In the 6-NDFL calculation, you need to fill out the title page, section 1 and section 2. However, they are filled out completely differently.

In section 1, reflect payments, deductions and taxes for the entire period from the beginning of the year. Income at different rates must be reported separately. In the same section you need to reflect the actual tax withheld from the income paid.

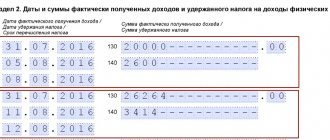

In Section 2, show information for the last three months only. In this case, you need to reflect only those payments for which the tax payment deadline occurs in this period. Therefore, in section 2, special attention should be paid to the dates of payment and withholding of tax.

The main thing when filling out the 6-NDFL calculation

–

carefully transfer data from tax registers for personal income tax. Therefore, if tax accounting is in order, then filling out the 6-NDFL calculation will not be difficult.

Who submits 6-NDFL and how?

This report is required to be prepared by personal income tax agents. Most often, they mean employers (clause 2 of Article 230 of the Tax Code of the Russian Federation) who pay salaries to staff. They can also be customers - companies and individual entrepreneurs who have paid income to performers under GPC agreements (contract, lease, etc.).

For more information about who should draw up the report, read the article “6-NDFL - who submits it and when?” .

And those who are not obliged to do this are described in the materials:

- “The procedure for submitting 6-NDFL for individual entrepreneurs without employees”;

- “If there is no salary, is it necessary to submit a 6-NDFL report?”.

The last day on which the Federal Tax Service inspectors will accept the report is the last day of the month following the reporting period (Article 230 of the Tax Code of the Russian Federation). The deadline for submitting the annual form differs from the usual one and is set for April 1 of the year following the reporting year. If hour X turns out to be a weekend or holiday, the report can be submitted on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). As for the deadline for submitting the calculation for 2021, it will not be postponed, because 04/01/2019 is Monday.

Read about how to check 6-NDFL for errors here .

Sanctions for violations

For violations of the deadline and form for filing 6-NDFL, tax and administrative liability is provided. All sanctions are collected in the following table.

Table 4. Possible sanctions for violating the procedure and deadline for filing 6-NDFL

| Violation | Sanction | Regulatory Standard |

| Form not submitted | 1 thousand rubles for each month (full and part-time) | clause 1.2 art. 126 Tax Code of the Russian Federation |

| The calculation was not received by the Federal Tax Service within 10 days after the deadline for submission | Blocking the current account | clause 3.2 art. 76 Tax Code of the Russian Federation |

| Error in calculation (if identified by the tax authority before the agent corrected it) | 500 rubles | Art. 126.1 Tax Code of the Russian Federation |

| Failure to comply with the form (submission on paper instead of sending via TKS) | 200 rubles | Art. 119.1 Tax Code of the Russian Federation |

| Submission deadline violation | 300-500 rubles per official | Part 1 Art. 15.6 Code of Administrative Offenses of the Russian Federation |

Company officials are held administratively liable . For example, a fine for late filing of 6-NDFL will be imposed on the chief accountant if his job description states that he is responsible for the timely filing of reports.

Has the 6-NDFL form been updated?

This question inevitably arises before the start of a new reporting campaign, and submitting 6-NDFL is no exception. This time, fortunately, there were no changes. The last time the form was edited by order of the Federal Tax Service dated January 17, 2018 No. ММВ-7-11/ [email protected] and became mandatory for use from March 26, 2018. We are renting it out in 2021.

you can here.

If your company is the successor of a reorganized company, and the previous employer did not submit reports, you are required to report for the employees transferred “by inheritance”.

How to calculate 6-NDFL during reorganization, see here.

Results

Reflection of the calculated personal income tax in the 6-NDFL report is a process that requires knowledge of the nuances of the legislation. At the same time, the existing basic formulas for calculating report indicators will help you independently check the correctness of your accounting data, without waiting for a request from the tax office.

The article “Attention! These are common mistakes in 6-NDFL.”

Sources:

Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

General rules for processing 6-NDFL

6-NDFL includes a title page and 2 sections. A distinctive feature of the report (when compared with 2-NDFL) is that the data in it is a summary and is not reflected separately for each person.

IMPORTANT! We advise you to fill out 6-NDFL in the following sequence: section 2 - section 1 - title page, that is, we start with detailed data and move on to general information.

Let us recall the basic rules for generating a report:

- We fill out the calculation for each OKTMO.

- If filling out by hand, use only a blue, purple or black pen.

- If we prepare a report on a computer, choose the Courier New font with a height of 16–18 points.

- We fill the cells from left to right, and put dashes in the empty ones.

- If there are no indicators, put 0 in the corresponding field.

- We do not use double-sided printing; inspectors will not accept such a report.

- We fill out the report with an accrual total.

- We take the indicators from the tax register.

IMPORTANT! If you don't keep tax records, you're at great risk. Their absence is recognized by the Tax Code of the Russian Federation as a very serious violation of the rules for accounting for income and expenses, which is punishable by a fine (Article 120 of the Tax Code of the Russian Federation).

Now let’s move on directly to filling out 6-NDFL line by line. We have prepared an example and detailed instructions to help you cope with this task.

Explanations for section 1 of the report:

- “Procedure for filling out line 70 of form 6-NDFL”;

- “Procedure for filling out deadline 040 form 6-NDFL”;

- “Procedure for filling out line 020 of form 6-NDFL”;

- “Procedure for filling out line 080 of form 6-NDFL”;

- “Procedure for filling out line 060 of form 6-NDFL”;

- “Procedure for filling out line 090 of form 6-NDFL”;

- “Procedure for filling out line 050 of form 6-NDFL”.

And here are the supporting articles for section 2 of the report:

- “How to reflect the recalculation of vacation pay in form 6-NDFL?”;

- “Procedure for filling out line 130 in form 6-NDFL”;

- “Procedure for filling out line 120 of form 6-NDFL”;

- “Procedure for filling out line 100 of form 6-NDFL”;

- “How to correctly fill out section 2 in the 6-NDFL calculation?”;

- “Procedure for filling out line 140 of form 6-NDFL”;

- “Procedure for filling out line 110 of form 6-NDFL”.

On our website you will also find expert explanations on how to reflect in 6-personal income tax one-time bonuses, income in kind, sick leave, vacation pay and compensation for non-vacation leave, material benefits, property deductions, financial assistance, dividends and other mandatory information.

Use our assistant for filling out the 6-NDFL calculation, and you will be able to identify errors before sending the form to the tax authorities.

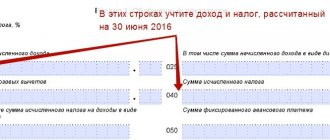

Filling out Section 1

In this section we transfer information about all income, including allowances, bonuses and cumulative payments from the beginning of the year ─ for the period from January to September. It also needs to reflect data on other income paid to “physicists”, for example, dividends. Section 1 is completed separately for each tax rate applied.

- Line 020.

We indicate the total amount of income accrued to employees since the beginning of 2020.

- Line 025.

If dividends were not paid in 2021, enter “0” in the line.

- Line 030.

We indicate the amount of deductions provided to employees that reduce taxable income.

- Line 040.

We display the amount of calculated tax from the beginning of the year, calculated using the formula: (line 020 – line 030) * line 010.

- Line 045.

We fill in if dividends were paid to the employee, personal income tax was accrued on them and subsequently paid to the budget. Otherwise, put “0” in the line.

- Line 050.

We indicate the total amount of fixed advances paid for foreigners working under a patent. If no such payments were made, enter “0”.

- Line 060.

We enter the total number of employees who received taxable income for 9 months of 2020.

- Line 070.

We indicate the total amount of personal income tax withheld since the beginning of 2021.

- Line 080.

We reflect personal income tax not withheld by the employer.

- Line 090.

We indicate the amount of personal income tax excessively withheld by the employer from the employee’s income (in accordance with Article 231 of the Tax Code of the Russian Federation).

Is it worth taking zeros?

The answer to this question is not as clear-cut as it might seem. If we are guided by the Tax Code of the Russian Federation, then only tax agents “surrender” under 6-NDFL. That is, if there are no accruals, there seems to be no need for a report. And if there are accruals, then there can be no zero at all. The tax authorities themselves say the same thing.

However, in practice, various situations occur, and it is impossible to provide for all of them in the Tax Code of the Russian Federation. Thus, incorrect indication of OKTMO and KPP, even if there are payments to individuals, may entail the need to submit a zero 6-NDFL. Detailed explanations, as well as a sample zero, can be found in these materials:

- “How to correctly correct OKTMO in the calculation of 6-NDFL?”;

- “The procedure for filling out form 6-NDFL with different OKTMO and checkpoints”.

In addition, you can take zero marks at will. This means that if you decide to prepare reports even without being a tax agent, Federal Tax Service employees will not be able to refuse to accept it.

Example of filling line 040

Line 040 is generally not difficult to fill out. But for clarity, let's look at an example.

Example

At Sady LLC, the amount of accrued wages for the 1st quarter was:

- January - 30,000 rubles;

- February - 35,000 rubles;

- March — 49,000 rub.

No deductions are provided to employees. The report will be filled out like this:

We automate the work of filling out 6-NDFL

The reporting period is a busy time for accountants, and of course, you want to use every opportunity that will help reduce the time for preparing reports. Today there are many ways to automate not only the process of issuing 6-NDFL, but also its verification and sending. Find details about commercial and free solutions here.

If you use 1C software, do not ignore this article, which reveals the nuances of filling out 6-NDFL in different versions of this accounting program. Please note that in older versions of 1C, generating 6-NDFL can be problematic. Here you will also find the procedure for filling out calculations using this well-known accounting program.

Do you want to fill out 6-NDFL online? We recommend reading this publication. From it you will learn what advantages online payment processing provides, how to carry it out and what difficulties you may encounter.

Filling out Section 2

In this section, include payments for the last 3 months of the reporting period ─ in the report for 9 months it is necessary to reflect data for July, August and September.

- Line 100.

We indicate the date of actual receipt of income reflected on page 130. When filling out this line, you must take into account that for some payments the timing of actual receipt of income is different.

The date of receipt of salary and monthly bonus is the last day of the month for which it is assigned, even if it falls on a weekend. When paying bonuses for a year, quarter or for a specific event, the date of receipt of income is considered the day of its payment (Letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115).

The date of receipt of income under a civil contract, sick leave and vacation pay, financial assistance, vacation compensation and dividends is the day the income is paid to the employee.

- Line 110.

We reflect the date of actual deduction of personal income tax from the income paid. Tax on all types of payments is withheld on the day the income is paid, that is, line 110 = page 100.

- Line 120.

We indicate the deadline for transferring personal income tax to the budget. The deadline for paying personal income tax on wages and other income, with the exception of vacation pay and benefits, is the day following the day the tax was withheld. And for vacation and sick leave - the last day of the month.

- Line 130.

We enter the total amount of income received (without subtracting personal income tax) as of the date indicated in line 100.

- Line 140.

We indicate the total amount of personal income tax withheld.

Sample 6-NDFL for 9 months 2020

Useful information from ConsultantPlus

You will find more useful information about filling out 6-NDFL in the ready-made solution developed by tax and accounting experts ConsultantPlus.

How to check whether 6-NDFL is filled out correctly, and what happens if errors are found

The Tax Code of the Russian Federation provides for liability both for late submission of 6-NDFL and for its incorrect submission, which can be considered:

- Incorrect method of submitting the report (on paper instead of electronically).

- Inclusion in the calculation of inaccurate data that was not corrected before detection by tax authorities.

And if the first violation is easy to avoid (just remember the number of individuals to whom you paid income), then it is better not to allow the second. Or, as a last resort, try to detect flaws before the inspectors do.

Read about the penalties applied by tax authorities in the articles:

- “Is it possible to accrue penalties for personal income tax after submitting 6-NDFL?”;

- “Is it possible to avoid blocking an account for failure to submit 6-NDFL?”;

- “Fines for 6-NDFL: rules for imposition”.

Still, before submitting the report, it is better to make sure that it is correct. This can be done in several ways: by comparing report data with accounting and tax registers, as well as using control ratios that are used by inspectors to check 6-NDFL. This will help reduce the risk of inconsistencies in reporting and eliminate the need to provide explanations and clarifications.

Do you have questions about filling out the updated calculation for 6-NDFL? Check it out here:

- “Covering letter for the updated calculation of form 6-NDFL”;

- “6-NDFL: the error of the first quarter is corrected by two clarifications”;

- “You may not submit the updated 6-personal income tax for the 1st quarter and half of the year when recalculating “extra” deductions for the employee in July”;

- “Return of personal income tax that was excessively withheld last year: is updated reporting necessary?”.

Permissible error when calculating the value

The control ratio of clause 1.3, specified in the letter of the Federal Tax Service of Russia No. BS-4-11 / [email protected] , allows for deviation of the value of line 040 from the calculated one:

K100 × page 060 × 1 rub.,

Where:

K100 - the number of payments shown in line 100 of section 2 from the beginning of the year;

line 060 - the number of persons in whose favor accruals were made from the beginning of the tax period.

The deviation arises due to the fact that, according to the rounding rules, tax amounts of less than 50 kopecks are discarded, and amounts containing 50 kopecks or more are rounded to the full ruble.

Unlike line 040 in 6-NDFL, which is filled out in rubles, the value of line 130 is indicated in rubles and kopecks.

Let's look at the situation using an example:

For 2021, Mayak LLC showed fifteen payments made in favor of ten employees on line 100.

In this case, the permissible error of line 040 in 6-NDFL will be no more than 150 rubles.

15 × 10 × 1 rub.

You can read more about control ratios in the article.

Calculated and withheld income tax

To understand the differences between the two personal income tax amounts, let’s consider each concept separately.

Calculated personal income tax. To fulfill the duties of a tax agent, the employer, before paying the employee wages, is obliged to calculate income tax on this amount. The tax is calculated taking into account deductions and subsequently transferred to the state budget.

Withheld personal income tax. Having calculated the tax, the employer performs one more operation - withholds the calculated amount from the employee’s salary.

The tax is calculated, according to the law, at the time of calculation of wages and equivalent amounts, and the withheld tax is the amount remaining with the employer for the purpose of its subsequent transfer to the budget. It is impossible to withhold tax before the date of actual receipt of income by an individual.

The indicators are interconnected: the tax must first be calculated, then withheld, followed by its transfer.

Current legislation provides for tax calculation no later than the last date of the month of income accrual. If the calculated tax was withheld in the same period, then the figures at the end of this period will be the same. However, this is not always the case. Calculated and withheld income taxes are reflected in separate lines in tax reporting forms, the data of which is subject to reconciliation:

- 2-NDFL;

- 6-NDFL.

The difference between the two values may arise when they are reflected in the specified forms according to the rules of tax legislation. For example: the indicators for calculated and withheld personal income tax (lines 040 and 070 f. 6-NDFL) are not equal to each other if wages accrued in the reporting quarter were issued in the next month falling in the new quarter. In the quarterly report, the withholding line will have a zero value or a value less than calculated (clarifications from the letter of the tax service No. BS-4-11/8609 dated 05/16/16).

Please note that the control ratios for the sixth form do not contain mandatory equality for lines 040 and 070 (letter of the tax service No. BS-4-11/3852 dated 03/10/16).

By the way! The transferred personal income tax is the amount that was actually transferred to the state budget at the end of the month.