Under current rules, corrections to tax documents are not permitted. Therefore, it is important to know exactly what information needs to be entered in a particular field. Filing income tax returns and taxes withheld from them affects many citizens, as a result of which interest in correctly filling out tax reporting is usually at a high level. This article will discuss a particular issue that concerns how the taxpayer’s attribute is determined in 3 personal income tax and for which categories of taxpayers this column is required to be filled out.

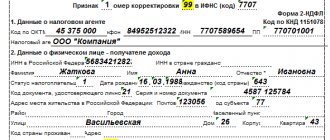

What are the values of the characteristic in the 2-NDFL header?

In 2-NDFL, the sign is indicated in the title of the certificate, which is filled out in accordance with Section II of the Recommendations for filling out the 2-NDFL form, approved by Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11 / [email protected] (hereinafter referred to as the Recommendations).

ATTENTION! Form 2-NDFL has been canceled for reporting for 2021; it will be submitted as part of the calculation of 6-NDFL.

Read more about changes in personal income tax reporting in the analytical Review from ConsultantPlus experts. You can get trial access to the K+ legal system for free.

To fill out a 2-NDFL certificate, in general, two values are used:

- “1” is assigned to a certificate confirming receipt of income;

- “2” is used to provide information about the impossibility of withholding personal income tax.

If the company has been reorganized, the following attribute codes are applied in the 2-NDFL certificate:

- “3” - indicated in the certificate by the legal successor, if he submits a certificate for a reorganized company - is applied by the legal successor submitting a certificate for a reorganized company, in the case where the tax agent paid an individual income from which he could not withhold tax (clause 5 of Article 226 of the Tax Code RF).

Read more about the 2-NDFL certificate in the material: “Why and where do you need a 2-NDFL certificate?”

Taxpayer characteristic codes

As is known, a property tax discount can be accrued not only to individuals who are owners of real estate, but also to individuals related to them by close forms of kinship - husband, wife, children, including those who have not reached the age of majority, and also to parents. In addition, a tax discount is provided even for those property assets that are owned in shared ownership.

In order to notify the tax inspector about to whom the property tax compensation is issued and what relation the individual has to the housing property, there is precisely such a cell as a taxpayer sign. The following codes are usually entered in this column:

- “01” - such figures are indicated if the taxpayer who is reducing his tax base is the owner of a housing property;

- “02” - this code is set in those situations in which a declaration for a property type of deduction is drawn up in the name of the wife or husband of an individual documented as the owner of the property;

- “03” – it often happens that parents, for some reason, decide to register an apartment, house or other property in the name of their son or daughter, who is currently under eighteen years of age. In order to return housing tax in such a situation, in the column that requires entering the taxpayer’s identification, you need to indicate the designation “03”;

- “13” – these numbers are written down if an individual claiming a tax discount for real estate has registered common ownership of the property for it, of which he himself, as well as his daughter/son who have not reached the age of majority, are participants;

- “23” - this combination of numbers should be written in cases where the taxpayer, who has expressed a desire to take advantage of the deduction for a property, has registered it as shared ownership between himself, his wife/husband, as well as their child who has not yet turned eighteen years old.

IMPORTANT! Only one of the above codes must be indicated on declaration sheet D1. If the taxpayer accidentally mixed up the code and then corrected it to the correct one, then the document containing the corrections will not be accepted by the tax inspector.

When to reflect feature 2 in certificate 2-NDFL

The attribute in the 2-NDFL certificate is filled in with the value “2” if the certificate contains information about amounts of income from which tax was not withheld (Section II of the Recommendations).

In the course of activities, situations arise when the personal income tax agent cannot fulfill the duties of withholding and transferring tax to the budget. For example, income is received in the form of material benefits. In such situations, it is necessary to notify the tax service and the taxpayer himself of the impossibility of withholding tax by the end of January of the year following the reporting year (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Attention! For 2021, certificates with any indication must be submitted to the Federal Tax Service no later than 03/01/2021. Let us remind you that previously a certificate with sign 2 had to be submitted by April 1. But starting from 2021, the deadlines for 2-personal income tax have been combined. Read more about the reduction in deadlines here.

The procedure for submitting information is as follows: a report can be submitted on paper only if the number of personnel is 10 people or less. If more than 10 people worked in 2020, the report will only be accepted in electronic form. Submission in paper form is possible in person, through a representative or by mail.

Hint from ConsultantPlus: If in the past year you did not pay an individual income from which personal income tax had to be withheld, then a zero certificate 2-NDFL ... See more details in K+, having received a free trial access to the K+ reference and legal system.

Procedure for filling out 3-NDFL

- in sub. 2.8 Sheet D1 of the 3-NDFL Declaration - the total amount of expenses for new construction or the acquisition of a real estate object (objects), which is accepted for property tax deduction for the reporting tax period based on the Declaration. This amount cannot be greater than the size of the tax base calculated in subparagraph.

The code is line 020.

Important!

If a taxpayer claims deductions for several real estate properties, he fills out Appendix 7 the required number of times.

The code is a two-digit number that indicates who is claiming the deduction. All indicator values are included in a separate Appendix No. 7 to the Order:

As can be seen from the table, codes are classified according to several indicators:

- who applies for the deduction (the owner himself, his spouse, parent);

- does the applicant use the right to transfer the deduction to previous periods, as a pensioner (clause 10 of Art.

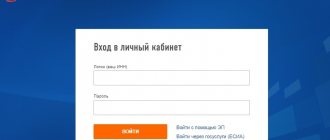

Taxology will tell you about deductions and taxes in simple language. Please write in the search bar the word or designation that you would like to know about and click the “Search” button below.

Responsibility for incorrectly filling out the header.

Responsibility for violating the deadline for submitting a certificate is provided for in Art. 126 of the Tax Code of the Russian Federation.

For more information about liability for failure to submit a certificate, see the material “What is the responsibility for failure to submit 2-NDFL”

To the question of whether it is legal to use this article in relation to incorrectly filling out the title of the certificate, in particular the “attribute” field, official departments do not have an answer.

There is a judicial precedent according to which incorrectly filling out the “attribute” field is not a significant error when submitting information to the tax service (resolution of the Federal Antimonopoly Service of the East Siberian District dated 04/09/2013 in case No. A19-16467/2012).

Tax return

Today, in order for an individual to reduce the size of the tax base or report on financial transactions related to his income, including the payment of taxes on them, there is a special document - a tax return. This document, as a rule, is submitted for verification to the tax service and must be filled out in accordance with the current form 3-NDFL.

A few facts and rules

Before you begin filling out the declaration, we advise you to pay attention to the following several aspects regarding the structure and rules for preparing this document:

- How to fill out. You can enter information into this document either using special software or manually. In the latter case, the individual must use a blue or black pen.

- What pages to design. As you know, the tax return form consists of many pages, but you only need to fill out the first few sheets, which are mandatory, as well as the pages related to the specific type of deduction that the taxpayer is claiming.

- When to submit for verification. Tax inspectors first check the declaration submitted for consideration according to two criteria: first, that the document was submitted no earlier than the end of the tax period in which the right to a tax refund arose, and second, that by this point in time the statute of limitations for accrual has not expired certain type of tax credit.

- How to enter data. All monetary amounts must be indicated accurately, that is, there must be not only that part of the amount that displays rubles, but also the part that records pennies. If there are empty cells in the field reserved for entering certain data, then regardless of whether the taxpayer writes numbers or letters there, he must put dashes in the empty cells.

Please note that the above rules and advice have a direct impact on the duration of the desk audit. If they are taken into account by the taxpayer and implemented in practice, the declaration will be checked within thirty days. Otherwise, the period for reviewing the document may take up to three months.

Where is the taxpayer identification in the declaration?

As noted earlier, a document drawn up according to the 3-NDFL model consists of mandatory pages for completion by all individuals and special sheets relating to the calculation of a specific type of tax discount.

The tax return includes sheet D1, which is intended for the procedure for calculating property-type deductions and requires indicating the taxpayer’s characteristics.

This indicator must be included in the first paragraph of the sheet, devoted to information about the property and expenses incurred by the taxpayer.

In paragraph one there is subparagraph 1.3, next to which the words “taxpayer characteristic” are written and next to it in brackets there is the designation 030. It is here that you need to enter a two-digit code that characterizes the very characteristic of the taxpayer discussed in this article.

Results

The taxpayer attribute field in the 2-NDFL certificate can take the value 1 if the tax was withheld from the employee’s income in full, 2 if the tax could not be withheld. Codes 3 and 4 are used by the legal successor submitting certificates for the reorganized company in similar situations. The deadline for submitting certificates with any indication is set at the same time: 03/01/2021.

Sources:

- Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected]

- tax code

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When it doesn’t make sense to fill out sheet D1

In some situations, even if the taxpayer's identification is entered correctly and the declaration is completed in accordance with all the requirements established by the current tax legislation, the income tax refund will still not be realized. This applies to the following cases:

- Receiving a property deduction. As a rule, a personal income tax refund for the purchase of any type of housing (or land), as well as for expenses associated with the repair work of these objects or their construction, is provided to individuals once.

- Buying a home from relatives. Those individuals who are relatives (namely spouses, parents of the owner of the property, children of the owner, as well as his brothers or sisters) and who carried out a transaction for the purchase and sale of property are not entitled by law to take advantage of an income tax refund. This restriction also applies to individuals connected by business relationships, for example, an employer-subordinate.

- Documents for deduction are not certified. As you know, a tax return is accompanied by a whole package of documentation confirming the accuracy of the information written in it. However, only some of them need to submit originals, and for most documents, copies must be made and submitted. However, if the copy is not certified, the document will not have legal force, so we strongly recommend that you do not forget about this.

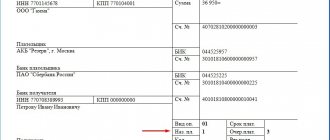

Notification of the transition to the simplified tax system from the beginning of next year

An example of filling out a notification for a company to switch to a simplified system from the beginning of the year

If you are planning to switch to the simplified tax system from the beginning of next year. In the notification you need to pay attention to the following fields:

- Your “Taxpayer Identification” code is “3”

- Indicate the date of transition to the simplified tax system with code “1” and indicate from January 1 of which year you will apply the special regime

- The fields about income for nine months and the residual value of fixed assets must be filled in by both the organization and the individual entrepreneur. Switching to the simplified tax system for an already operating business is the only case when you need to fill out these fields

Instructions for filling out a declaration for personal income tax refund for an apartment

Sheet A is intended to enable an individual to report in writing to the tax authority on his income received from sources located on the territory of the Russian Federation. Therefore, if a taxpayer’s profit is transferred to his bank card from other countries, then he must fill out Sheet B.

Sheet D1 is devoted to calculation data regarding property deductions that are provided in the case of the purchase of real estate, including an apartment. Otherwise, if the taxpayer sold the property, he is required to fill out sheet D2 instead of sheet D1.

We recommend reading: Fee for Entering into an Inheritance

Appendix 2

If you received income that is taxed at different rates, then fill out several sheets of Appendix 2. On one sheet, indicate income that is taxed at the same rate.

If all sources of income payment that are taxed at the same rate do not fit on one page, fill out as many 2 applications as you need. In this case, reflect the final results only on the last page.

On page 010, indicate the digital code of the country from which you received income, according to the all-Russian classifier of countries around the world.

On page 020, indicate the name of the organization that paid the income. When filling out this line, you can use letters of the Latin alphabet.

On page 030, indicate the currency code according to the all-Russian currency classifier.

On page 031, indicate the type of income code. Take the code from Appendix 4 to the Order.

On page 032, indicate the digital unique number of the controlled foreign company that is the source of income payment. Take the number from the notice of a controlled foreign company submitted to the Federal Tax Service. Fill in line 032 only if you are reporting income in the form of the amount of profit of a controlled foreign company.

On page 040, indicate the date of receipt of income. Enter the date in numbers: day, month, year in the format DD.MM.YYYY.

On page 050, indicate the foreign currency exchange rate to the ruble established by the Central Bank on the date of receipt of income, with the exception of income in the form of profit of a controlled foreign company. For income in the form of the amount of profit of a controlled foreign company, on page 050, indicate the average exchange rate of foreign currency to the ruble established by the Central Bank. Determine the average rate for the period for which the foreign company prepares financial statements for the financial year.

If a controlled foreign company determines profit (loss) according to the rules of subclause 2 of clause 1 of Article 309.1 of the Tax Code, on page 050 indicate the average foreign currency exchange rate to the ruble for the calendar year for which the amount of profit (loss) is determined.

On line 060, indicate the amount of income in foreign currency, and on line 070 - the amount of income in terms of rubles.

On page 071, reflect the value of the property (property rights) received during the liquidation of a foreign organization, which is exempt from taxation under paragraph 60 of Article 217 of the Tax Code.

On page 072, reflect the amount of dividends received from a controlled foreign company, which is exempt from taxation under paragraph 66 of Article 217 of the Tax Code.

On page 073, indicate the code for determining the profit (loss) of a controlled foreign company (clause 1.4 of Article 309.1 of the Tax Code).

On page 080, indicate the tax payment date.

On page 090, indicate the foreign currency exchange rate to the ruble established by the Central Bank on the date of payment of the tax.

On page 100, indicate the amount of tax paid in a foreign country in foreign currency. The basis is a document confirming income received and payment of tax outside Russia.

On page 115, indicate the amount of tax accrued on the profits of a controlled foreign company under Russian law.

On page 120, indicate the estimated tax amount calculated in Russia at the appropriate rate.

On page 130, indicate the estimated amount of tax to be offset (reduced) in Russia.

Fill out Appendix 3 of the declaration

Disable

For each type of activity, the specified paragraphs of Appendix 3 are filled out separately. The calculation of the final data is carried out on the last completed page of Appendix 3.

| Lines of application 3 of form 3‑NDFL | Displayed information |

| 010 | Activity code in accordance with Appendix 5 to the filling procedure |

| 020 | Code of the main type of business activity in accordance with the All-Russian Classifier of Types of Economic Activities |

| 030 | The amount of income received for each type of activity |

| 040 | The amount of expenses actually incurred, taken into account as part of the professional tax deduction, for each type of activity |

| 041 | Amount of material costs |

| 042 | Amount of depreciation charges |

| 043 | The amount of expenses for payments and remuneration in favor of individuals |

| 044 | The amount of other expenses directly related to the extraction of income |

| 050 | The total amount of income, which is calculated as the sum of the indicator values of lines 030 for each type of activity |

| 060 | The amount of professional tax deduction, which is calculated as the sum of the values of the line 040 indicator for each type of activity, or in the amount of 20% of the total amount of income received from business activities (line 030 x 0.20), if expenses related to activities as an individual entrepreneur, cannot be documented |

| 070 | Amount of actually paid advance payments (based on payment documents) |

Disable

Adjustment of the tax base. As for lines 090 – 100 of Appendix 3 of Form 3‑NDFL, they must be filled out only by those taxpayers who made independent adjustments to the tax base and the amount of personal income tax based on the results of the expired tax period in accordance with the provisions of clause 6 of Art. 105.3 of the Tax Code of the Russian Federation in the case of using prices of goods (works, services) that do not correspond to market prices in transactions with related parties:

– line 090 indicates the amount of the adjusted tax base, if such an adjustment was made in the reporting tax period;

– line 100 reflects the amount of the adjusted tax if the tax base was adjusted in the reporting tax period.

Professional deductions. Note that Sect. 6 “Calculation of professional deductions” is filled out by individuals - tax residents of the Russian Federation who received income from sources in the Russian Federation or outside the Russian Federation. The total amount of actually incurred and documented expenses for all civil contracts (line 120), as well as for all sources of payment of income received by taxpayers in the form of royalties and remunerations for the creation, performance or other use of works of science and literature is also indicated. and art, rewards to authors of discoveries, inventions, utility models and industrial designs (line 130). The total amount of expenses for royalties, remunerations for the creation, performance or other use of works of science, literature and art, remunerations to authors of discoveries, inventions and industrial designs within the limits of the standard is indicated in line 140. The total is summed up in line 150 by adding the values of the indicators of lines 120 - 140. Previously, these data were presented in sheet “G”.

Disable

All Federal Tax Service forums

- 01 - owner of the object;

- 02 - spouse of the owner of the property;

- 03 - parent of a minor child - owner of the property;

- 13 - a taxpayer claiming, according to the Declaration, a property deduction for expenses associated with the acquisition of an object in the common shared ownership of himself and his minor child (children);

- 23 - a taxpayer claiming, according to the Declaration, a property deduction for expenses associated with the acquisition of an object in the common shared ownership of the spouse and his minor child (children)

- I'm calling the call center. I ask the same question. After waiting (the operator clarified), I receive the answer “unfortunately, we do not provide advice on filling out declarations, please contact the tax office for advice about your place of residence. "

- I'm going to the tax office. I explain the situation. the girl who was consulting somewhere checked everything again (she said “I have now filled out all the necessary conditions (common joint property, etc.)”) and said that everything seemed to be filled out correctly, i.e. in the paragraph “taxpayer identification” there should be “1”, i.e. owner of the object. when asked what I should do with the clarification notice, I received the answer: “it’s not critical, if during the check there are questions, they will call you and clarify what is needed”

Type of ownership of the object

Let's move on to the next paragraph 1.2. (020), which is called “Type of ownership of the object”. Here the situation is a little simpler, since the declaration form itself indicates the decoding of the digital code:

| Code | Type of property | Explanation |

| 1 | Individual | To be completed in the case of sole ownership of a real estate property. Let's say the apartment was received under a purchase and sale agreement, and only one owner is indicated in the documents confirming the right of ownership. |

| 2 | Total share | Placed if the apartment or house has several owners, whose shares are determined. Most often, objects are transferred to shared ownership after privatization. In this case, each owner knows his share in square meters. |

| 3 | General joint | This option is also used when the property has several owners, but the difference with the previous form is that the owners’ shares are not determined. This option occurs mainly when spouses buy an apartment. |

| 4 | Property of a minor child | A citizen under the age of 18 cannot submit a declaration independently and receive a deduction for it. All procedures are carried out for him by his parents or legal guardians. |