Insurance premium calculator:

Link to the individual entrepreneur insurance premium calculator page. You may also need a payment order to pay insurance premiums for 2021.

If you are an individual entrepreneur, you are required to make fixed payments annually to the Pension Fund of Russia (aka PFR) and to the Federal Compulsory Medical Insurance Fund (aka FFOMS).

These payments are required to be made regardless of whether you are employed somewhere else, are conducting business, or are simply lying on the couch, being registered as an individual entrepreneur. Mandatory contributions of an individual entrepreneur are also not affected by the taxation system on which it is located (USN, OSNO, UTII, PSN - everyone pays!), nor the amount of your income or expenses. In any case, you are required to annually transfer fixed payments to these two funds (PFR and FFOMS).

This payment is fixed annually and indexed every year. Most often, of course, in a larger direction.

In 2021, Federal Law No. 322-FZ dated October 15, 2020 “On Amendments to Article 430 of Part Two of the Tax Code of the Russian Federation” was issued, according to which the amounts of contributions for 2021-2023 are changed. The data in the table below already takes these innovations into account.

| Year | Minimum wage | Pension Fund | FFOMS | Total |

| 2023 | Not important | RUB 36,723 | RUR 9,119 | RUB 45,842 |

| 2022 | Not important | RUB 34,445 | RUB 8,766 | RUB 43,211 |

| 2021 | Not important | RUB 32,448 | RUB 8,426 | RUB 40,874 |

| 2020 | Not important | RUB 32,448 | RUB 8,426 | RUB 40,874 |

| 2019 | Not important | RUB 29,354 | RUB 6,884 | RUB 36,238 |

| 2018 | Not important | RUB 26,545 | RUB 5,840 | RUB 32,385 |

| 2017 | 7,500 rub. | RUB 23,400 | RUB 4,590 | RUB 27,990 |

| 2016 | RUB 6,204 | RUB 19,356.48 | RUB 3,796.85 | RUB 23,153.33 |

Calculation of insurance contributions of individual entrepreneurs to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund for the month

From 2021, when calculating insurance premiums for individual entrepreneurs, the size of the minimum wage does not play a role. Instead, according to Article 430 of the Tax Code of the Russian Federation, fixed contribution amounts are established for 2021, 2021 and 2021 (see table above). To find out the monthly amount, you simply need to divide these amounts by 12.

REFERENCE: until 2021, the amount of insurance premiums depended on the value of the minimum wage and the formula for calculating insurance and medical contributions of individual entrepreneurs was as follows: Pension Fund = minimum wage x 26% x 12 months. FFOMS = minimum wage x 5.1% x 12 months.

If you needed to calculate how much to pay per month to the Pension Fund and the Federal Compulsory Medical Insurance Fund until 2021, simply multiply the amount of the minimum wage approved for a certain year by 0.26 and 0.051, respectively.

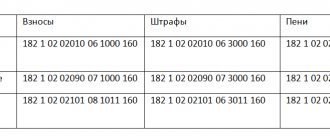

KBK IP fixed payment 2021

Payment of entrepreneur's personal contributions is made separately from employee contributions. For this purpose, special budget classification codes are provided:

| Fixed payment | Contribution | Penya | Fine |

| Compulsory medical insurance | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| OPS (including 1% over 300 thousand) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

If an entrepreneur decides to pay contributions to VNiM, then in the payment slip for these contributions he must indicate KBK 393 1 1700 180.

To pay off debts of individual entrepreneurs on personal contributions formed before 2017, other codes are used, which differ from those given in table 14-17 by familiarity:

- in the “medical” code 16-17, the familiar places change to “11”;

- in the “pension” code 14-17, the acquaintance places take the value “1100”;

- in the “pension - 1%” code, “1200” is placed on places 14-17.

When to pay IP fees

Before answering this question, you need to remember very important information: individual entrepreneurs working without registered employees have the opportunity to deduct 100% of insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund from the tax burden imposed on them by one or another taxation system.

Example. You are engaged in providing soap making services. In the first quarter you made 30 thousand rubles worth of soap. If you work under the simplified tax system, you pay 6% tax. From 30 thousand rubles. 6% is 1800 rubles. So, at the end of the quarter you pay this 1800 not to the tax office, but to the Pension Fund! In total, for the remaining 3 quarters you need to pay to the Pension Fund and the Federal Compulsory Medical Insurance Fund: (The total amount of the insurance premium is 1800 rubles).

You can pay fixed insurance premiums once a month, once a quarter, once every six months or once a year - whenever! Here it is important to cover the advance payment with the insurance premium, which individual entrepreneurs must pay quarterly without fail!

If you did not pay to the Pension Fund, but sent the money to the tax authorities, and at the end of the year it turned out that the insurance premiums completely cover the tax (since 100% of the contributions are deducted from the tax), then you will have to withdraw this money back from the tax authorities, which will be quite problematic.

Forget about habits

From January 1, 2021, control over the payment and accrual of insurance premiums passed to the tax authorities. Because of this, tax legislation acquired a new 34th chapter of the Tax Code of the Russian Federation, and the previous main regulations for the Social Insurance Fund and the Pension Fund of the Russian Federation have lost force or have undergone significant changes.

From now on, all tax rules apply to insurance premiums. Accounting veterans will smile sadly here: after all, before 2010, tax authorities were already administrators of deductions for insurance premiums. That is, we have partially returned to the times of the unified social tax.

Accordingly, all accountants and individual entrepreneurs who maintain accounting records once again urgently need to review the main points of filling out payment orders for insurance premiums. Although there are exceptions, which will be discussed below.

Also see "Insurance premiums from 2021: overview of changes."

How to properly pay insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund

Attention! Let's look at the example of contributions for 2018. Their total amount was 32,385.00 rubles.

Tip: Don't pay them every month. There is no point. We worked for the first quarter, calculated the tax, and it came out to 10 thousand rubles. So, pay these 10 thousand to the Pension Fund and the Federal Compulsory Medical Insurance Fund, and first to the Pension Fund of the Russian Federation.

Nothing for the tax authorities, because the contributions were offset against the tax. There are 22,385.00 rubles left, of which 5,840.00 are in the FFOMS.

For the second quarter, another 10 thousand in taxes came out. Again we do not pay tax, but pay to the Pension Fund. There are 12,385.00 rubles left, of which 5,840,000 are in the FFOMS.

For the third quarter, another 10 thousand in taxes came out. Again we do not pay tax, but pay to the Pension Fund.

BUT! We no longer send 10 thousand to the Pension Fund, but the remainder of the total contribution (from 26545.00), i.e. 6,545.00. And with this tranche we cover our obligations to the Pension Fund. But our tax was 10 thousand, and we paid 6,545.00. The remaining 3,455.00 is sent to the FFOMS. All that remains is to pay for honey. insurance: 5,840 - 3,455 = 2,385 rubles.

So already for the fourth quarter, when your tax amount again comes out to 10 thousand rubles, we send the remaining 2,385 to the FFOMS, and the remaining 7,615.00 to the details of the tax authorities!

Important! Sending to the Pension Fund or FFOMS means using the KBK for such payments, but the recipient is the Federal Tax Service.

Of course, this is just an example, and your tax already for the first quarter may amount to an amount exceeding insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund. Then it’s better to pay everything at once in the first quarter, and then you’ll have to make quarterly advance payments.

According to this above scheme, you relieve yourself of the burden of monthly payments and any risk of imposing penalties and other sanctions from the tax authorities.

Transfer of VNIM contributions to the Federal Tax Service

Since 2021, the functions of control over insurance premiums (except for “accidents”) have been transferred to the tax department, including social fees for temporary disability and maternity (VNiM) (Chapter 34 of the Tax Code of the Russian Federation).

In this regard, the payment details for paying VNIM contributions have changed and are as follows:

- TIN and KPP of the recipient - TIN and KPP of the Federal Tax Service at the place of registration of the payer of contributions (at the location of the separate legal entity or at the place of registration of the individual entrepreneur);

- recipient - the name of the Treasury and in brackets the abbreviated designation of the Federal Tax Service;

- KBK - since the payment administrator is the Federal Tax Service, the numbers with which the code begins are 182.

When filling out the remaining details for insurance premiums, tax officials recommend following the rules applied for tax payments (Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n).

Find samples of payment orders for insurance premiums filled out according to the updated rules in this article.

Do I need to pay insurance premiums when closing an individual entrepreneur?

If you are closing an individual entrepreneur, the tax inspector, accepting your closure documents, may require receipts confirming the fact of payment to the Pension Fund of all contributions for the year in which the closure procedure is carried out. Remember, you are not obligated to pay insurance premiums when you submit the paperwork to close! We read the article. 432 of the Tax Code of the Russian Federation, based on which this can be done within 15 days after the closure of the individual entrepreneur.

On the other hand, the insurance premium can be deducted from the tax, as we already know, which will be impossible if you transfer the money to the Pension Fund after closing, and not before. Therefore, before closing the individual entrepreneur, pay all contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund, according to the monthly calculations given above.

Important details regarding payments:

- The new form for reporting on the ESSS does not provide for the indication of previously mandatory data on the registration numbers of the payer of contributions in its branch of the Social Insurance Fund and/or the Pension Fund of the Russian Federation. From 2021, when transferring amounts during the generation of payment orders, there is also no need to include information on registration numbers.

- At the end of the year, it is definitely recommended to make a reconciliation with the funds. If debts are discovered, they must be repaid by the end of 2016.

- If an overpayment is detected, you must submit a corresponding application and supporting documents to the FSS/PFR office to process a refund. After checking the validity of the expenses, all funds will be returned.

Receipt for payment of insurance premiums to the Pension Fund

The most convenient way to pay insurance premiums is to generate a receipt yourself on the official website of the Pension Fund.

It's very easy to do. Step 1 . We follow the link: https://www.pfrf.ru/eservices/pay_docs/ and see the following:

Step 2 . We select the item “Insured”, our subject of the Russian Federation and then the item “Payment of insurance premiums by persons who voluntarily entered into legal relations under the compulsory insurance policy.”

A window will open with payment details:

Attention! The service has not yet introduced changes to the KBK part.

Step 3 . Next, enter your personal data in the “Generate receipt” block.

After entering the data, you can either print the receipt or download it in PDF format. This is what it should look like:

Such a receipt will not be suitable for direct payment at a bank due to the incorrect BCC. However, you can pay insurance premiums through Internet banking, the same Sberbank-Online, by filling out an electronic payment order based on the generated receipt. Or from your current account. The main thing is that the money comes to you, and where it came from, from which bank and account - it doesn’t matter.

Payment details for paying “unfortunate” social taxes to the Social Insurance Fund

Since 2021, employers will transfer only “unfortunate” contributions directly to the Social Insurance Fund, using the following details:

| Payment line name | Regular payment | Fine | Penalty | ||

| Recipient | Name of the regional social insurance authority at the place of registration of the policyholder | ||||

| payee's bank | Details of the treasury where the money is transferred | ||||

| Recipient's TIN and checkpoint | Data from the regional social insurance office at the place of registration of the policyholder | ||||

| KBK | 39310202050071000160 | 39310202050073000160 | 39310202050072100160 | ||

| OKTMO | The payer chooses according to his geographical location | ||||

| Payer status | 08 | ||||

| WIN | Fixed in field 22 only if there is a request for payment of arrears | ||||

Lines 106–110 of the payment slip do not need to be filled out.

A sample payment form for paying contributions for injuries to the Social Insurance Fund can be downloaded from the link.

Read about the rules for calculating “accident” premiums in the material “Insurance premiums for injuries in 2021 - rate and BCC.”

Where there is no change

Deductions for insurance against accidents and occupational illnesses (they are also contributions for injuries) remain under the jurisdiction of the FSS.

Let us remind the BCC of this contribution: 393 1 0200 160.

There are currently no changes to these contributions in the plans of officials and legislators. So you need to keep a report on their accrual to the Social Insurance Fund. Please note that the rates of these contributions and benefits have not changed either. On the contrary, there is talk to maintain the status quo regarding injuries until 2021.

For more on this, see Personal Injury Insurance Premiums in 2021: An Up-to-Date Review.

Fines and sanctions

Since taxes have more stringent requirements for their payment, this has now extended to contributions. Organizations and individual entrepreneurs will no longer be able to delay transfers: as well as for non-payment of taxes (fees), in 2021 inspectors can block the current accounts of companies and merchants. The same penalty may follow for late submission of contribution reports.

The amount of the fine under Art. 122 of the Tax Code of the Russian Federation fully apply to the new Chapter 34 of the Code in case of non-payment of contributions:

- 20% of the unpaid amount;

- 40% if it is proven that the non-payment was intentional.

Also see “New chapter of the Tax Code of the Russian Federation since 2017 “Insurance premiums”.

Read also

29.12.2016

For another company (IP)

We also remind you that in 2021, long-awaited changes to the procedure for paying taxes, fees and contributions were adopted: now third parties can deduct them for you.

In Russian business practice, a system of mutual settlements or mutual settlements is actively used. These are situations where one organization owes another. And vice versa. Instead of wasting money on current accounts, one party can ask, for example, its supplier to transfer certain obligatory payments to the treasury for it. And of course, this affects the completion of payment orders .

Previously, no matter how great the debts of the counterparties, it was formally impossible to transfer taxes and contributions for others. This ban has now been lifted. You can ask:

- another company (IP);

- his director to pay insurance premiums and taxes from his personal money.

This approach will help you avoid fines and penalties due to late transfers to the treasury.

For more information about this, see “Third parties now have the right to pay taxes, fees and insurance premiums for others.”