Companies on OSNO use an invoice (SCF) for VAT accounting. The universal transfer document (UTD) is used much less frequently, despite its ability to replace several documents: SSF and primary accounting documentation. What prevents the universal use of UPD? Can both documents be used simultaneously and in what cases? When is it preferable to use an invoice? Let's figure it out.

In what order is the universal transfer document form ?

Consignment note or act – when and what document to issue?

When processing transactions related to the shipment of goods, works, services, the seller is obliged to issue supporting primary documents.

What kind of documents could these be? To process the shipment, we first remember the following documents:

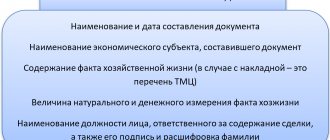

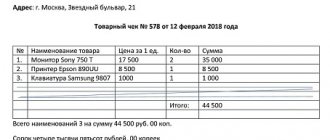

- Consignment note - used when shipping products of own production or goods intended for resale. Business entities can use the form of the unified form TORG-12, approved by Decree of the State Statistics Committee dated December 25, 1998 No. 132. They also have the opportunity to develop their own form based on it, but with the entry of all mandatory details (Article 9 of the Law “On Accounting” dated 06.12 .2011 No. 402-FZ, hereinafter referred to as Law No. 402-FZ).

- The act of acceptance and transfer of fixed assets is used when selling property. There is also a unified form in Resolution No. 7 of the State Statistics Committee dated January 21, 2003, but you can develop your own.

- Certificate of completed work/rendered services - drawn up when performing work/rendering services. There is no unified form; each organization or individual entrepreneur has the right to develop a form based on its own needs.

- Other forms of documents - these can be acts of acceptance and transfer of property rights, invoices for the release of materials to the party in the form M-15, etc.

If the organization operates in a general mode, the set of shipping documents must also include an invoice. We'll talk about its purpose in the next section.

Information about the seller and buyer

When specifying the TIN, the most common errors are of a technical nature. Incorrect indication of the buyer's or seller's TIN may result in denial of the deduction, since the TIN is the main requisite that allows identifying the seller, the buyer of goods (works, services), and property rights. Arbitration practice on this issue is ambiguous.

There are decisions both in favor of taxpayers with the conclusion that failure to indicate or incorrect indication of the TIN in the invoice does not entail a refusal to deduct (Resolution of the AS of the West Siberian District dated July 18, 2017 No. Ф042386/2017), and in favor of the tax authorities - when the refusal in the deduction is legal (Resolutions of the AS of the North-Western District dated 02.16.2017 No. F0713782/2016, dated 09.23.2016 No. F07-7535/2016, Ural District dated 09.17.2015 No. F09-6253/15).

The Letter of the Federal Tax Service of Russia dated 01/09/2017 No. SD-4-3/ [email protected] contains the following information: if line 6 “Buyer” of the invoice does not indicate the name of the taxpayer in accordance with the constituent documents, but the surname, first name , the patronymic of his employee, then such an invoice does not allow the tax authorities to identify the buyer of goods (work, services) during a tax audit. In this regard, the specified invoice is the basis for refusal to accept tax amounts for deduction.

From the Letter of the Ministry of Finance of Russia dated May 2, 2012 No. 03-0711/130, it follows that if the invoice contains typos in the name of the buyer (capital letters are replaced with lowercase ones and vice versa, extra symbols are added (dashes, commas, etc.), but at the same time, such an invoice does not prevent the tax authorities from identifying the main indicators during a tax audit, then there are no grounds for refusing to accept for deduction the VAT amounts presented by the seller to the buyer.

When purchasing or selling goods by separate divisions of the organization, in lines 6b or 2b of the invoice, the checkpoint of the separate division is indicated (Letters of the Ministry of Finance of Russia dated 05.18.2017 No. 0307-09/30038, dated 05.30.2016 No. 03-07-09/31053, dated 03.06 .2014 No. 03-0715/26524, dated July 24, 2013 No. 03-07-09/29204, Federal Tax Service of Russia dated November 16, 2016 No. SD-43/ [email protected] ).

As noted above, the main requisite for identifying the seller or buyer is the Taxpayer Identification Number (TIN), therefore errors in indicating the address of the seller or buyer should not prevent tax deductions.

In particular, incomplete indication of the address, abbreviations of words, replacement of capital letters with lowercase ones or vice versa are acceptable (Letters of the Ministry of Finance of Russia dated 08/30/2018 No. 03-07-14/61854, dated 04/25/2018 No. 03-0714/27843, dated 04/02/2018 No. 03-07-14/21045, dated January 17, 2018, No. 03-0709/1846, dated November 20, 2017, No. 03-07-14/76455).

What is the purpose of a shipping invoice?

An invoice is the primary tax accounting document for VAT. Organizations and individual entrepreneurs are required to submit this document on the OSN, highlighting in it the amount of tax to be paid to the budget for this operation.

Business entities that have received tax exemption under Art. 145 of the Tax Code of the Russian Federation.

In turn, special regime officers, for example, persons using the simplified tax system, may refuse to issue invoices, except in cases where they carry out intermediary or import operations.

The buyer on the OSN requires a correct invoice with all the details in order to accept VAT for deduction. Therefore, sellers should approach the issuance of this document with the utmost care. Its form was approved by Government Decree No. 1137 dated December 26, 2011. Economic entities do not have the right to develop any of their own forms on the basis of this, otherwise the buyer will not be able to accept VAT for deduction, and this is precisely the main purpose of the invoice (Art. 169 of the Tax Code of the Russian Federation).

ATTENTION! As of January 1, 2019, a new invoice form is in effect. Find out more from the material.

However, there is a document to replace the invoice - a universal transfer document. We'll talk about it in the next section.

How to fill out

The main feature is the multifunctionality of the documentation. It is worth remembering that usually completing this form does not cause any difficulties or difficulties. It contains lines familiar to all accountants and other MOLs.

In one part of the file there is a thick frame, it duplicates the data from the Federation Council, they are necessary. Information about the content of the operation, its participants and details of organizations is entered there. It is better not to prescribe anything unnecessary to this zone.

Under this block details of the agreement that was concluded by the parties are reflected. Using the indicator, the content of the transaction is identified, so it can be classified as mandatory details, although it is already outside the part.

Below is written everything about the waybills and other accompanying files, if any. It is no longer considered an indispensable indicator; it can be dispensed with.

Universal transfer document - what is it?

UPD is a kind of hybrid of a transfer document and an invoice. When completing a trade transaction, the seller can issue not two documents, but only one, which will contain the features of both:

- The invoice details in the UPD are surrounded by a black frame. This part (the presence and sequence of lines, columns and other details) must correspond to the form approved by the Government of the Russian Federation for the invoice. That is, when changes are made to the form, the last part of the UPD highlighted in a frame must also change in accordance with the new requirements.

- The part of the UPD outside the black frame can be changed and supplemented according to the needs of the document compiler - such modifications are not prohibited by law.

The UPD as a whole is intended to replace the set of transfer document (invoice, acceptance certificate, certificate of completion of work) with an invoice - then it has the status “1”.

Also, the UPD can only replace the transfer document - then it has the status “2”, and the invoice is issued separately.

The UPD form is not mandatory for use. It was recommended by the Federal Tax Service in 2013 in order to simplify document flow.

ConsultantPlus experts explained how to correctly fill out the UTD and how to take the document into account in tax accounting. If you don't have access to the system, get a free trial online.

We will describe below how controllers feel about the use of a set of consignment note and invoice and UPD separately.

Recommendations for filling out the UPD form

The form of the act, along with recommendations and the procedure for filling it out, was created by the Federal Tax Service and proposed for use in an official letter.

Recommendations for filling out the document:

- The introductory part is almost similar to an invoice, with the only difference being that the act contains a “Status”, several additional columns “Work/Product Code”, and a field where the number of sheets of the document is indicated. “Status” suggests two options to choose from: deed of transfer and invoice; transfer document. The code “Services, works/products” is indicated: OKUN, OKVED in relation to services and works; product article.

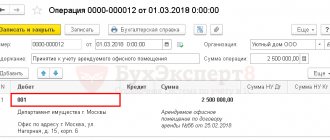

- Based on the terms of the transaction reflected in the agreement, when accounting for costs, several or one date is used, indicated in lines 16, 1 and 11. If, according to the agreement, it is permissible to use all dates, then when accounting for VAT, the seller indicates the date of shipment (p. 11), and purchaser – date of acceptance (page 16).

Dates must be entered in all lines to avoid any questions from the tax authorities.

- Lines 2 “Seller” and 6 “Buyer” reflect information about the participants in legal relations. For example, when transferring rights to own property - the user and the copyright holder, and when transferring the work performed - the customer and the contractor. The remaining data corresponding to the information contained in the invoice is filled out taking into account the requirements of Appendix No. 1 to State Regulation 1137.

- The line “Base of transfer” reflects data on financial activities and certain conditions of the transaction, indicating the details of the arrangement, agreement or order.

- The line “Information about the main cargo and transportation” indicates the data of transport documents, warehouse lists of movements, information about the cargo (configuration, weight and quantity).

- Lines 10 and 15 contain the full name, position and signatures of the relevant persons. If the product is transferred by the same person responsible for signing the invoice, then you do not have to sign it, but only enter your position and initials.

- Line 12 is intended for entering information about shipment. Accordingly, line 17 “Other data on acceptance/receipt” indicates data on the presence of claims or information on documentation.

- Lines 18 and 13 display information about the officials responsible for the correct registration of the fact of financial activity with the obligatory indication of the full name.

- Lines 19 and 14 are intended to indicate the name and other details identifying the financial entities of the transaction who drew up the transfer document. This may include information about an official who keeps accounting records on the basis of an agreement or information about an agent who transfers products purchased from the seller to the other party to the transaction, but on his own behalf.

These two details are required, but if the paper contains official stamps indicating the full names of all interested parties to the transaction, then these lines do not need to be filled in.

We are preparing the implementation: is it possible to issue a UPD instead of TORG-12 and an invoice?

In order to formalize ongoing trade transactions using UTD, organizations/individual entrepreneurs must consolidate this point in the accounting policy (AP).

All forms of documents used in business and not included in the albums of unified forms must be recorded in the UP in order to avoid conflict situations.

By registering a transaction with a universal transfer document, an economic entity does not violate the requirements of legislative norms, since, according to Art. 9 of Law No. 402-FZ, he has the right to independently determine the forms of documenting the facts of economic life - tax officials speak about this in a letter dated October 21, 2013 No. MMV-20-3 / [email protected]

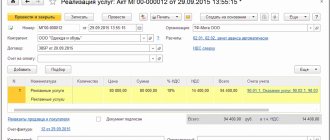

In accounting programs, when registering shipments, you often need to write out both documents - a waybill, for example, in the TORG-12 form, and an invoice, and when choosing a printed form, take advantage of the opportunity to print one document (UPD) instead of two. When performing work or providing services, a set of invoices and deeds can also be replaced by a universal transfer document, but in practice this is quite rare.

Who signs?

The signing requirement for each document is different. For an invoice, this is a two-sided certificate by authorized materially responsible persons responsible for the shipment and receipt of goods and materials, with a mandatory single signature, transcript of the signatories and a seal imprint of a legal entity, if used.

For an invoice, certification by authorized signatories is required only on the part of the seller, who confirm the moment of calculation of VAT for crediting to the budget, and for the buyer - for its deduction.

Results

So, in the article we:

- talked about the forms of primary shipping documents and why an invoice should or should not be included with them;

- found out why the UPD appeared and what distinguishes it from other shipping documents;

- characterized the position of the controllers in relation to the UTD and cited their letters, where they explain to business entities their rights to draw up and use the UTD or invoice when presenting VAT for deduction.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it allowed to compile UTD in foreign currency?

This issue often causes a lot of controversy among company leaders. Sometimes this even leads to refusal to use the format. The legislation determines that all primary documentation on the territory of the Russian Federation must be filled out only in Russian rubles. But the laws of the Federal Tax Service allow that the SF will be issued using dollars, euros or other money.

If we take both of these facts into account, it becomes clear that this is theoretically possible. But it is advisable to supplement the form with lines where the amount will be expressed in the official national currency. This will remove all the questions, and you will only have to add one column.