Changes for 2021

IMPORTANT!

In 2021, taxpayers will no longer have to submit advance property tax reports. They are officially cancelled. In April 2021, we report for the 4th quarter of 2021 and submit not a calculation, but a final property tax declaration for the entire 2021.

Canceling advance reports does not mean canceling the advance payments themselves. If legislators in your region have established a rule for mandatory advance payment of property taxes, then you will have to pay every quarter.

There is one more innovation. It concerns the procedure for calculating tax advances. In 2021, it is allowed to calculate the advance according to the changed cadastral value of the real estate, and not according to the value determined as of January 1 of the reporting period.

Who submits the payment in the 3rd quarter of 2021

The rules for calculating and paying property tax and submitting reports on it are regulated by Chapter 30 of the Tax Code of the Russian Federation. Like the final reporting for the year, the declaration on advances on property for the 3rd quarter of 2019 is provided by those taxpayers who have property assets subject to mandatory taxation on their balance sheet (Article 374 of the Tax Code of the Russian Federation). Starting from 01/01/2019, only those legal entities that own real estate are reporting (letters of the Ministry of Finance No. 03-02-08/5904 dated 02/28/2013, No. 03-02-08/41 dated 04/17/2012). If there are no real estate assets on the balance sheet of the institution, then they do not provide reporting to the Federal Tax Service.

Individual entrepreneurs do not submit a report and do not transfer an advance payment on property to the budget for the 3rd quarter of 2021, since, as a general rule, payment of contributions for them is carried out on the basis of notifications from the territorial inspection.

Determination of the tax base

When determining the tax base, not all property is included in the tax base. We will divide property that is not involved in determining the tax base into two groups: exempt and preferential.

Tax exemption

The list of property that is not recognized as an object of taxation is given in paragraph 4 of Art. 374 Tax Code of the Russian Federation. For example, land plots and other environmental management facilities (water bodies and other natural resources) and others.

At the same time, fixed assets belonging to depreciation group I or II are excluded from the tax base, i.e., with a useful life from 1 year to 3 years inclusive (clause 8, clause 4, article 374 of the Tax Code of the Russian Federation).

Privileges

The benefits include property listed in Article 381 of the Tax Code of the Russian Federation. Let us dwell in detail on the benefit applied to movable objects registered as fixed assets from 01/01/2013 (clause 25 [K=14; P=381; T=Article 381 of the Tax Code of the Russian Federation]).

If an organization applies this benefit, then it is necessary to follow regional legislation. Subjects of the Russian Federation are now solely vested with the right to establish benefits on their territory. If the region does not take advantage of this right, then from January 1, 2021, the benefits provided for in paragraphs 24 and 25 of Article 381 of the Tax Code of the Russian Federation will no longer apply on its territory.

What is the due date in 2021?

Tax legislation establishes strict deadlines for submitting advances on property taxes. Let us present the frequency of filing calculations for property contributions in the table:

| Period, 2021 | Deadline for submission | Period code |

| 1st quarter | 30.04.2019 | 21 |

| 2nd quarter (half year) | 30.07.2019 | 17 |

| 3rd quarter (9 months) | 30.10.2019 | 18 |

The deadline for paying the property tax of organizations and advances on it is determined for each subject of the Russian Federation by regional legislators (Article 383 of the Tax Code of the Russian Federation).

Due dates: tax and reporting period

The tax period is the calendar year (Clause 1, Article 379 of the Tax Code of the Russian Federation).

The reporting periods of the calendar year depend on the tax base (clause 2 of Article 379 of the Tax Code of the Russian Federation):

| The tax base | Reporting periods |

| The tax is calculated based on the average annual value of the property | I quarter, half year, 9 months |

| The tax is calculated based on the cadastral value of the property | I quarter, II quarter, III quarter |

Here are the deadlines for 2021: for the first quarter - no later than May 4, 2018; for the half-year (II quarter) – no later than August 1, 2021; for nine months (III quarter) – no later than October 31, 2018.

During established reporting periods, the tax authorities accept calculations for advance payments no later than 30 calendar days from the end of the corresponding reporting period (clause 2 of Article 386 of the Tax Code of the Russian Federation). Also see an example of calculating the average value of property for the reporting period.

Attention: an organization may be fined for being late in calculating advance payments for property tax.

Calculations of advance payments are recognized as documents necessary for tax control.

Firstly, sanctions for late submission of documents required for tax control are provided for in paragraph 1 of Article 126 of the Tax Code of the Russian Federation. The fine amount is 200 rubles. for each document not submitted.

Secondly, for untimely submission of such documents at the request of the tax inspectorate, the court may impose administrative liability on officials of the organization (for example, its head). The fine amount will be from 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

It is worth noting that calculations of advance payments are not equivalent to tax returns (Clause 1, Article 80 of the Tax Code of the Russian Federation). Consequently, an organization cannot be fined for late submission of calculations under Article 119 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated May 5, 2009 No. 03-02-07/1-228, paragraph 15 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 No. 71, resolution of the Federal Antimonopoly Service of the East Siberian District dated January 18, 2006 No. A58-4095/2005-F02-6999/05-S1, Volga-Vyatka District dated April 27, 2006 No. A82-2065/2005-27, Far Eastern District dated May 31, 2006 No. F03-A51/06-2/1217, Moscow District dated September 16, 2008 No. KA-A40/8744-08).

Where to submit an advance payment

Taxpayer organizations must provide an advance payment to the Federal Tax Service at the place of registration and location of property assets at the end of each reporting period. The largest organizations submit declarations and calculations strictly at the place of registration (Article 83 of the Tax Code of the Russian Federation).

The advance property tax report is sent electronically in specialized programs via telecommunication channels or submitted to the inspectorate on paper in person, through an authorized representative of the responsible person or by mail with a mandatory list of the package of documents sent. In electronic form, a report for advance payments of property tax for the 3rd quarter of 2021 is sent not only by enterprises classified as the largest, but also by taxpayers whose average number of employees is 100 people or more.

The corresponding accounts can be provided for account 02 “Depreciation of fixed assets”:

- depreciation on fixed assets not subject to taxation;

- depreciation on preferential fixed assets;

- depreciation on taxable fixed assets.

At the same time, for each group of subaccounts it is necessary to conduct analytics by type of property. For example, the group “Preferential fixed assets” from January 1, 2015 includes movable property accepted for accounting after January 1, 2013 (clause 25 of Article 381 of the Tax Code of the Russian Federation), as well as objects that have high energy efficiency in accordance with the list established by the Government of the Russian Federation or objects that have a high class of energy efficiency (clause 21 of Article 381 of the Tax Code of the Russian Federation).

ACCOUNTING RESTORATION, COST

However, if the organization does not have preferential objects and property that is not subject to taxation on its balance sheet, then there is no point in opening additional subaccounts to accounts 01 “Fixed Assets” and 02 “Depreciation of Fixed Assets.”

How to calculate the advance amount

The amount of contributions for the 3rd quarter to be paid to the budget is determined in two ways:

- At average annual cost based on balance sheet data.

- At cadastral value.

Calculation based on the average annual value is carried out if the taxpayer does not have recorded information about the cadastral value.

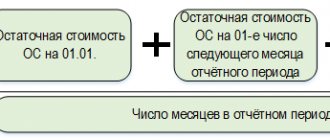

The formula for calculating the advance is as follows:

Advance payment = (average annual value of assets × % tax rate) / 4.

The average annual value is the basis for calculating property taxes. It is determined by summing the residual value of fixed assets as of the first day of the month, and then dividing by the number of calculated months. The calculation formula for the 3rd quarter of 2021 takes data on the residual value from 01/01 to 10/01/2019. The resulting amount is divided by 4.

If the payer knows the cadastral value of the property, then the advance payment is calculated according to the cadastre registers.

To determine the amount of the advance, the value according to the cadastre as of 01/01/2019 is multiplied by the tax rate established by the regional authorities (but not higher than 2.2%). The resulting value is divided by 4.

This calculation takes into account the period of ownership and use of the fixed asset during the calculation period. You will also need information about the technical, functional and quantitative condition of the asset at the reporting date.

Information about the cadastral value is located in the official open data source, which is generated based on the results of the cadastral valuation. Such information is also provided at the local branch of Rosreestr.

Do I need to submit zero property tax returns?

If you have taxable objects, but the total tax amount is zero, you need to submit a declaration. In this case, you are a tax payer and must report, despite the fact that the tax is zero.

This happens in two cases:

- Your property is fully depreciated, its residual value is zero. However, it is taxed at the average annual cost.

- All your real estate is exempt from tax under federal or regional benefits.

When an organization has no real estate recognized as an object of taxation at all, it is not a taxpayer and does not have to submit a declaration.

Advance calculation example

Let's calculate the amount of the advance payment for property tax for a budget institution for the 3rd quarter of 2021. Let's look at an example of calculating property tax for legal entities in 2021 for the ALLURE SDYUSSHOR. The organization has a separate building on its balance sheet for storing inventory; the cadastral value as of 01/01/2019 for this type of property has not been determined.

The calculation is based on the average annual cost. The residual value as of the 1st day of each month is:

- 01.01.2019 — 1 682 256;

- 01.02.2019 — 1 667 256;

- 01.03.2019 — 1 652 256;

- 01.04.2019 — 1 637 256;

- 01.05.2019 — 1 622 256;

- 01.06.2019 — 1 607 256;

- 01.07.2019 — 1 592 256;

- 01.08.2019 — 1 577 256;

- 01.09.2019 — 1 562 256;

- 01.10.2019 — 1 547 256.

The tax rate is 2.2%.

The tax payment is determined as the product of the average residual value and the tax rate. The official instructions for filling out an advance calculation for property tax 2021 provide for the summation of all residual value indicators as of the 1st day of the following month and deriving the average. In the case of SDYUSSHOR "ALLUR" this averaged value is 1,614,756 rubles. The down payment is calculated as follows: (1,614,756 × 2.2%) / 4 = 8881.16.

The advance amount is rounded to a whole value - SDYUSSHOR "ALLUR" must transfer 8881 rubles to the budget.

Examples of property valuation

Example No. 1.

Omega LLC is located in the Moscow region. For 2 sq. 2016 valuation of the fixed asset for the period under review:

| date | Final OS status | Property 1 and 2 am. Gr. (Clause 25 of Article 281 of the Tax Code of the Russian Federation) |

| 01.04.2016 | 1 850 485 | 350 377 |

| 01.05.2016 | 1 730 375 | 279 806 |

| 01.06.2016 | 1 610 265 | 209 235 |

| 01.07.2016 | 1 490 155 | 138 664 |

Average Cost OS RUB 1,297,781.5 ((1,850,485 + 1,730,375 + 1,610,265 + 1,490,155) ÷ 4)

Average Cost of preferential property 244,520.5 ((350,377 + 279,806 + 209,235 + 138,664) ÷ 4)

The transfer amount for the 2nd quarter is 23,172 rubles. (2.2% * (1,297,781.5 – 244,520.5)).

Example No. 2.

Sigma LLC is the owner of real estate in Moscow, with a value of RUB 12,133,856.

The property fee is 157,740 rubles. (12,133,856 ×1.3%) per year;

The quarterly payment will be 39,435 rubles. (157,740 ÷4).

How to fill out the calculation

We have compiled an algorithm for generating tax calculations for property taxes, taking into account the innovations of 2021. The advance property tax report consists of a title page and three sections. Section 2 has an additional block - section 2.1. Here's how to complete your 3rd quarter 2019 property tax advance estimate:

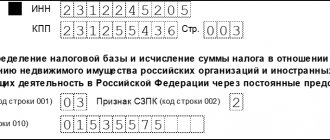

Step 1. Fill out the title page.

It reflects the taxpayer’s registration data:

- TIN;

- KPP and name, and, if necessary, TIN and KPP of the reorganized organization (if available);

- contact number;

- FULL NAME. manager or authorized person;

- date of application.

The first page indicates the adjustment number (for the original form - 0) and various codes - tax period code (for the 3rd quarter of 2021 - 18), territorial Federal Tax Service code, code at the location or registration (in normal cases - 214).

The title page is certified by the signature of the head and the seal of the reporting institution.

Step 2. Fill out section 1.

Here the specialist indicates the OKTMO of the reporting organization, the calculated advance amount for property tax and the budget classification code by which the payment is distributed.

Step 3. Fill out section 2.

Calculation procedures are carried out here. This advance calculation block is filled out separately for each immovable property on the taxpayer’s balance sheet. The form contains the code for the type of property according to the nomenclature from Order No. ММВ-7-21/ [email protected] For basic cases, this code has a value of 0.

Then OKTMO is indicated.

The contractor enters the residual value of the asset in strict accordance with the accounting data.

Column 4 of the calculation is intended to reflect the OST on property subject to contributions at a preferential rate. In the report for the 3rd quarter, lines from 020 to 110 are filled in, which corresponds to information from 01.01 to 01.10. After entering the basic data, the advance amount is calculated.

In line 120 the average value for OST is calculated.

Field 130 indicates the tax benefit code (determined by regional authorities) in the case of accounting for preferential assets, and field 140 indicates the average cost of preferential property.

The estimated tax rate is entered on line 170.

The calculated advance amount at book value is given in field 180.

The new reporting form does not contain line 210, which accumulates the results as of the reporting date.

Step 4. Fill out section 2.1.

This block is intended for entering information about cadastral registration. In the first field, enter the code for the cadastral or conditional number.

Line 020 contains the name of the property according to the cadastre.

In the new calculation form, the address of the asset is also filled in; lines with code 030 are provided for this.

Address fields are generated for those funds that have an inventory number, but at the time of submitting the report, a cadastral or symbolic designation was not assigned. If the address has not been assigned by the reporting date, then dashes are placed in the fields.

Step 5. Fill out section 3.

The third section of the advance calculation is filled out similarly to the second block - only according to cadastral data. Here you indicate the code of the type of property, OKTMO and the encoding of the type of information for the reporting fixed asset. Then the cadastral number (line 015) and cost data (line 020) are given. The specialist indicates the tax benefit index, if any (field 040) and the rate at which the property is taxed (field 070), on the basis of which the amount payable to the budget for the 3rd quarter of 2019 is calculated. The value is entered in cell 090. The total data on calculated contributions from section 2 and section 3 are summed up and entered in section 1 as the amount of the property tax advance for transfer (line 030 of section 1).

Real estate tax rate

According to Article 380 of the Tax Code of the Russian Federation, the rate is approved at the regional level and can be in the range of up to:

| Year | Rate for fixed assets | Rate for real estate (cadastral price) |

| Moscow | NK% | 2% |

| Dr. Regions | NK% | 2% |

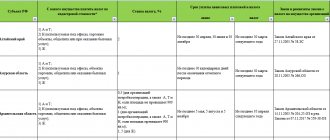

At the same time, regions have the right to set different rates taking into account the category of fixed assets of the taxpayer company and the current year. Let's consider the tax rates in the constituent entities of the Russian Federation for 2021.

| Additional diff. rates | OS cadastre | Region |

| not provided | not provided | Adygea |

| Yes | 0,9 | Altai |

| not provided | 2 | Bashkortostan |

| taken into account | 0,3 | Buryatia |

| taken into account | 0,8 | Dagestan |

| not provided | 2 | Ingushetia |

| Yes | 1,5 | Kabardino Balkaria |

| not provided | not provided | Kalmykia |

| taken into account | not provided | Karachay-Cherkessia |

| Yes | 1,5 | Karelia |

| not provided | not provided | Komi |

| not provided | not provided | Crimea |

| taken into account | not provided | Mari El |

| not provided | not provided | Mordovia |

| taken into account | not provided | Sakha |

| Yes | 1,5 | North Ossetia |

| Yes | 1,5 | Tatarstan |

| not provided | not provided | Tyva |

| Yes | 1,5 | Udmurtia |

| Yes | 1,5 | Khakassia |

| not provided | 2 | Chechnya |

| taken into account | not provided | Chuvashia |

| not provided | 2 | Altai region |

| Yes | 1,5 | Transbaikal region |

| taken into account | No | Kamchatka region |

| Yes | not provided | Krasnodar region |

| taken into account | not provided | Krasnoyarsk region |

| taken into account | not provided | Perm region |

| taken into account | 0,6 | Primorsky region |

| Yes | 1,5 | Stavropol region |

| Yes | 2 | Khabarovsk region |

| taken into account | 2 | Amurskaya o. |

| taken into account | not provided | Arkhangelsk o. |

| taken into account | 1 | Astrakhan o. |

| taken into account | 2 | Belgorodskaya o. |

| taken into account | not provided | Bryansk region |

| taken into account | not provided | Vladimirskaya o. |

| taken into account | not provided | Volgograd o. |

| taken into account | 2 | Vologda o. |

| taken into account | not provided | Voronezh region |

| taken into account | 1,2 | Ivanovskaya o. |

| not provided | 2 | Irkutsk o. |

| not provided | 0,75 | Kaliningrad island |

| not provided | not provided | Kaluzhskaya o. |

| taken into account | not provided | Kemerovo o. |

| taken into account | 1 | Kirovskaya o. |

| Yes | 1,5 | Kostroma o. |

| taken into account | 2 | Kurganskaya o. |

| taken into account | 2 | Leningradskaya o. |

| taken into account | 2 | Lipetskaya o. |

| taken into account | 1,5 | Magadan Island |

| taken into account | 1,5 | Moscow o. |

| taken into account | not provided | Murmansk o. |

| taken into account | 2 | Nizhny Novgorod o. |

| taken into account | 2 | Novgorod region |

| Yes | 1,5 | Novosibirsk o. |

| taken into account | not provided | Omsk o. |

| taken into account | 2 | Orenburg Island |

| taken into account | not provided | Orlovskaya o. |

| taken into account | 2 | Penza o. |

| taken into account | not provided | Pskov region |

| taken into account | not provided | Rostov region |

| Yes | 1,5 | Ryazan Island |

| taken into account | 0,9 | Samara o. |

| taken into account | 1 | Saratovskaya o. |

| taken into account | 1 | Sakhalin Island |

| taken into account | 1,5 | Sverdlovsk o. |

| taken into account | not provided | Smolenskaya o. |

| not provided | not provided | Tambov o. |

| taken into account | 2 | Tverskaya o. |

| taken into account | 1 | Tomsk o. |

| taken into account | 2 | Tula Island |

| taken into account | 2 | Tyumen O. |

| taken into account | not provided | Ulyanovsk o. |

| taken into account | 2 | Chelyabinsk o. |

| taken into account | not provided | Yaroslavskaya o. |

| taken into account | 1,3 | Moscow |

| taken into account | 1 | Saint Petersburg |

| taken into account | not provided | Sevastopol |

| taken into account | not provided | Jewish Autonomous Region |

| not provided | not provided | Nenets Autonomous Okrug |

| No | 2 | Khanty-Mansi Autonomous Okrug |

| taken into account | not provided | Chukotka Autonomous Okrug |

| not provided | 2 | Yamalo-Nenets Autonomous Okrug |

In all regions except for the river. Crimea and the city of Sevastopol, a rate of 2.2% is established for calculating the property tax, the basis of which is the average annual value assessment. Information on differentiated rates can be found in regional regulations.