When conducting business, entrepreneurs have to make payments to clients - that is, accept money for goods sold, services provided or work performed. As a general rule, cash register equipment should be used when making payments, but in some cases it is allowed not to be used. When services are provided, a document is issued that is equivalent to a cash receipt - a strict reporting form (receipt for payment for services). Not only receipts, but also many other documents are drawn up on strict reporting forms: travel passes, tickets, subscriptions, tourist vouchers, etc.

What is a strict reporting form

A strict reporting form , or BSO for short, is a document proving the transfer of funds from the consumer to the service provider. It is possible to use such a form only when providing various types of services to the population, i.e. BSO cannot be used between organizations, and in relation to the sale of goods, the use of BSO is also prohibited.

It is worth noting that strict reporting forms can be either in a strictly established form (receipt 0504510 refers to them), or in the form of templates developed individually (they must be registered in the company’s accounting policies).

At printing houses, strict reporting forms are issued in series, which contain a certain number of copies arranged in a strictly established chronological order (in the same order, the forms must subsequently be registered in a special enterprise accounting journal).

When is an account absolutely necessary?

The legislation specifies the moments when issuing an invoice is mandatory support for a transaction:

- if the text of the agreement did not specify the amount to be paid (for example, for communication services, etc.);

- for transactions involving the payment of VAT;

- if the selling organization is exempt from VAT;

- a selling company located on OSNO sells goods on its own behalf or provides services under agent agreements;

- if the customer made an advance payment to the seller company or transferred an advance payment for a product or service.

So, an invoice for payment is not a mandatory document , just like an accountable document. It cannot in any way influence the movement of financial funds, it can be suspended or not paid at any time - such phenomena occur quite often and do not have any legal consequences. However, this document is equally important for the parties to the transaction, as it allows them to enter into a kind of preliminary agreement on the transfer of funds.

Procedure for using the receipt

When implementing any service, filling out the receipt form 0504510 is the final step. Initially, an organization or individual entrepreneur provides a service to the consumer, after which the client or customer transfers money to an employee authorized to act on behalf of the company (usually either the direct executor of the order, or an accountant or cashier). Then the data on the funds received, along with other mandatory information, is entered into the receipt.

Next, information about the receipt is entered into the payment document register, indicating the form number, the person who paid for the service, and the amount of the paid amount.

It should be noted that the preparation of the receipt should be treated very carefully, errors must be avoided when filling it out, and it is imperative to clearly, in chronological order, enter data on all issued receipts into the journal of document forms.

Otherwise, in the event of a sudden tax audit, failure to comply with these rules may lead to serious penalties from supervisory authorities.

For a product or for a service?

An invoice may be issued as an arrangement to pay for a product or service provided, or for a type of work performed. The difference lies in the “Purpose of payment” column that the invoice contains.

To pay for goods, this column must contain a list of all types of goods sold, as well as the units in which they are measured (pieces, liters, kilograms, meters, rubles, etc.). It is necessary to indicate the quantity of goods and the amount for them (separately without VAT, if any, and the full amount).

When paying, you must indicate the type of service or work performed. Don't forget to mark the required quantity, as well as the amount with and without VAT.

REFERENCE! If the entrepreneur does not want, he may not fully decipher all types of supplies, indicating only the number of the contract under which the transaction is carried out. However, this information must still be reflected in detail in the delivery note or in the estimate. Therefore, it is in the interests of the entrepreneur to indicate in the invoice a complete list of paid goods or services.

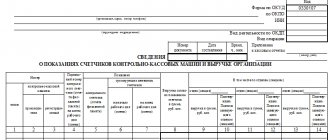

Rules for registering a journal for recording strict reporting forms

The journal, as well as the receipts themselves, must be kept in a strictly defined order. But first, it should be noted that it can be created within the enterprise according to an individual sample (in this case, its template must be approved in the accounting policy of the organization), or it can be purchased at a specialized store of forms.

The sheets of the journal must be numbered, laced and signed by the chief accountant of the company, as well as its director. It is not necessary to certify the journal with a seal, since starting from 2021, the use of seals and stamps in the activities of organizations does not apply to the requirements of the law. Receipts must be entered in it in strictly chronological order, without omissions or blots.

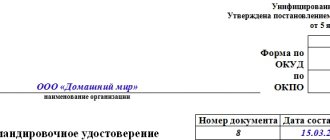

Account elements

There is no specific form for drawing up an invoice, but there are mandatory components that must be contained in it.

- Requisites individual entrepreneur or LLC (both seller and buyer):

- name of the enterprise;

- legal form of organization;

- legal address of registration;

- Checkpoint (for legal entities only).

- Information about the bank servicing the transaction:

- name of the banking institution;

- his BIC;

- numbers of current and correspondent accounts.

- Payment codes:

- OKPO;

- OKONH.

- Account number and date of its registration (this information is for internal use of the company; numbering is continuous, starting from the beginning every year).

- VAT (or lack thereof). If VAT is present, its amount is indicated.

- Last name, initials, personal signature of the compiler.

FOR YOUR INFORMATION! According to the latest legal requirements, printing on the invoice is not required.

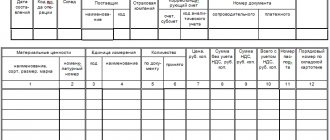

Rules for filling out a receipt

Receipt form 0504510 belongs to the category of unified and mandatory for use. As mentioned above, it is an analogue of a cash receipt, so it must contain the following information:

- name of the organization or information about the entrepreneur,

- actual and legal addresses of the company,

- date of issue,

- information about the consumer (including data from an identity document),

- the exact amount reflecting the cost of the service.

If any errors were made when entering information, there is no need to try to correct them, since crossing out, blurring, etc. adjustments in strict reporting forms are absolutely unacceptable. In such cases, the document is considered irreparably damaged; it should be crossed out and deposited in the same manner as for correctly executed forms. At the same time, information about it is also entered into the journal of payment documents with a note that the form was damaged.

How to receive funds

Reception is accompanied by compliance with the following procedure:

The cashier accepts cash one by one, carefully counting each bill- money is recalculated so that the depositor can see all the manipulations

- The PKO is signed only if the amount specified in the order corresponds to the funds actually received

Acceptance of finance from third-party organizations or from one’s own employees is carried out by order.

The procedure is carried out according to predetermined regulations. You can learn more about the procedure by studying legislative acts and regulatory documents.

If, after recalculation, a shortage of deposited funds is discovered, the cashier offers to deposit the missing portion to the depositor. If an excess is detected, the cashier returns the excess portion. If the depositor refuses to compensate for the shortfall, the procedure is cancelled.

How to create a PKO in 1C, watch the video:

Rules for issuing and storing receipts

You can fill out the document either in handwritten or printed form, but regardless of which method is chosen, the form must contain “live” signatures of both the recipient and the service provider.

The receipt is always issued in two copies :

- one of which, after entering data about it in the payment document register, is stored for three years in the archives of the enterprise (in case of a tax audit),

- the second is transferred to the consumer of the service who has paid its cost.

After the storage period for strict reporting forms for a certain period of time has expired, it is necessary to draw up an act of writing off documents in free form.

Prepayment invoice: sample and its required attributes

The structure and content of the document do not have strict legislative regulation. Business entities have the right to independently develop templates; they can be filled out manually or using automated means. The completeness of the information reflected in the invoice depends on the presence in it of the following elements:

- information about the organization that generated and issued the invoice, indicating its name and TIN codes with checkpoint;

- supplier's bank details;

- date and document number assigned during registration;

- listing of product items and types of services provided that are the subject of the contract;

- the number of goods to be paid, their units of measurement and the total cost;

- the amount for which the prepayment invoice is issued (a sample can be downloaded below);

- signatures of management and the person holding the position of chief accountant;

- seal.

The total amounts are given in the form in numbers and words. It is recommended to place a block with details at the top of the template. The central part of the sheet is allocated for the table insert. The columns of the table indicate information about the product or service that must be supplied or provided under the terms of the agreement.

The invoice amount can be determined in two ways:

- in the amount of the prepayment specified in the contract;

- in full.

If the amount to be transferred in advance is indicated, then the phrase “partial payment” must be present in the column for the name of the product or service. If the invoice contains the entire cost under the contract, then it is necessary to include in the document wording with a specific share of the funds that must be paid now.

If there is such a condition in the contract, you can make a reference to the clause of the agreement in the invoice form so that the buyer knows what part of the total amount he needs to transfer in advance.

Invoice for advance payment under the contract: sample with additional elements

Additional attributes can clarify delivery conditions, limit the time frame for shipment of goods or pickup, and focus on fixing the price for a certain period of time. You can include in a separate paragraph or in the form of a footnote the possibility of returning goods or money in certain situations.

An invoice for prepayment under a contract may contain individual elements from the contract documentation. This form can be used to notify the recipient of valuables that the person to whom the authority to accept goods will be delegated must have a power of attorney.

Who has the right to issue

In accordance with laws 54-FZ and 290-FZ, until July 1, 2019, receipts for payment for services may be issued by:

- Legal entities and individual entrepreneurs who perform work and provide services.

- Payers of the patent tax system.

- Legal entities and individual entrepreneurs who, due to the nature of their activities and location, cannot issue checks, as well as those located in remote areas.

- Payers of the single tax on imputed income when providing services listed in the Tax Code of the Russian Federation, namely:

- household;

- veterinary;

- car service and car wash;

- parking;

- transportation of people and goods;

- retail trade without sales floors or in stores with an area of up to 150 sq. m.;

- catering without halls or in premises up to 150 sq. m.;

- outdoor advertising;

- hotel rooms up to 500 sq. m.;

- rental of places for trade and catering.

As a rule, receipts are issued by small organizations that provide field services or cannot afford the purchase of a cash register, its registration, training an employee to use it and the monthly maintenance fee.

It is, of course, more convenient to punch out checks than to fill out forms manually and ensure the accounting and storage mentioned above, not to mention the transparency of receipts and activities, which is why the widespread use of online cash registers will be introduced starting next year.