Controllers reason as follows. Accountable amounts for which the employee has not reported are his debt to the company. The organization has the right to withhold the debt from the debtor's salary no later than one month from the day when the deadline for submitting the advance report has expired (Article 137 of the Labor Code of the Russian Federation). If the employer does not withhold money, the tax authorities have the right to recognize this amount as a payment in favor of the employee within the framework of labor relations and impose insurance contributions (subclause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 5 of the appendix to the letter of the Federal Tax Service of Russia dated April 14, 2015 No. 02-09-11/06–5250). In addition to additional assessments, tax authorities will also fine the company for non-payment and for distortion of personalized accounting information. If the employee later reports for the accountable amounts, the organization has the right to recalculate contributions. However, all this can be avoided if you follow the rules.

The lack of economic benefit will be proven by the company’s attempts to return the money

If the tax authorities make a claim, it would be advisable for the company to try to return the money during the audit. For example, if the amount of accountable funds is significant, enter into a written agreement with the employee that he will return the money in installments over a long period of time. The lack of income will be proven by the very fact of such an agreement and the first returns. The fact that an employee has violated the deadline for submitting an advance report is not a reason to charge additional personal income tax.

In one case, the director of the company did not report on accountable funds for more than a year. During this time, the debt grew to 88 million rubles. Tax officials did not miss the chance to get additional funds into the budget and offered the company to withhold personal income tax from this amount, imposed a fine and accrued additional penalties. The organization managed to win the dispute - the accountant and the company converted part of the amount into a loan, the director returned part of the amount to the company's cash desk, and the company returned part of it in court. The company decided to withhold the remainder from the salary in the amount of 50 percent.

The inspectors tried to challenge such re-registrations and returns, since they occurred after the inspection. But the court sided with the company. By default, accountable amounts are issued with the condition of reporting or return. Inspections must prove otherwise. They did not provide evidence that the employee received an economic benefit. All their arguments in favor of additional charges were based only on the violation of the deadline for submitting the advance report. The company tried to repay the debt, even after a tax audit. Consequently, in fact, the employee did not receive income, therefore fines and penalties are unlawful (Resolution of the Central District Administrative District dated July 19, 2016 No. F10-2385/2016).

The AC of the Central District agreed with this decision in its resolution dated November 2, 2016 No. F10-3997/2016. During the trial, the director will present documents regarding some of the funds issued. He returned the other part to the cashier. The court overturned the decision on additional assessment.

What was the reason for the trial?

The organization issued accountable funds to pay salaries to workers at construction sites geographically remote from the location of the organization.

In addition, money was also issued for business expenses related to current activities: for the purchase of building materials, services, fuel, and for travel expenses.

However, the inspection found that the cash book did not indicate dates and payroll numbers, nor information about to whom the funds were issued and for what period.

An analysis of wage payments to employee bank cards showed that in section 2 of the calculation in Form 6-NDFL, the organization included only the amounts of wages transferred to employee cards.

Payment of wages from accountable amounts was not reflected.

Payment documents confirming the payment of wages to workers at geographically remote construction sites were not presented.

Regarding the lack of evidence confirming the expenditure of money on business needs, the organization argued that a significant part of the advance reports had been destroyed.

The court was critical of this argument, since an official investigation into the destruction of documents was created after officials began conducting a tax audit.

It is better to issue money for a long term. It's safer

The company has the right to set a separate deadline for each accountable amount. This needs to be fixed in an order or memo. You can prescribe a single reporting deadline for everyone or fix different deadlines depending on the level of the position or the purpose of the money. For example, an accountant has three months to buy rare parts and report on these expenses. The deadline for the report on the purchase of household needs is three working days.

However, the above orders must be created in advance. In one of the cases, the company set a period of 24 months for reporting on funds. But she lost the trial because she presented an order for such a long term during the trial. During the audit of the company, the tax authorities did not see him. The judges considered the company’s actions to be an evasion of additional charges, and therefore did not take the order into account (resolution of the Third AAS dated September 28, 2015 No. 03AP-4126/2015).

If you miss the statute of limitations, you will have to pay personal income tax

If more than three years have passed since the date on which the employee was supposed to account for the accountable amounts or return them, the statute of limitations is considered to have expired. The company will not be able to repay the overdue debt even through court. In such cases, judges recognize that the employee received an economic benefit, which is subject to personal income tax (Resolutions of the North-Western District No. F07-5021/2016 dated 07/14/16, Central District No. F10-3997/2016 dated 11/02/16). If the statute of limitations has not expired, the accountable money is the employee’s debt (Resolution of the Fourth AAS dated March 25, 2015 No. 04AP-726/2015).

To protect themselves, organizations sign agreements with employees to repay the debt in installments, acts of reconciliation, or receive letters from them acknowledging the debt. In these ways, companies trigger the limitation period in a new circle (Article 203 of the Civil Code of the Russian Federation, paragraph 20 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated September 29, 2015 No. 43). But the reconciliation report or other documents must be signed before the expiration of the statute of limitations, otherwise they will not save you from the claims of the tax authorities (Resolution of the AS of the North-Western District dated July 14, 2016 No. F07-5021/2016).

How to write off unreturned amounts in accounting

If the director has forgiven the debt to the employee, then this amount must be recognized as another expense (clause 11 of PBU 10/99). In accounting, unreturned accountable money is recognized as another expense by posting Dt 91.2 Kt 94. The basis will be the order of the manager and the accounting certificate.

And if the company collects the amount in court, then it must be reflected in account 73 (or 76 if the employee has already quit). Moreover, the amount can be indicated in the amount that is considered correct on the basis of accounting records (clause 73 of the Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance No. 34n dated July 29, 1998, hereinafter referred to as the Regulations).

When the debt is doubtful (most likely it will not be repaid), a reserve for doubtful debts is created. You can write off such an amount if the court refuses to collect, the debtor does not have property to pay off the debt, it cannot be found, or the statute of limitations has expired. They do this at the expense of the created reserve, and if it is not there or there are insufficient funds, then they are recognized as another expense (clause 77 of the Regulations).

If a debt is written off due to the impossibility of collection (no property, no person found), then it should be recorded in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss” in order to monitor the possibility of its collection when the financial situation of the debtor is stabilized. Writing off a debt at a loss due to insolvency is not a cancellation of the receivable. It must be reflected on the balance sheet within 5 years from the date of write-off (clause 77 of the Regulations).

You will need to make the following entries in your accounting:

- the debt of the employee (dismissed) is reflected according to the report - Dt 73 (76) Kt 94;

- a reserve for doubtful accounts receivable was created - Dt 91.2 Kt 63;

- the debt of the accountable person is written off (if there is a reserve) - Dt 63 Kt 73 (76);

- the debt of the accountable person is written off (if there is no reserve or insufficient funds) - Dt 91.2 Kt 73 (76);

- debt written off due to impossibility of collection - 007.

Confirmation will be orders from the manager, accounting certificates, certificates of calculations, an agreement on debt forgiveness, an act of inventory of settlements.

It is necessary to indicate the basis for issuing accountable funds

Money issued on account cannot be considered a labor payment to an employee, as recognized by the Volga Region Autonomous District, Resolution No. F06-3232/2015 dated 12/09/15. The company issues funds so that the employee purchases goods or work for its needs. Money and goods do not become the property of the accountable. The absence of supporting documents does not prove that the employee received an economic benefit. The AS of the West Siberian District came to the same conclusion in its resolution dated September 30, 2014 No. A27-16522/2013.

Accountable funds cannot be considered payments under an employment contract, which means that insurance premiums do not need to be charged on them (Resolution of the Moscow District AS of December 23, 2016 No. F05-12835/2016).

A similar conclusion is contained in the resolution of the Volga District Court of December 25, 2015 No. F06-4463/2015 (upheld by the decision of the RF Armed Forces dated April 21, 2016 No. 306-KG16-3205).

However, if the organization systematically issues accountable funds to the director and does not indicate their purpose, the inspectors will file claims (Resolution of the Central District AS dated November 2, 2016 No. F10-3997/2016). Which side the court takes will depend on the circumstances of the case.

To avoid litigation, it is worth indicating the reasons for issuing money in official notes or orders: for the purchase of goods, for business needs, etc. But the purpose of accountable funds must correspond to the employee’s position. For example, the director can be given money for entertainment expenses.

In one case, the company gave money to an employee. The basis for issuing funds was the issuance of an interest-free loan to another company. The employee attached the borrower's receipt orders to the advance report. Inspectors suspected fraud and included accountable amounts in the employee’s income. The court removed the additional charges (resolution of the Arbitration Court of the North-Western District dated January 27, 2015 No. A42-3672/2012).

Procedure for working with accountable persons

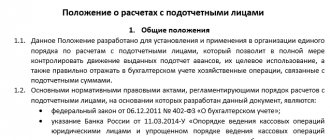

The accounting section of accountable persons at an enterprise is regulated by the following documents:

- the procedure for conducting cash transactions, approved by the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U;

- accounting policy;

- internal orders of the manager (order on the list of persons authorized to receive funds, the approved limit on travel expenses, the procedure for reporting on funds received).

How to correctly draw up an order, see the article “Drawing up an order on accountable persons” .

Read more about the regulatory framework for imprest amounts here .

For what purposes are funds allocated for the report:

- Household needs (as a rule, these are funds in small amounts or an approved limit for a certain period).

- Travel expenses.

- Entertainment expenses.

How are funds disbursed against the report:

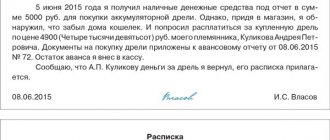

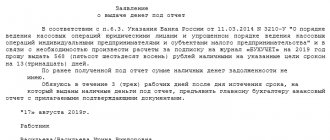

The employer issues an administrative document or the employee writes a statement addressed to the manager. The documents indicate the purpose of obtaining funds and the planned period of expenditure. The papers are endorsed by the manager and only after that money is issued from the cash register or transferred to a card (as a rule, corporate cards are opened for this purpose - for operational control of expenses).

ATTENTION! As of November 30, 2020, the rules for issuing reports have been simplified. Now, in the application for the issuance of accountable money, it is not necessary to indicate the amount of the advance and the period for which the accountable amounts are issued. The requirement to submit an advance report within three days has been removed. Employers were also allowed to issue one order for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

An example text of the statement is:

“In connection with a business trip to St. Petersburg from September 10 to 19, I ask for an advance in the amount of 40,000 rubles. to pay for hotel and daily allowance.”

Find out how to issue money on account and reflect calculations in accounting in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Upon the employee’s return from a business trip or upon completion of business expenses, a report is submitted to the accounting department with supporting documents attached - checks, receipts for services, hotel bills and others. The deadline for submitting such a report from November 30, 2020 is set by the employer. The requirement to submit an advance report within three days was excluded by the Bank of Russia’s directive No. 5587-U dated October 5, 2020.

What is the maximum amount that can be issued for a report, read here.

Supporting documents must be attached to the costs.

If the employee still has a debt, then the organization’s main counterargument is the ability to collect it. But if a company has already accepted an unconfirmed advance report from an employee and written off his debt, it should operate with the reality of costs. For example, the results of work, services or purchased goods. If the company paid the debt to the counterparty through an accountant, it is necessary to present acts of reconciliation with this counterparty.

In one of the legal proceedings, the organization accepted goods without documents for accounting. The employees attached to the advance reports acts of the working commission, certificates and reports, as well as orders from the director of the company for each of the accountable persons. The company considered that the individual accounted for the money. But the tax authorities did not agree with this, included these amounts in the income of employees and imposed contributions on it. The court sided with the company. He pointed out that the tax authorities did not provide evidence that the society received materials, goods, works and services free of charge. Consequently, the company paid for them, and the accountable money cannot be considered income of individuals (Resolution of the Autonomous District of the Ural District dated November 11, 2015 No. F09-7999/15). However, so far this is only one case in favor of the company, so it is not a fact that the tax authorities will also lose next time.

Accountable persons in accounting

You cannot talk only about the taxation of settlements with accountable persons without touching on the topic of accounting.

In accounting, all mutual settlements are carried out on account 71 in relation to each employee. When issuing funds (after all the conditions specified above have been met), the following transaction is generated:

Dt 71 “Settlements with accountable persons” Kt 50 “Cash”, 51 “Current account”.

After submitting the expense report, the following entries appear:

- Dt 20, 25, 26, 44 (cost accounts) Kt 71 “Settlements with accountable persons” - costs incurred are taken into account in the appropriate accounting accounts based on the attached advance report and documents;

- Dt 19 “VAT” Kt 71 - VAT on costs incurred is allocated and charged to a separate accounting account;

- Dt 50 “Cashier” Kt 71 “Settlements with accountable persons” - unspent funds are returned to the cash desk.

Read more about the accounting of amounts issued for reporting in our material “Features of advance reports in accounting .

Errors in advance reports may result in additional charges

In one of the cases, the court found that the tax authorities were right, since the primary documents that the company attached to the expense report did not contain the position, surname, first name and patronymic of the person who signed them. The sales receipts did not contain the names of the goods, but only general phrases: “household expenses” or “office supplies.” There were also no dates for drawing up the documents, the columns “quantity” and “price of goods” were not filled in, there was no seller’s signature. In this case, the accountable amounts can be considered the employee’s income. This is what the Supreme Court of the Russian Federation considered in its ruling dated 03/09/16 No. 302-KG16-450. The AC of the North Caucasus District came to the same conclusion in its resolution dated May 23, 2016 No. F08-2743/2016.

In another case, the director of the company received 4.7 million rubles on account, and confirmed the expenses with contracts with individuals. They were interrogated, it turned out that the individuals had never sold materials to the company and did not receive any money from it other than salaries. In addition, the goods that were specified in the sales contracts were neither written off nor leftover materials. The court sided with the tax authorities and supported additional assessments (resolution of the Federal Antimonopoly Service of the East Siberian District dated January 24, 2014 No. A19-2278/2013).

Another example is that employees attached checks from organizations that did not have registered cash registers to the advance report. As a result, controllers included the accountable money in the income of individuals. The court supported them (resolution of the Administrative Court of the North Caucasus District dated July 7, 2015 No. F08-3967/2015).

The regularity of payments will prove their salary nature

If employees have not yet reported on the previous amounts, the procedure for maintaining the cash register prohibits issuing new amounts to them for reporting. But many companies do not pay attention to this ban. In one of the cases, an individual entrepreneur transferred money monthly to the cards of his employees for several years. The purpose of payment indicated “for economic needs.” However, the employees did not report, did not return the balance, and the individual entrepreneur did not try to get his money back. When the tax authorities checked the individual entrepreneur, the statute of limitations for payments for 2010 and the first half of 2011 had already passed. As a result, the court sided with the inspectors and recognized all such amounts as income for individuals, regardless of whether the statute of limitations had passed or not (Resolution of the Administrative Court of the North-Western District dated April 21, 2016 No. F07-957/2016).

If payments of accountable amounts are made regularly, it will be similar to a salary. Especially if these amounts correspond to the level of wages. Sometimes an organization pays an employee a low salary, and gives the difference in the form of accountable funds. In this case, fiscal officials can draw a conclusion about the salary nature of the payments.

Example of taxation of settlements with accountable persons

Let's look at all the above nuances using a specific example.

sends an employee on a business trip to obtain special materials for the production of a new type of product. The business trip estimate also includes a visit to a restaurant with a supplier representative to conclude a contract on more favorable terms. According to the application, the employee was given 32,000 rubles. under report for 4 days. According to internal regulations, the daily allowance is 1,000 rubles.

NOTE! If an employee is sent on a business trip to the northern regions of the Russian Federation, the employer is obliged to provide him with warm overalls. Read more here.

Upon return, the employee provided documents on expenses:

- hotel rent - 4,000 rubles. per day (hotel bill) (excluding VAT);

- fare - 2,000 rubles. each way (tickets) (VAT not allocated);

- daily allowance - 4,000 rubles. (1,000 rubles per day);

- checks from the restaurant - 9,600 rubles. + a complete set of documents confirming the representative nature of these expenses.

For more details, see “How to properly document entertainment expenses - an example?” .

Bill of lading for materials - 160,000 rubles. — under the terms of the contract, payment is made within 15 days after the goods arrive at the buyer’s warehouse.

Let's reflect this advance report in accounting:

- Dt 71 “Employee” Kt 50 - 32,000 rub.

- Dt 26 Kt 71 - 16,000 rub. - hotel accommodation;

- Dt 26 Kt 71 — 4,000 rub. - travel payment.

For entertainment expenses, the accountant made a calculation at the end of the month:

- The wage fund for the period “January - August” amounted to 600,000 rubles. 4% of them - 24,000. Until now, there have been no entertainment expenses. Thus, the entire amount can be accepted as expenses.

- Dt 26 “Representation expenses” K 71 - 9,600 rubles. (fully reflected in tax accounting).

- Dt 26 Kt 71 — 4,000 rub. - daily allowances are taken into account.

- Dt 70 Kt 68.01 - 156 rub. — personal income tax is charged on the difference between the daily allowances established in the organization and those established by law (4,000 – 2,800) × 13%.

- Dt 10 Kt 60 - 160,000 rub. — materials have been capitalized but not paid.

- Dt 71 Kt 50 - 1,600 rub. — overexpenditure issued to the employee in the amount of 1,600 rubles.

Read more about personal income tax on daily allowances in excess of the norm in our material “How to correctly reflect daily allowances in excess of the norm in 6-personal income tax” .