Accounting for transactions with securities is necessary both in organizations that issue them and in enterprises that acquire shares as equity participation. In the article we will look at typical entries in securities accounting account 58 (purchase, sale, revaluation, loan) using examples.

What are securities?

Securities are documents confirming special property rights. Let's look at their types:

- Shares that give the right to receive part of the JSC's profits in the form of dividends.

- Bonds pay their face value as well as interest.

- A share gives the right to part of the company's property.

- A promissory note implies confirmation that one participant in the relationship must pay money to the other participant within a given period.

- Based on the check with the specified amount, the banking institution pays the funds to the other participant.

Typically, commercial firms purchase stocks and bonds.

How does a lender account for transactions under a securities lending agreement when taxing profits?

Features of securities valuation

Accounting for securities involves valuation. It can be carried out in various directions:

- Nominal cost. This is the price that is indicated on the paper itself. Considered a conditional value. That is, it does not reflect the actual cost of the paper.

- Market price. It is formed based on the values of supply and demand. The greater the demand, the higher the price. This type of cost gives an idea of the actual cost of the paper for a certain period.

- Book value. Represents the cost on the basis of which securities are recorded on the balance sheet.

- Accounting value. This is the value that is recorded in the accounting accounts.

- Liquidation value. It represents the cost of the liquidated joint-stock company, accrued per share.

If there is a difference between the nominal and market valuation, appropriate entries are made.

How to maintain tax accounting for securities denominated in foreign currency ?

Types of bonds in circulation and by form of income

In circulation there are state (federal, regional, municipal) securities and corporate ones - issued by legal entities. The date of transaction with bonds for their acquisition or disposal is the day of transfer of ownership.

According to the categories of income generation, there is a division into 2 types of securities - coupon and zero-coupon. Depending on the type of security, forms of income are established: (click to expand)

- In the form of interest with a specified payment period for coupon bonds. Payment control is carried out using cut-off coupons.

- In the form of a discount - the difference between the face value and the purchase price.

Securities, the market value of which is not determined, must reach the par value of the book value by maturity. The difference is taken into account evenly as part of other income or expenses throughout the entire period of use.

Accounting rules for bills of exchange

Bills of exchange are recorded in account 58, subaccount 2. They belong to debt securities. The debit direction displays the arrival and multiplication of the number of bills, and the credit direction shows the disposal. Let's look at the entries used to keep records:

- DT58.2 KT62. Receiving paper.

- DT91.2 KT58.2. Write-off of paper costs.

- DT58.2. KT51. The company bought the bills from another party.

- DT58.2 KT62. The paper is sent for payment to another person.

- DT91.2 KT58.2. Write-off of the book value of the paper.

If bills of exchange are sold, this transaction is recorded in account 91. However, account 91 is relevant only if the sale of securities is not considered the basic activity of the company. If this is a basic activity, account 90 will be required. To record transactions involving securities, account 58 is used.

Question: What differences between accounting and tax accounting may arise if in accounting the value of retiring securities that are not traded on the organized securities market (OSM) is determined by the average initial cost, and for profit tax purposes - by the FIFO method? How are these differences reflected in accounting in accordance with the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n? View answer

Results

Accounting for securities in accounting is carried out differently for the seller and the buyer; a set of nuances is taken into account: the purpose and type of the security, the purpose of its purchase, etc.

To reliably reflect securities in reporting, it is necessary to adhere to the principle of priority of the economic content of business transactions over their form.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Bond Accounting Rules

Accounting rules are approved in “Accounting for expenses on loans”. The debt to the bond owner is indicated as a loan obligation. For correspondence, accounts 66 and 67 are used. Which account should be used? This is determined by the type of debt on the bonds: short-term or long-term. For short-term debts, account 66 is used, and for long-term debts, account 67. Consider the types of accounting entries:

- DT76 KT51. Buying bonds.

- DT91.2 KT58.2. Debt identified.

- DT91 KT58.2. Amortization.

- DT58.2 KT91. Write-off of the difference between the initial and nominal valuation of securities.

- DT51 KT62. Receiving payments on papers.

If the funds paid are greater than the nominal value of the security, the amount of the difference is included in the structure of other income.

Central Bank classification

Securities

are a legally approved form of document confirming the rights of the owner and the obligations of the entity that issued the securities.

In the Civil Code, the concept of “security” includes:

- Bill of exchange;

- Promotion;

- Bond;

- Check;

- Mortgage;

- Investment share;

- Bill of lading;

- Other securities that are recognized as such at the legislative level.

Professional accounting services require knowledge of transactions that are correct when reflecting specific transactions on securities, and nuances in the form of purposes of acquisition, assignment, settlements in cash or otherwise, accrual of income, etc. The postings involve accounts 91, 58, 51, 76 by debit and credit.

Share Accounting Rules

To account for shares, accounts 58.1, 81 and 76 are needed. Accounting must solve the main task - control over the movement of shares of the company itself, as well as acquired shares. Postings are used to reflect the purchase, disposal, and sale of securities. Shares are the primary property of an enterprise that is included in the authorized capital. For this reason, the account 80 often appears in postings.

Let's look at the accounting entries used to account for shares:

- DT58.1 KT76. Purchase of shares.

- DT76 KT91. Calculation of interest on securities.

- DT91 KT58. Write-off of the value of securities disposed of due to sale.

- DT59 KT91. Write-off of the reserve formed due to depreciation.

- DT58 KT60. Accounting for the acceptance of securities on the balance sheet.

If a company has purchased shares, it must send a corresponding notification to the tax office. Also, the fact of purchase is recorded in the documentation. The purchase of shares must be reflected in the quarterly report. However, an accountant may also record relevant information in documents at the time of purchase. For example, this could be the preparation of sales and purchase agreements.

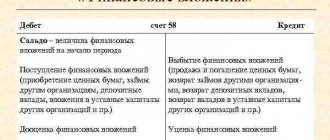

Accounting for financial investments

To account for the presence and movement of investments of organizations in government securities, shares, bonds, in the authorized capital of other organizations, as well as loans provided to other organizations, use account 58 “Financial investments”. The account is active, balance.

The debit of account 58 reflects the financial investments made by the organization in correspondence: D-t 58 K-t 51, 52, 91, 90.

For the loan, accounts 58 reflect the repayment (redemption) and sale of securities in correspondence: D-t 91 K-t 58, as well as the repayment of loans in correspondence: D-t 51, 52 K-t 58.

To account for the costs of acquiring financial investments, use either a separate subaccount to account 58 “Financial investments”, or a subaccount to account 76 “Settlements with various debtors and creditors” - 76/8 “Settlements for the acquisition of securities”, with the subsequent capitalization of financial investments directly to account 58 (subject to transfer of ownership of securities).

— When prepaying expenses for the acquisition of securities, the following entries are made in accounting:

- Dt 76, subaccount 8 “Calculations for the acquisition of securities” Kt 51 - for the amount of the transferred advance;

- Dt 58 Kt 76, subaccount 8 “Settlements for the acquisition of securities” - securities are capitalized.

— When receiving securities under a simple partnership agreement: D-t 58 K-t 80.

— When securities are received free of charge, an entry is made at their market value: D-t 58 K-t 98/2.

The exchange rate difference from the additional valuation of securities due to changes in the exchange rate is reflected in the form: D-t 58 K-t 91.

The following subaccounts can be opened for account 58:

58/1 “Units and shares”; 58/2 “Debt securities”; 58/3 “Loans provided”; 58/4 “Deposits under a simple partnership agreement.”

Analytical accounting of financial investments is carried out by type of investment (shares, shares, bonds) and the objects in which these investments are made (organizations that sell securities, organizations that borrow).

When using the journal order form of accounting, entries on the credit of account 58 are made in journal order No. 8. Debit entries are reflected in journal orders No. 2, 2/1, 8 in correspondence: D-t 58 K-t 51, 52, 76.

All securities held at the enterprise must be registered in the securities book. The book must be numbered, laced, sealed and signed by the manager and chief accountant.

Example of bond accounting

The company bought bonds of a banking institution in the amount of 1,500 rubles. The par value of the securities was 1,000 rubles. In this case, an expense occurs in the form of payment to the issuer. The maximum maturity period is 2 years. The owner of the bonds receives an income of 40% per annum every 6 months. In this case, the following transactions are performed:

- DT76 KT51. The cost of bonds in the amount of 1,500 rubles was transferred to the issuer.

- DT58.1 KT76. Fixation of the book value of securities in the amount of 1,500 rubles.

- DT76 KT91. Accrual of dividends in the amount of 300 rubles.

- DT51 KT76. Transfer of dividends in the amount of 300 rubles.

- DT91 KT58. Fixation of the share of reduction in the value of bonds.

This example lists the minimum number of transactions. However, in practice, as a rule, the number of transactions can reach 20.

IMPORTANT! In accounting, securities are recorded at their book value.

The bond issuer will use these shares:

- DT51 KT67. Issue and sale of securities at par value, if the par value is less than the purchase price.

- DT51 KT67. Issue and sale of securities at purchase price, if the nominal value is greater than the purchase price.

- DT51 KT98. The positive difference between the purchase price and the nominal value is taken into account. It is recognized as income in subsequent periods.

- DT97 KT67. A negative difference has been created.

- DT26 KT67. Interest accrued.

The write-off of differences between the nominal and purchase prices is recorded using these entries: DT98 KT91 and DT91 KT97.

Impairment testing

At least once a year (as of December 31 of the current year) in accounting, check for impairment of securities (i.e., current liquidity - saleability) if there are signs of a decrease in their price. Such signs, in particular, include:

- the issuer is declared bankrupt or shows signs of bankruptcy;

- execution of a significant number of transactions in the securities market with similar securities at a price significantly lower than their book value;

- absence or significant reduction in income payments on securities (for example, dividends, interest, coupons, etc.) with a high probability of their further reduction.

To conduct the audit, determine the estimated value of a particular security and compare it with the book value of the security. Select (develop) the methodology by which the settlement price is determined yourself and establish it in the organization’s accounting policy (clause 7 of PBU 1/2008). For example, for this you can involve an independent appraiser or (for shares) use the method of the issuer's net asset value per share (per share of a certain type).

Such a test may reveal a sustained significant decline in the value of a security characterized by:

- at the reporting date and at the previous reporting date, the estimated value of the security is significantly lower than the accounting value;

- during the reporting year, the estimated value of the security changed significantly only downward;

- at the reporting date there is no indication that the estimated value of the security will increase in the future.

This procedure is established by paragraphs 37–38 of PBU 19/02.

For information on how to test for impairment of other financial investments, see Signs of impairment by type of financial investment (shares, shares in the authorized capital, loans issued).

Errors that often occur when accounting for securities

Errors in accounting can be significant or insignificant. The former can influence the decisions of managers and raise questions among regulatory authorities. Therefore, the occurrence of major errors is unacceptable. Let's look at common accounting errors that are significant:

- Entering incorrect entries. For example, this could be the use of incorrect accounts or incorrect transaction amounts.

- Incorrect accounting of the buyer's bill. The security must be recorded in account 58. However, if the buyer has issued a bill of exchange, it must be recorded in the debit of account 62. If the person has transferred the security to third parties, the security is classified as short-term debt.

- When a company receives a bill of exchange free of charge, it does not notify the tax office about it. This is also a significant mistake, since reports must also be sent to the Federal Tax Service on gratuitous receipts.

- Expenses arising from the sale of securities are recorded as expenses. However, this is incorrect, since sales expenses cannot reduce tax payments.

A significant mistake is also the lack of primary documentation. Postings are always based on documents.

Accounting for investments in the authorized capital of other organizations

Financial investments in the authorized capital (shares) represent the amount of assets invested in the property of another organization to ensure its authorized activities.

You can make a contribution to the authorized capital of a joint-stock company only by purchasing its shares. You can transfer money or transfer property to pay for shares.

Contributions to the authorized capital of joint-stock companies are kept on account 58, subaccount 1 “Shares and Shares”, and are reflected as a debit to account 58/1 in correspondence with cash accounts:

D-t 58/1 K-t 51, 52.

When making a contribution to the authorized capital with property, the transferred objects are valued at the contract value (based on current market prices) and are reflected in the credit of accounts 90 “Sales” and 91 “Other income and expenses” and the debit of the same accounts - at the residual value (for fixed assets and intangible assets) and at actual cost (for goods and finished products).

The difference in debit and credit turnover on accounts 90 and 91 reflects the primary financial result of investments in shares.

If a contribution to the authorized capital of another organization is made with property, then the transferring party will make the following entries:

- D-t 58/1 K-t 90, 91 - the amount of the contribution is reflected in accordance with the constituent agreement;

- D-t 90 K-t 43, 41 - reflects the actual cost of finished products, goods transferred as a contribution to the authorized capital;

- D-t 02 K-t 01 - the amount of accrued depreciation on an object transferred as a contribution to the authorized capital of another organization is written off;

- D-t 91 K-t 01 - the residual value of the transferred fixed asset item is written off;

- D-t 91 K-t 99 (D-t 99 K-t 91) - reflects the financial result from the transfer of property or: D-t 90 K-t 99 (D-t 99 K-t 90).

Shareholders receive dividends on them, i.e. income that is paid from profits by the joint-stock company.

The accrual of dividend amounts is reflected by the entry:

D-t 76 K-t 91, receipt of dividends: D-t 51 K-t 76.

If the organization whose shares (shares) the enterprise has is liquidated, the following entries should be made:

- D-t 91 K-t 58/1 - the book value of the share (share) in the authorized capital of the liquidated organization is written off;

- D-t 01 (10, 41, 51, ...) K-t 91 - property and funds remaining after liquidation were received and distributed in favor of our organization;

- D-t 91 K-t 99 (D-t 99 K-t 91) - reflects the financial result from the write-off of shares in the authorized capital.

Example 1.

JSC Kosmos made a founding contribution to the joint Anglo-Russian venture in the amount of 250,000 rubles.

The entry will be made as follows: D-t 58/1 K-t 51 - 250,000 rubles.

Example 2.

Transferred as a contribution to the authorized capital of another organization:

- fixed assets at an agreed value (based on current market prices) in the amount of RUB 400,000;

- cash - 300,000 rubles.

Based on the results of work for the year, dividends were accrued in the amount of 72,000 rubles.

Reflection of transactions in accounting:

1) for the amount of cash and fixed assets contributed to the contribution to the authorized capital of another organization:

Dt 58/1 Kt 91 - 400,000 rubles, Dt 58/1 Kt 51 - 300,000 rubles;

2) accrual of income:

D-t 76 K-t 91 - 72,000 rub.;

3) receipt of income:

D-t 51 K-t 76 - 72,000 rub.