Regular interaction of business entities with partners, employees, budgetary structures and other persons is inevitably accompanied by the emergence of financial obligations.

Their repayment is often made by non-cash transfer of money from a bank account. In order for the servicing financial institution to execute the corresponding payment, the business entity must formalize and provide it with an order of proper content.

If such payments are made by the payer in several directions, it is necessary to take into account the order of transactions performed when drawing up a series of payments.

It is noteworthy that the clear sequence in accordance with which debits and non-cash transfers of funds for certain needs are carried out is strictly regulated by the norms of current legislation.

Why is it necessary?

First, you should understand what the order of payment in a payment order for transferring money means.

As a general rule, the bank is obliged to fulfill an order from a client to transfer tax to the budget within the next day after such an order is issued by virtue of clause 2 of Article 60 of the Tax Code. If there is not enough money in the client’s account to transfer taxes, then the client’s funds will be written off in a strictly defined manner, which is established by Art. 855 of the Civil Code of the Russian Federation.

It follows from the legislation that the order of payment in a payment order depends on whether payment must be made voluntarily or compulsorily.

The specified article of the Civil Code defines the following order of cash write-offs:

| 1 | Payments that occur under executive acts on compensation for harm caused to health or life Payment of alimony |

| 2 | Transfers in accordance with writs of execution for the payment of severance pay upon dismissal or salary arrears Payment of royalties |

| 3 | Payment of debts on taxes, fees and contributions Issuance of wages to employees |

| 4 | Cash payments for other executive acts |

| 5 | All other payment documents in the calendar sequence of their receipt |

As you can see, the order of alimony in the payment order is always number one and has priority over other demands and orders to the payer’s account. In fact, this is one of the ways to protect family values.

Mandatory payments of the 1st, 2nd, 4th and partially 3rd priority can be made by the bank without the client’s consent, since the basis for the transfer of money is an executive document. Therefore, in the generated payment order, the organization can only indicate the 3rd or 5th priority.

The general principle of the queue is this: all payments that belong to one queue are executed in the calendar order of their receipt by the bank.

Features of using codes 3 and 5

If all payments are made by the company within the specified time frame, code 5 is written on the payment slip. It is relevant for taxes of any type: simplified tax system, income tax, property tax.

Code 3 becomes relevant when there is a demand for debt payment. For example, this could be a collection order in which there is a sequence.

IMPORTANT! If the debt was identified by the organization itself, the number 5 is indicated on the payment slip.

Sequence under different circumstances

In some circumstances, the accountant may have difficulty indicating the priority code. Let's consider typical situations.

How to put it down correctly

As for taxes, the order of payment in the 2019 payment order for their transfer in the corresponding line of the payment is “5” when there is a voluntary payment without any receipts from the Federal Tax Service. In turn, payment of taxes based on the requirements of the inspection must be carried out by the bank in third place. Forced payment of penalties based on instructions from the tax authority is also carried out in third place.

Thus, the bank carries out all tax payments that are made on the basis of the client’s order only in the fifth place.

Personal income tax

For example, for personal income tax, the order of payment in the 2019 payment order in most cases has the value “5”. That is, the payer or tax agent does not violate the deadlines established by law for transferring income tax to the treasury, and there are no old debts to the budget for this tax.

Also see “What to indicate in the “Payment order” field in a personal income tax payment order.”

VAT

With regard to VAT, the order of payment in the 2019 payment order follows the general approach:

- when transferring independently, you must indicate the 5th queue;

- when collecting this tax forcibly - 3rd stage (clause 2 of the letter of the Ministry of Finance dated January 20, 2014 No. 02-03-11/1603).

Also see “Payment order at the request of the Federal Tax Service: details of filling out”.

Insurance premiums

The order of payment in the payment order for insurance premiums in 2019 will be similar. Due to recent global changes in legislation, these mandatory contributions have become similar in status to taxes. If there are no claims against you regarding the deduction of contributions, then put “5”.

Salary

According to the above gradation, the order of the salary in the payment order depends on whether the employer previously delayed its payment or not. Thus, the current wages (for the past month, etc.) are assigned to the 3rd stage, and its payment from the enterprise’s account according to the writ of execution goes as the 2nd stage.

Help

What is the order of payment in the financial assistance payment order? In our opinion, the logic should be this: if a company/individual entrepreneur is not obliged by law to issue it, then this is definitely the 5th priority. In other situations, you need to look at the document that provides the basis for which a person should receive financial assistance.

Also see “Who is entitled to financial assistance for vacation”.

Fine

The exact order of the fine in the payment order depends not on its type (tax/administrative, etc.), but on the order in which it is entered into the budget. If a person pays it of his own free will and the controllers have not received a corresponding order or receipt, then this will be the 5th stage. In the opposite situation - 4th line.

State duty

As for the state duty, the order of payment in the payment order is almost always “5”. The fact is that it is impossible to receive any government service without first confirming that the fee has already been paid to the budget on an initiative basis.

Also see “Payment order for payment of state duty to the arbitration court: sample”.

Dividends

If we are talking about the distribution of profits between business owners, then for dividends the order of payment in the payment order is set to the latest - fifth. From the state's point of view, they do not have priority over any other payments.

Also see “Dividend Payment Period”.

Types of write-off queues

The Civil Code of the Russian Federation, Article 855, establishes the following sequence of execution by financial and credit organizations of payments on the accounts of legal entities and individual entrepreneurs:

1. In calendar order,

i.e., as documents are accepted if there are sufficient funds in the account to make payments.

2. If funds are insufficient, the procedure established by law is used,

namely:

· 1st stage

involves the payment of enforcement documents on claims for compensation for harm to life and health, and for the collection of alimony;

· 2nd stage

— writs of execution for the payment of severance pay, wages and royalties;

· 3rd stage

– funds are written off according to documents for the payment of wages to employees, demands for payment of taxes and fees presented by tax authorities and state extra-budgetary funds are fulfilled;

· 4th stage

– other monetary claims under writs of execution are paid;

· 5th stage

– other requirements.

In 2013, legislators allocated six stages for writing off funds. However, by Law No. 345-FZ of December 2, 2013 in Art. 855 of the Civil Code, amendments were made; according to them, the payment of current tax assessments and insurance premiums was no longer transferred to a separate fourth priority. A new write-off procedure was approved - with the introduction of five stages.

For this reason, in payment orders for payment of tax charges of the current tax period

the organization must indicate the number

5

, i.e. classify them as the fifth priority.

Meanwhile, the payment of debts

the requirements

set by the tax authorities should be classified as the third priority, with the number

3

in the payment slip in column 21.

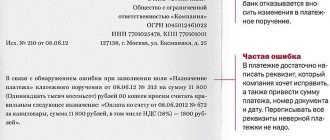

What to do if the order is incorrect

If there are enough amounts in the client’s current account to make all requested and necessary payments, then the queue specified in the order does not play a fundamental role. All payment orders will be executed by the bank in the order they are received. If there is not enough money in the account to fulfill all orders, the bank will write off the amounts in the order established by law (see above).

The bank has no right to refuse to transfer money to a client using a payment document that incorrectly indicates the order of payment.

If this detail is specified incorrectly, there are 2 options for correcting this error:

- Bank employees may ask the client to redo the payment document, since it is the bank that the inspection authorities will make complaints about the order of payments.

- The bank will make an independent decision to make the payment in accordance with the queue determined by law.

In any case, incorrect indication of the details in question in the payment will not affect the receipt of the transferred amounts into the budget.

Read also

02.01.2019

Results

A correctly completed purpose of payment when transferring a non-cash account will allow you to avoid claims from controllers.

The most important thing is to indicate that the amounts transferred are accountable funds. This will provide conclusive evidence that they are not the employee's income. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

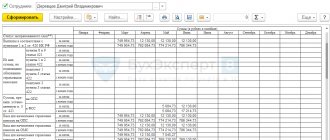

The order of payment in 2021. Table

You can find out what priority of payment to indicate when transferring taxes, contributions and other payments in 2021 from the table.

| What to write in field 21 of the payment slip “Payment order” | What transactions are money written off for? |

| 1 | — payments under writs of execution, which provide for compensation for harm caused to life and health, payment of claims for alimony. |

| 2 | — payments under executive documents, which provide for payment of severance pay and wages, payment of remuneration to authors of intellectual activity. |

| 3 | - current salaries of employees, write-off of debts for taxes and fees on behalf of the tax office, and payment of insurance premiums on behalf of fund control services. |

| 4 | — payments under writs of execution for other monetary claims. |

| 5 | — all other payments are in calendar order. |

If the company itself pays taxes and insurance premiums, the fifth line must be written on the payment slip (letter of the Ministry of Finance of Russia dated January 20, 2014 No. 02-03-11/1603). If you write, for example, the third line by mistake, the bank will not let the payment through. This queue is intended for writing off money for collection.

Payment order with decryption of fields

What order of payment should I put in a payment order?

The order of debiting money from a current account if it is insufficient is established by Article 855 of the Civil Code of the Russian Federation. There are five queues in total:

first of all

– payments under executive documents that provide for compensation for harm caused to life and health. As well as payment of claims for alimony;

second stage

– Payments under executive documents, which provide for payment of severance pay and wages to former or current employees, as well as payment of remuneration to authors of intellectual activity;

third stage

– current salary of employees. Write-off of debts for taxes and fees on behalf of the tax inspectorate. Write-off of debt for payment of insurance premiums on behalf of the control services of state extra-budgetary funds;

fourth stage

– payments under writs of execution for other monetary claims;

fifth stage

– all other payments are in calendar order

But if there is enough money in the account to make all the requested payments, the bank will write off the funds in calendar order.

What order of payment should I write on the payment slip for the transfer of taxes and contributions?

To list taxes and mandatory insurance contributions (fines and penalties for these payments), you need to enter the value 3 or 5 in field 21. These values indicate the order in which the bank will make payments if there is not enough money in the company account.

Value 3 is indicated in payment documents issued by tax authorities or fund employees during forced debt collection. Indicate the value 5 in payment slips when voluntarily transferring current payments.

That is, the bank will fulfill the company’s orders for the transfer of current tax payments later than the requirements of the regulatory agencies for the repayment of arrears (clause 2 of Article 855 of the Civil Code of the Republic of the Republic of Russia, letter of the Ministry of Finance of Russia dated January 20, 2014 No. 02-03-11/1603).

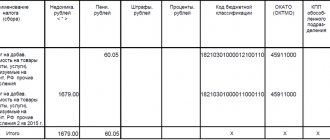

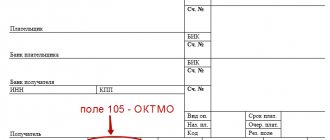

Where in the payment documents is the order of payment indicated?

The transfer of funds is regulated by the Central Bank Regulation “On the Rules for the Transfer of Funds” dated June 19, 2012 No. 383-P, according to which the order of payment in all types of transfer orders is entered in a separate column of the payment document, which has a detail number 21 with the name “Outline. payment."

Filling out details No. 21 (payment order) is provided for in the following payment documents:

· payment order;

· collection order;

· payment request;

· payment order.

In these documents, a single-digit number from the range from 1 to 5 is written in the details field, corresponding to the write-off queue established by paragraph 2 of Article 855 of the Civil Code of the Russian Federation. Responsibility for correctly indicating the order of payment lies with the payer. The credit institution has the right to return a document in which the payment queue is incorrectly indicated or is not entered at all.

Legal entities, as well as individuals registered as individual entrepreneurs, must always fill in field 21 in payment documents submitted to the bank, regardless of the cash balance in the current account. Leaving the “Payment order” field empty is allowed only in orders from the Central Bank and credit institutions to transfer funds to required reserves, as well as to return them.

In the daily activities of an organization, the number of different payments can be quite large, so the most important of them from the point of view of the law should be carried out before others. Mandatory payments are the most significant. Namely, payment of taxes and contributions to extra-budgetary funds. Therefore, in field 21 of the order to transfer money, a special detail is provided - the order of payment. Let's figure out how to set the order of payment in a payment order in 2021 and why this indicator is needed in general.

Where in the payment order should I write the order of payment?

In the payment order, field 21 is provided for the order of payment (Appendix 1 to Bank of Russia Regulations dated June 19, 2012 No. 383-P). It is there that they fill out the queue and put the corresponding number from 1 to 5 (Article 855 of the Civil Code of the Russian Federation). The value indicates in what order the bank will write off money from the current account if there is not enough money for all payments. For example, when transferring personal income tax, the tax agent puts it in the fifth line. (see sample). If there are enough funds, the details in field 21 will not affect anything. The servicing bank will make payments in the manner stated by the company. Below in the table you can see what order of payment to write in the payment order 2021.