The law requires that the management of companies and institutions (including individual entrepreneurs) ensure records of documentation containing records of the personal employment of citizens - namely work books and reserve forms. To do this, it is necessary to fill out the receipt and expenditure book for accounting of work book forms (WPK) for the sake of proper registration of all data on the expenditure/receipt of the above documents.

Sometimes the administration does not pay attention to the careful management of PRC or even turns a blind eye to the absence of this book at all. But such an attitude can lead to very unfavorable consequences for the company’s management, not only as a result of an inspection by government inspectors, but also in the event of a lawsuit filed by an employee.

If the company does not have this journal or an audit reveals facts of its incorrect maintenance, then the management of the organization is responsible, and the organization as a legal entity must pay a fine in the amount of 30,000 to 50,000 rubles, and the responsible employee - from 500 to 5,000 rubles.

Why keep records of work books?

According to Art. 65 of the Labor Code of the Russian Federation, among the documents provided by the employee to the employer for concluding an employment contract, there must be a work book.

For a number of reasons, an employee may not have a work book, and therefore the employer must act in accordance with labor legislation:

| Reason for lack of work record | Employer's actions |

| An employee enters into an employment contract for the first time | The employer issues a work book |

The work book is lost:

| At the request of the employee (indicating the reason for the absence of a work book), the employer is obliged to issue a new work book. |

Important! The employer is obliged to issue a work book for each employee who has worked for him for more than 5 days.

Some information about the finished book

In addition to standard books, you can buy a ready-made, laced, numbered and sealed book.

It meets all established requirements. It includes regulatory documents on the preparation of certain forms, examples of drawing up reports, applications and acts.

When purchasing such a book, the responsible person only needs to enter the seal number in a special field and start filling out the book.

This option is convenient and helps save time. This is a guarantee that the book will have its original composition until it is completed.

How can you keep track of work record forms?

According to clause 42 of the Rules for maintaining and storing work books, producing work book forms and providing employers with them, the work book forms and inserts in it are stored in the organization as strict reporting documents , as a result of which the work book form and the insert in it are accepted for accounting as a form strict reporting.

After the work book is issued to the employee, the employee’s debt to the employer, equal to the cost of the work book form, is taken into account.

The letter of the Ministry of Finance of the Russian Federation dated May 19, 2017 No. 03-03-06/1/30818 contains information provided by the Department of Tax and Customs Policy, which states that:

- operations involving the issuance by the employer of work books or inserts in them to employees , including the cost of their acquisition, are operations for the sale of goods and, accordingly, are subject to taxation with value added tax;

- the fee charged to the employee for the provision of work books or inserts in them is subject to corporate income tax in the generally established manner.

How corrections are made to a book

Sometimes it becomes necessary to make corrections. Their order does not differ from that used for documents in accounting.

- First you need to make a note “Record No. is considered invalid.” It cancels the incorrect entry. Such wording should be entered either immediately after the entry with an error, or after all entries, on a blank line.

- Next, make the correct entry. We do this on the next line.

- Immediately after the entry that contains the correct information, we indicate who made the changes: signature, full name, position, date.

What documents are used to record work records?

In accordance with clause 40 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers (approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225) in order to record work books, work book forms and inserts in it, Employers are required to maintain:

- receipt and expenditure book for accounting of work book forms and inserts in it;

- a book of accounting for the movement of work books and inserts in them.

The forms of these books are approved by the Ministry of Labor and Social Protection of the Russian Federation.

Who is responsible?

The person responsible for timely entering information into the journal and submitting reports on the movement of documents is determined by the head of the organization. Most often, this work is carried out by the organization's accountant.

It is not forbidden to oblige a representative of the personnel department or another employee of the institution/company, whose professional duties do not interfere with the timely completion of the book and control over access to it by third parties, to perform such activities.

When appointing someone responsible for the accounting book, this employee must familiarize himself with a written statement of the assigned obligations, and then leave a signature in the document indicating that he has read the job description.

Requirements for maintaining a receipt and expenditure book for recording work book forms and inserts in it

The rules for maintaining and storing work books, producing work book forms and providing them to employers (clause 41) regulate the procedure for maintaining documentation:

| Book title | Features of management |

| Receipt and expense book for accounting of work book forms and inserts in it | The book is maintained by the organization's accounting department. Information is entered on all operations related to the receipt and use of work book forms and the insert in it, indicating the series and number of each form. The book must be numbered, laced, certified by the signature of the head of the organization, and also sealed with a wax seal or sealed. |

The form of the receipt and expenditure book for recording work book forms and the insert in it was approved by Resolution of the Ministry of Labor of the Russian Federation of October 10, 2003 No. 69 “On approval of the Instructions for filling out work books.”

Maintaining the receipt and expenditure book for accounting for work book forms is carried out in the accounting department of the organization. The accountant appointed responsible for maintaining the document enters information as forms are received from the supplier and as the forms are used. When performing any transactions (income or expense), you must indicate the serial number of the work book form and the insert in it, as well as their cost.

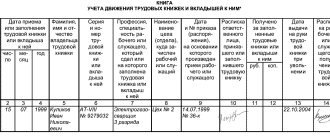

When filling out this form, you must enter the following information:

| Column no. | Intelligence |

| 1 | Record serial number |

| 2, 3, 4 | Date (day, month year) in the format HH.MM.YYYY |

| 5 | From whom the forms were received or to whom they were given |

| 6 | The basis (name of the document, number and date) on the basis of which the receipt or transfer of work book forms and inserts was made. |

| 7 | Number of received work books indicating the series and number |

| 8 | Number of inserts received in the work book indicating the series and number |

| 9 | Cost of received forms |

| 10 | Number of work books issued indicating the series and number |

| 11 | Number of issued work book inserts indicating the series and number |

| 12 | Cost of issued forms |

The form of the receipt and expenditure book for accounting of work book forms and the insert in it can be.

Sample of filling out the receipt and expenditure book for accounting of work book forms:

When maintaining a cash register book, the employee responsible for filling it out must provide reports both on the availability of work book forms and inserts, and on the number of issued (written off) forms.

This report is compiled once a month.

Requirements

The cover of the receipt and expenditure book is made of cardboard or other dense material.

Before you start filling out, the receipt and expense book must be:

- numbered;

- stitched;

- sealed;

- certified.

Numbers are placed on each page of the book. The first page is numbered “1”, then - in order. After completing one book, a new one is started, where it is recommended to start numbering again.

The firmware for the labor income and expense book is performed as follows:

- use an awl or hole punch to make two or three holes vertically on the binding side (you should leave no more than three centimeters between the holes);

- a nylon thread or tape is pulled through the holes two or three times (you can use regular thread in several folds or office twine);

- The ends of the stitching, about 7 cm long, are placed on the last page of the book and tied in a knot.

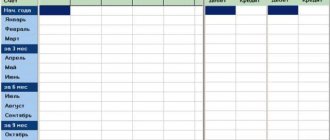

Accounting entries for work records

Work books are accepted as a strict reporting form:

| Debit | Credit | Explanation |

| 006 | Work books are accepted as strict reporting forms | |

| 91 | 60 | The cost of work books is accepted as expenses |

| 19 | 60 | VAT reflected |

| 006 | Writing off work books issued to newly hired employees | |

| 73 | 91 | Reimbursement of the cost of the work book by employees upon dismissal and receipt of the work book in their hands |

| 91 | 68 | VAT accrual on the cost of issued work record forms |

| 50 | 73 | The debt for the issued work record forms has been repaid |

Work books are accepted as assets:

| Debit | Credit | Explanation |

| 10(41) | 60 | Work books are accepted as inventories |

| 19 | 60 | VAT reflected |

| 006 | Work books are accepted as strict reporting forms | |

| 91(90) | 10(41) | The cost of issued work books is accepted as expenses |

| 91(90) | 68 | VAT accrual on the cost of issued work record forms |

| 006 | Writing off work books issued to newly hired employees | |

| 73 | 91(90) | Reimbursement of the cost of work books issued to employees upon dismissal is included in income |

| 50 | 73 | The debt for the issued work record forms has been repaid |

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

| Appendix No. 2 to Resolution of the Ministry of Labor of Russia dated 10.10.2003 No. 69 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Responsibility for violations in the accounting of work books

Responsibility for violations in the accounting of work books refers to a violation of the labor legislation of the Russian Federation, for which sanctions are imposed (Article 5.27 of the Code of Administrative Offenses of the Russian Federation, Article 15.11 of the Code of Administrative Offenses of the Russian Federation):

| Person who has violated the law | Amount of administrative fine (RUB) |

| The offense was detected for the first time | |

| Executive | 1 000 – 5 000 |

| Official (accounting violation) | 5 000 – 10 000 |

| Individual entrepreneur | 1 000 – 5 000 |

| Entity | 30 000 – 50 000 |

| The offense was detected again | |

| Executive | 10,000 – 20,000 or disqualification for 1-3 years |

| Official (accounting violation) | 10,000 – 20,000 or disqualification for 1-2 years |

| Individual entrepreneur | 10 000 – 20 000 |

| Entity | 50 000 – 70 000 |

In case of theft, destruction, damage or concealment of official documents, committed out of mercenary or other personal interest, Art. 325 of the Criminal Code of the Russian Federation, where the following sanctions may be applied:

- a fine in the amount of up to 200,000 rubles or in the amount of wages or other income of the convicted person for a period of up to six months;

- compulsory work for up to 360 hours;

- correctional labor for up to one year;

- arrest for up to three months.

Misconduct and responsibility

The absence in the organization of the Register of documents allowing to determine the work experience of citizens, places of work and duration of activity gives the regulatory authority the right to impose a punitive administrative penalty in the form of a fine:

- from 500 to 5 thousand rubles (for officials);

- 30–50 thousand rubles (for an organization).

Filling out the Accounting Book is carried out only by an authorized person. If a violation of this rule is detected, a fine is imposed: from 3–5 thousand rubles (for citizens), from 10–20 thousand rubles (for officials).

Questions and answers

Question No. 1. What to do if a personnel service employee spoils the work book form?

In this case, it is necessary to dispose of the damaged form, for which you will have to act in accordance with the algorithm:

- draw up an act on the disposal of the work book form, where you need to paste the cut-out part of the form, where the series and number are indicated;

- enter information into the income and expense book of work record books, where in a blank line indicate the following information: “The entry under No. ... is considered invalid” and create a new entry containing reliable information, indicating the position, full name, signature of the person responsible for making the entry, mark date of entry.

Question No. 2. What to do if the employee responsible for maintaining the receipt and expenditure book for accounting for work book forms and the insert in it made a mistake when entering information?

In this case, it is necessary to enter reliable information into the receipt and expenditure book, for which you will have to act in accordance with the algorithm:

- in a blank line directly below the entry or in the next free line, enter information in the income and expense book for accounting for work records, where you indicate the following information: “The entry under No. ... is considered invalid”;

- create a new record containing reliable information;

- indicate the position, full name, signature of the person responsible for making the entry, and note the date the entry was made.

Sealing

The “Rules...” stipulate that the receipt and expense book must be sealed with a wax seal or seal.

To affix sealing wax seals, the company must have special materials. This is a special seal, usually brass, sealing wax itself and equipment for melting it.

In addition, there are other negative aspects: the print comes out quite thick, creating inconvenience when filling out the pages; it may simply crumble over time.

The easiest way is to use a film device for sealing magazines that complies with GOST 31282-2004. A special film with indicator protection and a unique number is inserted into such a device. If the customer wishes, you can add information about the organization to the number.

The indicator protection is triggered when an attempt is made to peel off the applied seal. It is impossible to restore it. This could be a special pattern that remains on the paper, or the inscription “opened.”

In this way, the requirement established by the “Rules...” to protect the book from unauthorized opening is implemented.

Strips of paper cannot be used as a seal for this type of documentation, as is customary for ordinary magazines. This method does not provide a level of protection specified by law, which the inspection authorities will definitely pay attention to.

Certification signature

On the last page of the book, next to the seal, the following is indicated:

- number of pages in the firmware (it coincides with the last page number);

- position, full name and signature of the manager (this documentation is certified only by the first head of the organization);

- date of certification;

- seal number;

- a stamp is placed.

The seal must be placed so that the imprint covers the signature, the ends of the stitching thread (tape) and the seal.

Related documents

- Calculation note upon termination (termination) of an employment contract with an employee (dismissal). Form N T-61

- Certificate of acceptance of completed work (Unified form N KS-2)

- Act on suspension of construction (Unified form N KS-17)

- Act on dismantling temporary (non-title) structures (Unified Form N KS-9)

- Journal of work performed (Unified form N KS-6a)

- Certificate of cost of work performed and expenses (Unified Form N KS-3)

- Act on the return of inventory items deposited (Unified Form N MX-3)

- Act on a random check of the presence of inventory items in storage areas (Unified Form N MX-14)

- Act on the control check of products, goods and materials exported from storage places (Unified Form N MX-13)

- Act on acceptance and transfer of inventory items for storage (Unified Form N MX-1)

- Record sheet for inventory balances in storage areas (Unified Form N MX-19)

- Journal of receipt of fruits and vegetables at storage sites (Unified form N MX-7)

- Journal of receipt of products, inventory items at storage locations (Unified Form N MX-5)

- Journal of consumption of fruits and vegetables in storage areas (Unified form N MX-8)

- Logbook for recording the consumption of products, inventory items in storage areas (Unified Form N MX-6)

- Journal of accounting of inventory items deposited (Unified Form N MX-2)

- Card for recording vegetables and potatoes in piles (trenches, vegetable storages) (Unified form N MX-16)

- Report on the movement of inventory items in storage areas (Unified Form N MX-20)

- Report on the movement of inventory items in storage areas (Unified form N MX-20a)

- Inventory list of securities and forms of strict reporting documents (Unified Form N INV-16)

What else can you take as an example of a journal of strict reporting forms?

Any organization or individual entrepreneur can develop its own journal of strict reporting forms, adhering to the requirements that this document contains all the required details. Due to the fact that this register accumulates and systematizes information about the primary cash register, the book of accounting of strict reporting forms can be classified as registers that comply with the requirements of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The mandatory details of such registers are listed in clause 4 of Art. 10 of Law No. 402-FZ. Among them:

- name of the register and enterprise;

- start and end dates of register maintenance;

- units of measurement and size of accounting objects;

- chronological record of grouped accounting objects;

- Full name and position of the persons filling out the register, with signatures.

Read about the requirements for filling out the primary document in the material “Primary document: requirements for the form and the consequences of violating it .

Results

The book intended for accounting for BSO is maintained by government agencies on a specially established form (form 0504045). Other legal entities and individual entrepreneurs have the right to use this form or create their own, subject to compliance with the mandatory requirements for the details of such a document.

The employee who makes entries in the BSO accounting book is appointed by order of the manager and is the financially responsible person.

Entries in the book are kept in chronological order. Attached to it are the BSO counterfoils and their damaged/unused forms. The general rules for drawing up a BSO accounting book are similar to the rules for drawing up a cash book. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Office work at the enterprise

Office work is a specific branch of activity that involves organizing work with documents located in an organization or enterprise. Office work is characterized by work related to organizing work and documenting the activities of the enterprise. The head of the enterprise is responsible for working with documents.

All documents of any organization are divided into two categories:

- incoming documents that come from other enterprises;

- outgoing documents sent to other organizations.

Record keeping is an important link in the work of every institution. If documents are properly organized, it will be easier to keep track of them. It also facilitates the process of searching for documents that are located at the enterprise, determining their type and where they were compiled.

One of the most important management functions is document control. The purpose of this function is to obtain information that is necessary to assess the activities of the enterprise, its branches or specific employees.

Receipt and expense book form