Normative base

Directive of the Bank of Russia No. 5587-U dated October 5, 2020 “On amendments to the Directive of the Bank of Russia dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses”"

Directive of the Bank of Russia No. 1778-U dated December 26, 2006 “On the signs of solvency and rules for the exchange of banknotes and coins of the Bank of Russia”

Bank of Russia Regulation No. 630-P dated January 29, 2018 “On the procedure for conducting cash transactions and the rules for storage, transportation and collection of banknotes and coins of the Bank of Russia in credit institutions on the territory of the Russian Federation”

Directive of the Bank of Russia No. 4416-U dated June 19, 2017 “On amendments to the Directive of the Bank of Russia dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses”"

Additional questions

How to take into account cash payments with accountable persons

The issuance of cash on account and the acceptance of expenses incurred from it are reflected in accounting (budget) accounting as follows:

This is also important to know:

What to do if the employer does not pay wages

| Contents of operation | Debit | Credit |

| Cash issued against cash register report | 0 208 00 567 | 0 201 34 610 off-balance account 18 |

| Expenses were accepted for accounting based on the approved advance report | 0 401 20 000 0 109 00 000 0 105 00 000 0 106 00 000 | 0 208 00 667 |

| The unspent balance of the accountable amount was returned to the cashier | 0 201 34 510 off-balance account 18 | 0 208 00 667 |

| Overexpenditure on the advance report was reimbursed from the cash register | 0 208 00 567 | 0 201 34 610 off-balance account 18 |

Example 1.

An employee of an autonomous cultural institution was given cash from the cash register for travel expenses:

- daily allowance – 700 rub. (7 days x 100 rub.);

- accommodation – 4,900 rubles;

- travel – 3,000 rubles.

Upon returning from a business trip, the employee completed an advance report, attaching to it an act of accommodation services provided and a cash receipt in the amount of 4,900 rubles, as well as travel tickets in the amount of 2,700 rubles, which were also accepted as confirmation of the actual period of his stay in business trip (7 days). Unspent cash balance in the amount of RUB 300. entered into the cash register.

According to the accounting policy, travel expenses are included in general business expenses.

Transactions are carried out within the framework of income-generating activities.

In the accounting records of an autonomous institution, these transactions will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Cash issued from the cash register for travel expenses: | |||

| – daily allowance | 2 208 12 567 | 2 201 34 610 off-balance account 18 (code 212 KOSGU) | 700 |

| - accommodation | 2 208 26 567 | 2 201 34 610 off-balance account 18 (code 226 KOSGU) | 4 900 |

| – travel | 2 208 26 567 | 2 201 34 610 off-balance account 18 (code 226 KOSGU) | 3 000 |

| Travel expenses were accrued based on the approved advance report: | |||

| – daily allowance | 2 109 80 212 | 2 208 12 667 | 700 |

| - accommodation | 2 109 80 226 | 2 208 26 667 | 4 900 |

| – travel | 2 109 80 226 | 2 208 26 667 | 2 700 |

| The unspent balance of cash (3,000 – 2,700) rubles was returned to the cash desk. | 2 201 34 510 off-balance account 18 (code 226 KOSGU) | 2 208 26 667 | 300 |

How to record payments using bank cards

The issuance of funds on account using bank cards and the acceptance of expenses incurred through them are reflected in accounting (budget) accounting as follows:

| Contents of operation | Debit | Credit |

| Funds were transferred from the personal account to a card issued by OFK to receive cash based on the institution’s application | 0 210 03 561 off-balance account 17 | 0 201 11 610* off-balance account 18 |

| 1 304 05 000** | ||

| The accountable person received cash through an ATM using cards issued by OFK, as well as paid for purchased services (work, goods) using cards through an electronic terminal or other technical means intended for performing transactions using cards | 0 208 00 567 | 0 210 03 661 off-balance account 18 |

| Accepted on the basis of the advance report and supporting documents the amounts of expenses made by the accountable person | 0 401 20 000 0 109 00 000 0 105 00 340 0 106 00 310 | 0 208 00 667 |

| The balances of unused imprest amounts were returned to a bank card through an ATM or cash dispenser | 0 201 23 510 off-balance account 17 | 0 208 00 667 |

| The amounts of received returns of receivables using bank cards have been received (credited) to the institution’s personal account | 0 201 11 510* off-balance account 18 | 1 201 23 610 off-balance account 18 |

| 1 304 05 000** |

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

* The account is used by budgetary (autonomous) institutions.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

New reporting rules from November 30, 2020

The Bank of Russia, by instruction No. 5587-U dated October 5, 2020, simplified the rules for issuing money on account and established new responsibilities for cashiers when accepting and issuing cash. Main changes in cash transactions and reporting from November 30, 2021:

- In the application for the issuance of accountable money, it is not necessary to indicate the amount of the advance and the period for which the accountable amounts are issued.

- One order allows you to process several cash issuance transactions for reporting to one or more employees. In this case, indicate the name, amount and period for which the money is issued for each accountable person.

- The advance report no longer needs to be submitted within three days. An organization or individual entrepreneur will be able to independently set the deadline within which the accountable person must report. This rule should be enshrined in internal local acts - in the regulations on settlements with accountable persons.

New rules for cash transactions have been introduced:

- When accepting cash at the cash desk, the cashier monitors the condition of banknotes and coins in accordance with the instructions of the Central Bank No. 1778-U dated December 26, 2006. Banknotes and coins that can be used for payments must be accepted by the cashier. These include banknotes and coins that do not contain signs of counterfeiting, without damage or such damage as noted in the instruction of the Central Bank No. 1778-U dated December 26, 2006.

- Cashiers are prohibited from dispensing banknotes from the cash register that have one or more damages specified in paragraphs 6–15 of clause 2.9 of Bank of Russia Regulation No. 630-P. These banknotes are handed over to the bank.

- To identify the recipient of the cash, the cashier makes sure that in front of him is the person indicated in the cash receipt order. If he knows a person, he does not ask him for an identity document. In other cases, the cashier himself decides what confirmation to require.

Experts discussed how to issue money on account and reflect settlements with accountable persons in accounting. Use these instructions for free.

Labor Code: rights and obligations of accountables

Labor legislation is also directly related to the issue of regulating relations with accountable persons. Thus, the Labor Code of the Russian Federation:

- extends to the manager the general procedure for processing accountable amounts due to his employment relationship with the company issuing money on account - Art. 16–19 Labor Code of the Russian Federation;

- determines the obligation of the employee to reimburse unspent reporting amounts within the period during which claims can be made against him - Art. 137 Labor Code of the Russian Federation;

- establishes a limit on the amount of deductions from an employee’s salary - Art. 138 Labor Code of the Russian Federation;

- obliges the employer to compensate the employee when using his personal property, including money (Article 188 of the Labor Code of the Russian Federation), to compensate expenses when sent on business trips (Articles 165, 168, 168.1 of the Labor Code of the Russian Federation).

Who is entitled to receive accountable money?

Accountability is the means that are given to employees to carry out the company’s instructions. Relatively recently, the rules for issuing money for reporting in 2021 were established - from November 30, 2020, with the entry into force of Bank of Russia Directive No. 5587-U.

The employer, according to Part 1 of Art. 19 Federal Law No. 402-FZ dated December 6, 2011 “On Accounting”, is obliged to organize and maintain internal control of business transactions. The procedure for monitoring the issuance of money to accountable persons is determined by the head of the company. He issues an order with a list of persons entitled to receive funds from the organization’s cash desk.

Accountable persons are persons to whom an organization or individual entrepreneur gives money to carry out instructions and who are obliged to provide a report on their use. They are any employees of the enterprise.

Results

An internal document developed for settlements with accountable persons serves as an assistant for maintaining order when processing the issuance of funds and their intended use. Those points and subtleties that are not regulated by law must be specified in the Regulations. In this case, the accountant will have a legal basis for recording the fact of economic activity.

Sources:

- Labor Code of the Russian Federation

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

- Directive of the Bank of Russia dated March 11, 2014 N 3210-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to issue a report according to the new rules

Before the introduction of the amendments, in order to receive money, the employee sent an application to the accounting department or human resources department, which indicated the required amount and an explanation of what it would be spent on. But after the adoption of the instruction of the Central Bank of the Russian Federation No. 4416-U dated June 19, 2017, it is not necessary to submit an application. To issue accountable money, an order or other administrative document of the company on behalf of the director is sufficient. The form of such a document is arbitrary, but indicates the required details:

- Full name of the reporting person;

- document registration number;

- amount of cash;

- the period for which cash is issued;

- purpose (optional);

- director's signature and date.

In an order, it is permissible to indicate several employees and reporting assignments at once, all at the discretion of the organization’s management. If the reporting provisions provide for a statement, it is written, the new procedure for issuing and spending accountable amounts in 2021 does not prohibit this. Organizations independently create document flow.

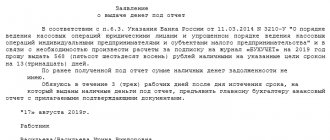

Application from an employee

| Issue 1000 rubles on account for up to 10 days Naumov | To the Director of JSC Region-Service Naumov F.I. from document specialist Pletnevoy I.G. |

Statement

I ask you to issue funds in the amount of 1000 rubles for the purchase of office supplies.

| 20.01.2021 | Pletneva | Pletneva I.G. |

Order on accountable persons

| Limited Liability Company "Alfa" (Alpha LLC) |

ORDER No. 3

about accountable persons

In order to ensure cash discipline

I ORDER:

1. Chief accountant L.I. Maksimova issue reports once a week in amounts not exceeding 3,000 (three thousand) rubles to the following employees:

- accountant T.N. Frolova to make cash payments under all necessary circumstances;

- caretaker Romanova E.D. for the purchase of office supplies for the needs of the organization.

2. The period for issuing the report is 3 working days.

3. In all other cases, the issuance of cash on account is approved by a separate order.

| Director: | Sokolov | Sokolov K.E. |

The following have been familiarized with the order:

| Chief Accountant: | Maksimova | Maksimova L.I. |

| Accountant: | Frolova | Frolova T.N. |

| Caretaker: | Romanova | Romanova E.D. |

Legal regulation of settlements with accountable persons: Law No. 402-FZ

Let's consider a list of the main provisions of the law on accounting that are relevant to the preparation of local administrative documents, advance reports and primary accounts confirming the expenses of the accountable person:

- Each fact of the enterprise’s economic activity must be confirmed by a primary document. Documentation drawn up for non-performed business operations is not accepted for accounting (Clause 1, Article 9 of Law No. 402-FZ).

- All primary documentation must include the details listed in paragraph 2 of Art. 9 of Law No. 402-FZ.

- The primary report is drawn up immediately upon the commission of a particular fact of economic activity or immediately upon its completion. Responsible persons who prepare primary documentation are required to promptly transfer it to employees who record business transactions at the enterprise (Clause 3, Article 9 of Law No. 402-FZ).

- The enterprise is charged with organizing effective internal control of its economic activities (Clause 1, Article 19 of Law No. 402-FZ).

In fulfillment of the last obligation in the above list, the enterprise issues, in particular, an order from the manager approving the list of employees who have the right to receive money on account. We advise you to draw up a list of accountables by order, but not to list these persons in the accounting policy. This is explained by the fact that the list of employees approved by the order can be changed at any time. But it is not always possible to make changes to the accounting policy (Clause 6, Article 8 of Law No. 402-FZ).

You can follow the link for orders on accountable persons.

How much to report?

In Russia, payments in rubles that are carried out within the framework of one agreement should not exceed 100,000 rubles. This is indicated in clauses 5 and 6 of the instructions of the Central Bank of the Russian Federation No. 3073-U dated 10/07/2013. The issuance of funds for reporting from November 30 did not change this limit.

It is believed that this limit cannot be exceeded, but there are some nuances. This limit on expenses is established only for settlements with other organizations and individual entrepreneurs (clause 6 of the instructions of the Central Bank of the Russian Federation No. 3073-U), and it does not apply to settlements with individuals who are employees of the enterprise. This includes wages, social benefits, personal needs of the head of the organization and the issuance of funds on account. Taking this into account, issuing a larger amount is not a violation of cash discipline.

Code of Administrative Offenses of the Russian Federation: liability for violation of the procedure for working with cash

There is no direct liability for failure to comply with the procedure for issuing accountable funds established by Directive No. 3210-U. However, some situations (for example, issuing money on account without an employee’s application or an order from the manager) may entail claims from regulatory authorities related to violation of the procedure for storing cash in the cash register. But for these offenses a very specific liability is already provided - under Art. 15.1 Code of Administrative Offences.

Read about the amount of fines for such violations in the article “Cash discipline and responsibility for its violation .

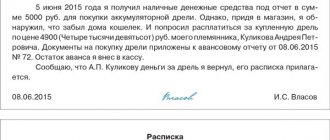

Advance report for the amount received

As stated in clause 6.3 of the instructions of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014, until August 19, 2017 it was prohibited to issue money if the employee did not provide a report on previously received amounts. Now money can be issued even if the employee has not repaid the debt on previously issued funds. The three-day period for submitting an advance report no longer applies. The deadline is set by the organization.

But this does not mean that employees no longer need to prepare advance reports on amounts spent. The employee must submit reporting documents on the money spent to the accounting department. The legislation does not establish a specific period during which an employee must submit a report on the money spent. It is indicated in the employer's order. Accountants must prepare new accounting documents in accordance with the order.

If the return period is not established, the employee submits the report on the same day on which he received them. This is indicated in the letter of the Federal Tax Service No. 04-1-02/704 dated January 24, 2005. There are special advance report conditions for travel expenses. According to clause 26 of the regulation, approved by government decree No. 749 of October 13, 2008, the employee is obliged to report on them within 3 working days from the date of return from a business trip.

Money accountable to debtors

The new 2021 accountability rules remove the previous prohibition on transferring money to accountables who have not repaid previous debts. From the new version of clause 6.3 of the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014, the condition that money is allowed to be issued is excluded subject to the full repayment by the accountable person of the debt for previously received amounts. But management and accountants should use these changes carefully. Whether an institution can issue a new accountable amount to an employee who has previously been issued an accountable amount is decided by the manager or chief accountant. If there is an objective need, it is permissible to give the employee several advances in a row, without waiting for reporting documents on previous amounts. For example, an authorized employee paid in advance for an upcoming event for clients as part of entertainment expenses, and accordingly, reporting documents have not yet been provided to him. At the same time, the employee was urgently sent on a business trip, and therefore he needed money for travel expenses with an outstanding debt on the previous advance.

It is necessary to limit the circle of persons who are allowed to have debt, and set a debt limit for them for a certain period, so that for accountable persons the changes do not become a reason for systematic violation of financial discipline. Is it possible to issue money for an account if you have not accounted for the previous one? It is undesirable without objective reasons, although there is no direct prohibition on this now.

What to consider in 2021

When accepting an advance report, take into account changes in the design of cash receipts and BSO - the required details include information about the name of the buyer (organization or individual entrepreneur) and his tax identification number.

When making settlements with accountable persons in 2021, taking into account the latest changes, remember:

- If the accountable person has been given a power of attorney to purchase goods and services in the interests of the organization and he has presented it to the seller, then the seller is obliged to reflect this data in the issued cash receipt.

- If the seller is unable to reliably establish that an individual is acting in the interests of a particular organization, then he is not required to comply with this requirement for issuing a check. In this case, the buyer for the seller is the individual himself, and the cash receipt is issued in the usual manner.

Accounting and the amount of settlement with the supplier are not the same thing

When there is a conversation about limiting the amounts involved in accountable business operations, confusion often arises and the amount of 100,000 rubles is mentioned. Where did she come from?

It should be understood that the process of receiving and spending funds by an accountable employee includes 2 main business operations:

- Receiving money from the employer as an account for purchases necessary for the implementation of its activities.

- Purchasing goods and services from a supplier and making payments to him.

And if the first operation, as we found out, does not imply legislative restrictions on amounts, then the second in terms of cash payments (i.e., money issued on account) is strictly regulated by the Bank of Russia directive “On making cash payments” dated October 7, 2013 No. 3073 -U, setting a limit amount for them.

According to clause 6 of this document, the limit is in the amount of 100,000 rubles. applies to cash payments under one agreement made between legal entities, entrepreneurs, as well as between a legal entity and an individual entrepreneur.

The above restriction does not apply to ordinary individuals (citizens who are not entrepreneurs) participating in settlements with companies and individual entrepreneurs. At the same time, an individual employee who acts in a transaction not independently, but on behalf of his employer (for example, by proxy), is also obliged to comply with cash payments (Article 182 of the Civil Code of the Russian Federation).

Fact

Regarding the establishment of the maximum possible amount of 100,000 rubles. The legislation does not provide for any time limits (for example, the common misconception “100,000 rubles in one day”). Thus, this limit cannot be circumvented by dividing the payment amount under the agreement into several payment transactions made on different days.

We are changing the regulations on conducting cash transactions

Enterprises should update the regulation on working with imprest amounts to take into account the latest changes since November 30, 2020.

Employees have the right to receive accountable funds in cash at the enterprise's cash desk. It is also allowed for the company to issue money to a bank card, including to the employee’s salary card (instruction No. 3073-U, letter of the Ministry of Finance No. 03-11-11/42288 dated July 25, 2014). To make this possible, the procedure for settlements with reporting employees should be recorded in the company's accounting policies.

Money is issued through the cash desk in accordance with the following requirements:

- When preparing cash documents, the accountant must be guided by the provisions of instructions No. 3210-U.

- Money is issued to an accountable person on the basis of an order (or other administrative document) or upon his written application. As stated in the letter of the Central Bank of the Russian Federation No. 29-1-1-OE/2064 dated 09/06/2017, the order is signed by the director, the date and registration number are indicated in the order.

- The period for which money can be issued for accountability is established in the administrative document for its issuance. The reporting period is established by the management in the reporting provisions. During this time, the accountable is obliged to report or return the money to the organization.

- The issuance of money for reporting from the cash register is formalized by an expenditure order, the return of the balances of accountable amounts is formalized by receipt orders. It is also possible to issue money for reporting by transferring it to the applicant’s bank card (letter of the Ministry of Finance No. 03-11-11/42288 dated 08/25/2014). It is allowed to return the money to the accountable by transferring funds to the company's current account. The possibility of non-cash accountable payments is fixed in the accounting policy.

- There is no limit on the amounts that can be reported. The enterprise has the right to issue money to the accountable person in any amount. The settlement limit (RUB 100,000 per agreement) must be taken into account only when making payments between enterprises. In this regard, there have been no changes for accountable persons.

- Issuing money on account to a person who has a debt is permissible by order of management.

- Organizations and individual entrepreneurs have the right to issue money not only to those employees who work on the basis of a permanent employment contract, but also to those who are in civil legal relations with the enterprise (letter of the Central Bank of the Russian Federation No. 29-1-1-6/7859 dated 10/02/2014 ).

- The issuance of cash is formalized by posting Dt 71 Kt 50, and when transferring funds to a card - by posting Dt 71 Kt 51.

Reflection of goals, deadlines and limits on accountable amounts

Accountable money is given to employees of the enterprise for expenses related to the direct activities of the organization. According to paragraph 5 of Directive No. 3210-U, an employee is a person with whom an employment contract or a civil law contract has been concluded. This means that both a full-time employee and an outside contractor can receive money.

In this paragraph of the Regulations, you can give a general description of what expenses the money will be given to employees:

- administrative and economic,

- representative,

- travel allowances

Or it is possible, at the discretion of management, to issue a separate order approving the list of business expenses and the amounts within which funds will be issued. Accountable amounts exceeding those specified in the order must be additionally approved by the manager.

The terms for which the accountable person can receive money are also determined by management and can be simultaneously specified in an order with a list of the purposes for issuing the advance and its limit. The Regulations themselves should indicate that specific deadlines for certain accountable amounts are indicated in a separate order. For cases not specified in the order, a clause should be fixed in the Regulations that defines the general maximum reporting period, for example, no more than a month.

A list of employees entitled to receive money for business expenses will make the accountant’s work easier. It can be presented in this Regulation in the form of a list of positions. It is better to collect specific names in a special list of accountable persons and issue them by a separate order, so as not to re-issue the entire Regulation due to the addition of an additional accountable person to the list.

Find out how to write an order correctly from this article .