Who should lead KUDiR

All taxpayers must maintain KUDiR using the simplified tax system.

It does not matter which object of taxation they chose - “Income” or “Income minus expenses”. The book is needed to take into account business operations, determine financial results and calculate the amount of tax payable. Businessmen record their income and expenses within the business in it. You also need to conduct KUDiR in order to monitor compliance with restrictions on the use of the simplified tax system. The amount of income for the year should not exceed 150 million rubles.

The document is maintained in a standard form developed by the Ministry of Finance (Order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n).

VAT and special regimes

As is known, when applying special tax regimes, in particular the simplified tax system, the taxpayer is exempt from the obligation to pay VAT. However, in practice, any business entity using the special regime under consideration may have a situation where, based on the results of completed transactions, payment of VAT is required, regardless of the status of the payer. Such situations include:

- purchase of goods outside the Russian Federation and their subsequent import;

- acting as a tax agent;

- reflection of the VAT amount in issued invoices.

General rules for maintaining and filling out KUDiR

A new book is started for each tax period, that is, every year. It can be issued in paper or electronic form. The filling order depends on this.

On paper you need:

- fill out the title page;

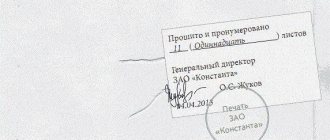

- sew and number the pages, indicate the total number of pages at the end;

- certify the KUDiR with the signature of the individual entrepreneur or the head of the organization;

- put a stamp, if used.

If you make corrections to the paper version, prepare explanations for them, date the corrections and confirm it with the signature of your manager.

After the end of the tax period, when maintaining a book in electronic form, you need to:

- print KUDiR;

- sew and number all pages, indicate the total quantity on the last sheet;

- certify the book with the signature of the management;

- put a stamp on the printed book, if available.

It is convenient to maintain an electronic book in special accounting services, for example, in Kontur.Accounting, which checks the document for compliance with the rules of tax legislation.

All entries are entered into the book on the basis of primary documents and strictly in chronological order. The book is formed even if there were no transactions in the period - then it is filled with zero indicators.

You do not need to submit the book to the Federal Tax Service, but if tax inspectors request it, you will have to provide it. According to the rules, it must be stored for four years, and taking into account the right to carry forward losses for 10 years, it is recommended to store KUDiR for 11 years.

How to apply for KUDiR

Every year begins with the registration of a new KUDiR. Entries in the book can be made manually or filled out on a computer and printed at the end of each quarter. At the end of the year, the book must be bound and numbered, the number of pages must be indicated on the last sheet, signed and sealed if available. There is no need to certify the book with the tax office. Keep the completed book for 4 years and provide it to the tax authorities upon receipt of a request.

Instructions: how to fill out the KUDiR section by section

Photo instructions: how to stitch KUDIR

Submit reports in three clicks

Elba will help you work without an accountant. She will generate reports, calculate taxes and prepare KUDiR.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Composition of KUDiR on the simplified tax system “Income” in 2021

In general, KUDiR includes a title page and five sections. But for the simplified tax system of 6%, you don’t need to take into account expenses, so you don’t need to fill out all sections of the book.

On the simplified tax system of 6%, taxpayers fill out sections I - income only, IV and V.

Section I “Income and Expenses”

This section chronologically lists all transactions that were made in each quarter. Enter into the table:

- primary data - date and number;

- contents of the transaction: for example, “Advance from Alfa LLC” according to contract. No. 123 dated March 29, 2020";

- the amount of the business transaction: if income is received, enter the amount in column 4; expenses in column 5 for the simplified tax system of 6% do not need to be taken into account.

The list of income that is important for calculating tax is given in Art. 346.15 Tax Code of the Russian Federation. Other income does not need to be taken into account.

Important! Remember that the cash method is used. Therefore, if you have shipped the goods, but have not yet received payment for it, this is not reflected in the amount of income. Enter all income into KUDiR only when you receive it at the cash desk or in your bank account.

There is no need to take into account expenses, but there are exceptions:

- expenses for preventing reductions, compensated from the budget;

- expenses to support medium and small businesses, financed by subsidies.

They are reflected in column 5 of section I.

I. Income and expenses

| Registration | ||||

| N p/p | date and number of the primary document | Contents of operation | income taken into account when calculating the tax base | expenses taken into account when calculating the tax base |

| 1. | 03/15/2020 Transfer and Acceptance Certificate No. 5 | Receipt of goods from Maruska LLC under contract No. 55/2 dated 03/04/2020 | 350 000 | |

| Total for the quarter | ||||

Section IV “Expenses that reduce the amount of single tax”

In this section, taxpayers using the simplified tax system of 6% reflect the amount of insurance premiums paid for individual entrepreneurs and employees, paid sick leave, and contributions for voluntary health insurance. This includes all amounts that reduce the tax base.

Reducing income through contributions is the legal right of the taxpayer. Individual entrepreneurs without employees can deduct the entire amount of insurance premiums from the tax base and not pay tax at all. And individual entrepreneurs with employees and organizations reduce the tax by a maximum of 50%.

Rules for reflecting income and expenses in KUDiR under the simplified tax system

In KUDiR you need to record only those incomes and expenses that are taken into account when calculating the simplified tax system. Moreover, expenses need to be included in the book only if you are using the simplified tax system “Income minus expenses.” And on the simplified tax system “Income” it is enough to reflect in the book the income and insurance premiums paid for individual entrepreneurs and employees.

You need to take into account income from the sale of goods, work or services, as well as some non-operating income. Make an appointment with KUDiR on the day you receive payment from the client. In a special article you will find details about accounting for income in the simplified tax system.

Expenses are more difficult. Firstly, only expenses from Section 346.16 of the Tax Code can be taken into account. Secondly, this must be done on the last date:

- date of full payment to the counterparty;

- date of receipt of paid goods, works or services from the counterparty;

- the date of transfer of the goods to the final buyer (if you are buying the goods for subsequent resale).

A separate article describes the nuances of accounting for expenses in the simplified tax system.

Each entry in KUDiR is confirmed by primary documents. These can be payment orders, strict reporting forms, sales or cash receipts, acts, invoices and others.

Book of accounting of income and expenses for the simplified tax system

News KUDiR in Elbe

With Elba, keeping a book of income and expenses will not be difficult! We will automatically fill in the required fields and help you save the KUDiR in Word or PDF format!

What will happen if you don’t conduct KUDiR

The tax office can at any time request a KUDiR, which will have to be provided within 10 days. The document must be printed, bound, numbered and certified with signatures and seals (if any). If the book is not presented upon request, a fine of 200 rubles will be charged. Additionally, administrative punishment may be applied in the form of a fine from 300 to 500 rubles.

If during the inspection violations are discovered that are associated with an understatement of the tax amount, the businessman faces a fine of 10,000 rubles to 20% of the paid tax, but not less than 40,000 rubles.

Tax registers when applying the simplified tax system

The use of the simplified tax system frees the taxpayer not only from the obligation to pay VAT, but also from the preparation of documents related to this tax. At the same time, there are exceptions to this rule.

Thus, when an obligation to pay VAT arises, the need to submit a declaration for the specified tax automatically arises. And, for example, when carrying out transport and forwarding activities, the taxpayer has the obligation to draw up invoices and, accordingly, their accounting journals (clause 3.1 of article 169, clause 5.2 of article 174 of the Tax Code of the Russian Federation).

But this obligation does not mean that simplifiers must do everything that VAT payers do, namely, compile other tax registers, including a purchase book.

In addition, in 2014, the Ministry of Finance of the Russian Federation, in letter No. 03-07-14/48815, indicated that for persons engaged in intermediary activities in the interests of the principal, there is also no obligation to compile a purchase book and a sales book.

KUDiR and simplified tax system online

From July 1, 2021, the Federal Tax Service plans to introduce a new regime for individual entrepreneurs using the simplified tax system “Income” - simplified tax system online. Dmitry Satin, deputy head of the Federal Tax Service, spoke about this on the air of the “Taxes” program. Information about this is also posted on the official website of the Federal Tax Service.

Now all simplified entrepreneurs must keep a book and submit a tax return every year. This still requires time investment, hiring a specialist or knowledge in the field of accounting. If an individual entrepreneur switches to the simplified tax system online, then the Federal Tax Service will calculate taxes for him. This is possible thanks to the emergence of online cash registers, from which the tax office automatically receives information about business income and expenses. There is no need to conduct KUDiR in this mode.

The only problem is that you will not be able to manage tax calculations and there is a possibility that you will constantly have to dispute the amounts and prove your position. And if an individual entrepreneur is far from accounting, then it is almost impossible to understand that taxes were calculated in error. It’s good that the transition to the simplified tax system online is voluntary. You can decide what is more important: saving time on reporting or saving money on taxes.

To switch to the regime without declarations and KUDiR, it is enough to submit an application in the taxpayer’s personal account on the Federal Tax Service website. You will receive notifications about accrued tax amounts through the service.

Don’t want to fill out the KUDiR yourself? Connect to the Kontur.Accounting service. You just need to enter data on income and expenses, and the service will automatically create KUDiR and tax returns. In Kontur.Accounting it is convenient to keep records, pay salaries and submit reports. All new users receive 14 days of service as a gift.

Enter the site

RSS Print

Category : Accounting Replies : 455

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. ...Next. → Last (46) »

| olgaps |

| Help me please. My beloved husband opened a retail outlet for spare parts and registered an individual entrepreneur, entrusting me with keeping records. The taxation system is income tax. Now it’s a question of filling out the goods accounting book. I read the instructions, entered the entire receipt of goods, quantity, supplier prices, I understand how to fill out the payment for the goods. BUT I DON’T FIGURE OUT how to enter the sold goods. In retail trade, there is no shipment using invoices; sales are made using cash receipts. Is it really necessary to enter each receipt number and the product sold on it (we have an assortment of 5,000 items) and is it necessary to conduct a quarterly inventory? Does anyone have experience checking this miracle book of IMNS? |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Alesenka [email protected] Belarus Wrote 669 messages Write a private message Reputation: | #2[264720] January 27, 2011, 16:32 |

Notification is being sent...

| olgaps [email hidden] Minsk Wrote 2 messages Write a private message Reputation: | #3[264752] January 27, 2011, 16:56 |

Notification is being sent...

| Lyubov Mikhailovna [email protected] Belarus, Minsk Wrote 1160 messages Write a private message Reputation: | #4[264964] January 27, 2011, 10:37 pm |

Notification is being sent...

Enjoy every little thing and don't be nervous about every bastard.| Lyubov Mikhailovna [email protected] Belarus, Minsk Wrote 1160 messages Write a private message Reputation: | #5[265188] January 28, 2011, 13:26 |

Notification is being sent...

Enjoy every little thing and don't be nervous about every bastard.| Re-singing [email hidden] Belarus, Minsk Wrote 2675 messages Write a private message Reputation: 388 | #6[265208] January 28, 2011, 13:42 |

Notification is being sent...

Have you tried throwing a mosquito?| Lyubov Mikhailovna [email protected] Belarus, Minsk Wrote 1160 messages Write a private message Reputation: | #7[265219] January 28, 2011, 13:50 |

Notification is being sent...

Enjoy every little thing and don't be nervous about every bastard.| Wiktoria-2010 [email hidden] Belarus Wrote 5 messages Write a private message Reputation: | #8[265237] January 28, 2011, 2:05 pm |

Notification is being sent...

| Lyubov Mikhailovna [email protected] Belarus, Minsk Wrote 1160 messages Write a private message Reputation: | #9[265259] January 28, 2011, 2:14 pm |

Notification is being sent...

Enjoy every little thing and don't be nervous about every bastard.| Lyubov Mikhailovna [email protected] Belarus, Minsk Wrote 1160 messages Write a private message Reputation: | #10[265594] January 28, 2011, 21:07 |

Notification is being sent...

Enjoy every little thing and don't be nervous about every bastard.« First ← Prev. ...Next. → Last (46) »

In order to reply to this topic, you must log in or register.