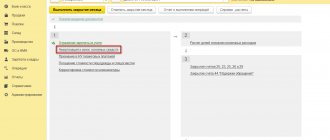

Home — Civil procedural law — How is leased property depreciated after its redemption in 2021

Let's consider the accelerated depreciation formula: AMu = AM*AMC, where AMu denotes the rate of accelerated depreciation AM denotes the rate of depreciation, which is calculated in accordance with the validity period of the contract AMC denotes the accelerated depreciation coefficient, which can vary from 1 to 3 Application of the accelerated depreciation coefficient when leasing a car is also considered a significant advantage of the transaction, which lessees willingly take advantage of. It is also acceptable that this opportunity applies to all categories of clients (legal entities and individuals, as well as entrepreneurs). Some companies on their official websites provide a convenient opportunity to use an online calculator that will help you quickly calculate the amount of payments at different coefficients, as well as estimate the residual value of the upcoming purchase of the vehicle.

Features of depreciation during leasing

Info

Calculation and accrual are carried out by the party on whose balance sheet the car or work equipment is located. The maximum coefficient is 3. If the contract term is from 1 to 5 years, it is considered short-term, which is the reason for imposing a restriction - depreciation is not calculated. When applying the usual coefficient, the depreciation rate must be multiplied by the appropriate indicator.

It is set in the numerical range from one to three, multiplication by a fractional value is allowed, for example, 1.5. Formula for calculation: AMu = AM*KUA The following values are substituted:

- AMu – established rate of depreciation with acceleration;

- AM is the norm, which is calculated based on the total duration of the leasing agreement;

- AMC – coefficient.

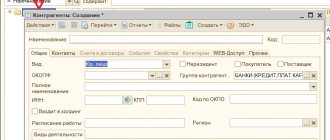

Documents for registering a car after leasing

When the lease ends, the new owners have a question about what documents are needed to re-register the car. The list of papers confirming that the car has been purchased is as follows:

- Final settlement agreement with the leasing company.

- The act of acceptance and transfer of the car from the leasing company of your organization.

- A purchase and sale agreement between the lender and the borrower.

- Act of registration in the REO of the vehicle for an individual (if he was the lessee).

Redemption value of leased property (transactions)

In accounting, the initial cost is defined as the sum of all payments under the leasing agreement excluding VAT. But in tax accounting, a completely different rule applies: the initial cost is equal to the amount of the lessor’s expenses for the acquisition of the leased asset <p. .In addition, in tax accounting, leased property is taken into account differently in different periods.1. During the period of validity of the leasing agreement - as a leased item. Expenses for tax accounting purposes include monthly depreciation of the leased asset and the part of the lease payment that exceeds the amount of accrued depreciation. Thus, the residual value of the leased property on the date of its redemption in tax accounting does not matter. You can simply forget about it. After all, everything that you paid to the lessor as current payments, you have already recognized as expenses.2.

Reflection of depreciation by the lessee

Depreciation of the leased asset is carried out by the lessee only when the property is accepted on the balance sheet. In this case, the accountant makes the following entries:

| Dt | CT | Operation |

| 08-9 | 76-5 | Cost of accepted rental item |

| 08-9 | 60 | Delivery costs and other related services |

| 19 | 60 | VAT accounting along with delivery |

| 01-9 | 08-9 | Putting the leased object into operation |

| 68-1 | 19 | Acceptance of VAT for deduction |

| 60 | 51 | Payment of transportation costs |

| 76-5 | 02-9 | Calculation of depreciation for leasing for the past month |

Is it possible to change the depreciation method after purchasing the leased property?

The main benefit is that at the end of the contract the leased asset can be purchased at a minimum cost. Increasing coefficient The increasing coefficient is the value due to which the amount of payments under the contract increases. It should be used in order to shorten the repayment period of the debt under the transaction and redeem the car sooner. When calculating the coefficient, it should be taken into account that if the car or equipment was registered on the balance sheet of the leasing recipient, then this indicator will correspond to the current tax rate for a specific vehicle. Russian legislation contains an indication that the party to the transaction that is the balance holder has the right to apply a special increasing coefficient of 1-3.

Re-registration of a car to an individual

At the end of the leasing agreement, the owner of the car becomes the lessee. Further, he has the right to sell the vehicle to individuals. face. In most cases, the object becomes the property of the borrower after payment of the redemption price of the property, unless a different procedure is established by the leasing agreement.

A special procedure is possible for sellers - legal entities. persons who skip the stage of placing a car on their own balance sheet, immediately selling it to an individual.

In this case, the bank through which the vehicle is paid for must accept money from a legal entity on the condition that the actual buyer of the property is an individual. That is, the money comes from the final consumer of the property, and a corresponding payment receipt is issued in his name. After this condition is met, the purchased car can immediately be registered to an individual.

Accounting and depreciation of leased property in practice

Important

However, when assessing income tax savings, it should be taken into account that the initial cost of property both when leasing and when purchasing fixed assets directly is the same and the total amount attributed to costs by calculating depreciation of fixed assets will also be the same both with accelerated depreciation and and with the usual scheme for calculating depreciation charges. The only difference is that with the accelerated depreciation method this will happen faster. But at the end of the leasing transaction, if the leased property is completely written off, depreciation on it will no longer be included in expenses, and with the usual depreciation calculation, fixed assets will be depreciated, reducing the income tax base.

When applying the accelerated depreciation method, it is necessary to control the total amount of expenses and the financial result of the company.

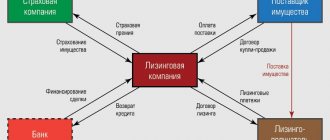

Accounting for a leasing agreement with the lessor

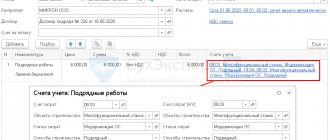

Let's look at an example of leasing transactions on the lessor's balance sheet . Let the property purchased for leasing be on the balance sheet of the lessor. Let's take the numbers again from the example above.

Let's assume that the leased object was purchased by the lessor for 450,000 thousand rubles. (including VAT 75,000). useful life 60 months. Depreciation is calculated using the straight-line method and amounts to RUB 6,250. ((450,000 - 75,000) / 60 months)

The purchase and commissioning operations are as follows:

| Debit | Credit | Sum | VAT |

| 08 | 60 | 375 000 | OS object received from the supplier |

| 19 | 60 | 75 000 | input VAT reflected |

| 60 | 51 | 450 000 | the object has been paid to the supplier |

| 68 "VAT" | 19 | 75 000 | input VAT is accepted for deduction |

| 03 “Material assets (MT) in the organization” | 08 | 375 000 | OS object is accepted for accounting |

| 03 “MCs transferred for temporary possession” | 03 “MC in the organization” | 375 000 | the equipment is transferred to the lessee |

| 20 (23,25,26…) | 02 | 6 250 | depreciation accrued |

Accounting for leasing payments:

| Debit | Credit | Sum | Content |

| 51 | 62 | 150 000 | an initial payment has been received from the lessee |

| 76 AB | 68 "VAT" | 25 000 | VAT allocated from advance payment |

| 51 | 62 | 25 000 | received monthly payment from the lessee |

| 62 | 90 | 25 000 | revenue is reflected in the amount of the monthly payment |

| 90 "VAT" | 68 "VAT" | 4 166,67 | VAT charged |

| 68 "VAT" | 76 AB | 1 041,67 | VAT refunded on prepayment |

Now let’s consider the process of buying out leased property from the lessor, if he is also the balance holder of this property.

| Debit | Credit | Sum | Content |

| 51 | 62 | 1 500 | the redemption value of the property was credited to the account |

| 02 | 03 | 150 000 | the amount of accrued depreciation is written off |

| 91 | 03 | 225 000 | the residual value of the leased object was written off (375,000 - 150,000) |

| 62 | 91 | 1 500 | income from the redemption price is taken into account |

| 91 | 68 "VAT" | 250 | VAT is charged on the redemption price |

Let's consider accounting with the lessor if the property is included on the lessee's balance sheet.

Acquisition, payment and commissioning are no different from the case when the lessor is the balance holder.

There is no need to accrue depreciation on the leased asset - based on the terms of the leasing agreement, it must be accrued by the lessee (clause 50 of the Guidelines for accounting of fixed assets). The transfer of the leased object to the lessee is usually reflected in the following order:

| Debit | Credit | Sum | Contents of operation |

| 97 | 03 | 375 000 | the leased object is transferred to the balance sheet of the lessee |

| 011 “Assets leased” | 375 000 | the cost of the leased asset is reflected in the off-balance sheet account |

In this case, the costs recorded on account 97 can be recognized as expenses for ordinary activities as income in the form of leasing payments is recognized through a reasonable distribution between reporting periods (for example, in proportion to leasing payments recognized in income) (clause 5, 19 PBU 10/99 “Expenses of the organization”).

The posting in the income generation period will be as follows: Dt 20 (23.25...) Kt 97.

Let's consider accounting for monthly lease payments:

| Debit | Credit | Sum | Content |

| 51 | 62 | 150 000 | an advance has been received |

| 62 | 90 | 150 000 | the advance is recognized in the amount of income |

| 90 "VAT" | 68 "VAT" | 25 000 | VAT charged |

| 20 | 97 | 75 000 | part of the cost of the leased object is recognized as expenses in proportion to recognized income (150,000 × 100 / 750,000 = 20% × 375,000) |

| 51 | 62 | 25 000 | monthly payment has been received into your account |

| 62 | 90 | 25 000 | income is recognized in the amount of the lease payment |

| 90 "VAT" | 68 "VAT" | 4 166,67 | VAT charged |

| 20 | 97 | 12 500 | part of the cost of the leased object is recognized as expenses in proportion to recognized income (25,000 × 100 / 750,000= 3.33% × 375,000) |

The redemption of leased property is registered with the following entries:

| Debit | Credit | Sum | Content |

| 62 | 90 | 1 500 | income is recognized in the amount of the redemption price |

| 90 "VAT" | 68 "VAT" | 250 | VAT charged |

| 20 | 97 | 75 000 | the initial cost of the leased asset not written off at the time of redemption is reflected (12,500 × 24 - 375,000) |

| 51 | 62 | 1 500 | the redemption price of the lease was credited to the account |

| 011 | 375 000 | the leased object is written off balance sheet |

If the redemption value is not separately allocated in the leasing agreement, then the redemption of the leased asset, subject to payment of all payments, is formalized by a single write-off from off-balance sheet account 011 “Fixed assets leased” in the amount of the lessor’s costs excluding VAT.

Redemption of leased property: acceptance for accounting

Term The period for calculating depreciation on leased property does not exceed the duration of the transaction. Even if the leasing agreement was terminated early, the lessor undertakes to restore depreciation, because the vehicle is on its balance sheet. This is regulated by Federal Law. Such a resolution insures lessees against possible risks and unfair financial fraud of leasing companies. Since groups 1-3 of leased property are not subject to depreciation, the period may exceed a five-year period. Thus, depreciation is especially beneficial for legal entities and private entrepreneurs who have rented special equipment or trucks. Acceleration of depreciation is possible from any period of the leasing agreement, but the important thing is that it is the coefficient that is taken into account.

How to register a car for a new owner?

To re-register a vehicle you need to do the following:

- Receive from the leasing company all the documents necessary to re-register the car.

- Write an application to the traffic police to make changes to the vehicle registration certificate due to a change of owner.

- Get your license plates verified.

- Pay the fee and insure the owner's liability.

- Submit the necessary documents to the traffic police department.

- Pick up the inspection ticket and a new registration certificate.

- Complete the inspection procedure.

Depreciation when leasing a car

Increasing the volume of depreciation deductions helps to achieve a reduction in the tax rate on the lessee's profit. But such a privilege can only be used at the time the contract is valid. Thus, the primary price of a car differs slightly from the cost of a vehicle purchased directly.

There will be no special differences with accelerated depreciation. If this method is used, control the financial activities of the enterprise and its expenses. Otherwise, accrued amounts of accelerated depreciation may lead to increased costs and ultimately serious losses.

Another advantage of accelerated depreciation is that at the end of the leasing transaction, the residual value of the vehicle will be more accessible to the buyer, because it will be significantly reduced due to monthly deposits. Moreover, this coefficient has a controlled value and is fixed by agreement. Accelerated depreciation helps reduce the residual value of a leased car and is calculated using a formula that we will discuss below. Financiers explain to their clients the essence of depreciation as follows: it is the acceleration of payments for leasing and redemption of a vehicle through the use of a special coefficient that increases cash contributions. Accelerated depreciation during leasing It is this type of depreciation that is considered by clients to be the most profitable aspect of leasing, which indicates that leasing is a more flexible financial transaction than a car loan.

What difficulties may arise when registering a leased car with the traffic police?

Registration of a leased car by a legal entity is not always quick and easy. Some companies prefer to handle vehicle registration themselves, but without the proper experience, difficulties cannot be ruled out. The most common problems that arise when performing registration actions:

- Contacting an inappropriate MREO. Not all branches of the State Traffic Inspectorate serve legal entities. In order not to waste time, you need to first find out whether cars belonging to organizations are registered in the selected area

- Queues and lack of appointments. Most departments where you can register for a leasing vehicle accept only by appointment through the Public Services service. But not all employees have the opportunity to apply on the portal, as a verified account is required

- Incomplete set of papers. If at least one document is missing, you will have to postpone registration - this is a loss of several hours, and sometimes several days. If the vehicle owner fails to meet the deadlines set by the state, he will pay a fine.

- Errors when drawing up a contract. To fix them, you will have to contact the leasing company again - this is also a waste of time

- Difficulties in paying state fees. Quite often, applicants pay for the wrong services, which is why they have to return to the traffic police, get a new receipt and pay the fee again. But it takes more than one week to get a refund of the paid state duty, and the procedure does not always end in success

How is leased property depreciated after its redemption in 2018?

It is obvious that when using accelerated depreciation of fixed assets, their residual value will decrease much faster than when calculating depreciation using the usual method. In addition, the complete write-off of fixed assets when using accelerated depreciation with a coefficient, for example, 3, is carried out three times faster. All this allows you to significantly reduce the amount and period of payment of property tax when using the accelerated depreciation method. Using the method of accelerated depreciation of fixed assets allows you to reduce the taxable base for income tax by increasing the amount of depreciation deductions for the leased asset. This effect is achieved during the period of validity of the leasing transaction.

Attention

Depending on whether the equipment or vehicle is on the balance sheet of the lessor or the recipient, a coefficient of no more than 3 may be accrued. However, according to tax legislation, its accrual is not allowed for property belonging to depreciation groups 1-3.

- Funds used in scientific and technical activities can also be purchased by the company under a leasing agreement. For them, the maximum indicator is 3.

- An increasing factor (IC) can be applied to equipment used in agricultural activities - in poultry farms, greenhouse plants.

There is no need to make changes in accounting policies if PC is used when calculating depreciation on fixed assets of an enterprise. How to calculate Features of calculating depreciation are described in Russian legislation, namely, in the Federal Law “On Leasing”, as well as in the Tax Code of the Russian Federation.

The equipment will be fully depreciated over the leasing period of 36 months. In this example of calculating accelerated depreciation, you can also take the useful life of the equipment to be equal to, for example, 80 months. In this case, the monthly depreciation rate will be 1.25%, the depreciation rate using an increasing factor of 2.22 - 2.775%.

The equipment will also be completely written off within 36 months. The use of the accelerated depreciation method has its own characteristics and nuances. Our company’s specialists will help you understand the choice of the optimal scheme for using the accelerated depreciation mechanism.

In the Tax Code, Article 256, goods subject to depreciation are recognized as:

- any type of movable property;

- results obtained in the process of mental activity;

- objects that have been recognized as the intellectual property of the lessee.

There is no specific division into categories in depreciation, but when concluding an agreement, the parties must decide among themselves who will register the leased item. This can be done by the end user or the leasing company. Depreciation is an excellent opportunity for an individual entrepreneur to increase his income due to the fact that he is exempt from paying tax on the transaction.

Another obvious advantage is that when purchasing a car on lease, you do not need to take out an insurance policy such as compulsory motor liability insurance, which also allows you not to invest additional funds.

Inseparable improvements to the leased asset

Improvements to leased property may be separable or inseparable.

Separable improvements belong to the lessee; the lessor may not even know that they were made.

Inseparable improvements must be made with the consent of the lessor.

If such consent is obtained, the lessor reimburses the cost of these improvements to the lessee. However, the contract may provide that inseparable improvements are made at the expense of the lessee. If the lessee has not received written consent to carry out inseparable improvements, then he cannot demand compensation from the lessor for their cost. In this case, there will be no tax consequences for the lessor.

Tax consequences for the lessor when performing inseparable improvements with his consent

VAT

If the lessor compensates for the cost of inseparable improvements

If, when transferring inseparable improvements, the lessee issues an invoice, then the presented VAT can be deducted (letter of the Federal Tax Service of Russia for Moscow dated January 26, 2007 No. 19-11/06916).

If the lessor does not compensate for the cost of inseparable improvements

In this case, according to the financial department, the lessor has no right to a deduction on the lessee’s invoice (see letter of the Ministry of Finance of Russia dated April 25, 2011 No. 03-07-14/39).

As justification, it is stated that invoices received during the gratuitous transfer of goods (work, services) are not registered in the purchase book (clause 11 of the Rules, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914, a similar norm - p 19 Rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Income tax

If the lessor compensates for the cost of inseparable improvements

Provided that inseparable improvements are made in the form of capital investments, their accounting is carried out according to the rules of Article 258 of the Tax Code of the Russian Federation, established for accounting for inseparable improvements when leasing property. According to paragraph 5 of paragraph 1 of Article 258 of the Tax Code of the Russian Federation, these capital investments are subject to depreciation from the lessor.

If the lessor does not compensate for the cost of inseparable improvements

In this case, the inseparable improvements are amortized by the lessee (paragraph 6, clause 1, article 258 of the Tax Code of the Russian Federation).

Property tax

If the leased asset is recorded on the lessor’s balance sheet

On the one hand, inseparable improvements belong to the lessor.

At the same time, until these improvements are transferred to him (upon the return of the leased asset or at the time of compensation for the cost of inseparable improvements), they must be taken into account by the lessee. It is he who will be the payer of property tax in this case (letters of the Ministry of Finance of Russia dated November 3, 2010 No. 03-05-05-01/48, dated December 22, 2010 No. 03-05-05-01/62, Decision of the Supreme Arbitration Court of the Russian Federation dated January 27. 2012 No. 16291/11).

If the leased asset is taken into account on the balance sheet of the lessee

The lessee will increase the value of the leased property and pay property taxes.