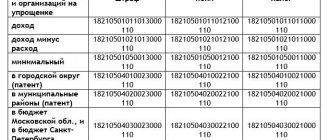

All payers of taxes and mandatory contributions are required to use the KBK when filling out payment orders. For this purpose specifically

In calculating 6-NDFL, you need to fill out the title page, section 1 and section 2. In this case

Document year: 2019 Document group: Help Document type: Help Download formats: DOC, PDF

Electronic sick leave is no longer an innovation, but people are still wary of it

In order to get an answer to the question of what code 503 means in

The responsibility of tax agents is to provide reporting in Form 6-NDFL. Reports must be provided every

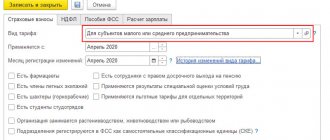

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

Unfortunately, each of us is familiar with the situation when you feel that you are getting sick... Weakness, headache,

A tax return is a key type of reporting to the Federal Tax Service, which is prepared by almost all taxpayers.

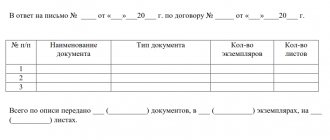

Main purpose Understanding how to create an inventory of documents allows you to establish an organization’s internal records management, which