What to spend money on

The organization's expenses are not always paid with funds from its current account. In some cases, it may be necessary to issue funds to the employee on account. Such cases include:

- Economic needs of the organization (for example, purchase of goods, work or services);

- Business trip (when the employee is given daily allowance, as well as money for travel and accommodation);

- Entertainment expenses.

The basis for issuing funds from the cash register is one of the following documents:

- an employee’s application containing a director’s visa containing the amount of issue, as well as the period for which it is allowed to be issued;

- the manager's order to issue funds will be reported.

In order for the organization to be indicated as the buyer in the documents issued to the accountable employee when purchasing goods, in addition to the accountable funds, the employee must be given a power of attorney.

Consequences of unjustified issuance of amounts on account

For none of the reasons listed in the previous section, a company (or individual entrepreneur) cannot be held liable. And although the Code of Administrative Offenses contains Art. 15.1 entitled “Violation of the procedure for handling cash and the procedure for conducting cash transactions, as well as violation of the requirements for the use of special bank accounts”, liability for it can only arise in the following situations:

- cash settlements with legal entities in excess of the established limit;

- non-receipt of cash to the cash desk;

- violation of the procedure for storing cash;

- violations committed by payment agents.

The established amount of penalties for these violations is 4,000–5,000 rubles. for officials and 40,000–50,000 rubles. - for legal entities. There are no sanctions for other situations.

However, irresponsible issuance of funds to the account can be even more expensive - for example, if tax authorities reclassify a large amount issued to the director for a long period as an interest-free loan and charge personal income tax on the material benefit.

It is also not a difficult task for controllers to establish that the endless issuance and return of funds from the subaccount is used to disguise exceeding the cash register limit.

IMPORTANT! Even if the auditors understand the true meaning of the operations carried out by the business entity with the funds issued for accountability, they will have to defend their point of view in court. Arbitration practice in this area is very heterogeneous (for example, the decisions of the 7th Arbitration Court of Appeal dated March 26, 2014 in case No. A67-5875/2013 and the FAS of the Volga District dated March 13, 2014 No. A65-15313/2013 were adopted in favor of the company, and decision of the Moscow City Court dated 08/14/2013 in case No. 7–1920/2013 and resolution of the Federal Arbitration Court of the North Caucasus District dated 07/05/2012 No. F08-3500/12 in case No. A53-8405/2011 - in favor of the Federal Tax Service).

For more information about liability for violations committed when handling cash, read the article “Cash discipline and liability for its violation .

To whom can accountable money be issued?

Money can be issued from the organization's cash desk only to those employees with whom the organization has entered into an employment contract or a civil contract. Thus, you can issue an advance for future expenses not only to a full-time employee, but also to your contractors. For example, an organization hired workers under a civil contract to perform a certain amount of work. To complete them you will need to purchase materials. Accordingly, it is possible to provide such employees with funds for the purchase of materials (

Automatic cash transactions without cashiers

Before the amendments, cash transactions were allowed to be carried out using software and hardware. Now this provision has been specified: they can be carried out using automatic devices that operate without a cashier.

Such devices must meet the following parameters:

- accept and issue cash;

- recognize at least four security features on banknotes (paragraph 14–19 clause 1.1 of the Central Bank Regulation No. 630-P dated January 29, 2018).

Cash taken from the machine must be accepted according to the PKO, and the loading of the machine with money must be registered through the PKO.

Order for the release of money for reporting

Since employees are not required to write statements for the issuance of accountable amounts, they must be replaced with an order (instruction) from the head of the company.

The procedure for issuing an order is not specified in the Central Bank Instructions, but it is stated that the order must contain:

- Full name of the employee to whom accountable funds are issued;

- The amount of money that must be issued to the employee;

- Deadline for issuing funds to the accountable.

Important! If the manager’s order for the issuance of accountable funds contains inaccurate wording, the Federal Tax Service has the right to regard this as a violation of the rules for storing cash. For this, the company faces administrative punishment in the form of a fine of up to 50,000 rubles.

Let's consider the wording options in the order for the issuance of accountable amounts.

For example, the following wording: “I order in the future to extradite O.P. Petrova.” funds up to 30,000 rubles without statements” or such “I order that Petrova O.P. be extradited. funds without statements until the advance amount reaches 30,000 rubles” does not contain precise wording, which means it can be regarded as a violation.

Let's give an example of wording that will allow you to issue accountable funds to an employee without fear of inspection authorities: “issue O.P. Petrova on account of 30,000 rubles for 5 working days for the purchase of stationery.”

The order may also contain an order to issue accountable funds to several employees at once, for example, when sending several employees on a business trip.

We attach a sample order for the issuance of accountable funds to several employees when they are sent on a business trip.

Sample order for issuance for reporting 2021

Quality control of accepted cash

The cashier will now additionally have to check the solvency of cash according to the requirements of clause 1 of the Bank of Russia Instructions dated December 26, 2006 No. 1778-U. Money that does not contain signs of counterfeiting or damage is considered solvent, with the exception of the following:

- banknotes - soiling, wear, tears, abrasions, small holes, punctures, inscriptions, stains, stamp impressions, missing corners or edges;

- coins - minor mechanical damage.

If the money is damaged but still valid, the cashier must accept it.

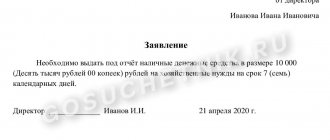

Application for the release of money for reporting

Despite the fact that statements are not required to be written according to the rules for issuing accountable funds, some organizations find it more convenient to work with statements. In this case, the previous application form can be somewhat simplified. For example, remove the clause that the employee has already submitted an advance report on accountable funds issued to him earlier. This requirement is no longer valid; now it is possible to give money to the accountable even if he has not yet paid off the previous advance received.

However, if a company wants to maintain such a requirement, then it can simply change the wording. For example, you can indicate that a new advance is issued only if the employee has reported on the old one. Such a rule should be written down in the enterprise’s Regulations on accountable employees.

Here is an example of an employee’s application for the issuance of accountable funds.

Sample application for the issuance of funds (form 2021)

If the provision on accountable employees does not contain wording that funds are issued only at the request of the employee, or after a full report on the funds received from the previous advance, then they must be paid. If, in addition, the manager wants to limit the amount of accountable funds, then the Regulations must provide wording according to which the size of a one-time payment, or the total amount of the employee’s debt, cannot exceed a certain limit.

Payments made by notaries through accountants

Let's consider the situation. The employer-notary plans to issue cash on account to the employee for the purchase of a computer worth more than 110,000 rubles. Does he have the right to do this and can the seller refuse to accept the full amount in cash to the notary office employee?

In this case, there will be no restrictions on the amount of amounts - neither on the amount reported (since there are no such restrictions in principle), nor on the amount paid. The fact is that notarial activity is recognized as a legal activity performed on behalf of the state and is not recognized as entrepreneurial, since it is not accompanied by the extraction of profit (Resolution of the Constitutional Court of the Russian Federation dated May 19, 1998 No. 15-P).

At the same time, privately practicing notaries are equated to entrepreneurs only in tax legal relations (Article 11 of the Tax Code of the Russian Federation). In other cases (including those related to cash payments), notaries are not subject to the rules established for individual entrepreneurs (letter of the Federal Tax Service for Moscow dated 04/08/2011 No. 17-26/034104). Therefore, an employee of a notary office who has received cash on account from his employer can pay in full with it, even if the purchase price is more than 100,000 rubles.

Funds issued for reporting always attract increased attention from tax authorities. That is why it is very important to correctly prepare all documents and mutual settlements with accountable persons. ConsultantPlus experts explained in detail how to do this. Get trial access to the K+ system and go to the Guide for free.

Money is accountable to the employee’s card

When an organization transfers days to an employee by bank transfer, then writing an application or issuing an order is not required. The above procedure applies only to cash payments. But it would still be a good idea for the company to issue one of these documents. This way she will protect herself from unnecessary proceedings by inspection bodies. In addition, in the company’s local act it is better to include a condition according to which the organization has the right to transfer accountable money to the employee on the card. And in the payment order by which funds will be transferred to the employee’s card, it must be indicated that the money is issued on account.

Important! Accountable funds can be transferred to the employee’s salary card or to his personal card. To do this, the employee needs to write a statement with the corresponding request and specifying the details for the transfer.

Results

Correct execution of advance reports and cash documents for the issuance and acceptance of accountable amounts guarantees competent accounting for account 71 “Settlements with accountable persons.”

The formation of transactions must be carried out in accordance with the chart of accounts current in the Russian Federation, and the mechanism for issuing and receiving accountable amounts - in accordance with the instructions of the Central Bank of the Russian Federation No. 3210-U. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to report money to the account?

The head of the organization sets a deadline after which the employee must account for the funds received. For example, an accountant was given an advance for the purchase of stationery for a period of 5 days. After this period, the accountant must provide a report within 3 days. If the report is drawn up on travel expenses, then the employee must report within 3 days from the date of return from the trip.

If an employee receives accountable money on a card, they can report on it later than the established three-day period. The rules of “cash” restrictions do not apply to non-cash payments, so the manager has the right to set the deadlines for the report independently. The main thing is that this is recorded in the Regulations on the issuance of accountable funds of the company (

Rules for drawing up a document

There is no unified form, but pay attention to the following rules:

- Create a document on the institution’s letterhead in a single copy. If such a form is not available, then in the header of the document indicate the name of the government agency (full), number, date and name of the order.

- A sample of a new order for reporting should be registered in the order register in the usual manner.

- When creating a new order, strictly follow the chronological order, otherwise the inspectors will suspect forgery.

- Only the head of the organization or his deputy or the person acting as head has the right to approve the document.

- In the document, be sure to indicate the following details: Accountable person: last name, first name and patronymic (if any), position.

- Subreport amount: indicate the amount in words and figures, in rubles and kopecks.

- Purpose: write down the specific purpose of the allocated money.

- Reporting deadline: indicate the deadline (day, month, year) until which the money was issued.

Don't forget to appoint a responsible person, for example, a chief accountant. If the organization does not have an accounting department, then control over compliance with this order should be entrusted to the manager.