- 1. General Provisions

- 2. The procedure for issuing cash on account

- 3. The procedure for the cashier when accepting and issuing funds for reporting

| I approve | |

| [organizational and legal form, name of organization, enterprise] | [signature, full name, position of the person approving the position] |

| [day month Year] M.P. |

back to contents

Accountability statement: why and by whom it is published

An internal document on the procedure for settlements with accountable persons for funds issued for business needs is developed in the organization to ensure full control of the movement of accountable amounts, their intended use and correct reflection in accounting.

When developing the Regulations, it is necessary to use regulatory documents regulating the relations of participants and their actions:

- Directive of the Central Bank of the Russian Federation “On the procedure for conducting cash transactions” dated March 11, 2014 No. 3210-U;

- Law “On Accounting” dated December 6, 2011 No. 402-FZ;

- by order of the Ministry of Finance of the Russian Federation “On approval of the Chart of Accounts” dated October 31, 2000 No. 94n;

- Labor Code of the Russian Federation.

The regulation may be an annex to the accounting policy, or it may be an independent local document.

Reflection of goals, deadlines and limits on accountable amounts

Accountable money is given to employees of the enterprise for expenses related to the direct activities of the organization. According to paragraph 5 of Directive No. 3210-U, an employee is a person with whom an employment contract or a civil law contract has been concluded. This means that both a full-time employee and an outside contractor can receive money.

In this paragraph of the Regulations, you can give a general description of what expenses the money will be given to employees:

- administrative and economic,

- representative,

- travel allowances

Or it is possible, at the discretion of management, to issue a separate order approving the list of business expenses and the amounts within which funds will be issued. Accountable amounts exceeding those specified in the order must be additionally approved by the manager.

The terms for which the accountable person can receive money are also determined by management and can be simultaneously specified in an order with a list of the purposes for issuing the advance and its limit. The Regulations themselves should indicate that specific deadlines for certain accountable amounts are indicated in a separate order. For cases not specified in the order, a clause should be fixed in the Regulations that defines the general maximum reporting period, for example, no more than a month.

A list of employees entitled to receive money for business expenses will make the accountant’s work easier. It can be presented in this Regulation in the form of a list of positions. It is better to collect specific names in a special list of accountable persons and issue them by a separate order, so as not to re-issue the entire Regulation due to the addition of an additional accountable person to the list.

Find out how to write an order correctly from this article .

Is it possible to do without an order?

The presence of an order on accountable persons is not strictly mandatory ; however, if the enterprise uses the practice of transferring funds to employees on account (and without this, the activities of any organization are practically impossible), it is better to stock up on this document. Otherwise, as a result of a sudden inspection by the tax service or labor inspectorate, sanctions from regulatory structures in the form of a fine, which can be imposed both on the legal entity itself and on its director, cannot be ruled out.

Mandatory conditions for issuing accountable amounts

When developing the Regulations, it is necessary to reflect under what conditions the issuance of accountable amounts should occur. These rules are described in clause 6.3 of the procedure for conducting cash transactions:

- The issuance of money to the account is carried out on the basis of an application from the employee (from November 30, 2020, it is not necessary to indicate the amount and period for which the advance is issued) or an administrative document from the manager (from November 30, 2020, it is allowed to be issued for several cash advances to one or more accountable persons , in this case, the document must indicate the full name of the recipients, the amounts to be reported and the terms for which they are issued).

NOTE! The presence of debt on accountable amounts is not a limitation for receiving a new advance (clause 1.3 of instruction No. 4416-U).

- It is advisable to note the period during which the director reviews and signs the application, and how long after this the employee must be given the money to account. If the money is issued by order of the director, then similarly indicate the period during which the employee receives the money against the cash register.

- The Regulations should also fix the following point. Provided that an employee cannot, for any reason (lack of cash in the company's cash register or being at the workplace), receive an advance, but has the right, with the verbal consent of the manager, to make expenses in the interests of the company from his own funds, their subsequent compensation is made based on the application employee.

For more details, see: “What to do if the accountable person has spent his money?”

- If an employee receives an advance payment for settlement under the organization’s power of attorney, then it is necessary to note in the Regulations in what cases this should happen. You should also write that cash payments on behalf of a company with legal entities and individual entrepreneurs under one agreement should not exceed the limit established by law (for 2021 it is 100,000 rubles).

What document and how are cash payments regulated? Read here: “What is the limit for cash payments between legal entities?” .

If the employee spent personal money

If an employee has raised his own funds to meet the needs of the organization, he draws up a reporting statement. The employee writes an application for reimbursement of the money spent by him, the manager accepts, reviews and approves it. An order is then issued to reimburse the money spent.

IMPORTANT!

If the employee spent his own money, this is not reporting!

The reimbursement algorithm must be described in the organization’s regulatory framework by drawing up a local act with an appendix in the form of a sample report on the employees’ own money spent on the needs of the institution. How to formalize the issuance of reports according to the new rules in this situation is established in the accounting policy and in the regulations on the issuance of money for reports to employees.

The accounting department must carefully check the submitted primary documents for reimbursement. If possible, the employee must register them directly with the organization in order to avoid additional personal income tax accrual to him. Letter of the Ministry of Finance No. 03-04-06/3-65 dated 04/08/2010 explains such situations as follows: there is no economic benefit in the employee’s actions, and accordingly, there is no taxable base.

Deadlines and procedure for submitting advance reports

An advance report is a document on the basis of which control of cash flows and the establishment of the fact of a business transaction take place, because with it primary documents confirming this fact are submitted to the accounting department.

The Regulations must specify within what time the report in Form AO-1 must be submitted to the accounting department. From November 30, 2020, the organization can independently set the deadline for the accountable person to submit the advance report. The requirement that it must be submitted no later than 3 working days after the expiration date for which the reports were issued, or from the date of return to work, has been cancelled. If the report form is developed independently at the enterprise, taking into account its specifics, it is necessary to approve it by order of the manager, and write a clause about this in the Regulations.

It is recommended that a detailed description be made of what source documents must be submitted and how they must be completed in order for them to be accepted as evidence of expenditure incurred. It is often not enough to have one payment document - a cashier's check or a counterfoil for a cash receipt order. You may also need the following documents for purchased goods or services:

- in retail trade - sales receipt;

- in wholesale - delivery note and invoice;

- when paying for services - an agreement, an invoice, an acceptance certificate or a universal transfer document.

Important! Recommendation from ConsultantPlus To avoid the problem of confirming expenses in situations where cash receipts are lost or cash receipts have faded, we recommend doing the following. See K+ for three options.

What has changed in the algorithm for issuing funds?

The new reporting rules represent the following sequence of actions:

- The employee submits to the accounting department an order for the issuance of money and a report signed by the head of the institution in any form.

- Accountable persons, the changes of 2021 approved this innovation, are now allowed to have debt on previously issued advances. But before issuing, make a complete reconciliation of mutual settlements with him.

- The employee provides an advance report no later than 3 working days after the date established in the order. All available documents confirming expenses must be attached to the advance report. Unspent money is returned to the organization's cash desk (the accountant creates a cash receipt order).

- An accountant or cashier checks the received expense report and primary documents to ensure they are filled out correctly. The inspection period is set independently by each institution through local regulations.

Important

If the management of a budget organization wants to protect itself from non-repayment, approve a ban on issuing funds if the employee has an existing debt. For this purpose, the Regulations on settlements with accountable persons are approved.

No changes in accountable amounts have been recorded in 2021. The employee has the right to receive any amount of money in advance without restrictions. If an employee pays with suppliers, contractors or performers as a representative of a budget organization, the amount of cash given to him is limited to 100,000 rubles per contract.

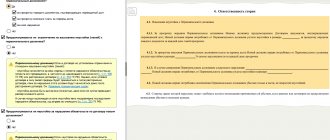

Procedure for checking and approving advance reports

In this part of the Regulations, it is necessary to reflect the main points related to the advance report, after the preparation of which the employee, together with the primary documents attached to the report, submits it to the accounting department. In particular, these:

- The accountant fills out a receipt for the advance report and gives it to the employee.

- It is advisable to describe how the report itself and the documents attached to it are verified. Primary documents must contain the necessary details, correspond to the purpose and match the amount. Documents filled out incorrectly will not be accepted for accounting and will be reimbursed to the accountant.

- After checking and filling out his part of the report, the accountant sends the document for signature to the chief accountant, and then to the manager for approval.

- The period during which the report must be checked and approved, as well as the amounts for this analytical account must be closed, must be indicated in the Appendix. For example, a week is given to check and approve a report, and 2 business days are given to issue overruns or deposit the balance into the cash register after approval by the manager. If the balance of the account is not returned within the specified period, the enterprise has the right to withhold this debt from the salary of the accountable person in accordance with the law (Article 137.138 of the Labor Code of the Russian Federation).

Important! Recommendation from “ConsultantPlus” To withhold an unreturned amount from an employee’s salary, you need to: 1) draw up an order from the manager about withholding in any form. This must be done no later than... (for more details, see K+).

How to correctly reflect the return in accounting, read the article “Return by an accountable person of the amount of an unspent advance .

- If during the period for which accountable funds were issued, the employee did not purchase anything, then within the period specified in the Regulations the money in full must be returned to the organization.

- If an enterprise is active, as a result of which accountable amounts are regularly issued to a large number of employees, then for control and accounting it is recommended to carry out an inventory of settlements with accountable persons several times a year. This issue should also be covered in the Regulations.

For settlements with accountable persons regarding travel expenses, it is recommended to issue a separate Regulation on business trips, which should consider all the nuances of travel expenses and possible disagreements with accountable persons and tax authorities.

A sample of such Regulations can be found at the link.

Important nuances of drawing up instructions

One of the most important points to which special attention should be paid: the instructions must describe in detail what supporting documents must be required when making expenses and which columns must be filled out in them. Reporting employees in most cases do not have an accounting education, and therefore may not know exactly what requirements apply to primary documentation accepted for accounting. A detailed explanation of these rules will allow you to avoid mistakes on the part of the accountable person and submit the expense report in the correct form within the specified period.

The instructions should reflect another very important point: the reporting employee has the right to make cash payments with one company under one contract for an amount of no more than 100,000 rubles.

In addition, the instructions must reflect the nuances that relate to specific operations, that is, describe in detail the intended use of accountable amounts. For example, when sending an employee on a business trip, this may be a list of travel expenses that are subject to reimbursement, and when purchasing property, this may be a list of inventory items (or their enlarged groups).

To learn about what mistakes can be made when working with accountable persons, read the material “Mistakes made in accounting for settlements with accountable persons.”

Regulations on accountable persons: sample 2020-2021

When developing the Regulations on settlements with accountable persons in 2020-2021, it is possible to establish the right of an employee to receive sums of money for business needs not only in cash, but also by non-cash means, using:

- company corporate card;

- employee's personal bank cards.

This can be done on the basis of an application from the employee or an order from the manager (letter of the Ministry of Finance dated July 21, 2017 No. 09-01-07/46781). If money is issued upon application, then the employee indicates his card details in it.

A sample Regulation on settlements with accountable persons can be downloaded here.

You can add or shorten the sample to suit the specifics of your business.

Taxes from issued reports in 2021

For tax purposes, consider the operation of transferring the 2020 report as an advance payment. There are no special features associated with the fact that the employee received the money.

Income tax

Until the organization actually receives the goods (services are provided or work is performed), it will not incur expenses. Therefore, the accountable amounts issued do not reduce the income tax base.

Insurance premiums from accountable money

There is no need to accrue contributions for compulsory pension (social, medical) insurance on the amounts issued on account. This is explained by the fact that the money received by the employee is not remuneration for the work performed or services provided, from which these mandatory payments must be transferred, but compensation for future expenses.

Personal income tax reporting in 2021

Money spent on household needs and business trips are not considered payments to employees if there are documents confirming the expenses. This is explained by the fact that they were issued for a period of time and with the condition of a report on their use. That is, employees do not receive any benefit from accountable money. Therefore, do not withhold personal income tax from accountable amounts.

The company must calculate personal income tax and contributions from the reporting persons if the employee does not report purchases on time. A letter with this conclusion was recently issued by officials from the Ministry of Finance. But there are four reasons why you are not obliged to follow the new clarification.

Results

An internal document developed for settlements with accountable persons serves as an assistant for maintaining order when processing the issuance of funds and their intended use. Those points and subtleties that are not regulated by law must be specified in the Regulations. In this case, the accountant will have a legal basis for recording the fact of economic activity.

Sources:

- Labor Code of the Russian Federation

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

- Directive of the Bank of Russia dated March 11, 2014 N 3210-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.