Commercial enterprises are often faced with the need to make cash payments. Accountable amounts are issued through the organization's cash desk or transferred to the card of the responsible person.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Upon completion of the production task, the recipient is required to submit an advance report on the use of the issued funds.

In this case, you need to figure out what document is drawn up after the advance report when the accountant overspends the amount provided to him.

Justified overspending

Overspending can be considered justified if the following conditions are met:

- the employee spent money on completing a task assigned by the organization (as a rule, it is indicated in the manager’s order to issue money on account);

- The employee presented documents confirming the existence of overspending (for example, cash receipts).

If one of the specified conditions is not met, the employee may not be reimbursed. These are the requirements of the instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55.

Typical mistakes when making payments to accountable persons

Therefore, a power of attorney is not required.

In our opinion, the first point of view is more reasonable and it is better to issue a power of attorney. In business practice, powers of attorney are issued not only for the actual conclusion of transactions, but also for the implementation of other “representative” functions. For example: a power of attorney is needed for an employee who takes documents on the organization’s ownership of real estate, if this employee is not the head of a legal entity.

You can issue money on account only on the basis of an employee’s application addressed to the manager.

It records the specific period for which the funds were issued (hereinafter -).

The manager can set a deadline either in the form of a specific period (for example, 14 working days) or in the form of a specific date (for example, until June 9).

Compensation for overspending from the cash register

The amounts that the employee spent in excess of those received on the report, give him from the cash register. To do this, fill out a cash receipt order form No. KO-2. Indicate the number and date of this document in the line of the advance report “Overexpenditure issued by cash order.” This is provided for in the instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55.

Situation: is it possible to make an entry about compensation for overexpenditure (details of the cash receipt order for which the payment was made) of accountable amounts in the employee’s advance report after its approval?

Yes, you can.

The period during which an organization must compensate an employee for overspending is not limited by law. Therefore, you can make an entry about debt repayment in the advance report even after its approval. The instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55 do not contain a prohibition in this regard.

Situation: is it possible to reimburse an employee for overexpenditure of accountable amounts during his vacation?

Yes, you can.

There is no need to wait until the employee returns from vacation. Current legislation does not prohibit paying overages to an employee during the period when he is on vacation (Article 22 of the Labor Code of the Russian Federation, instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55).

Therefore, if necessary, the organization has the right to reimburse the employee for overexpenditure while he is on vacation.

Situation: is it possible to reimburse an employee for overexpenditure of accountable amounts after the employee returns from vacation? The employee submitted an advance report and went on vacation the next day.

Yes, you can.

After the accountant has checked the expense report, it must be approved by the manager. The period during which the manager approves the expense report is not limited by law. He can do this a few days after the employee has submitted the report to the accounting department. The accounting department should pay the employee only after the manager approves the advance report. Therefore, the organization has the right to reimburse the overexpenditure of accountable amounts after the employee returns from vacation. This conclusion can be drawn from the instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55.

When issuing money from the cash register to compensate for the overspent amount, make the following entry:

Debit 71 Credit 50

– the employee is reimbursed for expenses exceeding the amount previously issued on account.

An example of compensation to an employee for expenses in excess of the amounts issued to him on account

Secretary of Alpha LLC E.V. Ivanova purchased stationery for the organization. On March 31, she was given 2,000 rubles for these purposes. But she spent 2100 rubles. For this amount, she submitted supporting documents to the accounting department (sales and cash receipts, where VAT in the amount of 320 rubles was allocated), there is no invoice.

On April 1, the head of Alpha approved Ivanova’s advance report.

On April 3, the Alpha cashier gave Ivanova an overexpenditure in the amount of 100 rubles. (2100 rub. – 2000 rub.).

Alpha's accountant reflected these transactions as follows.

March 31:

Debit 71 Credit 50 – 2000 rub. – money was issued against Ivanova’s report.

April 1:

Debit 10 Credit 71 – 1780 rub. (RUB 2,100 – RUB 320) – stationery purchased by the employee was received;

Debit 19 Credit 71 – 320 rub. – VAT on purchased stationery is taken into account;

Debit 91-2 Credit 19 – 320 rub. – VAT is written off at the expense of the organization’s own funds.

April 3:

Debit 71 Credit 50 – 100 rub.

– the employee was compensated for expenses in excess of the amounts given to her on account.

Results

To confirm the fact of overexpenditure for a joint-stock company, it is necessary not only to document all expenses, but also to carry them out in accordance with the task set when issuing funds.

Payment of overexpenditures is carried out after the JSC has been checked by the accounting department and approved by its management. The basis for payment is the advance report itself. Payment can be made either in cash from the company’s cash desk or by transfer of funds to the employee’s card. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Compensation for overspending on a salary card

Situation: is it possible to reimburse an employee for overspending of accountable amounts to the same bank card to which his salary is transferred?

The legislation does not contain a clear answer to this question.

The advance report form provides for only one form of compensation for overspent accountable amounts - cash. The same opinion was expressed by the Bank of Russia in letter dated December 18, 2006 No. 36-3/2408.

At the same time, in letter dated December 24, 2008 No. 14-27/513, when commenting on settlements for business trips, the Bank of Russia indicated that the issue of the possibility of using bank cards for settlements on accountable amounts does not fall within its competence. The previously issued letter was not canceled. Therefore, the organization must independently decide whether to be guided by this letter or not.

Some arbitration courts do not deny the possibility of reimbursement of overspending to an employee’s bank card. For example, in resolution dated February 11, 2008 No. A52-174/2007, the Federal Antimonopoly Service of the North-Western District indicated that the organization lawfully transferred accountable funds to the employee’s “salary” account. And the employee, in turn, subsequently lawfully returned the unused accountable amounts from his bank account. These transactions were confirmed by the manager’s order (it recorded the possibility of issuing accountable amounts to employees by transferring them to bank cards), an employee’s advance report, a cash receipt order (on the basis of which the balance of the unused advance was returned to the organization), invoices, cash register checks , receipts.

To avoid unnecessary disputes with regulatory agencies, whenever possible, make all payments for accountable amounts through the cash desk. However, in any case, there is no responsibility for reimbursing the employee for overspending of accountable amounts to the same bank card to which his salary is transferred. The number of cash violations (violations of the procedure for working with cash and conducting cash transactions) does not include compensation for overspending of accountable amounts on a salary card (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

How to properly return accountable money to the organization’s account?

The content of the article

These days, almost every employee has a salary card. It is to this card that money can be transferred to the account. It is more convenient for an individual to return the balance of unused funds to the organization’s account from the same card through online banking.

How to do this in practice?

Firstly, the possibility of issuing and returning accountable money through a current account to or from employee salary cards or bank cards of persons involved under civil law contracts must be enshrined in a local act of the enterprise - for example, draw up a Regulation on settlements with accountable persons or include it in the Accounting Policy .

Secondly, it is necessary to return accountable funds to the current account by making an entry “return of unused accountable amounts in the “payment name” field. This entry will allow you to avoid problems with the tax authorities and not include the amounts received in the tax base for profit tax, VAT and income when applying the simplified tax system. If, when making a payment, the accountant did not indicate that the money transferred is a return of the unused amount, it is better to formalize this with an explanatory note to the payment.

Compensation of employee's personal money

An employee can purchase necessary goods (work, services) for the organization at his own expense. In this case, an advance report need not be drawn up, since this document is required to be drawn up only by those employees to whom the organization’s money was issued (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

To reimburse personal expenses, the employee must write an application and attach documents confirming the purchase (cash receipts, invoices, strict reporting forms, travel documents, etc.).

Return of accountable amounts to the current account, postings

Receipt of funds to the organization's current accounts in accounting is documented by the following transactions:

Dt 51 Kt 71 - unused accountable funds were received into the organization’s bank account.

Dt 52 Kt 71 - unused accountable funds were received in the foreign currency account of the organization’s company.

Dt 73 Kt 51, 52 - the amount of the bank commission for the transfer was returned to the employee.

Dt 91 Kt 73 - bank commission is recognized as an expense.

The last two entries are recorded in accounting if the local act of the enterprise stipulates the possibility of compensating the bank’s commission.

Personal income tax and insurance premiums

Regardless of the taxation system applied, money paid to an accountable person, provided there are supporting documents, is not taxed:

- Personal income tax (Article 209 of the Tax Code of the Russian Federation);

- contributions for compulsory pension (social, medical) insurance (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

The fact is that the amounts reimbursed to the accountable person are not remuneration for a completed task, but compensation for expenses incurred by him. These amounts were paid to the employee not as wages. In addition, they do not bring economic benefits (income) to the employee (Article 41 of the Tax Code of the Russian Federation).

Accountable amounts: assignment, issue, return of unused amount

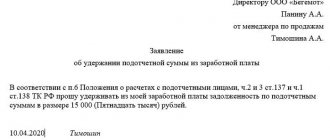

According to Art. 137 of the Labor Code, in order to repay the unspent advance, the employer can withhold amounts from the employee’s salary within one month after the deadline for submitting reports. This provision applies if the employee does not dispute the grounds and amounts of deductions.

Such a decision is formalized in a separate order and must be confirmed in writing by the employee. The Labor Code of the Russian Federation stipulates that the maximum amount of deductions from each payment to an employee should be no more than 20% of the “net salary”.

- DT71 KT50(51) – money was issued for reporting from the cash register (current account).

- KT71 DT20 (26, 44, 71) – write-off of funds for main production expenses (general business expenses, additional sales costs).

- KT71 DT07 (10, 15, 41) – accountable amounts were used to purchase material assets.

- KT71 DT50 – refund to the cash register.

- KT71 DT94 – amounts not returned on time are taken into account.

- DT70 KT94 – non-refunded amounts are withheld from the accountable person.

All transactions involving the use of funds must also be entered into the program. The basis for writing off money may be a plane ticket purchased by the organization itself. In this case, the document “Issue of monetary documents in the “Bank and cash desk” section is generated.

It indicates the full name of the accountable person, and on the second tab the document itself, for example, like this: “ticket for the Moscow-Belgorod-Moscow plane.” This operation creates a transaction from DT71 to KT50 for the amount of the ticket price. The application first goes to the accountant. He checks whether old settlements with accountable persons have been closed.

If an employee has not provided a report on previously used amounts, then new cash cannot be issued to him. Entertainment expenses, travel allowances, daily allowances – a document must be presented for all money spent. The results of report processing show who owes what and how much.

If there is a difference between the funds issued and the funds used, it means that the employer or employee owes a debt.

OSNO, simplified tax system and UTII

Money paid to an employee in order to reimburse overexpended accountable amounts will be included in expenses when calculating income tax and single tax when simplifying the difference between income and expenses. To do this, it is necessary to confirm their economic feasibility (clause 1 of article 252, clause 2 of article 346.16 of the Tax Code of the Russian Federation). The procedure for accounting for these expenses depends on what the employee paid. For example, entertainment expenses incurred during a business trip can be taken into account within the normal limits. Expenses when purchasing materials and fixed assets are taken into account in a special manner.

The calculation of the single tax under simplified income and the calculation of UTII does not affect the reimbursement of overspent accountable amounts to the employee, since organizations using these special regimes do not take into account any expenses at all (clause 1 of Article 346.14, clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account when calculating income tax the cost of goods (work, services) purchased through an employee before the organization compensated him for the overexpenditure of the amounts issued for reporting for this operation?

The answer to this question depends on what accounting method the organization uses when calculating income taxes.

If an organization calculates income tax using the accrual method, then the moment of compensation to an employee for overexpenditure to recognize costs for purchased goods (work, services) is not important. Recognize expenses during the period in which they are incurred. This is directly stated in paragraph 1 of Article 272 of the Tax Code of the Russian Federation.

If an organization calculates income tax using the cash method, then expenses are considered incurred only after they are actually paid. Payment for goods (work, services) is recognized as the termination of a counter-obligation by the purchaser to the seller, which is directly related to the delivery of goods (work, services). This is stated in paragraph 3 of Article 273 of the Tax Code of the Russian Federation. Article 273 of the Tax Code of the Russian Federation does not establish any specifics in the case of purchasing goods (work, services) through an employee (representative) of an organization. When the accountable pays for goods (work, services), the debt to the seller is repaid. However, as employees of the Ministry of Finance of Russia explain, until the overexpenditure is reimbursed to the accountant, it cannot be assumed that these expenses were paid by the acquiring organization (clause 1 of Article 252 of the Tax Code of the Russian Federation). The organization will have actual expenses only after compensation for overexpenditures. Therefore, in order to recognize expenses in tax accounting, it is necessary that the organization fully reimburse the employee for the overexpenditure.

An example of compensation to an employee for expenses in excess of the amounts issued to him on account. The organization applies a general taxation system. Income tax is calculated using the cash method

Secretary of Alpha LLC E.V. Ivanova purchased stationery for the organization. On March 24, she was given 2,800 rubles for these purposes, but she spent more. Ivanova submitted to the accounting department an invoice, a cash receipt, a receipt slip and an invoice for the amount of 3,000 rubles. (including VAT - 458 rubles).

On March 26, the head of Alpha approved Ivanova’s advance report. On the same day, the purchased stationery was transferred to household needs. On March 31, the organization’s cashier gave Ivanova 200 rubles. (3000 rubles - 2800 rubles), which the employee spent in excess of the money received on the report.

The Alpha accountant reflected these transactions as follows.

March 24:

Debit 71 Credit 50 – 2800 rub. – money was issued against Ivanova’s report.

26 March:

Debit 10 Credit 71 – 2542 rub. (3000 rubles – 458 rubles) – stationery purchased by the employee was received;

Debit 19 Credit 71 – 458 rub. – VAT on purchased stationery is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 458 rub. – VAT paid to suppliers is claimed for deduction.

March 31:

Debit 71 Credit 50 – 200 rub. – the employee was compensated for expenses in excess of the amounts given to him on account.

Expenses for the purchase of stationery when calculating income tax in the amount of 2542 rubles. Alpha's accountant took into account in March.

Situation: is it possible for an organization to take into account in expenses the cost of goods (work, services) purchased through an employee in a simplified manner, before he was compensated for the overexpenditure of the amounts issued for reporting for this operation?

No you can not.

When calculating a single tax under simplification, an organization has the right to recognize expenses only after they are actually paid. Payment for goods (work, services) is recognized as the termination of a counter-obligation by the purchaser to the seller, which is directly related to the delivery of goods (work, services). This is stated in paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. Article 346.17 of the Tax Code of the Russian Federation does not establish any specifics in the case of purchasing goods (work, services) through an employee (representative) of an organization. When the accountable pays for goods (work, services), the debt to the seller is repaid. However, until the overexpenditure is reimbursed to the accountable, it cannot be assumed that these expenses were paid by the acquiring organization (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation). The organization will have actual expenses only after compensation for overexpenditures. Therefore, when calculating a single tax under simplification, in order to recognize expenses, it is necessary that the organization fully reimburse the employee for the overexpenditure. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated January 17, 2012 No. 03-11-11/4.

An example of compensation to an employee for expenses in excess of the amounts issued to him on account. The organization applies simplification. The organization pays a single tax on the difference between income and expenses

Alpha LLC applies a simplified tax system; it pays a single tax on the difference between income and expenses.

Secretary E.V. Ivanova purchased stationery for the organization (paper, staplers, pens, etc.). She was given 2,000 rubles for these purposes, but she spent 3,000 rubles. (including VAT - 458 rubles).

On February 11, the head of Alpha approved Ivanova’s advance report in the amount of 3,000 rubles.

On February 13, Ivanova was compensated in the amount of 1,000 rubles. (3000 rubles - 2000 rubles), which she spent in excess of the money given to her on account.

When calculating the single tax (on the difference between income and expenses) for the first quarter, the Alpha accountant included 3,000 rubles in expenses.

Reimbursement period for advance report to employee

Its printed form includes:

- transferred amounts;

- directions of their use;

- details of supporting documents.

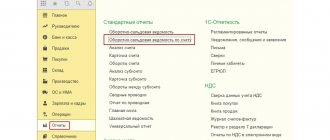

In the program, all these amounts are written off using the “Advance report” document in the “Bank and cash desk” section. It consists of 5 tabs. The first is called “Advances”. The documents on the basis of which funds were issued to the employee (PKO, bank statement) are listed here. The “Products” tab contains a list of areas for using funds.

If necessary, the “Returnable container” is filled in. If, using the funds received, the employee paid for goods or services provided to the organization, then these amounts are reflected on the “Payment” tab. After posting the document for these transactions, posting DT60 KT71 will be generated.

All other expenses, including daily allowance, travel expenses and general business needs, are reflected in the “Other” tab.

Expenses associated with a business trip are reimbursed to the employee in the manner established by the collective agreement or local regulations of the organization (if the organization is a commercial one). Legal basis: According to Part 1 of Art.

129 of the Labor Code of the Russian Federation, wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions that deviate from from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). In accordance with Art.

How to file an overexpenditure on an advance report

But to do this, it is necessary to indicate in the management accounting order the possibility of this method of transferring funds. In the application itself, the worker must write that the money is transferred to his salary card and provide details.

In the payment order, the purpose of the payment should be indicated as the movement of accountable amounts. Documents for the expense report submitted by an employee of the organization must include slips of all checks.

Example Let's look at how settlements with accountable persons are displayed in NU and BU. From the cash desk of the enterprise on April 25, 2016, a sum of funds was provided to the office manager of the conditional LLC in the amount of 2,000 rubles for a period of 4 days for the purchase of office supplies.

On the same day, the accountant issued the accountable amounts based on an application signed by the manager: DT71 KT50 - 2000 rubles.

Terms of reimbursement to an employee of expenses according to the advance report

LEARN MORE ABOUT THE APPLICATION Money paid by a reporting employee in foreign currency can be reflected both in foreign currency and in rubles according to the current exchange rate at the time of payment for goods or services.

Previously, reimbursement of expenses according to the expense report began with the preparation of an order from management on the employee’s performance of an official task, which could be issued in the form of an order listing accountable persons and a list of goods or services for which money belonging to the organization was issued.

Today it is not necessary to draw up an order - it is enough to simply add the corresponding clause to the accounting policy document.

Internal documentation may specify the rules and terms for reimbursement of expenses for the advance report. When purchasing goods or paying for services with their own money, an employee of an organization acts on its behalf.

Reimbursement based on advance report

In other words, if the overexpenditure was issued later than the advance report, then the cost accounting is taken into account upon the fact of payment of money to the employee in a specific tax period. However, within the framework of one contract, the amount of payment made by the employee should not exceed 100,000 rubles. (Instructions of the Central Bank No. 3073-U).

Possible exceeding of the limit is monitored by a responsible person appointed by the head of the enterprise. Violation of the established procedure may become the basis for bringing officials to administrative liability (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). How long does it take to reimburse? Reimbursement for overexpenditure must be made within a reasonable time.

If the company’s cash desk does not have the required amount, the parties can agree to pay the money in installments.

Reimbursement of expenses for advance report after dismissal of an employee

When completing the report, the employee and cashier must fill in the following fields:

- Name of the organization;

- number, date of preparation of the report;

- details of the structural unit;

- Full name of the responsible person;

- personnel number, employee position;

- appointment of an advance;

- data on the previous advance;

- accounting entry;

- application;

- the report has been verified;

- information about the chief accountant and accountant;

- a receipt confirming the acceptance of the report for verification;

- signature of the accountable person.

The “Accounting entry” column displays accounting entries and account numbers on which the accountable amounts spent are recorded. Documents confirming the costs incurred must be attached to the advance report. Documents must be numbered in the order in which they were recorded.

Typical mistakes when making payments to accountable persons

When issuing money from the cash desk of an enterprise, accounting entries are made as follows: Dt 71 Kt 50 Reimbursement of expenses exceeding the amount of the previously issued accountable amount Example of filling out an AO Advance report must be drawn up within three days from the end of the period for which accountable amounts were issued or from the date the employee's return from a business trip. However, if the employee returned on a day off, then the time recording begins from the first working day. The form of the reporting document and recommendations for filling it out were approved by Resolution of the State Statistics Committee No. 55. The advance report is drawn up in 1 copy.

The accountant's responsibilities include checking the intended use of money, the availability of supporting documentation and the correctness of the report. When receiving documents, the employee is given a receipt indicating that he has submitted the report for verification. After verification, the document must be approved by the head of the enterprise.

Attention

A note indicating acceptance of the report is made in the appropriate column of the document. When issuing an overexpenditure, the report indicates the date of preparation and the number of the cash order. The report must contain a transcript of the signature of the cashier and chief accountant.

The next step is to write off accountable amounts. This is what the company's accounting department does. Write-offs are made on the basis of an approved advance report. But, if the report has not been verified, for example, due to the unreasonableness of the money spent by the employee, then it is not accepted for accounting.

If employees of an enterprise use funds received from the cash register, they must submit a report. Based on this document, the company’s accounting department writes off money for operating or administrative expenses. Essence After three days from the date of return from a business trip, the employee must report on the funds received and spent.

To do this, an advance report of the accountable person is drawn up, and documents confirming the expenditure of funds are attached to it: travel tickets, hotel bills, etc. The form of the form is approved by the manager. Unused amounts are handed over to the cashier using a receipt order.

If the employee does not have enough issued funds, then the overexpenditure is also compensated from the cash register, but according to an expense order. If the employee does not provide a report on the use of funds at all, then this amount is withheld from his salary.

Accounting accounting Accountable amounts are reflected in the balance sheet on account 71.

In the absence of documents, for example, for rental housing, exemption from income tax is provided within the limits of the law. Payments related to reimbursement of travel expenses are also not subject to mandatory insurance contributions. What is it? Overspending implies an excess of the amount of money spent over the amount issued for reporting.

In other words, this is not a reward for work performed, but compensation for costs incurred by the employee. Consequently, compensation for overruns does not bring economic benefits to the employee (Article 41 of the Tax Code of the Russian Federation). Therefore, amounts received by the employee are not subject to income tax.

Source: //11-2.ru/srok-vozmeshheniya-po-avansovomu-otchetu-rabotniku/