The procedure for obtaining the status of an individual entrepreneur involves submitting documents to the Federal Tax Service. After the period of time established by law, it is necessary to obtain individual entrepreneur documents after registration. Legislation does not stand still; legal procedures are simplified every year by regulatory acts. What the registration of an individual entrepreneur looks like in 2021 is the topic of this review.

What are the differences between the constituent documents of individual entrepreneurs and LLCs?

As we have already noted, the concept of constituent documents of a legal entity is enshrined in law. Moreover, the Civil Code of the Russian Federation recognizes only the organization’s charter in this capacity. The establishment agreement has not been a constituent document for several years, although it contains the basic conditions for the interaction of partners in a limited liability company. Another important document for the organization is the agreement with the director. After all, the manager acts on behalf of a legal entity without a power of attorney and represents the company in transactions and legal relations.

An individual entrepreneur does not develop a charter for his business and does not enter into an agreement with the manager. In transactions with partners, he acts on his own behalf, as an individual. What then is meant by the constituent documents of an individual entrepreneur?

In this case, we mean official confirmation of the legal activities of the entrepreneur. That is, the constituent documents of an individual entrepreneur are proof that a person has been registered with the Federal Tax Service, and information about him is included in the state register of businessmen.

But the application for registration of an entrepreneur in form P21001 is not considered to be the constituent documents. This is just background information that is needed at the preparatory stage - before registering a business.

Free consultation on individual entrepreneur registration

Tax office address 46

Tax office No. 46 is located at 125373 Moscow, Pokhodny proezd, building 3, building 2.

You can get to the tax office:

●

Volokolamskaya metro station, then bus 837 or minibus No. 441;

●

metro station "Skhodnenskaya", then minibus No. 368 (if you got off the first car from the center) or buses No. 678, 199 (if you got off the last car from the center);

●

Tushinskaya metro station, then buses No. 2, 266, 88, 177 (you need to get off from the last car from the center).

Where to get confirmation of the legal activities of an individual entrepreneur

Business entities are registered by the Federal Tax Service. The Federal Tax Service makes a decision on the possibility or refusal to register an individual entrepreneur, on the basis of which a special document is issued - a USRIP entry sheet. Until 2021, a certificate of registration of individual entrepreneurs was issued instead, which still has legal force.

Now the entry sheet from the state register is sent to the individual entrepreneur only in electronic form to the email specified in the P21001 form. In principle, to start your activity, you just need to print this document from the letter from the Federal Tax Service. But if you wish, you can also receive a record sheet in paper form. To do this, you need to submit an application to the registration inspectorate, which registered the entrepreneur.

So, the USRIP entry sheet or individual entrepreneur registration certificate is the main document on the basis of which an entrepreneur conducts his business. But in addition, there is also an important list of papers that counterparties and banks request.

ENVR

If you choose the Unified Tax on Imputed Income (UNIT), regardless of the size of your earnings, you will pay the established 15% of imputed income. Having chosen this reporting system, from the general list of documents you need to submit:

- A tax return that must be submitted every quarter before the beginning of the second ten days of the month following the reporting period.

- Taking into account indicators such as the number of employees and the area of the retail space.

List of constituent documents for an existing individual entrepreneur

What constituent documents should an individual entrepreneur have? With the reservations that we have already mentioned, this list can include:

- Identity document of an individual entrepreneur. For Russians this is usually an internal passport, for foreigners - a notarized translation of a foreign document. There is no need to present a power of attorney or an order to manage the activities of an individual entrepreneur, because the entrepreneur acts on his personal behalf as an individual, which is confirmed by his passport.

- Certificate of assignment of TIN. Most individuals receive this document even before registering an individual entrepreneur, but if this is not the case, then the Federal Tax Service will definitely appropriate it. An individual tax number is required to identify a taxpayer, submit reports, enter into agreements, conduct transactions on a bank account, etc.

- USRIP entry sheet or individual entrepreneur registration certificate. The entry sheet is also called an extract from the register, and it contains the most complete information about the legal status of an individual entrepreneur. So, from it you can find out the date and place of registration of the individual entrepreneur, OGRNIP code, and business activity codes according to OKVED.

- Statistics codes. Rosstat assigns unique digital codes to each business entity: OKATO, OKTMO, OKFS, OKOPF. They are indicated when filling out payment documents and reporting, opening a current account, etc.

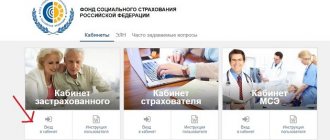

- Notification of registration of an individual entrepreneur as an insurer in the Social Insurance Fund. If an individual entrepreneur plans to hire workers, he must register with the social insurance fund within 30 days after concluding the first employment contract.

How to register through “State Services”: step-by-step instructions

Algori:

- Complete registration. The site operates a multi-stage account system. First, a basic one is created, for this you need to enter your full name and contact information. Then the account status is increased by entering SNILS and passport data. The third level of account, qualified, can be obtained after visiting the State Services office to confirm your identity. To submit documents online, you need a third level.

- Login to your account. Go to the catalog and select “Individual Entrepreneur Registration”.

- Fill out the application, indicate OKVED codes. Upload scans of your passport as a multi-page document in TIFF format. To change the format you will need a converter.

- Sign the application using an electronic signature. Confirm the method of receiving documents online.

You can obtain an electronic digital signature at certification centers that work for AETP accreditation. The signature required to work through State Services costs 1,800 rubles. The time frame for issuing an electronic signature ranges from several hours to 2 days.

In what cases are constituent documents of an individual entrepreneur needed?

An individual entrepreneur must keep the documents listed above for the entire period of business, but the main consumers of this information are not the individual entrepreneur himself, but counterparties and banks. The fact is that, according to current legislation, it is these interested parties who are responsible for checking the status of an entrepreneur.

The obligation to verify the integrity of a transaction partner is established by Resolution of the Plenum of the Supreme Arbitration Court of October 12, 2006 No. 53 and numerous letters from the Federal Tax Service and the Ministry of Finance. If you conclude an agreement with a person who is not listed in the state register of individual entrepreneurs or organizations (even though such status is declared), then the costs of the transaction with him cannot be taken into account when calculating tax.

Moreover, the party to the contract that did not exercise due diligence when choosing a partner may be accused by the Federal Tax Service of participating in an illegal scheme and tax evasion. Therefore, you should not be surprised that in preparation for the transaction, your counterparty will request a Unified State Register of Entrepreneurs and other documents confirming the status of an entrepreneur.

As for banks, they can open current accounts for business payments only to those who are not involved in illegal transactions. The security service of any bank will definitely check the documents of an individual entrepreneur, as well as his business reputation, if it has already been established. In this case, the bank risks its own license, which can be revoked by the Central Bank at any time and stop the work of the credit institution.

Opening a current account may be refused, and the bank is not obliged to explain the reasons for the refusal. The worst thing is if the individual entrepreneur is added to the so-called black list, being on which it is impossible to open a current account in any of the Russian banks. This will significantly complicate or even completely paralyze business activities.

Thus, the constituent documents for an individual entrepreneur are a kind of business passport, without which it is impossible to fully operate.

Filling out an application: sample and tips

You need to be careful when filling out form P21001. It is errors in these documents that are the main reason for refusal to open an individual entrepreneur.

When submitting documents online, almost all fields are filled in automatically. The data that the user provided when registering an account with the Federal Tax Service or the State Services portal is used. You need to go straight to page 003 to select OKVED codes.

OKVED determines the activities of the company. You can specify up to 40 codes on one sheet at once. If necessary, additional sheets can be used. When registering, it is recommended to enter up to 10 codes, including the main one. The main OKVED determines the activities of individual entrepreneurs, and additional ones are useful in the provision of support services. It is not necessary to carry out the activities specified using additional OKVED. The codes can be changed in the future by sending a request to the Federal Tax Service.

conclusions

- Officially, individual entrepreneurs do not have constituent documents, but in practice they are understood as confirmation of the legality of business activity.

- The main evidence of registration of an individual entrepreneur is the Unified State Register of Entrepreneurs. Information from this register is publicly available to all interested parties. If an entrepreneur is registered before 2021, the entry sheet can be replaced with an individual entrepreneur registration certificate.

- The list of constituent documents for individual entrepreneurs also includes a copy of the entrepreneur’s passport, a certificate of TIN assignment, notices of registration as an insurer, statistics codes, and sometimes bank account details.

- The constituent documents of an individual entrepreneur are needed not only by the entrepreneur himself, but also by his transaction partners, who are obliged to verify the integrity of the counterparties. Banks also request this information when opening a current account.

PSN

Another type of taxation regime is the patent system (PSN). The patent value usually depends on the type of activity of the entrepreneur. But the required document is always the Income Accounting Book and a one-year patent for individual entrepreneurs.

Detailed information about various tax regimes for individual entrepreneurs can always be found on the official website of the Federal Tax Service. To do this, you need to go to a special section with information about tax documents that every businessman conducting business in Russia is required to submit.

Certificate of provision of services or work performed

This document confirms that the services have been provided or the work has been completed, and the customer has no complaints about their quality. The act is signed by both the contractor and the customer.

In “Kontur.Elbe” the act is drawn up very simply. It is enough to select a counterparty, indicate the service and price. Then you need to send the counterparty a completed document containing your signature and seal.

Create a deed for free in Kontur.Elbe

An invoice for payment

In fact, an invoice for payment is not a strictly mandatory document, but it is often used for convenience in work. The invoice indicates the quantity and cost of the goods, as well as details for transferring payment. You can develop your own invoice form for payment. But it’s easier to use a ready-made template in “Kontur.Elbe” - select the counterparty, indicate the goods or services, their quantity, price and the document is ready.

Agreement

The contract describes the rights and obligations of the parties to the transaction. Typically it contains the following sections:

- Subject of the contract: what will happen as a result of the transaction (for example, sale of goods, provision of services, performance of work);

- Contract amount and payment procedure: when and how much to pay.

- Rights and obligations of the parties: what actions the parties to the contract can (or should) take.

- Responsibility of the parties: what will happen if the individual entrepreneur or the client violates the terms or other terms of the contract.

- The procedure for changing and terminating a contract: how to terminate a contract or accept additional agreements to it.

- Details of the parties: current accounts, INN, OGRN and addresses of the entrepreneur and his counterparty are indicated.

The agreement is usually drawn up in two copies and signed by each party.

If you use a standard contract form to work with clients, replacing the necessary details in Word or Excel, use the templates from Kontur.Elbe. Upload your agreement template, and the program will automatically fill in the details of the counterparty from the directory.

Draw up contracts for free in Kontur.Elbe using ready-made templates

For some transactions, a written contract is not necessary at all. For example, a retail sales contract is considered concluded from the moment the buyer is issued a cash receipt, sales receipt or other document that confirms the fact of payment.

Here are the templates for the most common contracts:

– Service agreement template; – Contract agreement template; – Supply agreement template.

Packing list

This document formalizes the sale of goods to another entrepreneur or organization. This document is not used to work with individuals. The invoice is issued in two copies: the first remains with the supplier and records the shipment of goods, and the second is transferred to the buyer and is needed by him to accept the goods.

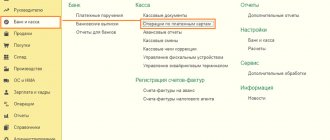

Usually the invoice is drawn up according to the standard form No. TORG-12. You can use the invoice template.

In Kontur.Elbe you can create an invoice based on an invoice.

Create an invoice for free in Kontur.Elbe

How else do they plan to simplify the registration of individual entrepreneurs?

The Ministry of Finance presented a draft law (Project ID: 02/04/08-20/00107106), which involves introducing amendments to the Federal Law of 08.08.2001 No. 129-FZ (on state registration of legal entities and individual entrepreneurs).

The bill provides for additional simplifications of the individual entrepreneur registration procedure, namely the option of submitting an application for state registration through the taxpayer’s personal account using a non-qualified electronic signature.

Another idea is to relieve citizens of the need to provide a copy of their passport to register an individual entrepreneur.