The procedure for depositing cash into the current account of a legal entity is regulated by Bank of Russia Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses.”

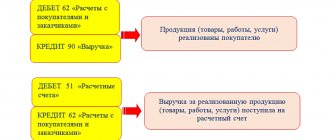

Cash transactions (regardless of the source) must be reflected in the organization’s accounting documents in the form of entries involving 50 and 51 accounting accounts.

An authorized representative of the organization - its manager, employee or third party - can deposit cash into the bank's cash desk. Their powers are approved by orders or powers of attorney.

A representative of the organization must know the exact amount and source of funds. There are several such sources for legal entities.

Table 1. Cash symbols by income items

| Income Source Symbol | Name | Sources of funds |

| 02 | Proceeds from the sale of goods | Revenue from retail, wholesale trade and public catering, as well as other activities whose turnover is included in the turnover of retail trade and public catering |

| 11 | Receipts from the sale of paid services (work performed) | Receipts from the sale of services of transport enterprises, film distribution, theatrical and entertainment organizations, travel companies, etc. This also includes cash receipts from rental services, fees for communication services and housing and communal services |

| 12 | Receipts of taxes, fees, insurance premiums, fines, customs duties, self-taxation funds for citizens, contributions, insurance premiums | Cash from taxes, fines, fees, insurance premiums, as well as share, entry, target, charitable and other contributions, contributions of founders to the authorized capital of organizations |

| 15 | Proceeds from real estate transactions | Receipts from the sale of real estate, as well as for transfers to pay for real estate. Contributions to the accounts of HOAs, housing cooperatives and other organizations related to real estate transactions |

| 32 | Other supply | Reflects all sources not related to symbols 02 – 31: return of unused accountable funds received from cash checks, proceeds from the sale of own property, payment for the rental of bank safe deposit boxes |

There are 2 ways to deposit cash into a legal entity’s current account:

- through a bank cash desk;

- self-collection.

Let's look at each method in more detail.

Depositing personal funds into the LLC current account

Any person has the right to deposit personal money into the company’s account. To prevent them from being considered trade revenue, a loan agreement must be concluded - then you will not have to pay extra taxes. The agreement must reflect the amount, term of the loan and its conditions.

We recommend reading: Where to open a current account for individual entrepreneurs and LLCs: comparison of tariffs and reviews.

Depositing cash proceeds and personal funds into an account - what is the difference?

It is better to spend money on business from a current account. If you buy equipment, pay salaries and pay for supplies in cash or with a personal card, then there will be no expenses on the account. In this case, it will be difficult for individual entrepreneurs on OSNO and simplified tax system to take into account expenses to reduce tax. You can forget something and overpay.

But the money in the account may not be enough to settle payments with counterparties or pay taxes. In this case, the entrepreneur can top up the account at any time - deposit cash proceeds or personal money into it. There will be no problems with cash proceeds: put it in and pay taxes on the income. But with personal funds it’s not so simple.

The tax office considers all amounts that go into the account as income, and taxes must be paid on the income. If this is not done, after an inspection, additional taxes will be assessed and you will be forced to pay penalties and fines. However, an entrepreneur’s personal money is not considered income and should not increase the tax base (Clause 2 of Article 41 of the Tax Code of the Russian Federation). To protect yourself, make sure to complete your payment correctly.

Find your bank to maintain your account

Select bank

Find your bank to maintain your account

Select bank

How to deposit money into a current account from the founder of a legal entity. faces

The founder can deposit money into the LLC's current account at bank cash desks or by transfer from a personal card. In order to correctly replenish the account, it is necessary to indicate that the founding capital is being paid or the money is being deposited under an interest-free loan agreement.

How to top up your account through the cash register

To replenish the LLC's current account with cash, you need to come to the bank branch with your passport, the decision of the meeting of participants and the loan agreement and draw up a receipt document for the cash deposit. After checking the documents, the operator will credit the money.

We recommend reading: Rating of banks for small businesses with profitable cash settlement services for individual entrepreneurs and LLCs.

Cash deposit to the bank

Example: From the cash desk of the organization “Confetprom”, cash in the amount of 10,000 rubles was deposited into the bank account of this organization on August 28, 2012.

To reflect this operation, you need to create a document “Cash expenditure order” (menu or “Cash” tab) with the type of operation “Cash deposit to the bank”. When posted, the document generates the posting Dt 51 Kt 50.

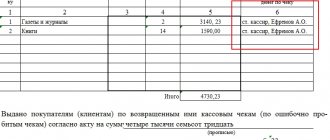

Movements in the current account are reflected in the Bank Statements journal. However, if we open this journal (menu or “Bank” tab) and indicate the date 08/28/2012, we will see that there are no transactions for that day in it. However, at the bottom of the journal the receipt amount of RUB 10,000 is displayed. To see the document used to formalize the cash deposit to the bank, you must click the “Including movements” link. The list of movements displays the cash receipt order: