Each simplified tax system payer, be it a company or a businessman, pays a single tax based on the requirements determined for the chosen taxation regime. Despite the difference in the forms of ownership of enterprises and in the calculation of simplified tax, its transfer is formalized by a standard payment order, the perfect completion of all the necessary attributes of which becomes a guarantor of timely transfer to the budget. Let's talk about the features of processing such payments by enterprises and entrepreneurs using the simplified tax system.

How to find out the tax details for paying the simplified tax system

You can find out the tax office details for paying tax according to the simplified tax system using the “Determination of Federal Tax Service Details” service on the tax office website. With its help, you can find the necessary data, knowing only your registration address.

If you know the tax office number, you can also directly go to its official page from the search engine by asking a request indicating the Federal Tax Service number and region. In the “Official Inspection Details” section there will be a link “Inspection Payment Details”.

In the new version of the individual entrepreneur’s personal account, the section “Address and payment details of your inspection” is located in the “Applying to the tax authority” service. It opens in the general list when you click on the “All services” button on the main page of your personal account.

Procedure for filling out receipts

Entrepreneurs can obtain up-to-date details for paying taxes using a special service. The online program generates documents taking into account the current BCC, place of registration of the payer and other factors.

Business representatives have the right to consult with the tax office on how to fill out a receipt. Employees of territorial departments are required to provide assistance free of charge. You can request information in person, through a representative or by telephone.

How to correctly fill out an individual entrepreneur’s payment slip on the simplified tax system “income”

Basic details can be divided into several groups.

1. Information about the taxpayer

You must indicate your last name, first name, patronymic, tax identification number and registration address. It is necessary to indicate the address; without it, the bank will not miss the tax payment. The payment order also indicates the taxpayer's current account, the bank where it is opened, his BIC and correspondent account, the checkpoint remains blank.

For additional identification of the taxpayer status, indicate in the fields:

- 101 - code 09;

- 105 - OKTMO code corresponding to the municipality where you are registered.

2. Information about the payee

The details are filled in taking into account the information received about the payment details of the tax office.

Despite the fact that the funds are intended for the tax inspectorate, the actual recipient of the payment must indicate the federal treasury department for the corresponding region, and the name of the specific inspection must be written in brackets.

The correspondent account number is not filled in.

3. Payment information

Basic data is entered in the fields:

- 6 and 7 - payment amount in words and numbers, respectively;

- 24 - purpose of payment;

- 104 - KBK;

- 106 - basis for payment;

- 107 - tax period;

- 108 and 109 - document number and date.

The BCC determines the type of tax payment. For the simplified tax system “income” the following codes are used:

- 182 1 0500 110 — basic amount of tax;

- 182 1 0500 110 - tax penalties;

- 182 1 0500 110 — interest on tax;

- 182 1 0500 110 - fines for late tax payment.

The most common reasons for payment:

- TP - payments within the established payment period;

- ZD - repayment of overdue debts on a voluntary basis;

- TR - repayment of debt after a requirement issued by the tax authority.

For other cases, specific codes are provided; they can be clarified on the tax website or using reference services.

The tax period when paying an advance according to the simplified tax system is a quarter, when paying the last payment - a year. If payment is made in response to a demand for repayment of a debt, the due date specified in it is set.

The document number and date are entered in accordance with the received request. When the payment grounds are TP and ZD, zeros are placed instead.

The received request may also indicate the UIN; it must be reflected in field 22.

Where can I get a receipt?

Of course, if you use an accounting program (for example, “1C”), then this is done by pressing two or three buttons. But what if there is no such program?

Then you can use the service for generating receipts from the Tax Service of the Russian Federation (FTS).

By the way, I recommend using it (if you don’t have an accounting program), since this is the official service of the Federal Tax Service.

But please note that if you have an individual entrepreneur account with a bank, it is strongly recommended to pay taxes (and contributions) only from it. The fact is that banks, starting in 2021, control this moment too. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash.

How to generate a receipt for advance payment under the simplified tax system?

We go to the official website of the Tax Russian Federation using this link:

https://service.nalog.ru/payment/payment.html?payer=ip#paymentEdit

We agree to the processing of personal data and click on the “Continue” button:

Select the payment method “Filling out all payment details of the document”

And we get to the following screen:

We indicate here that the individual entrepreneur pays using a payment document (that is, using a receipt). And click the “Next” button and go to the next screen.

Enter the code of your Federal Tax Service + OKTMO

In the “IFTS Code” field, enter the code of your tax office. Let our individual entrepreneur live in the mountains. Ivanovo, its tax office code is 3702, and its OKTMO code is 24701000 (see screenshot below).

Of course, you will enter your tax office code and your OKTMO. If you don’t know them, you can check with your tax office.

Or try to determine the code of your tax office + OKTMO using the “Determine by address” function.

Check the box next to “Locate by address” and enter your registered address. But, nevertheless, I recommend checking this data again with your tax office if you are not completely sure.

Regulation of the use of budget classification codes

KBK is used to record expenses, income and is used in tax and accounting, with the help of which payment documents are drawn up.

The KBK has greatly facilitated the work of distributing the budget among the regions of the Russian Federation at the federal level for the next year. When making a payment, it is possible to fully determine its category, purpose, who sent it and when. A set of 20 digits, each of which relates to payment categories.

KBC classifies different categories of payments:

- fines for damage caused;

- payment of insurance;

- taxes of any categories;

- state fees, etc.

If the code is written incorrectly, money can go in a completely different direction, which subsequently threatens the imposition of fines.

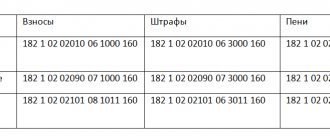

KBK for insurance premiums of individual entrepreneurs “for themselves” in 2021

In 2021, individual entrepreneurs pay insurance premiums “for themselves” according to the CBC listed below:

| Type of contribution | KBK upon payment | ||

| contribution | penalties | fine | |

| In the Pension Fund of the Russian Federation (fixed payment and 1% on excess income of 300 thousand rubles) | 182 1 02 02140 06 1110 160 | 182 1 02 02140 06 2110 160 | 182 1 02 02140 06 3010 160 |

| In FFOMS | 182 1 02 02103 08 1013 160 | 182 1 02 02103 08 2013 160 | 182 1 02 02103 08 3013 160 |

Same for all taxpayers

The general information that taxpayers provide is passport data, which must be entered. The KBK code differs for categories of payments and directions to the budget. Therefore, the code for profit and income minus expenses will be different. Details for paying the simplified tax system, purpose of payment and everything else are filled out according to the same principle.

They can only change if the payer himself has changed any data, for example, last name, name of the organization. All data on details are updated in accordance with legislative acts, which will be reported to the Federal Tax Service.

Benefits and vacation pay

Personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid. For example, an employee goes on vacation from March 6 to March 23, 2020. His vacation pay was paid on March 2. In this case, the date of receipt of income and the date of withholding personal income tax is March 2, and the last date when personal income tax should be transferred to the budget is March 31, 2021 ( postponed to 05/06/2020 due to coronavirus, quarantine and non-working days).

In general, pay the withheld personal income tax in 2021 to the details of the Federal Tax Service with which the organization is registered (paragraph 1, clause 7, article 226 of the Tax Code of the Russian Federation). Individual entrepreneurs, in turn, pay personal income tax to the inspectorate at their place of residence. However, individual entrepreneurs conducting business on UTII or the patent taxation system transfer tax to the inspectorate at the place of registration in connection with the conduct of such activities.

After the budget receives personal income tax transferred by tax agents, these funds are distributed between the budget of the constituent entity of the Russian Federation and the budgets of municipalities (settlements, municipal districts, urban districts) according to the standards established by budget legislation.

Federal Law No. 172-FZ of June 8, 2020 exempted individual entrepreneurs, notaries, lawyers, and other private practice specialists affected by the coronavirus from paying personal income tax for the 2nd quarter of 2021. This is an advance payment for the first half of 2021 minus the advance for 1 quarter. 2021.

Payment at a bank branch

To pay the state fee for opening an individual entrepreneur at a bank branch you must:

- Download or receive a payment receipt from the bank itself. You can download the form for paying the duty in 2021 here.

- Enter into the document the details of the body that will register the individual entrepreneur (IFTS or MFC).

- Pay the state fee at a branch of any bank in Russia.

You can also fill out a receipt for payment of the fee for registering an individual entrepreneur on the Federal Tax Service website (see below for the procedure for filling it out through the Federal Tax Service service). The system will automatically enter all the necessary details into the document. All you have to do is print it out and take it to the bank.

How to properly pay insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund

Attention! Let's look at the example of contributions for 2018. Their total amount was 32,385.00 rubles.

Tip: Don't pay them every month. There is no point. We worked for the first quarter, calculated the tax, and it came out to 10 thousand rubles. So, pay these 10 thousand to the Pension Fund and the Federal Compulsory Medical Insurance Fund, and first to the Pension Fund of the Russian Federation.

Nothing for the tax authorities, because the contributions were offset against the tax. There are 22,385.00 rubles left, of which 5,840.00 are in the FFOMS.

For the second quarter, another 10 thousand in taxes came out. Again we do not pay tax, but pay to the Pension Fund. There are 12,385.00 rubles left, of which 5,840,000 are in the FFOMS.

For the third quarter, another 10 thousand in taxes came out. Again we do not pay tax, but pay to the Pension Fund.

BUT! We no longer send 10 thousand to the Pension Fund, but the remainder of the total contribution (from 26545.00), i.e. 6,545.00. And with this tranche we cover our obligations to the Pension Fund. But our tax was 10 thousand, and we paid 6,545.00. The remaining 3,455.00 is sent to the FFOMS. All that remains is to pay for honey. insurance: 5,840 - 3,455 = 2,385 rubles.

So already for the fourth quarter, when your tax amount again comes out to 10 thousand rubles, we send the remaining 2,385 to the FFOMS, and the remaining 7,615.00 to the details of the tax authorities!

Important! Sending to the Pension Fund or FFOMS means using the KBK for such payments, but the recipient is the Federal Tax Service.

Of course, this is just an example, and your tax already for the first quarter may amount to an amount exceeding insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund. Then it’s better to pay everything at once in the first quarter, and then you’ll have to make quarterly advance payments.

According to this above scheme, you relieve yourself of the burden of monthly payments and any risk of imposing penalties and other sanctions from the tax authorities.

Payment amounts

The total mandatory fixed payment for insurance premiums of individual entrepreneurs for 2021 is 40,874 rubles. It includes a contribution to compulsory health insurance – 32,448 rubles. and compulsory medical insurance contribution – 8426 rubles. (clauses 1, 2, clause 1, article 430 of the Tax Code of the Russian Federation).

The deadline for payment of the fixed payment for 2021 is no later than December 31, 2020. You can pay your fees in installments throughout the year or in one lump sum. Transfer contributions for compulsory medical insurance and compulsory medical insurance to the Federal Tax Service in two separate payments:

BCC of a fixed contribution to OPS – 182 1 02 02140 06 1110 160.

BCC of a fixed contribution for compulsory medical insurance – 182 1 02 02103 08 1013 160.

| Type of contribution | KBK |

| Insurance premiums for compulsory health insurance for yourself (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance for yourself | 182 1 0213 160 |

If the fee is paid to the wrong BCC, it will be stuck in unclear payments. The tax office will not see it and may charge a penalty on the amount owed. However, this is illegal - after all, an error in the KBK is not a basis for recognizing the obligation to pay the contribution as unfulfilled (Letter of the Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/[email protected]).

If you made a mistake with the KBK, fill out an application to search (clarify) the payment. In the application, indicate the type of insurance premium, the BCC for which it was paid and the tax period (the year for which it was paid). A document confirming payment of this fee must be attached to the application.

Federal Law No. 172-FZ dated 06/08/2020 for individual entrepreneurs affected by coronavirus reduced the monthly fixed contributions to compulsory pension insurance (for themselves) by 1 minimum wage for the entire 2021 - from 32,448 rubles. up to 20,318 rubles.

Fixed Contribution Tariffs

IN 2020

The following tariffs apply

for payments to individual entrepreneurs “for themselves”

:

| Payers | Pension Fund, insurance part | FFOMS |

| Individual entrepreneurs (regardless of the taxation system), notaries, lawyers and other persons obligated to pay fixed fees | 22.0% (of which 6% is the joint part of the tariff, 16% is individual) | 5.1% |

Why do we need contribution rates if they are not calculated as a percentage of income for individual entrepreneurs? And how many pension points you will be awarded depends on the Pension Fund’s contribution rate.

Calculation of contributions for incomes over 300 thousand rubles

If the income of the payer of insurance premiums for the billing period exceeds 300,000 rubles, in addition to the fixed pension contributions indicated above (32,448 rubles), contributions are paid in the amount of 1% of the income exceeding 300,000 rubles. Note! Health insurance premiums for incomes over 300 thousand rubles are not paid

! Those. The amount of contributions to the FFOMS is fixed for all individual entrepreneurs, regardless of the amount of annual income.

Example:

The income of an individual entrepreneur in 2021 was: RUB 350,000. for activities subject to the simplified tax system and 100,000 rubles. for activities for which UTII is applied (how income is calculated is indicated above). Total 450,000 rub. The amount of contributions to the Pension Fund for 2021 will be 32,448 + (450,000 − 300,000) × 1% = 33,948 rubles. The amount of contributions to the FFOMS is 8,426 rubles.

The total amount of fixed insurance contributions to the Pension Fund for the year cannot be more than eight times the fixed amount of insurance contributions established for the year. Those. no more than 32,448×8 = 259,584 rubles.

Example:

The income of an individual entrepreneur using the simplified tax system in 2021 was: 30,000,000 rubles. The amount of contributions for 2021 would be 32,448 + (30,000,000 − 300,000) × 1% = 329,448 rubles, however, since it is greater than the maximum possible contributions of 259,584 rubles, 259,584 rubles are paid. contributions to the Pension Fund and contributions to the Federal Compulsory Medical Insurance Fund in the amount of 8,426 rubles.

KBK for payment of a single tax with a simplification of the difference between income and expenses

For example, the rate of the simplified tax system “Income minus expenses” St. Petersburg 2021 is 7%. This percentage is set from 01/01/2021 to the present. Before this period, in St. Petersburg, a rate of 10% was applied on the amount of the resulting difference between income and costs. But in the Moscow region, a reduced rate is established for certain types of activities. For example, 10% - for manufacturing enterprises in Moscow.

Please note that legislators have set restrictions here too. The rate under the simplified tax system “Income minus expenses” cannot be less than 5%, and cannot exceed 15%. The benefit is approved by the power of the subject. If such a privilege is not provided, taxpayers calculate tax at the maximum rate of 15%.

We recommend reading: Amount of Funeral Benefit in 2021

Innovations in the BCC from January 1, 2021

From 2021, the BCC must be taken from Appendix 1 to the Procedure approved by Order of the Ministry of Finance of Russia dated 06.06.2019 N 85n, Appendices 1, 2 to Order of the Ministry of Finance of Russia dated 06.06.2019 N 86n. This is new. In 2021, the codes were taken from Appendices 1, 2, 3 to the Procedure approved by Order of the Ministry of Finance of Russia dated June 8, 2018 N 132n;

We have, conditionally, summarized the new BCCs from January 1, 2021 into several groups of changes.

Change No. 1: New BCC for state duty

New BCCs from 2021 concern new payments that will be transferred. For example, starting from 2021, the Federal Tax Service will begin to maintain a unified accounting reporting resource. Tax authorities will provide data from balance sheets, but will require a fee for this. The money must be transferred according to KBK 182 1 1300 130 (Appendix 2.1 to Order No. 86n as amended by Order No. 149n).

We also added codes for the state fee for a comprehensive environmental permit (048 1 0800 110), payments for information from the Unified State Register of Real Estate (321 1 1301 130).

Change No. 2: new BCCs for fines for violations

In 2021, a specific BCC is provided for fines for each type of tax violation. Instead of two BCCs for fines from Chapter 16 of the Tax Code, you need to use 20 codes (details in the table below).

New codes have also been introduced for administrative fines for late returns, failure to provide information to the Federal Tax Service and other violations in the field of finance, taxes and fees (see below the KBK table on administrative tax fines).

Separate codes were also introduced for fines for violations of state registration legislation, illegal sale of goods, and non-use of cash registers (see the KBK table for fines for violations in business activities).

We also added codes for paying administrative fines for violating environmental protection rules, traffic rules for heavy trucks, etc.

Changes No. 3: new BCC for excise taxes

For excise taxes on ethyl alcohol from food and non-food raw materials, which was produced in Russia, one code was established: 182 1 03 02011 01 1000 110 instead of codes 182 1 0300 110 and 182 1 03 02012 01 1000 110. Codes for excise taxes on imported ethyl alcohol and wine, grape, fruit, cognac, Calvados, and whiskey distillates remain the same. See the table with the BCC of excise taxes on goods produced in Russia.

Payment deadlines

Advances are transferred quarterly no later than the 25th day of the month following the expired reporting period: 1st quarter, half year, 9 months.

At the end of the fourth quarter, the advance payment is not transferred separately, since with the end of the quarter the calendar year ends and the tax on the simplified tax system must be calculated based on the results of the year.

Tax payment deadline:

- for organizations - no later than March 31 of the year following the previous year;

- for individual entrepreneurs - no later than April 30 of the year following the previous year.

If the last day of the payment deadline falls on a weekend, the payment is postponed to the next working day.

General procedure for processing tax payment orders

Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n determines the mandatory details for paying taxes and insurance premiums:

- 101 - status of the payer who issued the payment document;

- 104 - twenty-digit budget classification code, where the first three digits correspond to the tax administrator number;

- 105 - OKATO;

- 106 - basis of payment, consists of two letters (TP, ZD, AR);

- 107 - frequency of tax payment - month, quarter, half year, year;

- 108 — document date, filled in depending on the indicator of field 106;

- 109 - document number, if the debt is repaid on demand;

- 110 - payment type, currently not filled in.

This is important to know: Where to pay property tax for individuals