At the end of the reporting period, companies are required to prepare and submit annual financial statements to regulatory authorities. In what composition and by what deadline do I need to submit annual financial statements for 2021?

The preparation of financial statements begins with checking the correctness of the generated turnovers and balances in the accounting accounts.

In the article “Priority tasks by January 1, 2021,” we present the main activities that an accountant needs to carry out before preparing financial statements.

Important!

If the turnover is formed in accordance with current accounting standards and the company’s accounting policies, and the accounting program provides the necessary detail of accounts, then the preparation of financial statements is, in fact, a technical work.

In addition, in many 1C software products there is an express check of accounting and analysis of the state of accounting. One of the purposes of such checks is to analyze accounting results, the presence of account balances that must be distributed, etc.

However, in a number of non-standard, complex business transactions, it would be useful for an accountant to trace the movement in the accounts of synthetic and analytical accounting and the correctness of the formation of the corresponding line of accounting statements.

Who should report to Rosstat

Statistical reporting is provided for any business entity, regardless of the type of their activity. Large organizations are required to report regularly; they often submit several reporting forms at once. Representatives of small and medium-sized businesses, as well as micro-enterprises, submit statistical reports when they participate in continuous statistical observations once every 5 years, and in the period between this they can be included in the Rosstat sample based on various criteria - type of activity, revenue volume, number, etc. (Resolution of the Government of the Russian Federation dated February 16, 2008 No.).

Reports within the framework of sample studies can be submitted quarterly or monthly, and for micro-enterprises only annual statistical reporting is acceptable (Clause 3, Article 5 of Law No. 209-FZ dated July 24, 2007).

Form p 3 statistics due dates in 2019

In line 30 you need to reflect the amount of revenue excluding VAT. This indicator is considered similar to the “Revenue” indicator in the “Income Statement”. Cost, selling and administrative expenses should be recorded in lines 31 and 32, respectively. The result of activities is shown in line 33. A separate line (34) includes revenue from the sale of fixed assets. Line 35 takes into account interest on the use of borrowed funds. Section 3 The third section is completed once a quarter. This section contains information on the types of current and non-current assets (lines 36–50). Line 50a is completed on the annual form. The indicators correspond to similar indicators in section 1 of the balance sheet. Section 4 To be completed once a quarter. The section contains information on goods shipped and services provided by country.

In 2021, most companies submit monthly Form P-4 statistics. The article contains a form that is current for 2021. Read how and when to fill out the form, who is exempt from reporting to statistics. Download for free the form P-4 statistics in 2018 Download a sample of filling out the form P-4 statistics in 2021 To whom and where must you report on form P-4 statistics in 2018 Report on form P-4 “Information on headcount and wages” workers" in 2021 (not to be confused with P-4 (N-3)) Rosstat must:

- commercial organizations;

- budgetary organizations;

- separate units of both;

- An individual entrepreneur who has employees.

Please note that for Rosstat it will not matter whether the constituent documents reflect data on a separate division or what role it plays in the structure of your business.

How to find out which forms of statistical reporting you need to report on

Having formed the sample, the territorial bodies of Rosstat are obliged to notify the individual entrepreneurs and organizations included in it of the need to submit the relevant reports, as well as provide forms for completion. If there was no such notification, individual entrepreneurs and companies can independently find out what forms they will use to report in 2018.

How can I find out from the statistics agency which reports (by TIN, OGRN or OKPO) need to be submitted in 2021? The easiest and fastest way is to go to the Rosstat website, on the page ]]>statreg.gks.ru]]> indicate your status (legal entity, individual entrepreneur, branch, etc.) and enter one of the listed details in the special fields. As a result, the system will generate a list of statistical reporting forms that a person must submit, indicating their name, frequency and submission deadline. If the list of statistical reporting forms for 2021 is empty, you do not need to report to Rosstat in this period. Information on the site is updated monthly.

Also, a company or individual entrepreneur can contact the territorial body of Rosstat with an official written request for a list of reports, but this will take much more time (clause 2 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

Statistical reporting 2018 - examples of updated forms

In 2021, the Statistical Office, as usual, updated most reporting forms.

Thanks to Rosstat Order No. 564 dated August 31, 2017, some of the reports on monitoring market services, tourism activities, transport and administrative offenses were updated. In particular:

- No. 1-round;

- No. 1-IP (,

- No. 1-TR (motor transport) “Information on freight vehicles and the length of non-public roads”;

- No. 1-AE “Information on administrative offenses in the economic sphere”, etc.

In addition, the updates also affected reporting related to monitoring agriculture, forestry, hunting, and the environment. Here it is worth noting order No. 545 dated August 24, 2017. As examples, we give the following forms:

- No. 2 “Production of agricultural products in personal subsidiary plots and other individual farms of citizens”;

- No. 4-cooperative “Information on the activities of agricultural consumer cooperatives”;

- No. 1-ЛХ “Information on forest reproduction and afforestation”;

- No. 2-TP (hunting) “Information on hunting and hunting management”;

- No. 4-OS “Information on current costs for environmental protection”, etc.

A complete list of federal statistical surveillance forms and accounting forms is published on the Rosstat website.

Statistical reporting forms and deadlines for their submission

Statistical forms can be grouped depending on the type of business entity: for example, statistical reporting of individual entrepreneurs, micro-enterprises, medium and small firms, large organizations; there are also forms on which all of the listed entities can report.

Some 2021 statistical reporting may only be intended for certain sectors of activity: agriculture, retail trade, construction, etc. You can also highlight statistical reports presented by the number and composition of personnel, volume of revenue, products produced, etc.

Each statistical form has its own deadlines for submission, violation of which can result in significant fines (Article 13.19 of the Code of Administrative Offenses of the Russian Federation): 10 – 20 thousand rubles. for officials, and 20-70 thousand rubles. For the company. Responsibility for repeated violation of deadlines for submitting statistical reports will increase to 30-50 thousand rubles. for responsible officials, and up to 100-150 thousand rubles. for the organization. The same penalties apply when submitting false statistical data.

If there are no indicators for filling out reporting, Rosstat must be notified about this in a letter, and it should be written every time the next reporting date occurs (clause 1 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

Along with statistical reports, legal entities are required to submit a copy of their annual accounting reports to Rosstat. Accounting “statistical” reports (including those in simplified forms) are submitted no later than 3 months after the end of the reporting year (for 2017, the deadline is 04/02/2018). For violating the deadline, officials can be fined 300-500 rubles, and the company 3-5 thousand rubles. (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Requirements for the preparation of financial statements

When preparing annual financial statements, a company must proceed from the fact that such statements must give a reliable picture of its financial position as of the reporting date, financial results and cash flows for the reporting period, which are necessary for users of these statements to make economic decisions (Article 13 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, hereinafter referred to as Law No. 402-FZ).

What does the accounting set include?

A set of financial statements for 2021 must be submitted to the tax inspectorate and statistical authorities no later than April 1, 2021* (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation, article 18 of the Federal Law).

*Note.

03/31/2019 falls on a day off, and therefore companies must submit financial statements for 2021 to the Federal Tax Service and statistical authorities no later than 04/01/2019.

The composition of the presented financial statements for 2021 is systematized in the table:

| Who represents | What forms | Reasons |

| Organizations not related to small businesses | Balance sheet | Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n, Letter of the Federal Tax Service of the Russian Federation dated July 16, 2018 No. PA-4-6/ [email protected] |

| Income statement | ||

| Statement of changes in equity | ||

| Cash flow statement | ||

| Report on the intended use of funds received | ||

| Small businesses | Balance sheet | Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n (Appendix No. 5), Letter of the Federal Tax Service of the Russian Federation dated July 16, 2018 No. PA-4-6/ [email protected] |

| Income statement | ||

| Non-profit organizations | Balance sheet | Order of the Ministry of Finance of the Russian Federation 07/02/2010 No. 66n, Information from the Ministry of Finance of the Russian Federation “On the peculiarities of the formation of financial statements of non-profit organizations” (PZ-1/2015), Letter of the Ministry of Finance of the Russian Federation dated July 4, 2018 No. 07-01-10/46137. |

| Income statement | ||

| Report on the intended use of funds |

Accounting statements can be provided both on paper and in electronic form. At the same time, the signature of the chief accountant on the paper form is not required (Order of the Ministry of Finance of the Russian Federation dated April 6, 2015 No. 57n). To date, the obligation to submit financial statements in electronic form has not been established (letter of the Federal Tax Service of the Russian Federation dated December 7, 2015 No. SD-4-3/21316, letter of the Ministry of Finance of the Russian Federation dated June 11, 2015 No. 03-02-08/34055).

Important!

Starting with reporting for 2021, tax authorities will accept financial statements only in electronic form through a specialized operator for electronic reporting (Federal Law of November 28, 2018 No. 444-FZ). Relief has been made for small businesses. “Kids” will be required to submit financial statements through a special operator for 2021.

Submission of statistical reporting in 2021

Please note that many reporting statistical forms have been developed for almost any economic sector and type of activity. Here we provide tables for statistical reporting relevant in 2021, some of them with deadlines for submission.

| Form | Kind of activity | Subject | Frequency and deadline for submission to Rosstat |

Statistical reporting in 2021, submitted regardless of the type of activity: | |||

| MP (micro) | All types | microenterprises | Annual, February 5 next year |

| PM | All types | small businesses | Quarterly, 29th day after the reporting quarter |

| 1-T | All types | legal entity other than SMP | Annual, January 20 next year |

| 1-T (working conditions) | All types | legal entity other than SMP | Annual, January 19 next year |

| 1-IP | All types except retail trade (excluding motor vehicle trade) | IP | Annual, March 2 next year |

| 1-enterprise | All types, except insurance, banks, government agencies, financial and credit organizations | legal entity other than SMP | Annual, April 1 next year |

| 1-T (working conditions) | All types | legal entity other than SMP | Annual, January 19 next year |

| P-2 | All types | legal entity other than SMP | Quarterly, 20th day after the reporting quarter |

| P-2 (invest) | All types | legal entity other than SMP | Annual, April 1 next year |

| P-3 | All types | Legal entity with a total capital of more than 15 people, except for self-employed enterprises | Monthly, 28th day after the reporting month Quarterly, 30th day after the quarter |

| P-4 | All types | legal entity other than SMP | Monthly, with MSS above 15 people. – 15th of the next month Quarterly, with SSCh 15 people. and less – the 15th day after the reporting quarter |

| P-4 (NZ) | All types | a legal entity with a social capital of more than 15 people, except for self-employed enterprises | Quarterly, 8th day after the reporting quarter |

| P-5 (m) | All types | a legal entity with a social capital of more than 15 people, except for self-employed enterprises | Quarterly, 30th day after the reporting quarter |

| P-6 | All types | legal entity other than SMP | Quarterly, 20th day after the reporting quarter |

| 5-З | All types, except insurance, banks, government agencies, financial and credit organizations | legal entity other than SMP | Quarterly, 30th day after the reporting period (1st quarter, half year, 9 months) |

| All types | legal entity, except SMEs and non-profit organizations | Annual, April 1 next year | |

| 12-F | All types, except insurance, non-state pension funds, banks, government agencies | legal entity other than SMP | Annual, April 1 next year |

| 18-KS | All types | legal entity other than SMP | Annual, February 4 next year |

Submission of statistical reporting in the field of trade: | |||

| PM-bargaining | Wholesale | SMEs, except microenterprises | Monthly, 4th day after the reporting month |

| 1-conjuncture | Retail | legal entity | Quarterly, 15th day of the second month of the reporting quarter |

| 1-conjuncture (wholesale) | Wholesale | legal entity, except micro-enterprises | Quarterly, 10th day of the last month of the reporting quarter |

| 1-removal | Trade | legal entity, except micro-enterprises | Quarterly - on the 5th day after the end of the quarter, annual - on March 1 of the next year |

| 1-TORG | Wholesale and retail trade | legal entity other than SMP | Annual, February 17 next year |

| 1-IP (trade) | Sale of goods to the public, repair of household products | IP | Annual, October 18 of the reporting year |

| 2-RC | Trade in certain goods | Individual entrepreneur and legal entity | Annual, March 30 next year |

| 3-TORG (PM) | Retail | SMEs, except microenterprises | Quarterly, 15th day after the reporting period |

Statistical reporting of organizations providing services: | |||

| 1-IP (services) | Paid services to the population | IP | Annual, March 2 next year, |

| 1-services | Paid services to the population | legal entity, legal entities (except for law offices) | Annual, March 1 next year |

| 1-YES (services) | Services | legal entity, except for microenterprises and non-profit organizations | Quarterly, 15th day of the second month of the reporting quarter |

| 1-manufacturer prices | Manufacturing and services | Individual entrepreneurs and legal entities, except micro-enterprises | Monthly - 22nd of the reporting month, annual - March 11th of the next year |

What reports should be submitted to statistics for those involved in agriculture: | |||

| P-1 (СХ) | Agricultural activities | legal entity, except SMP and peasant farms | Monthly, 3rd day after the reporting month |

| 1-farmer | Sowing crops | SMP, peasant farm, individual entrepreneur | Annual, June 11 of the reporting year |

| 2-farmer | Sowing crops and perennial plantings | SMP, peasant farm, individual entrepreneur | Twice a year on October 2 and November 2, or once a year on November 21 of the reporting year |

| 3-farmer | Availability of farm animals | SMP (monthly), individual entrepreneurs and microenterprises (once a year) | 2nd day after the reporting month, or January 6th after the reporting year |

| 1-purchase prices | Agricultural production | legal entity other than peasant farms | Annual, March 2 next year |

| 2-purchase prices (grain) | Purchase of domestic grain for main production | legal entity | Menstruation, 15th of next month |

| 1-СХ-prices | Agricultural activities | legal entity, except peasant farms and microenterprises | Monthly, 20th of the reporting month |

| 1-СХ (balance) – urgent | Purchase, storage, processing of grain and its processed products | legal entity | Quarterly, 7th day after the reporting quarter |

| 10-MEH (short) | Agricultural activities | legal entity, except peasant farms and microenterprises | Annual, January 20 next year |

| 29-СХ | Agricultural activities in the presence of sown areas, hayfields, or only perennial plantings | legal entity, except SMP and peasant farms | Annual, |

Statistical reporting 2021 - deadlines for the mining industry: | |||

| 1-IP (month) | Extraction and processing; production and distribution of gas, steam, electricity; fishing, logging | Individual entrepreneur with 101 or more employees. | Menstruation, 4th working day of the next month |

| MP (micro) - nature | Individual entrepreneurs and micro-enterprises with up to 15 people. | Annual, January 25 next year | |

| PM-prom | Individual entrepreneurs with employees from 16 to 100 people, small enterprises | Monthly, 4th working day after the reporting month | |

| 1-nature-BM | legal entity other than SMP | Annual, February 10 next year | |

| DAP-PM | Mining, manufacturing, air conditioning, gas, steam, electricity | small businesses | Quarterly, 10th of the last month of the quarter |

| 1-DAP | legal entity other than SMP | Monthly, 10th of the reporting month | |

| IAP | Mining, manufacturing, air conditioning, gas, steam, electricity, water supply, sanitation, waste collection and disposal, pollution removal | legal entity, except micro-enterprises | Annual, October 10 of the reporting year |

List of statistical reporting for the oil and gas industry: | |||

| 1-TEK (oil) | Production of oil, associated gas and gas condensate | legal entity other than SMP | Annual, January 28 next year |

| 1-TEK (drill) | Drilling of the wells | legal entity other than SMP | Annual, January 28 next year |

| 2-TEK (gas) | Availability of gas wells on the balance sheet | legal entity other than SMP | Annual, January 28 next year |

| 6-oil | Oil production and refining | legal entity other than SMP | Quarterly, 30th |

| 1-motor gasoline | Production of motor gasoline and diesel fuel | legal entity other than SMP | Weekly, 1 day after the reporting week, until 12 noon. |

Construction statistics - reports in 2021: | |||

| DAS | Construction | legal entity, except micro-enterprises | Quarterly, 10th day of the second month of the reporting quarter |

| 9-KS | Construction | legal entity, except micro-enterprises | Monthly, 25th of the reporting month |

| 12-construction | Construction | legal entity other than SMP | Annual, January 15 of the current year |

Statistical reporting of transport enterprises: | |||

| 65-ETR | Operation and maintenance of urban electric transport | legal entity | Annual, January 25 next year |

| 65-autotrans | Transportation of passengers by buses and passenger taxis | legal entity, except micro-enterprises | Annual, February 10 next year |

| 1-TR (motor transport) | Transportation of goods by road; non-public roads on the balance sheet | legal entity, except micro-enterprises | Annual, January 25 next year |

| 11-GA | Air transportation | legal entities and their separate divisions | Quarterly, 15th day after the reporting quarter |

| 12-GA | Monthly, 7th day after the reporting quarter | ||

| 14-GA | Monthly, 15th day after the reporting quarter | ||

| 32-GA and 33-GA | Quarterly, 7th day after the reporting quarter | ||

| 1-TARIFF (auto), 1-TARIFF (ha), 1-TARIFF(more), 1-TARIFF (yellow), 1-TARIFF (pipe), 1-TARIFF (internal water) | Transportation of goods by road, air, sea, railway, pipeline, water transport | legal entity | Monthly, 23rd of the reporting month |

List of popular statistical forms

From time to time, Rosstat issues orders in which it approves new forms or cancels irrelevant ones.

In 2021, companies and individual entrepreneurs should be guided by Rosstat Order No. 419 dated July 22, 2019. This document contains forms for different enterprises.

In addition to the above order, Rosstat issues orders for individual forms. Thus, Rosstat Order No. 461 dated July 27, 2018 approved one of the most labor-intensive forms to fill out - Form 1-Enterprise.

Basic forms of statistical observation for medium and large companies

Organizations that are not related to small businesses submit various forms according to number, according to company turnover, according to fixed assets, according to wages, etc.

- Form 1-Enterprise - it must be sent to Rosstat annually before April 1 inclusive.

- Form 4-TER is submitted annually before February 16 after the reporting year.

- Form 1-technology is submitted annually before January 20 after the reporting period.

- Form P-1 - drawn up every month. It must be sent to Rosstat on the 4th working day of the month following the reporting month. For example, for July 2021, P-1 must be sent before 08/06/2020, because August 4 - Saturday. An organization has the right to send a report to statistics electronically or on paper.

- Form P-5 (m) is popular among quarterly reporting. Organizations submit it to the statistical authorities on the tenth working day after the end of the reporting period. For the 1st quarter of 2021, form P-5 (m) must be submitted by 04/14/2020 inclusive.

- The timing of some forms of statistics depends on the performance of the reporting company. For example, form P-4 has two reporting periods: month and quarter. Every month, no later than the 15th day after the reporting period, the form is submitted by all legal entities that meet one of the conditions provided by law. For example, the average number of employees over the previous two years was more than 15 people (including part-time workers and civil servants) or the annual turnover during this period was more than 800 million rubles. For companies with fewer than 15 employees and a turnover below 800 million rubles, the reporting frequency is quarterly. They need to submit P-4 to Rosstat by the 15th of each quarter after the reporting period. The exception is new and reorganized companies. They send P-4 in the general manner, namely monthly until the 15th day of the month following the reporting month.

- Form P-2 must be submitted by the 20th day of the month after the reporting quarter. The deadline for annual reporting is February 8.

In addition to the listed forms, Rosstat may require others to be submitted. Always clarify what exactly Rosstat needs from your organization. To do this, on the website https://websbor.gks.ru/webstat/#!/gs/statistic-codes, indicate the TIN, OKPO or OGRN, and perform a search. After this, you will be able to download a list of forms required for submission to Rosstat.

Basic forms of statistical observation for small businesses

The set of statistical reporting for small companies is much smaller than for medium and large businesses. Some companies even report only once every five years with continuous monitoring.

Federal Law No. 209-FZ dated July 24, 2007 assigns companies the obligation to submit reports to statistical authorities.

Most often, small businesses are faced with filling out the following forms:

- MP (micro) is due once a year until February 5th.

- MP (micro) - nature - annual form. The reporting person must submit the report to statistics electronically by January 25. But the law does not prohibit sending the form on paper within the same period.

- Individual entrepreneurs report in Form 1-IP annually until March 2.

- The PM form is submitted by small enterprises once a quarter before the 29th day of the month following the reporting quarter

In addition to these forms, there are forms for individual industries and areas among small businesses. For example, quarterly form 1-NANO contains data on the shipment of goods related to nanotechnology.

What does the list of reports depend on?

There is a rule according to which ordinary organizations submit documents to Rosstat every year, but individual entrepreneurs and small businesses do not submit documents at all or selectively. The list depends on the number of employees, type of activity, type of taxation. Thus, simplified statistical reporting for 2018 differs from OSNO.

Another important factor is whether the business is included in the sample. Rosstat conducts monitoring in two ways:

- Solid. A certain type of activity is determined (a list of OKVED codes) for which continuous observation is carried out. All companies and individual entrepreneurs that operate under these codes submit certain forms. So, if education is monitored, then in 2021 SVE statistical reports must be submitted.

- Selective. In a certain way, a list of companies is compiled that report on some activity. You can find out whether a company is included in the sample on the website or in TOGS.

Usually, if an enterprise is included in the sample, the responsible persons are notified about this by mail or by telephone.

In addition, absolutely all organizations in Russia, Moscow and the Moscow region submit statistical reporting for 2021 on financial indicators. This is the same set of forms that are submitted to tax authorities by March 31st.

Rosstat - reporting by TIN: verification algorithm

Identifying the full composition of statistical reporting will not take much time. To carry out Rosstat verification of TIN reporting, you only need a computer with access to the Internet and your organization’s TIN.

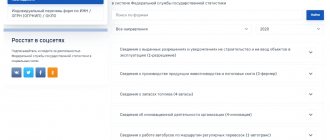

The first step is to switch to the official electronic portal: Rosstat - reporting of organizations by TIN. The appearance of the Internet portal page looks like this:

Step two - enter the organization’s details in order to check on the Rosstat website which reports to submit using the TIN. If the company’s TIN is unknown, then information can be obtained from OKPO or OGRN.

Step three - click the “Get” button. It is located directly below the fields for entering subject identification information. The system analyzes the entered details and almost instantly produces search results.

So, let's analyze the information received. The first part of the generated search results contains the registration codes of the economic entity. These codes are also contained in the Letter from Rosstat, which is sent to the organization upon initial registration. If the letter is lost, the codes can be checked here.

Next, the portal presents a list of Rosstat reporting forms for 2019, which this particular organization is required to submit.

Please note that the list discloses information not only about the name and frequency of provision of statistical reporting. In this section you can download current report formats for filling out electronically.

At the very end of the page, you can export the received information.

In simple words, an organization can download a list of reports or re-prepare and print a letter with codes from Rosstat.

Forms on which reports must be completed

Please note that the agency itself determines the format of reporting documents during participation in the study, and therefore provides forms that must be filled out. If you have been notified of inclusion in the sample, but have not received a reporting form, it is better to request one yourself. Likewise, in this case, it is better to independently check with representatives of the government agency about the deadlines for submitting statistical reports in 2021.

A list of organizations that are included in all Rosstat observations this year is publicly available on the agency’s website. Just go to the website www.gks.ru, then go to the section containing information for respondents and find the corresponding list there.

You can find your organization in this list or make sure that your company is not being monitored by using the details of your company. Just enter OKPO, INN or OGRN of your organization into the search and information system and click the “Get” button. After this, you can either find your organization in the list of monitored ones or not. If it turns out that your company was included in the study, then on the same website you can find all the deadlines for submitting statistical reports, as well as forms valid in 2021.

Another option is to send a written request to the department, to which you will receive an official response with all the clarifications you are interested in.

Form p-4

Important Attention! If for a month or even a longer period you have not paid wages to your employees, or the company is generally bankrupt, then you still need to report to state statistics in Form P-4. You need to send a report in form P-4 statistics to the territorial body of Rosstat of the Russian Federation at the location of the legal entity and separate divisions. Info And if the activity is not carried out at the location, then the report is submitted at the place of its actual conduct. Deadlines for submitting form P-4 statistics in 2018 In 2021, the same principles for deadlines for submitting form P-4 statistics will apply as in the previous year. That is, it all depends on the number of workers in the enterprise. The information is detailed by budget level:

- federal;

- regional;

- municipal.

If the employees to whom the enterprise owes money were employed in the execution of a state or municipal order, then the debt to them is duplicated in column 4 of the table in the main section of the form. 2.4. About the amount of the wage fund for the last month of salary calculation (page 07).

The fund must be shown for those months for which the debt is reflected on page 02 of the main section of the form. 2.5. On the number of employees to whom the company is late in paying wages (p.

08). 2.6. About outstanding debt:

- for 2021 (page 09);

- for 2021 and earlier (page 10);

- persons who were laid off in 2021 and earlier (p. 11).

The report in Form 3-F is signed by the head of the organization and the person responsible for submitting statistical reports.