Submitting reports to the tax office in 2021 for individual entrepreneurs using the simplified tax system

All owners of individual entrepreneurs, according to the legislation of the Russian Federation, are required to submit declarations to the Federal Tax Authority in a timely manner.

There are two options for submitting tax reports for individual entrepreneurs in 2018 according to the simplified tax system, these include:

- Payment of a tax fee of six percent.

- Payment of tax on income minus expenses in the amount of 15%.

Both forms are acceptable for a company with or without employees. The difference is that if there are employees, the owner of the company must send reports not only to the tax authority, but also to the Pension Fund of Russia, as well as the Social Insurance Fund.

Reporting on the simplified tax system requires regular registration of documents with data on income to the tax office.

Formation of documentation is allowed both in paper format and in electronic form. The first option must be sent to the authorized body in person or by letter, and the second can be sent via Internet channels.

Accounting Standards

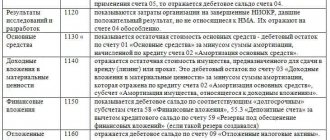

There are two types of accounting standards - PBU and IFRS.

PBU - Accounting Regulations - Russian Standards . PBUs regulate the accounting of assets, liabilities and events of economic activity of a legal entity. The provisions are adopted by the Ministry of Finance and apply to commercial organizations, except banks.

IFRS - international financial reporting standards. Accepted by the International Accounting Standards Board (IASB). Mandatory for European companies whose shares are listed on the stock exchange, as well as in individual European countries.

Russia is currently in the process of reforming its internal accounting in accordance with IFRS.

Tax reporting deadlines in 2021

The simplest format for individual entrepreneurs is the absence of employees.

In this case, you only need to submit one report – a tax return. This report is compiled once every 12 months. The document reflects information at the end of the year: income and expenses.

Only one form is used to fill out, which does not change depending on the interest rate. The completed document must be submitted by the last day of April (until April 30, 2019).

When filling out the form, it is mandatory to take into account the income in the tax register. Sometimes expenses are recorded.

It is necessary to develop a register form and consolidate it in the tax accounting policy in advance if the individual entrepreneur uses a simplified taxation system. There is no need to prepare accounting reports using the simplified tax system, which greatly facilitates the activities of entrepreneurs.

When a company employs employees, it is necessary to submit reports not only to the tax service, but also to other authorized authorities.

The reporting of an individual entrepreneur working on the simplified tax system requires maintaining a book of expenses and income without fail. This point is clearly explained by Article 346.24 of the Tax Code of the Russian Federation.

If the organization employs at least one hired person, it is necessary to apply the reporting scheme below. Every year it is necessary to provide a certificate of the worker’s income, a declaration under the simplified tax system, as well as information about the number of personnel.

Quarterly, 6-NDFL, 4-FSS and documentation reflecting insurance premiums for the tax authority should be generated and calculated. Data are prepared on a monthly basis in the SZV-M form.

So, the deadlines for submitting reports of individual entrepreneurs on the simplified tax system in 2021 for a company with employees will be as follows:

Documents for the Social Insurance Fund

- 6-NDFL – until July 31, 2019 (from January to July) and until October 31, 2019 (for nine months).

- Tax return – until 04/30/2019.

- 2-NDFL – until 04/30/2019.

- 4-FSS (injuries) - in paper form until July 20, 2019 (January-June) and until October 22, 2019 (for nine months of 2021), in electronic form until July 25, 2019 (January-June) and until October 25 .2019 (for nine months of 2021).

- Calculation of insurance premiums – until 31.07. 2021 (January-June) and until October 31, 2019 (for nine months of 2021).

Documents for PF

SZV-M and SZV-STAZH until July 16, 2019 (for June 2018);

- Until August 15, 2019 (for July 2018).

- Until August 17, 2019 (for August 2018).

- Until October 15, 2019 (for September 2018).

- Until November 15, 2019 (for October 2018).

- Until December 17, 2019 (for November 2018).

Deadline and methods of submission

Financial statements are submitted by organizations annually before March 31 of the year following the reporting year.

You can submit reports in different ways:

- Directly to the Federal Tax Service. In this case, the filing date will be considered the day the reporting is submitted.

- By mail. In this case, the day the reporting is submitted is the date of mailing (usually a valuable letter with an inventory).

- In electronic form via TKS. The date of submission will be the date indicated on the dispatch confirmation.

Tax reporting forms in 2021

New structure of document 4-FSS. Speaking about reporting forms in 2021, you should pay special attention to the changes that relate to the structure of the 4-FSS calculation. This document is provided by employers to the Social Insurance Fund when making contributions for injuries.

Reporting for 9 months, starting from 2021, will be filled out taking into account the updated version (FSS order No. 275 of June 7, 2017).

According to the legislation, the following information has been added to the new form:

- An additional line has been added to the title page to indicate the level of budget from which the employer receives funding if he operates as a budgetary enterprise.

- An additional line (1.1.) has been added to table No. 2 to record data on arrears in contributions of policyholders who have undergone reorganization or on debts of divisions of companies deregistered with the Social Insurance Fund.

- A line (14.1) has been added to table No. 2 to record debts of the Social Insurance Fund to the policyholder or deregistered divisions of the company.

Taking into account all the changes, the following adjustments have been made:

- The data from line No. 8 (formula) is now reflected in line 1.1.

- The data in line No. 8 (formula) is now reflected in line 14.1.

Adjustments were made to the order in which the calculation was completed. The procedure itself was supplemented with the following provisions:

- Period for calculating the average number of staff.

- Written off debt.

Useful material : Agreement between individual entrepreneur and individual entrepreneur. Sample document.

Planned inventory

Before drawing up the annual financial report, the organization conducts an inventory. This is done without fail by all legal entities to ensure the reliability of reporting.

The essence of the inventory is to check the presence and condition, assess the property and liabilities of the company, as well as document them. The audit is comprehensive, that is, all assets and liabilities are checked.

The inventory is carried out on the basis of the relevant regulations approved by the head of the company during the reporting year.

Inventory stages:

- an inventory commission is created;

- the latest documents on the receipt and expenditure of property and liabilities are obtained;

- receipts are taken from financially responsible persons;

- inventory records (acts) are prepared;

- the presence and condition of assets and liabilities are checked;

- inventory results are summarized and approved;

- inventory results are reflected in accounting.

Updates to statistical reporting

The innovations also affected statistical reporting. According to Rosstat Order No. 566 dated September 1, 2021, the following reporting forms were introduced:

- 1-T records data on staff size and wages.

- 1-T (working conditions) reflects information about working conditions and the calculation of required compensation in connection with these conditions.

- 1-T (GMS) reflects the size of the staff and income in municipal and government agencies.

- 2-GS (GZ) records information on additional education of federal employees.

- 2-MS reflects additional education of municipal employees.

To generate reports on a monthly basis, starting from February 1, 2021, use:

- 1-3 reflects information about the workforce.

- 3-F records information about overdue wage payments.

- 1-PR contains information about suspension of work due to strikes.

- P-4 reflects state data and earnings.

- P-4 (NZ) records information about underemployment of workers.

It is worth noting that more than a hundred reports on various types of grounds can be sent to Rosstat. Each business entity must constantly monitor innovations in statistical forms.

Now it’s worth talking about the innovations that are planned in the near future, assuming that in 2021 they will acquire legal force.

Mandatory audit

Some organizations are required to attach an auditor's report . In particular, the obligation applies to:

- all joint stock companies;

- state-owned companies and corporations;

- credit organizations, funds, insurance and clearing companies, securities market participants;

- self-regulatory organizations;

- organizers of gambling and lotteries;

- organizations with revenue for the last year of more than 400 million rubles and assets of more than 60 million rubles.

Full information about which legal entities must attach an auditor's report to their annual financial statements is contained in the Law of December 30, 2008 No. 307-FZ “On Auditing Activities”.

What is new to expect when filling out the 3-NDFL declaration?

Today, 3-NDFL is filled out according to the form that was introduced by order of the Federal Tax Service on December 24, 2014.

Presumably, adjustments will be made to the legislative act in accordance with the provisions of the draft dated May 11, 2017 No. 02/08/05-17/00065969. Today the project is at the adoption stage.

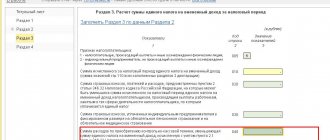

Changes will be made to the following points:

- The order of data presentation (sheet E).

- The procedure for providing information (sheet 3) regarding deductions within securities.

- Lines about data on real estate, upon the sale of which there is a need to pay personal income tax, will be added to sheet K.

It is likely that amendments will be made to the order related to updated provisions on the procedure for filling out the declaration. The changes will also affect document barcodes.

Interesting material: Increase in personal income tax in 2018 for individuals.

Results

Constant work is underway to update the forms submitted to regulatory authorities. Therefore, before submitting it, you must make sure that the form on which the report is drawn up is up-to-date.

Sources:

- Order of the Federal Tax Service of Russia dated October 7, 2019 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

- Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated August 14, 2019 No. SA-7-21/ [email protected]

- Order of the Ministry of Finance of Russia dated April 19, 2019 No. 61n

- Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p

- Resolution of the Board of the Pension Fund of 01.02.2016 No. 83p

- Order of the Federal Insurance Service of the Russian Federation dated September 26, 2016 No. 381

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Changes in financial statements submitted to Rosstat

All forms of reporting provided, as well as deadlines for submitting documents, remain unchanged in 2021.

However, it is worth paying attention to the fact that innovations are expected in determining the addressee of this documentation. At the moment, financial statements are submitted to Rosstat and the Federal Tax Service.

In accordance with the bill dated March 6, 2017 No. 02/04/03-17/00062756, it is assumed:

- Cancellation of submission of financial statements to the statistical authority.

- Formation of a unified information base for processing documents in the Federal Tax Service. Data from this database can only be requested for a fee.

- The ability for business entities to submit reports at their own discretion: both in paper form and in electronic form (or simultaneously in both). In this case, the reporting company must be ready to submit a paper version of the reporting to the Federal Tax Service upon request.

We recommend material: Documents for closing an individual entrepreneur in 2021.

Legal regulation and general requirements

Legal regulation of financial statements is carried out by the Law of December 6, 2011 No. 402-FZ “On Accounting”, the Regulations on Accounting ( PBU) , and the norms of the Tax Code.

The legislation establishes a number of requirements for financial reporting. Here are some of them:

- Credibility . The information provided must be real.

- Neutrality , that is, objectivity.

- Materiality . Reporting should reflect indicators that influence what decisions were made in the company.

- Sequence of recording business transactions.

- Integrity and completeness of the data presented.