Document year: 2019

Document group: Help

Document type: Help

Download formats: DOC, PDF

One type of confirmation of the solvency of employees is a free-form income certificate. The 2021 sample remains unchanged. There is no single standard for paper confirmation, but there are a number of requirements that apply when drawing up the document.

The paper confirms not only income, but also the frequency of receipt, permanent place of work and period of employment. This document is used for submission to various institutions.

The income certificate is made in the established forms, which are registered by the Resolutions and Orders of the authorities. Also, such a document can be made in free form, taking into account the inclusion of mandatory clauses. Such a certificate has legal force; it simply makes it possible to bring a document if the employer refuses to provide a standard sample, or such certificates are simply not issued.

Let's take a closer look at the type of document flow, where you can get it and under what conditions, as well as instructions for filling out and basic rules.

Get ready for thoughtful reading and read the article to the end: free-form income certificates are offered for free.

Types and features of certificates

To obtain reference information from the employer for submission to various institutions, the employee must write a written application. Also indicate what specific information should be reflected in the document, for what period, and for what purposes the specified information will be used. You don’t have to specify a specific goal, then the performer will simply write “at the place of requirement.”

Important! The sample and information provided will depend on the information requested and the institution to which the certificate is submitted.

In general, certificates from the employer about income from the employer can be divided into two types:

- certifying the citizen’s time of work (in general, and at the current place of employment), his qualifications, and position. Additionally, they may indicate information about the level of education and the institution in which the employee studied;

- certifying his earnings for the last period. Usually this is three or six months.

Regardless of the form and purpose, the paper must contain the company details, general information about the employee and his identity document. Due to the fact that the document contains personal information that cannot be disclosed to outsiders, the employer is required to draw up a written statement.

Information about the employee is filled in based on the company’s primary and accounting documents:

- personal affairs;

- work books;

- pay slips;

- tax returns and others.

Often, established samples of income certificates 2-NDFL, 3-NDFL, form 182n, certificates in the form of the institutions for which they are drawn up (in the bank form) or in free form are used.

Results

Salary certificate is a generalized name for certificates that may be required by various authorities. Its form and design rules depend on the situation in which it is needed.

Sources:

- Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n

- Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation”

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

In what case does it apply?

The certificate is requested by various institutions, authorities, courts, bailiffs and others in order to:

- Confirm the officiality of income, its size and stability of income;

- Find out about the citizen’s work experience, position and qualifications.

Most often, help is needed:

- Banks and credit organizations;

- To introduce yourself to a new workplace;

- Social security authorities and others to determine benefits and payments due (sample - certificate of income for 3 months for payment of child benefits);

- To the employment center to determine benefits;

- Judicial authorities;

- Bailiffs when executing a writ of execution;

- Other organizations.

A sample certificate in this form is most often submitted to banks, if the credit program allows this form of presentation, as well as to consulates and visa centers for obtaining a visa.

When going to court

If an employee goes to court on issues related to violations of the Labor Code, he will also need the document in question. Usually the request for its provision is sent by the prosecutor. For example, this paper is used to calculate the amount of compensation for forced absence.

Certificate of average daily earnings for the court

Who issues the certificate

A certificate is requested from the direct employer. To do this, a written application is written addressed to the manager with a request to provide a certificate. You also need to indicate what information should be reflected.

The employer prepares the certificate within three days from the date of receipt of the request.

For persons legally located in the Russian Federation (records of work and residence are kept), the employer also has the right to provide information for reference.

If a citizen has several jobs, and all of them are officially registered, each certificate is requested separately from each employer.

To confirm the income of an individual entrepreneur (individual entrepreneur) for a visa, loan or other things, a free-form certificate is not suitable; a declaration, a sample registration certificate and, if necessary, statutory documents are submitted.

All income codes in the 2-NDFL certificate

Here is a complete list of 2-NDFL codes that may have to be indicated in the document:

As you can see, the list is quite large, but this does not relieve the accounting department from the need to carefully read it and select exactly those codes that are required to be indicated in the certificate.

Document 2-NDFL allows you to get a loan from a banking institution, provides special tax benefits for the educational and medical period, facilitates obtaining a foreign visa and resolves housing and mortgage issues.

Procedure and deadline for issuing the form at the place of work

| Writing a written request addressed to the manager that you need a certificate of income. To do this, you need to approach the secretary, a HR specialist, or immediately the responsible accountant. For a civil servant in 2021, the same rules for requesting a certificate of income (available on this page). | If the institution to which the certificate will be submitted has provided an approximate form, attach it to the application. Typically, employees verbally request the document immediately from an accountant or HR specialist. By law, this must happen in writing in order to protect yourself in case the employer refuses to provide a certificate |

| It takes three days to review the application and prepare the initial data. | The time is calculated from the moment the application is received by the employer. Refusal to submit a certificate, delaying deadlines are illegal on the part of the employer |

| A completed certificate can be obtained from the secretary, the human resources department or an accountant. | The document can also be handed over to the applicant’s immediate supervisor. |

| Usually one copy of the paper is prepared, but upon request, the contractor will prepare the quantity that the applicant needs | An employer cannot refuse a certificate even if this is not the first request in a year. |

If an institution or government agency does not establish strict requirements, download the income certificate and enter it into the accounting department.

The document does not have an official validity period; its relevance is determined by the institution for which the certificate is prepared. Since the document certifies recent income, it is considered to be valid for 30 days. Therefore, it is more advisable to take the paper at the beginning of the month, when the accruals are ready and the financial statements are submitted.

Important! If the employer refuses to provide information for any reason or delays the provision, causing the recipient to suffer, the latter has the right to file a complaint with the labor inspectorate and even file a lawsuit in court. But this can only be done if the citizen has documented the application.

Applying for loans, subsidies and visas

Credit institutions usually do not require a certificate of average earnings to determine the amount of unemployment benefits, but bankers need a document on the average salary for the last three to six months. Existing legislation does not establish a unified form for such a document and does not specify what information it includes.

But banks require that it contain:

- name of company;

- Contact details;

- employee's length of service;

- job title;

- monthly data on wages.

A similar document is sometimes requested to apply for subsidies.

Rules for issuing a certificate

Even for a free form, certain filling requirements must be met. Otherwise, the certificate may simply not be accepted. Conventionally, the document can be divided into several information blocks:

- Part about the employer. Indication of names (full and abbreviated), legal address and actual location, form of organization, activity codes, registration information, etc. Details may not be indicated if the certificate is drawn up on company letterhead;

- Part about the employee. Standard information is indicated: name, identification document details;

- The main part is the information for which the certificate was taken. Data on income received for the requested period (monthly).

You can also separately highlight the block with certifying signatures and seals. The executor who compiled it and the head of the organization sign for the authenticity of the certificate. The seal is affixed provided that it is available at the enterprise. Although it is not mandatory, it is better to include it if available. An example of a free-form income certificate is available on our page; detailed instructions are discussed in the next section.

Prohibited:

- Corrections, blots, strikeouts;

- Using correction fluid;

- Print on both sides of the sheet;

- A document with obvious printing defects (spots, streaks, faded print).

You can clarify in advance what requirements for the certificate are imposed by the person to whom it is intended. Because there are no uniform standards.

The same rules apply if the employee is employed by an entrepreneur and requests a sample income certificate for a visa.

How to order a 2-NDFL certificate online

Detailing the income level of Russian citizens falls into the category of personal information. For this reason, you will never find such data freely available on the Internet.

Starting in 2014, the Russian Tax Service launched an electronic service. For each taxpayer, a section is open on the server of the department (IFTS), where you can always find out your tax accruals, debts and planned accruals.

You can obtain data to access the section at the inspection office at your place of residence. You can order a document in your personal account for the periods in which your employer reported to the tax office. As a rule, this is a year.

Before ordering detailed income information online, you need to ask the receiving organization whether they will accept such a certificate.

Instructions for filling out an income certificate

An accountant is responsible for issuing certificates. If the filling procedure and form are clear with the established samples, then when filling out the paper in free form, questions may arise.

First, check with the place of your request whether they have their own reference samples. For example, these are being developed by various banks. Ask for a sample and enter it into the accounting department. The performer will only have to fill it out. This is important because you can only ask for information about income, but in the end it turns out that they also wanted a certificate from you about property and liabilities and expenses for the past 2021.

Secondly, if the place of demand does not have its own form, check the full list of information that the accountant must reflect.

Otherwise, if there are no requirements for the form and mandatory information, the contractor will fill out information about the company, the employee and his recent income.

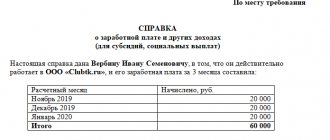

To make it clearer, let’s look at the instructions using an example with screenshots. Here is one of the free form certificate samples (you can download this form from the link).

We are considering the simplest option. At the top is the date of issue and contact phone number, as well as a rectangular stamp with the company details. If the certificate is drawn up on company letterhead, a stamp is not needed. If not, it is additionally better to indicate the TIN, KPP and OGRN.

After the word “Issue”, information about the recipient of the document, the period of work and the position in which he is located is indicated.

Next, the main block of information is written down - about the employee’s income. In our example, income for the last three months is indicated. Since the certificate is given at the beginning of April (in the example), March, February and January become the calculated months for us. Social security or a bank will require a sample certificate of income for 6 months.

The table can be improved by adding more information about calculated taxes and income before taxes.

At the end, the manager and senior accountant sign. The official seal, if available, is placed on the designation of M.P.

Special requirements

As for the informational part, that is, directly the amount of the employee’s income, some social security authorities require this information to be presented in the form of a table. It looks something like this:

| Month | Total amount of payments (RUB) | Withheld (RUB) | Issued by hand (RUB) |

| October | 10 000 | 1 300 | 8 700 |

| november | 10 000 | 1 300 | 8 700 |

| December | 10 000 | 1 300 | 8 700 |

| Total | 30 000 | 3 900 | 2 6100 |

So that the employee does not waste time, and the accountant does not redo the certificate again, it is better to find out in advance in what form the data should be presented.

Attention! One of the purposes of a salary certificate is to receive a subsidy for housing costs. In this case, it should contain data not for 3, but for 6 months . This is the requirement of paragraph 32 of the Rules for the Provision of Subsidies, approved by Decree of the Government of the Russian Federation of December 14, 2005 No. 761.

This is important to know: What benefits can you get from the state in social security?

Possible mistakes

Errors that often appear in help are related to:

- with typos;

- spelling errors, errors in names and titles;

- incorrect indication of codes, details and addresses;

- submitting false amounts for wages;

- taking into account the wrong period.

By the way! One of the common mistakes (due to the carelessness of the performer) concerns the indication of the taxpayer number. There are times when the contractor confuses the employer and employee codes.

Responsibility for compiling and providing information on the certificate lies with the executor - an accountant or other responsible person. Certificates with errors or false information will not be accepted at the place of request. Therefore, check the paper first so that there are no typos or obvious errors, make sure that the general information is provided correctly (for example, the work experience is calculated correctly, the position is indicated correctly, etc.).

To make it easier to navigate such a document in the future, download a free sample income certificate in free form. Study the information, ask the person who is requesting it, what exactly he wants to see in the paper, and in what form it is best to compile it. If necessary, consult in advance with the accountant who issues such certificates in your company. By the way, the latter, in addition to the application, may request consent to provide personal information. This is due to the fact that the certificate contains personal data. In this case, consent can be requested each time a new certificate is requested.

The article is over, but you still have questions? Ask them to the duty lawyer on our site.

The specialist will also help you understand the nuances of drawing up certificates of income and expenses for civil and government employees.

All deduction codes in the 2-NDFL certificate

The types of deductions that were paid to the employee are reflected in document 2-NDFL using a specific code. They are assigned individually to each type of tax expense.

Check out the full list of deduction codes:

Main categories of deductions

There are several categories:

- standard child expenses imply the presence of certain codes, which depend on the child’s age, place of education, disability, and also depending on the degree of parental connection (parents, guardians). When providing a deduction for a child, the order in which the children appear must be taken into account;

- property deduction includes expenses for construction work or the purchase of a home, land, as well as targeted loans necessary for the purchase of housing;

- social expenses of the taxpayer for self-study, education of loved ones - brother or sister. Taxpayers who are parents are also assigned a special expense code for the education of children under 24 years of age. This category also includes medical expenses for the taxpayer and his children;

- professional include confirmed expenses for work or services in the civil legal sphere, royalties;

- deductions on income that is not taxed within a certain value range. This item includes the cost of gifts from the organization, financial assistance for retired employees, winnings and prizes, as well as one-time financial assistance for the birth or adoption of a child.

Filling rules

You can read the full instructions describing the procedure for filling out a certificate using this SPO by clicking on the following link.

General rules for entering information:

- First of all, you should enter the full name, date of birth and passport details of the applicant, then you can start working on the files of family members.

- To avoid confusion when working with the document, the columns are equipped with footnotes “*” and “**”, explaining what information should be entered.

- When the desired value is not found, you can select the “Other” field and enter information in text mode.

- The quantitative values of each indicator must be entered with an accuracy of kopecks. After the desired value has been entered, you need to press Enter. If there is a need to edit data in tables, you can left-click on the icon located in the cells to change the source information. Removing rows follows the same principle.

- If the program detects errors in filling, it will highlight the corresponding fragment in red and put an exclamation mark containing the key to correcting the inaccuracy.

- All data is automatically saved every minute. If necessary, you can save the document manually by clicking on the “Save” button.

- In fields in which there is no need to enter information, you should not put a dash or the symbols “Z”, “0”. Instead, you should enter the phrase “I do not have” or “does not have.”

- After filling out all columns and saving the entered information, the certificate should be printed. If during the filling process all required fields were not filled in, the program will inform the user about the incorrect preparation of the document before printing. After the document is printed, you need to check it for printing defects. A certificate containing streaks or stains that may appear due to a low-quality cartridge is not allowed to be submitted.

- Correcting inaccuracies using a proofreader or corrections made with a pen is not acceptable.

- It is not permitted to stitch or staple sheets.

The open source software is equipped with a fairly user-friendly interface

Each page, except the last one, must be signed in the lower right corner. It is necessary to ensure that it does not occupy the space allocated for barcodes.

Step-by-step instructions for filling out

To start working with the program, you must perform one of the following actions:

- if the open source software is launched for the first time, you should select the “Create a new package of documents” function;

- if declarations have already been drawn up, you need to select the “Create package of documents” function.

Next, you need to enter data following the instructions provided.

Table 1. Instructions for filling

| Step | Description |

| Step #1 | Fill out the column providing information about the applicant. Please indicate:

|

| Step #2 | After entering this information, you should click on the “Next section” box and enter the profit data, regardless of their source. |

| Step #3 | Then you need to enter information about the expenses incurred during the reporting period. It is possible to indicate information about the acquisition of real estate, securities and other expenses. If no such transactions have been made, this page does not need to be completed. All pages that do not need to be completed should be skipped and moved on to the next ones. |

| Step #4 | If you own property or vehicles, you need to fill out the appropriate sections. |

| Step #5 | Carry information regarding bank accounts and deposits. Shares and securities, if any, should also be mentioned. |

| Step #6 | List the real estate used, such as a rental apartment. |

| Step #7 | Provide information about monetary obligations in the form of loans, advances or credits. |

Information about the applicant

Profit data

Property information

Information about bank accounts

Upon completion of the certificate, you need to check the box next to the sentence “I confirm the accuracy and completeness of this information.”

The completed certificate can be sent for printing by clicking the “Print” button. Before outputting the data to paper, the program will open a preview window and insert the QR codes necessary for the control service.

If there is a need to save the completed document to a flash drive, when saving the certificate, you should select the storage location instead of the folder that was previously installed in the flash drive. If it has already been saved, you need to right-click to select the “Send” function and send the help to the flash drive.

Preparing to work with open source software

First of all, you should inspect the work tool for compatibility with the program. The computer or laptop must have the following characteristics:

- Windows XP or Windows 7;

- 1 GB of free memory.

In addition, a laser printer is required to print the completed certificate. Before you start, you need to install the program by downloading it from the official website or running the installation file from the disk. If the application does not run in Windows XP or Windows 7, you should run the application on another computer or run updates for the system programs you are using.

After the “Book Help” shortcut appears on your desktop, you can begin creating a document.

To start the open source software, double-click on the shortcut with the left mouse button

What to do if the company is liquidated

Another rather problematic situation cannot be excluded when, at the time of applying for a certificate, the enterprise is no longer functioning (liquidated) and information about it is excluded from the Unified State Register of Legal Entities. There are several ways to obtain a 2-NDFL certificate in such a situation.

So, if a new employer requires a certificate, he sends a request to the Pension Fund branch and the local Federal Tax Service explaining the reasons for this need. A certificate may be required for the correct application of standard deductions or the calculation of vacation and sick pay, when information about deductions made by the previous employer is indispensable.

In response to this request, information will be provided on income and deductions from it for a specific individual for the requested period. Also, the insured person himself can independently send a request to the Pension Fund of the Russian Federation in the form approved by Order of the Ministry of Health and Social Development dated January 24, 2011 No. 21n.

In addition, an individual can independently obtain the necessary information about accrued and paid personal income tax through his personal account on the website of the Federal Tax Service of Russia.