When a taxpayer receives a “Request for the submission of documents (information)” from the Federal Tax Service, he must send a response within the prescribed period. However, there may be situations when there are no documents or they cannot be prepared on time - for example, they are lost or are in the archive. Report this to the tax office within 1 day

from the moment the request is received.

Sending a notification does not guarantee

, which will give you more time to prepare.

From the moment the tax authority receives your notification, within 2 days

it must send a new request with a refusal or with a decision to extend the deadline.

When tax authorities request documents

Tax inspectorates have the right to request documents from organizations and individual entrepreneurs as part of ongoing audit activities. Namely, this is a request for documents within the framework of:

- desk audit;

- on-site audit.

In addition, tax authorities may not conduct an audit of a person, but have the right to request information from him in connection with another audit (Article 93.1 of the Tax Code of the Russian Federation).

Responsibility in case of failure to provide

If the stated requirements of a government body are ignored, the responsibility lies with:

- Individual entrepreneur;

- Head of the organization;

- Officials;

- Individual.

Notification to the tax office that the requested documents are not available.

Photo glavbukh.ru Refusal to provide documentation is regulated by the legislation of the tax system.

What are the consequences of being late: fines

Failure to fulfill or untimely fulfillment of the Federal Tax Service's requirement to submit documents is a violation of the legislation of the Russian Federation (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation). Tax and administrative liability has been established for this:

| Tax liability | Administrative responsibility |

| The fine under Article 126 of the Tax Code of the Russian Federation is 200 rubles. for each unsubmitted (lately submitted) document. If within 12 months there has already been a fact of prosecution for a similar offense, then the amount of the fine will double and amount to 400 rubles. (200 rubles × 2) for each unsubmitted (lately submitted) document (Article 114 of the Tax Code of the Russian Federation). | For failure to comply (untimely fulfillment) of the requirement to submit documents at the request of the tax inspectorate, the court may impose administrative liability on officials of the organization (for example, its head) in the form of a fine in the amount of 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation). |

Deadline for responding to the request of the Federal Tax Service

Typically, the Federal Tax Service's requirement specifies a period within which documents or a written explanation must be submitted, or both.

If the request from the tax office was received electronically, you need to send a receipt to the Federal Tax Service. To do this, the organization has six working days in accordance with clause 5.1 of Article 23 of the Tax Code of the Russian Federation.

A direct response to the tax office’s request must be prepared and sent within five working days. The deadline is established by paragraph 3 of Article 88 of the Tax Code of the Russian Federation.

Most often, the deadline for responding to the request of the Federal Tax Service is fixed, and it is indicated in the request itself.

If you do not have time or cannot fulfill the requirement

If an organization or individual entrepreneur understands that it will not be possible to submit documents to the Federal Tax Service within the deadline (10 days), then a special notice must be submitted to the tax office to extend the deadline for submitting them.

At the same time, we will immediately say that there is no exhaustive list of reasons for the inability to submit documents. Therefore, please cite any circumstances that prevent the company from submitting documents on time. For example, vacation or sick leave for the chief accountant. You can also indicate the following as a reason for renewal:

- requesting a very large amount of information (it is impossible to quickly make all copies);

- the need for additional time to deliver documents from a branch of the organization;

- business trip of the general director.

Notification of the impossibility of submitting documents on time must be submitted to the Federal Tax Service within the day following the day of receipt of the request for their submission. Only in this case will they be able to satisfy him. If you are late, then most likely your request for an extension will not be considered.

Please keep in mind that the notification must indicate the exact date by which the taxpayer will deliver the documents to the Federal Tax Service.

Accountant in self-isolation, impossible to respond to request

When a delay in providing documents or information is needed, in order to avoid fines and problems, you need to send notifications to the Federal Tax Service about the impossibility of timely submission of documents. After all, refusal to submit documents threatens tax liability under Article 126 of the Tax Code of the Russian Federation.

The Federal Tax Service may extend the period for submitting documents or explanations at the request of the taxpayer. There must be reasons for this. In the usual case, such reasons are: illness of the person responsible, a large volume of documents required, etc.

Under quarantine conditions, an accountant can refer to non-working days introduced by Presidential Decree No. 206 dated March 25, 2020 and Moscow Mayor Decree No. 34-UM dated March 29, 2020.

New notification form from 2019

From June 9, 2021, a new form of notification about the impossibility of submitting documents (information) in electronic form within the established time frame, as well as the format for its submission, is in effect (Federal Tax Service order No. ММВ-7-2/204 dated April 24, 2019).

The main difference from the previous form is that the notification has 3 parts, which indicate documents and information that:

Will be presented later:

In principle, it is impossible to imagine (lost/handed over to auditors/law enforcement officers):

We have previously submitted (indicate which tax authority and with what documents):

Is it necessary to use this particular form? We believe so. However, some lawyers note that tax authorities must consider the notification on its merits, even if it is issued in any form. The fact is that the use of an unapproved form cannot be considered a tax offense. An exception would be a situation where the company sent an electronic notification in such a format that it is impossible to read. Then the tax authorities will not even be able to familiarize themselves with it.

You can download the official tax notification form from our website for free using the direct link here.

We note that the complete update of the notification form is associated, in particular, with the changes made to paragraph 5 of Art. 93 of the Tax Code of the Russian Federation, which limit the repeated request by tax authorities of documents.

You can view and download for free a completed example of a notice of failure to submit documents to the tax office on time using the direct link here.

General information on requesting documents

Those who, due to their occupation or life situation, have encountered a requirement from a government agency understand how voluminous a package of documents they can sometimes request.

The legislation establishes three options for serving a claim on a taxpayer:

- In person or to a trusted person against signature;

- Sending registered mail;

- Using the taxpayer's personal account.

How to respond to a request for tax documents? Answer in video:

Delivery deadlines:

- When sent by registered mail, the person is deemed to have been notified on the sixth day after dispatch.

- When sending a request through an individual account, the citizen must submit a receipt of acceptance of the request. The day of delivery of the document is considered the day of payment of the receipt.

When can a declaration not be stamped? See the link.

It is worth understanding that failure to submit documents requested by a government agency threatens the taxpayer with penalties. The only exception is in the case of unlawful actions of a state inspector.

What documents may be requested?

The state authority has the right to request:

- Information about the activities of the taxpayer;

- Information about the activities of the taxpayer's counterparty;

- Information about the controlled transaction;

- Updated declaration.

In essence, the category of documentation is determined by the body itself during inspection.

Document requirements from the tax office. Photo sbis.usoft.ru

In addition, the request must meet the basic requirements:

- The taxpayer should be able to easily identify the information;

- The information requested must be relevant to the audit being carried out.

Will the request be granted?

Based on the notification of the impossibility of submitting documents on time, the head of the Federal Tax Service (his deputy) has the right to:

- or extend the deadline for submitting documents;

- or refuse to extend the deadline.

The form of the decision of the tax inspectorate based on the results of consideration of the notification was approved by order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/628 (Appendix No. 19). Such a decision must be made within 2 working days from the date of receipt of the notification in question (paragraph 3, paragraph 3, article 93, paragraph 6, article 6.1 of the Tax Code of the Russian Federation):

the actual in the notification itself . This will give you a better chance of getting it.

ADVIСE

It is better to justify why you are asking for such a period of deferment (for example, 20 days). For example: count how many copies of documents you can make in 1 day. Divide the total volume of documents by this number and get the time frame within which you can comply with the Federal Tax Service’s requirement. If you are talking, for example, about an accountant’s vacation or sick leave, then attach supporting documents to the notification (an order for vacation or sick leave).

Also, in our opinion, it makes sense to submit at least part of the documents to the Federal Tax Service, and ask for a deferment for the rest. This way, the tax inspectorate will understand that the payer wants to fulfill the requirement, but simply cannot meet the deadline.

Tax documents must be stored, as a rule, for 4 years (subclause 8, clause 1, article 23 of the Tax Code of the Russian Federation). If this period has expired, please report it.

Read also

10.07.2019

In what form are documents submitted?

The organization must submit documents that the inspection has the right to require during a desk audit (clause 2 of Article 93 of the Tax Code of the Russian Federation):

- on paper (for example, in the form of copies);

- in electronic format.

Standard form

In order for the interaction to be most competently organized, Federal Tax Service Order No. ММВ-7-234 dated January 25, 2021 was issued for this case.

It has a special application in the form of a notification, that is, a letter. Only in this form will the Federal Tax Service pay any attention to the message.

The likelihood of a request made in a letter being granted will depend on the reason for the delay in providing the documents, as well as the reason why they are being delayed.

It is interesting that the same form is used if it is impossible to provide the requested documents in principle, in their absence.

Application for transfer of inspection

Considering that there are certain difficulties in conducting inspections, the applicant requests assistance in rescheduling them.

Ref. No.______

"___"_______________G.

To the Head of the Ministry of Internal Affairs of the Department of Internal Affairs of the city ______________

I hereby present to you for approval the schedule of inspections of the Ministry of Education “__________” on compliance with consumer rights by business entities in the city of ________ in the year _________. At the same time, we express our gratitude for the assistance of the Public Control Ministry in carrying out work to conduct inspections of compliance with consumer rights and their protection. Thus, in __________, together with employees of the __________ Department of Internal Affairs, two inspections were carried out at facilities that had previously prevented inspections. During the inspection, gross violations of consumer rights were identified and reports were drawn up, copies of which are attached. Also, an agreement was reached with the employees of __________ Rovd on providing assistance in the future, in the event of opposition to the legal activities of the MOU from entrepreneurs. We also inform you that plans (schedules) for conducting inspections in the MOU “___” are drawn up separately for each month, broken down by ten days. Considering that there are certain difficulties in carrying out inspections, we ask for assistance in conducting them in the third ten days of February in the territory of the __________ district of the city __________.

Chairman of the MOU “___” ____________________

What should be in the letter

A letter to extend the deadline for providing documents is drawn up in the same way as any business correspondence. It must contain the details of the organization whose employees compose it. To do this, it is better to print on the company’s letterhead. If there is none, then at the very top of the page you must indicate the basic data: name, TIN, checkpoint.

It is also a mandatory requirement to indicate the full name of the Federal Tax Service, position, surname and initials of the employee of this institution to whom the letter is addressed.

In the provided sample document, these two points are in the upper right corner. First - to whom the message is intended, then - from whom. Indicating the details.

Please note that there is no need to indicate the full name of the head of the organization at the very beginning. To register a letter, the date and city are also placed in the header.

Body of the letter

In order to express the contents of the message as accurately and concisely as possible, it is necessary to indicate in the main text after the header:

- Requirements and his data, which came from the tax office. They include: its number, date of preparation and receipt. If necessary, you need to briefly retell the topic. For example: “In relation to the supplier.”

- Within what time period must documents be submitted to a specific division of the Federal Tax Service?

- A valid reason why the data cannot be provided within the specified time frame. For example, the sheer volume of documentation. Sometimes all the requested papers can amount to thousands of sheets, and the company has only a few accountants on staff, or the chief accountant has gone on sick leave (with sick leave provided). In short, the reason must be compelling and clearly stated. Only in this case does the chance of satisfying the request increase.

- Link to paragraph 5 of Article 93.1 of the Tax Code of the Russian Federation. It talks about the possibility in principle of such a postponement due to extraordinary reasons.

- Request for a deferment for an indefinite period of time. The shorter this period (subject to a good reason), the more favorably the tax authorities will react to the message.

- When all requested documents have been provided.

The letter ends with the signatures of the head of the organization and the chief accountant. Through this document you can show your readiness for constructive cooperation with the Federal Tax Service.

In order to increase the likelihood of a favorable attitude towards the request on the part of the Federal Tax Service, it is recommended to provide those documents that are still possible.

Dispatch

Before sending, the letter is recorded in the outgoing correspondence journal. In order for it to reach the addressee accurately, it is advisable to send the paper by letter with a receipt mark or hand it over to a Federal Tax Service employee and receive a receipt stating that the letter was indeed accepted.

Otherwise, if the letter does not reach the addressee, the organization risks finding itself at a severe disadvantage.

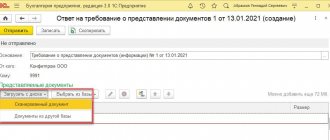

How to submit a form via Extern

To use the response form in Kontur.Externe, you need to go to the page with the request and click on the “Respond to request” button. After this, you need to select “Notify about the inability to provide documents.”

Now you need to fill out the notification form, selecting the reason why it is impossible to submit documents, and fill in the required fields.

When will electronic reporting not be accepted?

Thus, non-receipt/late receipt of receipts and protocols for receiving electronic reports is not so bad. The fact that electronic documents were delayed somewhere on the way to the Federal Tax Service due to a technical failure does not mean that the taxpayer has violated something and is to blame for something. All declarations sent on time will still reach the addressee without any refusal protocols. Naturally, if the taxpayer did not make a mistake himself - he signed the declaration with a valid electronic signature, sent the declaration to “his” tax office, etc. If such violations are discovered, then refusal protocols are possible.

The list of grounds for refusal to accept electronic reporting is given in clause 28 of the Regulations on the acceptance of declarations, approved. by order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n. This list is closed. The grounds for refusal to accept electronic declarations include the following:

- lack of documents proving the identity and powers of the individual submitting the tax return;

- submission of a tax return not in the established format;

- lack of an enhanced qualified electronic signature of the head of the organization;

- discrepancy between the data of the owner of a qualified certificate and the data of the head of the organization specified in the tax return;

- submission of a tax return to a tax authority whose competence does not include the acceptance of this tax return.

Technical errors and failures when sending tax returns are not grounds for refusing to accept them.

Moreover, in accordance with paragraph 4 of Art. 80 of the Tax Code of the Russian Federation, tax authorities are expressly prohibited from refusing to accept a tax return submitted in the prescribed form.

Accordingly, untimely acceptance by tax authorities of a timely sent electronic declaration will not entail any adverse consequences for the payer. The main thing is that the payer has confirmation from the EDF operator that the reports are sent on time.

Compiling a letter to the FSS of Russia

A letter to the insurance fund is drawn up by analogy with the Federal Tax Service and the Pension Fund. The finished document is also signed by the director and chief accountant of the enterprise, and is accompanied by a certificate from a financial institution confirming that there is no movement of money in the account.

The main information of the letter to the FSS will be:

- Indication of the territorial body of the FSS.

- Company name.

- Addresses, basic legal details. faces.

- Indication of the lack of movement of funds in the account and non-accrual of wages to employees.

A sample letter for the FSS is below:

Based on the foregoing, it follows that the letter of absence of activity is intended to inform regulatory authorities about the non-commercial activity of the enterprise during a certain period of time. Such a document is sent for the sole purpose of avoiding unjustified assessment of taxes, contributions, and penalties. There is no legally established form for such a letter, so the company can draw it up at its own discretion, guided by the general rules of office work.

Top

Write your question in the form below

Applications

In order to give specificity to the message, various documents may be attached to it explaining the reasons for the delay. They may be:

- Sick leaves.

- Copies of notifications.

- Extracts from the organization's regulations. For example, if the documents, according to it, are stored in one of the separate divisions of the company.

- Leave orders.

- Extracts from the staffing table, etc.

The attachments, of course, must correspond to those specified in the letter about extending the deadline for providing documentation for tax reasons. This is the only way to correctly prepare this document.

As part of tax control, inspectorates can send various types of demands to taxpayers. We will tell you in what time frame it is necessary to respond to such requirements in our consultation.

Let’s immediately make a reservation that usually there is no dispute about when it is necessary to respond to the tax office’s request (in how many days), because this period is indicated in the tax inspectorate’s request (Federal Tax Service Order No. ММВ-7-2 dated 05/08/2015 / [email protected] ).

What the Federal Tax Service says and what to do

The Federal Tax Service of Russia has previously explained that various errors may occur in connection with the transition to a new tax administration program. In particular, failures and delays in sending payers the resulting receipts for processing the reports they submitted.

In this regard, the Federal Tax Service drew attention to the fact that timely sent electronic reporting is considered submitted even in situations where, due to technical reasons, this reporting was received by the Federal Tax Service with a delay.

The main and sufficient evidence of the timely submission of tax and accounting reports is the date of confirmation of the sending of documents, generated by the electronic document management operator.

Therefore, if tax authorities have any complaints regarding reporting, you must contact the technical support of your EDF operator and request confirmation of the date of submission of the declaration.

There is no need to re-submit reports for which the tax authorities have not provided the resulting receipts. These are technical errors and taxpayers do not bear any responsibility for these errors.

According to the Federal Tax Service, the relevant clarifications have already been communicated to the territorial tax authorities. We have no reason not to trust the Federal Tax Service, so tax officials will neither fine nor seize bank accounts for late receipt of declarations due to failures.

Standard form

In order for the interaction to be most competently organized, Federal Tax Service Order No. ММВ-7-234 dated January 25, 2021 was issued for this case.

It has a special application in the form of a notification, that is, a letter. Only in this form will the Federal Tax Service pay any attention to the message.

The likelihood of a request made in a letter being granted will depend on the reason for the delay in providing the documents, as well as the reason why they are being delayed.

It is interesting that the same form is used if it is impossible to provide the requested documents in principle, in their absence.

Penalties

Penalties for each failure to provide an extract are imposed in the amount of 200 rubles. Refusal to submit a declaration of income by a legal entity is subject to a fine of 100 thousand rubles.

If an individual entrepreneur or legal entity refuses to provide information about a third-party taxpayer, or provides false information, a sanction in the amount of 10 thousand rubles is imposed on the legal entity, and 1000 rubles on the individual.

What will happen to vacation in 2021? More details here.

If the government agency was provided with incorrect information or it was submitted after the established deadline, a penalty of 5,000 rubles is applied. In case of a repeated incident within a calendar year, 20,000 rubles.

When there will be no fine

- In the event that the requested documents were not related to the ongoing inspection.

- If the requested documents were provided earlier.

- Tax legislation establishes that a government entity may require statements related to accounting or established by tax legislation. Penalties cannot be imposed for the demands of others.

- If providing information is not possible due to physical absence. In other words, if the required information is simply not available.

What documents may the tax office require? Watch the video:

Answer

According to existing laws, the Federal Tax Service inspector to whom the letter is addressed is obliged to respond to it within two working days. If no response is received (but there is evidence of receipt), then this is a reason for a claim on the part of the sender.

In general, time is a fundamentally important point when conducting tax audits. All documents must be provided within five days.

But it is worth considering that the answer will not necessarily satisfy the sender. The Federal Tax Service has the right to refuse a deferment, so there is a possibility that you will have to meet the originally stipulated deadlines.

Typical mistakes when filling out

Notification of the absence of indicators at the request of Rosstat authorities should be short and concise. Therefore, most mistakes come down to the fact that the letter writers indicate unnecessary information: for example, what data the company can provide and what it cannot, why the company does not have some information, etc.

If the notification does not contain individual statistical codes, the verification process for this organization will increase, since the service will need to collect all documentation for a specific person.