The concept of fixed assets

Definition 1

Fixed assets are assets used in the economy a large number of times in production in an unchanged natural (material) form. These funds gradually transfer their own value to the product or service being created.

In practice, in accounting and statistics, fixed assets include objects with a service life of more than a year. The cost of fixed assets is an established and periodically revised value depending on changes in prices for products (products) of capital-forming industries.

The classification of fixed assets divides them into 2 types:

- Fixed production assets (FPF), including means of labor that are fully involved in the repeating production process by transferring their value in parts to finished products as they wear out.

- Fixed non-productive assets, which are material goods of long-term use. They do not take part in the production process, but are considered objects of public or personal consumption (residential building, school, hospital, club, cinema, public transport, etc.) This group of fixed assets is financed from the budget.

There is also an active and passive part of fixed assets. The active part includes a set of funds that directly affect objects of labor. Through the action of the passive part of fixed assets, conditions for the normal functioning of the production process are created.

Note 1

The classification of fixed assets into active and passive parts is conditional.

general characteristics

The production of products involves means (structures, buildings, equipment, etc.), as well as objects of labor (fuel, raw materials, etc.). Together they form production assets. A certain group partially or completely retains its natural material form over many cycles. Their cost is transferred to finished products as they wear out in the form of depreciation charges. The specified group is formed by production. They are directly involved in the process of releasing goods. Non-productive funds ensure the formation of social infrastructure.

Composition, valuation methods and balances of fixed assets

Fixed assets

– produced assets that, in an unchanged physical form, are repeatedly used in the economy, gradually transferring their value to created products and services.

In the practice of accounting and statistics, fixed assets include objects with a service life of at least a year and a value higher than the established and periodically revised value in accordance with changes in prices for the products of capital-forming industries.

Fixed assets are divided into production and non-production.

Main production assets

(OPF) are means of labor that are entirely involved in repeating production processes and transfer their value in parts to the finished product as they wear out. The study of OPF is based on the natural-material classification presented in Table 5.1.

Table 5.1.

Classification

The main production assets include:

- Buildings are architectural objects designed to create working conditions. These include garages, workshop buildings, warehouses, etc.

- Structures are engineering-construction type objects used to carry out the transportation process. This group includes tunnels, bridges, track construction, water supply systems, and so on.

- Transmission devices - gas and oil pipelines, power lines, etc.

- Equipment and machines 0 presses, machine tools, generators, engines, etc.

- Measuring devices.

- Computers and other equipment.

- Transport - locomotives, cars, cranes, loaders, etc.

- Tools and equipment.

Balance sheet asset sections

The final result of economic and commercial activities is the “Balance Sheet” report, where separate sections highlight the book value of assets, which is divided into the following indicators:

- Non-current assets with a service life of more than 12 months:

- Intangible assets (IMA);

- The result of research work;

- Fixed assets;

- Property rented out and making a profit from it;

- Long-term investments;

- Part of the income tax asset deferred until the next reporting period;

- Other objects that have characteristics of non-current assets.

- Current assets serve the production process for 12 months. This group includes:

- Materials for production;

- Accounts receivable;

- Cash on hand at the enterprise;

- VAT on purchased goods, which are indirectly, but also the property of the enterprise;

- Short-term cash investments.

Key quantities

The cost of OPF can be replacement, residual and initial. The latter reflects the costs of obtaining OS. This value is unchanged. The initial cost of funds that come from the capital investments of certain companies can be established by adding up all the costs. These include, among other things, transportation costs, the price of equipment and installation, etc. Replacement cost is the cost of purchasing the OS in current conditions. To determine it, funds are revalued using indexation or the direct recalculation method based on current market prices, confirmed by documents. equal to the recovery value, reduced by the amount of wear. There are also private indicators of OS usage. These include, in particular, the coefficients of intensive, integral, extensive operation of equipment and shifts.

How is the initial price of an object formed?

Fixed assets are reflected in the balance sheet at their original cost - the sum of all expenses for the purchase of the object. Such costs include:

- Payment to the seller of the object;

- Transportation costs;

- Costs of consulting services related to the purchase of the property;

- Customs duties and fees;

- The amount of non-refundable taxes paid upon acquisition of the property;

- Expenses for state registration of property rights to the object;

- Payment for services of intermediary firms;

- Other expenses.

Loss of original properties

The average annual cost of OPF is determined taking into account depreciation and amortization. This is due to the fact that with prolonged use of the products in the technological process, they quickly lose their original properties. The degree of wear can vary and depends on various factors. These include, in particular, the level of operation of the facilities, the qualifications of the personnel, the aggressiveness of the environment, etc. These factors influence various indicators. Thus, to determine capital productivity, an equation is first drawn up, which establishes the average annual cost of the general fund (formula). Capital-labor ratio and profitability depend on revenue and the number of employees.

Book value of fixed assets: features and differences from the market

The book value differs significantly from the market value of the property due to the difference between the mechanisms that determine them. The book value of an enterprise is formed by combining the actual expenses incurred for the acquisition of fixed assets by the company, and therefore cannot be an accurate assessment of the value of the asset, since it does not reflect its real market price. Market value always depends on elements of competition, demand and demand. It is formed by the amount that the buyer is able and willing to pay. By and large, these two values are in no way related to each other and can be polar different in the assessment of the same object.

For example, a company's workshop equipment with complete wear and tear (zero cost) is in excellent working condition and is in demand on the market. It will be sold for 1 million rubles. This example demonstrates the significant differences between the residual book value of an asset and its market price.

However, there are also completely opposite cases. For example, a new machine with a book value of 500 thousand rubles. the enterprise is trying to sell, but due to obsolescence, estimated at 200 thousand rubles, it can only be sold for 300 thousand rubles. That is, the book value of the object in this example is greater than the proposed market value, which resulted in a loss-making transaction.

Fixed assets in the balance sheet

are reflected in line 1150 of the “Non-current assets” section. Read about the features of data generation for this line in our material.

Obsolescence

It means the depreciation of funds even before the physical loss of properties. can manifest itself in two forms. The first is due to the fact that the production process reduces the cost of products in the areas in which they are produced. This phenomenon does not lead to losses, since it is the result of an increase in savings. The second form of obsolescence arises due to the emergence of such OPFs, which are characterized by high productivity. Another indicator that is taken into account is depreciation (the process of transferring the cost of funds to manufactured products). It is necessary to form a special cash reserve for the complete renovation of facilities.

Average annual cost of OPF: formula for calculating the balance sheet

To determine the indicator, it is necessary to use the data that is present in They must cover transactions not only for the period as a whole, but also separately for each month. How is the average annual cost of open pension fund determined? The balance formula used is as follows:

X = R + (A × M) / 12 - / 12, where:

- R - initial cost;

- A is the value of the introduced funds;

- M is the number of months of operation of the introduced OPF;

- D is the liquidation value;

- L is the number of months of operation of retired funds.

OS put into operation

As can be seen from the information above, the equation by which the average annual cost of open pension fund is determined (formula) includes indicators that require separate analysis. First of all, the initial price of the funds is established. To do this, take the amount of the account balance at the beginning of the reporting period. 01 balance sheet. It should then be analyzed whether any fixed assets were introduced during the period. If this was the case, you need to set a specific month. To do this, you should look at the revolutions by db sch. 01 and establish the value of the funds put into operation. After this, the number of months in which these OSs were in use is calculated and multiplied by the cost. Next, the average annual cost of OPF is determined. The formula allows you to determine the cost of the funds put into use. To do this, the figure obtained by multiplying the number of months of use by the initial price of the OS is divided by 12.

Disposal

During the analysis, in addition to the funds put into operation, written-off funds are determined. It is necessary to establish in which month they dropped out. To do this, the revolutions are analyzed according to Kd sch. 01. After this, the value of the disposed funds is determined. When writing off fixed assets during the entire reporting period, the number of months in which they were in use is established. Next, you need to determine the average annual cost of the disposed funds. To do this, their price is multiplied by the difference between the total number of months in the entire reporting period and the number of months of operation. The resulting value is divided by 12. The result is the average annual cost of general purpose assets that have left the enterprise.

Final operations

At the end of the analysis, the total average annual cost of the open pension fund is determined. To do this, you need to add up their initial cost at the beginning of the reporting period and the indicator for the funds put into operation. The average annual cost of fixed assets removed from the enterprise is subtracted from the resulting value. In general, the calculations are not complicated or labor-intensive. When calculating, the main task is to correctly analyze the statement. Accordingly, it must be compiled without errors.

The balance sheet of an enterprise accumulates all information about the availability of property (assets) and the sources of its receipt (liabilities) as of a certain date, i.e., it reflects the financial condition and demonstrates this information to users. The first section of the balance sheet is devoted to non-current assets, a significant proportion of which are fixed assets. Let us recall how fixed assets are reflected in the balance sheet by looking at a specific example.

Literature

- PBU 6/01

- IFRS 16 “Property, Plant and Equipment”

- Astakhov V.P. Accounting (financial) accounting: Textbook. 5th edition, revised and expanded. — Moscow: ICC “Mart”; Rostov NlD: Publishing House, 2004. - 960 pp. (Series “Economics and Management”);

- Babaev Yu. A. Accounting theory: Textbook for universities. — 2nd ed., revised. and additional - M.: UNITY-DANA, 2001.-304 p.;

- Babaev Yu. A. Accounting: Textbook for universities. - M.: UNITIDANA, 2002. - 476 p.;

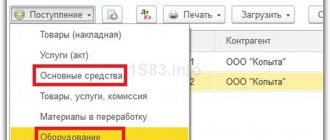

Example 2

A manufacturing company decided to create a new warehouse for storing materials and goods. The construction of the building was carried out by the company’s workers, the final cost of the work according to the estimate was 10 million rubles.

The accounting transactions show:

Dt08.03 Kt60,10,70, 69, etc.

10 million rubles – the actual costs of building a warehouse are taken into account (salaries of employees involved in construction, insurance contributions from wages, cost of materials expended (according to the act of writing off inventories), costs for additional services of contractors (for example, drawing up estimate documentation), etc.) .

Dt01 Kt08.03

10 million rub. – a new warehouse building was registered and put into operation

What applies to fixed assets

These assets include property that supports the production and management process of the company - buildings, structures, plots of land, perennial plantings, machine tools, equipment, power machines, vehicles, etc. The cost of recorded fixed assets is formed from the costs aimed at their acquisition (manufacturing), and is gradually repaid by monthly depreciation. This is carried out using one of the methods chosen by the company and enshrined in the accounting policy (clause 48 of PBU dated July 29, 1998 No. 34n):

- reducing balance;

by the sum of numbers of years of SPI (useful life);

in proportion to the volume of output (work, services).

Please note that not all fixed assets are depreciated. For example, land, environmental management facilities, road facilities, museum exhibits, housing stock, mobilization funds in conservation, as well as property owned by non-profit organizations are not subject to traditional depreciation charges.

In terms of liquidity, fixed assets are considered low-liquidity assets, since it is often impossible to immediately turn them into means of payment and quickly sell them if necessary.

Details

Note from the author! Line 1150 can display information about the debit balance of account 08 for subaccounts 01-04 (in terms of fixed assets) and the debit balance of account 07. The company makes the decision to include data independently (if the data is unimportant, the balances can be displayed on line 1190).

Fixed assets are understood as assets of an organization intended for long-term use for the purposes of the company.

According to the accounting rules, in order to accept acquired assets on the balance sheet as fixed assets, certain conditions must be simultaneously met:

- Asset purpose:

production of company products, performance of work, services;use for management needs;

leasing – transfer of an asset for temporary use and possession to third parties or temporary use.

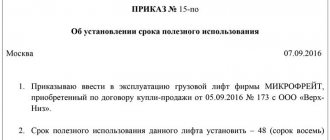

- The useful life of the object is more than 12 months or during the operating cycle (when the cycle is more than a year).

- When purchasing an asset, the company does not have the goal of further resale of the object.

- The use of an asset affects the company's income: the asset's ability generates economic benefits for the firm with continued use.

Note from the author! Assets acquired solely for rental purposes are shown on the balance sheet as income-generating investments in tangible assets.

Fixed assets are expensive objects used by the company for a long time:

- buildings, structures;

- production equipment (for example, machines);

- control devices and computer technology;

- transport;

- expensive household equipment;

- livestock;

- perennial plantings;

- natural resources: land, water, etc.

Fixed assets on the balance sheet and their valuation

Since fixed assets are a long-term asset (with a service life of more than a year) and tend to gradually wear out during operation, its value changes at each reporting date, that is, the assessment of the recorded fixed assets changes depending on revaluations or due to depreciation charges, unless, of course, it relates to depreciable property. Depreciation is a regulatory indicator that affects the value of fixed assets.

Fixed assets are reflected in the balance sheet at cost reduced by the amount of accrued depreciation (clause 35 of PBU 4/99), i.e. at residual value. In the company's balance sheet, the valuation of fixed assets is indicated at the residual value: the original value minus depreciation.

In accounting, the initial (or replacement after revaluation) cost of fixed assets is taken into account as the debit of account 01 “Fixed assets”, and the amount of accrued depreciation is recorded as a credit of account 02 “Depreciation of fixed assets”. Accordingly, the residual value is calculated as the difference between the amounts of initial cost and depreciation (D/t 01 minus K/t 02).

In the form of the balance sheet, a separate line 1150 “Fixed assets” is provided to reflect the amount of fixed assets valuation as of the reporting date.

Leased fixed assets are subject to separate accounting in account 03 “Income-generating investments in tangible assets”. Depreciation on them is calculated in the same way as on all fixed assets on the account. 02, recorded in the analytical accounting registers, and the residual value of such property occupies line 1160 “Profitable investments in materiel” in the balance sheet.

Example

The company has OS objects presented in the table. Depreciation is calculated using the straight-line method (original cost / number of months of service = depreciation amount per month). The land plot is not subject to depreciation; other objects are depreciated.

| Initial cost as of 01/01/2016 (in rubles) | Accrued depreciation | |||

| Plot of land | ||||

| Equipment | ||||

| Lathe | ||||

| Total | 6 960000 | 413 830 | 413 830 | 413 830 |

In the balance sheet in line “1150” the presence of OS will be reflected as follows:

- at the beginning of 2021 – RUB 6,960,000;

at the end of 2021 – RUB 6,546,170. (6,960,000 – 413,830).

Since January 2021, the company has leased out the lathe. The accountant, based on the order of the manager, opened an analytical accounting register, and the cost of the machine is 308,570 rubles. (360,000 – 51,430) was transferred from account 01 to account 03 and included in the balance line “1160”. At the end of 2021, it includes a machine valuation in the amount of 257,140 rubles. (308,570 – 51,430);

In line “1150” at the end of 2021, the cost of the operating system was 5,875,200 rubles. (6,546,170 – 308,570 – 300,000 – 62,400).

Under the terms of continued rental of the machine in 2021, the following lines are filled in the balance sheet:

- “1150” in the amount of RUB 5,512,800. (5,875,200 – 300,000 – 62,400);

“1160” in the amount of 205,710 rubles. (257,140 – 51,430).

The row data is summed up and ultimately reflected in the first section of the balance sheet (line “1100”). For fixed assets in the balance sheet as of December 31, 2021, the entries look like this:

| Indicator name | ||||||||||||

| ASSETS | ||||||||||||

| I. NON-CURRENT ASSETS | ||||||||||||

| Intangible assets | ||||||||||||

| Research and development results | ||||||||||||

| Intangible search assets | ||||||||||||

| Material prospecting assets | ||||||||||||

| Fixed assets | ||||||||||||

| Profitable investments in material assets | ||||||||||||

| Financial investments | ||||||||||||

| Deferred tax assets | ||||||||||||

| Other noncurrent assets | ||||||||||||

| Total for Section I | 5 718 510 | 6 132 340 | 6 546 170 | |||||||||

There are the following types of valuations of fixed assets: full and residual book value, full and residual replacement value.

Full book value

(a kind of “initial cost”) is formed at the moment the object enters into operation.

Depending on the source of receipt of fixed assets, their initial cost is understood as:

The cost of fixed assets contributed by the founders towards their contribution to the authorized capital of the enterprise by agreement of the parties;

The cost of fixed assets manufactured at the enterprise itself, as well as purchased from other enterprises or persons - in the amount of actual costs, including costs of delivery, installation, installation;

The cost of gratuitously received fixed assets, as well as funds allocated as government subsidies.

Replacement cost

- its essence is as follows: every year buildings, machines, equipment are put into operation, but at each time stage the prices for means of production differ (for example, it is obvious that two buildings of the same type, one of which was built in 1980, and the other - in 1995, have different prices). As a result, the balance sheets of industrial enterprises include fixed production assets acquired at different times and therefore valued at different prices, i.e., in fact, they are expressed in incomparable prices. To evaluate fixed assets at uniform prices, their periodic general revaluation (according to a single methodology and all sectors) is required. Such revaluation was last carried out on January 1, 1995, and the full book value of fixed assets based on inventory results as of January 1, 1992 was taken as the initial basis.

wear out during use

.

The monetary expression of losses by objects of their physical and technical-economic qualities is called depreciation of fixed assets. The original cost minus the amount of depreciation is called the “residual value of fixed assets”

.

The replacement cost of fixed assets minus depreciation is called “residual replacement cost”

. The degree of depreciation (in percentage) of each individual object after revaluation must remain equal to its degree of depreciation before the first assessment according to accounting data.

BALANCE OF FIXED FUNDS

is a statistical table, the data of which characterize the volume, structure, reproduction of fixed assets for the economy as a whole, industries and forms of ownership.

According to the data of this balance, indicators of depreciation, suitability, renewal, disposal, and use of fixed assets are calculated. Data on the availability of fixed assets is used to calculate indicators of capital intensity, capital-labor ratio, capital productivity and other important economic calculations. The balance of fixed assets is compiled by statistical authorities at the federal and regional levels at full and residual (less depreciation) value. Both balances can be compiled according to the balance sheet valuation in current prices, in average annual prices or in constant (base period) prices.

Average annual cost of fixed assets (FPE)

- an indicator that any accountant needs to calculate property taxes. We will explain below how to calculate the indicator and where to get the formula from.

Why is it necessary to determine the book value of assets?

Economic services calculate the value of assets for various purposes.

In particular, find out the absolute value of the property as a whole or by its constituent elements, for example, exclusively fixed assets, intangible assets or liabilities. Informing partners and users - investors, founders, insurers - is the responsibility of the enterprise, and they have the right to request various information, and first of all, about the condition of assets. For them, a “Certificate on the book value of assets” is provided, which is based on the specified calculation formula and, although not a mandatory form, is compiled quite often. We will learn how to calculate the book value of an enterprise's assets, and for what purposes such calculations are carried out. The book value of assets is necessary, first of all, when analyzing the financial activities of the company - the main tool for assessing the production and financial condition of the company. This indicator is used when calculating intra-company values:

▪ return on property, which determines the amount of profit that the company receives from each ruble invested in the purchase of raw materials and production of the product.

▪ asset turnover demonstrating the effectiveness of their use.

Legislators have established the obligation to establish the amount of assets when concluding major transactions. To determine the value of the transaction, the book value of assets and the value of property sold under the concluded agreement are calculated. If the size of the assets being sold exceeds a quarter of the value of all assets on the balance sheet, then the transaction is considered large. In order to implement such an agreement, it is necessary to fulfill the conditions of the current legislation - to achieve a positive decision at the meeting of shareholders on the issue of the sale of property. In addition, it is necessary to correctly calculate the value of assets. If this value is set incorrectly or not calculated at all, the transaction can quite legally be declared void or terminated. Let's look at how to determine the book value of assets on the balance sheet:

| Indicator name | Line code | as of 12/31/16 | as of 12/31/15 |

| 1. Non-current assets: | |||

| NMA | |||

| OS | 689 500 | 721 000 | |

| Total for 1 section | 689 535 | 721 048 | |

| 2. Current assets: | |||

| Reserves | |||

| VAT on purchased assets | |||

| Accounts receivable | |||

| Cash | 2 451 | 3 054 | |

| Total for section 2 | 6 563 | 9 557 | |

| BALANCE | 696 098 | 730 605 |

From the universal form of the balance sheet, which already contains the calculation formula, it is easy to understand how to calculate the book value of assets on the balance sheet: line 1600 accumulates the values of lines 1100 and 1200, i.e.

689,535 tr. + 6,563 tr. = 696,098 tr. – book value of assets at the end of 2021, and 721,048 tr. + 9,559 tr. = 730,605 tr. – amount of assets as of December 31, 2015.

In turn, lines 1100 and 1200 are the sum of the lines included in the corresponding sections. Each line contains information about the availability of the corresponding assets.

For example, as of December 31, 2021, the company has intangible assets in the amount of 35 thousand rubles, fixed assets - 689,500 thousand rubles, inventories - 3420 thousand rubles. etc.

By analyzing line-by-line values, for example, comparing the values of line 1210, the economist builds the dynamics of changes in the availability of an asset over control periods of time. In the course of analytical work, the economist is faced with such a concept as the market value of assets, which is the price of property at which it can be sold at the moment. This value cannot be seen on the balance sheet and is used only as a marker that determines the value of existing assets.

Formula for calculating the average annual cost of fixed assets

Since the procedure for paying taxes is fixed in the Tax Code, the formula for calculating any tax can be found there. Property tax is no exception.

The tax base for calculating property tax is the average annual cost of fixed assets.

The detailed calculation procedure is described in clause 4 of Art. 376 Tax Code of the Russian Federation.

GHS = (A1 + A2 + A3 + A4 + A5 + A6 + A7 + A8 + A9 + A10 + A11 + A12 + B1) / 13

, Where

SGS - average annual cost;

A2-A12 - the residual value of the property on the 1st day of each month, where the figure is the serial number of the month (for example, A3 - the residual value as of March 1);

The denominator of the formula contains the number 13 - this is the number of months in the tax period increased by one (12 + 1). The numerator ultimately also adds up 13 indicators.

Tax reporting on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Try it

Results

To reflect fixed assets in the balance sheet, a specific line (1150) is allocated in the section devoted to non-current assets. This property includes objects of a certain value (above 40,000 rubles) and service life (over 1 year). On the balance sheet, this cost is shown reduced by the amount of depreciation. Situations of changes in value associated with additional equipment (reconstruction, partial write-off) and revaluation are disclosed in the appendices to the balance sheet.

- New

- Popular

- Discussed

Division of an apartment between owners

21.01.2021

Coefficients fa What is pb

21.01.2021

Economic system and its

21.01.2021

Rosreestr portal - reference information on objects

21.01.2021

How to get Priority Pass: where to apply for a card on the best terms

21.01.2021

Financial programs Openbravo

21.01.2021

Creating the Most Desirable Product: Exploring Banknote Design

21.01.2021

Banknotes with an unusual design that are a pity to spend

21.01.2021

Accounting for the buyer of a bonus product with a “zero” price

21.01.2021

How to check out of the hostel When can you check out of the hostel

21.01.2021

- Magnit promotion - Star Wars How to get a Star Wars figurine

- Percent of a number calculator

- A couple of thousand dollars in recycling fee to catch up, or when Russian cars turn out to be not so cheap Recycling fee for cars in Belarus size

- How to find out online the class of driver and KBM for compulsory motor insurance using the RSA database

- Calculation of maternity benefits. How to calculate maternity benefits. What determines the size of maternity benefits?

© Copyright 2021, starcoins.ru - Credit. Microloans. Electronic money. Debit cards. Credit cards.

Calculation of the average cost of fixed assets with an example

Average cost differs from average annual cost in that it is used only when calculating advance property tax payments.

An example of a formula for calculating the average cost for six months:

CC = (A1 + A2 + A3 + A4 + A5 + A6 + B1) / 7,

Where

СС - average cost;

A2-A6 - the residual value of the property on the 1st day of each month, where the figure is the serial number of the month (for example, A3 - the residual value as of March 1);

Unlike the formula for calculating the average annual cost, in the above formula all indicators are taken as of the 1st day of the month; data at the end of the month is not used.

Note!

The calculations do not use the residual value of objects that are not subject to property tax or are recorded at cadastral value.

Example

.

Auto-jazz LLC repairs premium cars. Auto-jazz has repair equipment on its balance sheet.

Residual value of fixed assets in rubles:

as of 01/01/2018 - 589,000;

as of 02/01/2018 - 492,000;

as of 03/01/2018 - 689,000;

as of 04/01/2018 - 635,000.

In February, new equipment was purchased, as a result of which the residual value at the beginning of March became higher.

Let's calculate the average cost for January - March:

SS = (589,000 + 492,000 + 689,000 + 635,000) / 4 = 601,250.

Indicators of condition, movement and efficiency of use of fixed assets

- Indicators of the state of the OF.

- Depreciation coefficient of funds: Kizn = Depreciation / Full Cost

- Funds validity coefficient: Kgodn = Residual Cost of the Fund / Full Cost

- Indicators of movement (reproduction) of fixed assets

- Receipt coefficient = Cost of PF received in a given year / Total cost of PF at the end of the year

- Renewal coefficient = Cost of new funds introduced in a given year / Total cost of PF at the end of the year

- Retirement rate = Cost of PF retired during the year / Full cost of PF at the beginning of the year

Example No. 1. The main production assets of the enterprise at the beginning of 1995 amounted to 2825 million rubles. The entry and disposal of fixed assets during the year are reflected in the table:

Determine the average annual and output cost of fixed production assets (cost at the end of the year). Solution: Residual value at the beginning of the year: C est. = 2825 million rubles. During the year the following fixed assets were received:

million rubles During the year, fixed assets were disposed of: Cost of fixed assets disposed of: RUR million. Cost of fixed assets at the end of the year: C y.o. = C n.g. + C p - C b = 2825 + 100.833 - 12.333 = 2913.5 million rubles.

With OF = (C NG + C CG)/2 = (2825+2913.5)/2 = 2869.25 million rubles.

K rev = C new / C k.g. = 170/2913.5 = 5.83% The share of new fixed assets in their total volume was 5.83%.

K select = C in /C n.g. = 23/2825 = 0.81% The share of disposed fixed assets during the year in their total value was 0.81%.

Example No. 2. The following data are available on the movement of fixed production assets of the enterprise: Total initial cost of fixed assets 420 at the beginning of the year, million rubles. During the year, million rubles: new funds introduced 60 disposed of at residual value 8 Total initial cost of disposed funds, million rubles. 40 Depreciation of fixed assets at the beginning of the year, % 30 Annual depreciation rate, % 15 It is necessary to construct a balance sheet of fixed assets at full and residual value. Solution: Total initial cost at the beginning of the year: C . = 420 million rubles. Residual value at the beginning of the year: C est. = 420*(100-30)% = 294 million rubles. Cost of received fixed assets: C p = 60 million rubles. Cost of retired fixed assets at original cost: C in = 40 million rubles. Cost of retired fixed assets at residual value: C rest = 8 million rubles. Cost of fixed assets at original cost at the end of the year: C y.o. = C n.g. + C p - C b = 420 + 60 - 40 = 440 million rubles. Depreciation charges for the year: A = C k.g. x HA = 440 * 15% = 66 million rubles. Residual value of fixed assets at the end of the year: C est. = C rest n.g. + C rest p - C rest b - A = 294 + 60 - 8 - 66 = 280 million rubles. Average annual cost of funds at initial cost: C OF = (C of the current year + C of the current year)/2 = (420+440)/2 = 430 million rubles. Average annual cost of funds at their original cost: C ost OF = (C ost NG + C ost KG)/2 = (294+280)/2 = 287 The depreciation coefficient shows what part of its total value the fixed assets are already lost as a result of their use. K and n.g. = 30% K and k.g. = (C k.g. -C rest k.g.)/C k.g. = (440-280)/440 = 36.36% Depreciation of fixed assets increased (36.36-30 = 6.36%). The serviceability coefficient shows what part of its total value the fixed assets have retained as of a certain date. K and n.g. = C rest n.g. /C n.g. = 294/420 = 70% K and k.g. = C ost k.g. /C k.g. = 280/440 = 63.64% The renewal coefficient (K rev) characterizes the share of new fixed assets in their total volume (according to full assessment) at the end of the period and is calculated using the following formula: K rev = C new / C k.g. = 60/440 = 13.64% The share of new fixed assets in their total volume was 13.64%. The retirement coefficient (K vyb) characterizes the share of retired fixed assets during the period in their total value (at full valuation) at the beginning of the period and is calculated by the formula: K vyb = C in /C ng. = 8/420 = 1.9% The share of retired fixed assets during the year in their total value was 1.9%.

Example No. 3. The following data is available on the movement of fixed production assets throughout the enterprise for the year: the full book value of fixed production assets at the beginning of the year, 2248 thousand rubles. depreciation rate at the beginning of the year, 30%; new fixed production assets were put into operation during the year, 200 thousand rubles. received from other enterprises at full cost, 40 thousand rubles. their residual value as of the date of receipt, 36 thousand rubles. fixed production assets were disposed of at residual value, 10 thousand rubles. percentage of depreciation of retired assets 70 average annual depreciation rate, 7%

Determine: 1) The volume of fixed production assets at full book value and at residual value at the end of the year; 2) Indicators of the movement of fixed production assets (renewal and disposal rates); 3) Depreciation and serviceability rates at the end of the year.

Production assets are the main assets of the enterprise, which play a major role in determining the profit of the production cycle. Their book value is calculated by the formula: initial cost minus depreciation charges.

How to determine the average annual cost of fixed assets on the balance sheet in thousand rubles.

The balance sheet is an excellent source for determining and analyzing the return on assets.

The average annual value of property is often used for analysis. To do this, you need to take the figures recorded in Section I of the balance sheet under the line “Fixed assets”. For comparison, two years are taken, for example the reporting year and the previous one.

SGS = (Gotch + Gpred) / 2, where

Gotch - the cost of the OS at the end of the current year;

Gpred - the cost of the operating system at the end of the previous year.

Let's consider an example of calculating the GHS from the balance sheet

. Auto-jazz LLC repairs premium cars. Auto-jazz has repair equipment on its balance sheet. The cost of the operating system on the balance sheet as of December 31, 2017 is 983,000 rubles, and as of December 31, 2018 - 852,000 rubles.

To get the GHS, we use the above formula:

GHS = (983,000 + 852,000) / 2 = 917,500 rubles.

Fixed assets in the balance sheet

are reflected in line 1150 of the “Non-current assets” section. Read about the features of data generation for this line in our material.

Structure of fixed assets

Fixed assets in the balance sheet are reflected in the group of non-current assets. They are used in production activities and evenly distribute the entire amount of the cost of fixed assets to accrue the calculation of manufactured finished products or services produced.

Fixed assets consist of:

- Real estate (buildings, structures);

- Owned land plots;

- Transport (cars);

- Equipment and inventory for the production process;

- Motor transport and mobile mechanisms;

- Computer technology;

- Measuring instruments;

- Pets;

- Green spaces grown over a long period of time;

- Roads owned by the company;

- Expensive expenses for land enrichment;

- Capital investments in leased real estate fixed assets.

Depreciation charges gradually reduce the original cost of objects. The service life of the OS is calculated according to the new OKOF classifier from 2021.

It is important to take into account that regardless of the results of the company’s financial and economic activities (profitable or unprofitable), the amount of costs for depreciation of fixed assets remains the same.

What is considered a fixed asset?

Fixed assets include property assets that can be used as production assets necessary for the manufacture of products (providing services, carrying out work), as well as property used to manage the company. The fixed assets include:

- buildings and constructions;

- land;

- equipment;

- auto, motorcycle and other equipment;

- computing devices;

- measuring instruments;

- household equipment;

- farm livestock;

- perennial plantings;

- on-farm, logistics roads and railways, as well as other similar assets.

Fixed assets also include capital investments in the land fund (carrying out work that significantly improves the quality of agricultural land), environmental management facilities, as well as completed capital investments in leased property.

The cost of registered fixed assets consists of all costs associated with their acquisition and is repaid through depreciation. Depreciation charges are made using one of the methods chosen by the enterprise (clause 48 of the PBU for accounting and accounting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n):

- linear;

- reduction of balance;

- by the sum of the numbers of years of useful life;

- in proportion to the volume of production.

NPO property is not depreciated. The cost of land and mining facilities, water and other subsoil is not repaid.

Kinds

To account for fixed assets, determine their composition and structure, their classification is necessary. There are the following groups of fixed production assets (including according to Russian PBU 6/01):

- Buildings (shop buildings, warehouses, production laboratories, etc.);

- Structures (engineering and construction facilities that create conditions for the production process: overpasses, highways, tunnels);

- On-farm roads;

- Transmission devices (electricity networks, heating networks, gas networks);

- Machinery and equipment, including: Power machines and equipment (generators, electric motors, steam engines, turbines, etc.).

- Working machines and equipment (metal-cutting machines, presses, electric furnaces, etc.).

- Measuring and regulating instruments and devices, laboratory equipment.

- Computer Engineering.

- Automatic machines, equipment and lines (automatic machines, automatic production lines).

- Other machinery and equipment.

The following are also taken into account as part of fixed assets: capital investments for radical improvement of land (drainage, irrigation and other reclamation works); capital investments in leased fixed assets; land plots, environmental management objects (water, subsoil and other natural resources).

Cost of fixed assets on the balance sheet: line 1150

In accounting, fixed assets include assets worth more than 40,000 rubles. with a service life of more than a year. In the balance sheet, fixed assets are reflected in the amount of their value reduced by the amount of depreciation (i.e., at the residual value).

To learn how the residual value of fixed assets is determined, read the material

“How to determine the residual value of fixed assets .

In the case of additional equipment (reconstruction, partial write-off) of fixed assets, leading to a change in the initial cost, this information is reflected in the appendices to the balance sheet.

The same applies to the case of revaluation of property, carried out by indexing the replacement cost of assets or by direct recalculation to the actual market value. Any differences that arise are credited to additional capital.

Disclosure of information in accounting. reporting

In the bay. reporting must disclose the following information:

- About the inventory price of the object, as well as depreciation accrued on it at the beginning and end of the reporting period;

- On the movement of financial assets during the reporting period;

- On methods for assessing PF that were received under contracts that provide for payment in kind;

- About PF objects, the cost of which is not repaid;

- On changes in the price of the PF at which they were accepted for accounting (revaluation, retrofitting, reconstruction and other situations);

- About the PF, handed over or leased;

- About the SPI of objects accepted by the company;

- On methods for calculating depreciation for certain groups of financial assets;

- About PF, which are taken into account as part of profitable investments in inventory and materials;

- About real estate that has been accepted for registration and is actually being operated, but is in the process of state registration. registration.

Purpose of the service.

Using the online service, the average annual cost of fixed assets and the balance of movement of fixed assets at the full initial and residual value are determined. Fixed assets (fixed assets) are non-financial produced assets (part of the property) used by an organization repeatedly or continuously for a long time (more than 12 months) in the production of products (performance of work, provision of services), as well as for management purposes.

Building

- these are architectural and construction objects intended for living, working, serving the population and storing material assets, having walls and a roof as the main structural parts.

Structures

- engineering and construction facilities designed to carry out the production process and various non-production functions, for example pipelines, power lines, overpasses, bridges, roads, parking lots, platforms, fences, etc.

Machinery and equipment

- power, working, information devices , transforming energy, materials and information.

Vehicles

are vehicles designed to move people and goods.

Full original cost

— the cost of the general fund in the prices taken into account when they were placed on the balance sheet.

Residual cost

– this is the cost of fixed assets at the prices at which they were put on the balance sheet, taking into account depreciation AND as of the date of determination. OPS = PPP – I

Book value of the PF at the end of the year: C y.o. = C n.g. + C in xT 1 /12 - C out xT 2 /12 where T 1 is the number of full months during which the funds received in the reporting year were valid; T 2 – the number of full months during which the funds disposed of in the reporting year were not active.

Average annual cost of fixed assets: C = (C ng + C kg) / 2

The systematic accumulation of funds in the depreciation fund is ensured through annual depreciation charges A, included in the cost of manufactured products. Depreciation charges for fixed assets during the reporting period are calculated monthly, regardless of the calculation method used, in the amount of 1/12 of the calculated annual amount. For newly received objects, depreciation is accrued from the 1st day of the month following the month the object was put into operation, and for retired objects it ends on the 1st day of the month following the month until the object is fully repaid or written off from accounting due to termination of the right property.

Scheme of the balance sheet of the enterprise's fixed assets at the full initial cost C kg. = C n.g. + C in - C select

Scheme of the balance sheet of the enterprise's fixed assets by residual value C kg. = C n.g. + C new + C in – C selected – A