Issuing money on account: who receives it?

The accountable person may be an employee of the company (directive of the Bank of the Russian Federation “On the procedure for conducting cash transactions” dated March 11, 2014 No. 3210-U).

Is it possible to issue a report to a non-employee, see here.

The issuance of funds to the account occurs for the needs of the company (purchase of office supplies, business trips, purchase of small office equipment, furniture, etc.).

In the guide from ConsultantPlus you will find the nuances of issuing funds against an advance report. If you do not have access to the K+ system, get a trial online access for free.

Advance reports in accounting

The returning employee who has completed his official assignment draws up a report on expenses made on the standard form AO-1. Note that business trip expenses in terms of daily allowance are normalized - the tax base is reduced by the established limits. The standard per day is 700 rubles. when traveling within the Russian Federation, 2500 rubles. – on business trips abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation). The company has the right to set its own daily allowance rates. Exceeding the limits means for the company attributing excess amounts to profit, for the employee - taxation of the difference with income tax. Let's consider various options for travel expenses listed in advance reports and their accounting.

Issuance for reporting: we prepare documents

Step 1. Issue an order on accountable persons, where you indicate the names or positions of employees.

How to draw it up, read the article “Drawing up an order on accountable persons - sample 2021 - 2021”.

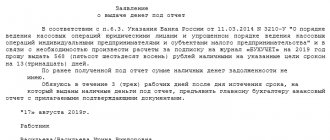

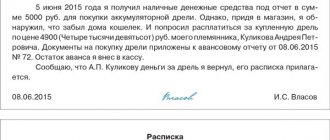

Step 2. The employee writes a statement or the head of the enterprise signs an order for him to receive money on account.

For a sample of such a statement, see the article “We are preparing an application for reporting - sample 2021 - 2021.”

Step 3. The employee draws up an advance report for the amount received in the report.

The accountable person is obliged to account for the amount received for expenses. From November 30, 2020, the organization can independently set the deadline for the accountant to submit the advance report. The previous requirement that the JSC must be submitted no later than 3 working days after the expiration date for which the reports were issued, or from the date of return to work, has been cancelled.

ConsultantPlus experts explained in detail how to prepare an advance report. Study the material by getting trial access to the K+ system for free.

The advance report form can be found in the article.

You can learn how to fill it out correctly from the material “Sample of filling out an advance report in 2020 - 2021” .

The company can draw up and approve its own report form. It must contain the mandatory details specified in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The accountable person is obliged to attach supporting documents to the report (cheque, receipts, acceptance certificate, invoice TORG-12, railway and air tickets, payment orders, etc.).

Using a special card account

A posted employee can be issued a corporate bank card opened in his name - debit or credit.

Dt 55 “Special bank account” Kt 51 - transfer of funds from the current account to a special account.

If the card account is opened in foreign currency, then the transfer occurs from the foreign currency account: Dt 55 Kt 52.

How to reflect in the organization's accounting travel expenses associated with sending an employee on a business trip abroad if he independently purchased foreign currency to pay for travel expenses (hotel payment)? Read the answer to this question in ConsultantPlus by receiving trial demo access to the legal reference system. It's free.

It is recommended to open sub-accounts for account 55 to account for settlements in rubles and for accounting in foreign currency.

As funds are spent on the debit card, the movement of money should be reflected by posting Dt 71 Kt 55 - money was used (withdrawn) for travel expenses.

If you use a credit card opened on the basis of a bank loan agreement, then the crediting of money according to the credit line to the card account is reflected as follows: Dt 55 Kt 66 (67)

Also, as funds from the credit card are spent, we make an accounting entry Dt 71 Kt 55.

The interest accrued by the bank for the use of loan funds is reflected in the entry Dt 91-2 Kt 66 (67).

Money issued for reporting: postings

In accounting, settlements with accountants are reflected in the account. 71.

Issuance of reports - postings depend on where the funds are issued from:

- the issuance of funds from the cash register is reflected by entry Dt 71 Kt 50;

- if money is issued from a current (currency) account, then instead of Kt 50, Kt 51 or Kt 52 is used.

The debt of an accountable person is written off depending on the intended purpose of the funds issued:

- if the money was issued for business needs: Dt 26 Kt 71;

- if this is a business trip, then the write-off is made by recording Dt 26 (44) Kt 71;

- if the purchase of goods, materials: Dt 41 (10) Kt 71;

- if after using the money the accountable person has a surplus, then the return of the money to the cash desk is reflected by the entry Dt 50 Kt 71.

For more information about this, see the article “Return by an accountable person of the amount of an unspent advance.”

If the accountable person has spent more, he is given the missing amount: Dt 71 Kt 50 (51).

And if the employee does not report for the money issued, withhold the amount from the salary (Article 137 of the Labor Code of the Russian Federation): Dt 70 Kt 71.

ATTENTION! This can be done with the written consent of the employee (letter of Rostrud dated 08/09/2007 No. 3044-6-0). Remember, you can count no more than 20% of his salary against debt (Article 138 of the Labor Code of the Russian Federation).

For more information about all the nuances of this operation, see the article “How to deduct funds previously issued on account from your salary?”

Issuing an advance for travel expenses: postings

The presence of a business trip order is the basis for issuing an advance amount to cover upcoming expenses. The accountant calculates their approximate cost and issues an advance payment, documenting its issuance with the following posting:

D/t 71 K/t 50 (51) for the accountable amount.

The same entry is used to accrue an additional advance if the business trip is reasonably extended and the funds issued to the employee were not enough. However, cases when an employee has to lend to a company, that is, use his own funds for work needs, are not uncommon.

Results

There are many mandatory activities that an accountant must be aware of when working with accountable funds. After all, if something is missed, then during an inspection by tax authorities, fines may be imposed on the company.

Read more about tax audits of accountable persons in the article “Tax audit of settlements with accountable persons (nuances).”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Typical transactions for 71 accounts

C is used to reflect transactions with accountable persons. When issuing funds, amounts are posted according to Dt 71, when expenses are allocated - according to Kt 71.

The issuance of funds to an employee can be made either in cash or in non-cash form:

| Dt | CT | Description | Document |

| 71 | Funds were issued in cash through the cash register | Account cash warrant | |

| 71 | Funds were transferred to a bank card | Payment order | |

| 71 | Funds were issued from special bank accounts | Bank statement | |

| 71 | Funds in foreign currency were transferred to a bank card | Bank statement | |

| 71 | 50.3 | Travel documents were issued to an employee who is going on a business trip | Account cash warrant |

If the amount of funds issued has not been fully spent, the balance may be returned:

| Dt | CT | Description | Document |

| 50 | 71 | Refund by employee in cash through the cash register | Receipt cash order |

| 71 | Transferring the balance of funds to a special bank account | Bank statement | |

| 71 | Crediting the balance of funds in foreign currency | Bank statement |

Transactions with accountable persons can be reflected using production accounts:

| Dt | CT | Description | Document |

| 20 | 71 | Reflection of accountable amounts as part of the main production expenses | Advance report, supporting documents |

| 71 | Reflection of accountable amounts as part of auxiliary production expenses | Advance report, supporting documents | |

| 71 | Reflection of accountable amounts as part of the costs of correcting defects | Advance report, supporting documents | |

| 71 | Reflection of accountable amounts as part of the expenses of service production | Advance report, supporting documents |

At retail trade enterprises, sales expenses may be incurred through an accountable person:

| Dt | CT | Description | Document |

| 44 | 71 | Reflection of sales expenses incurred through an accountable entity | Advance report |

Goods and materials purchased by an accountable person are reflected in accounting by the following entries:

| Dt | CT | Description | Document |

| 10 | 71 | Materials purchased by the accountable person have been received | Advance report |

| 41 | 71 | Goods purchased by the accountable person have been received | Advance report |

Posting examples

As examples of transactions with documentation, you can consider the following transactions:

- purchase by an accountant of a valuable object: Dt 08 (10, 15) – Kt 71

- purchase of things with money allocated for reporting: Dt 41 - Kt 71, amount - 3,650 rubles, basis - invoice for expenses

- for calculating VAT on JSC (8,400 x 20%): Dt 19 - Kt 71, amount - 1,680 rubles, basis of JSC and invoice

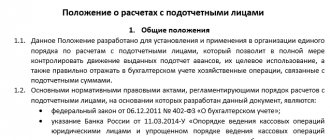

Circle of accountable persons

Not every employee is eligible to receive an advance. If an organization gives out money to everyone, this will raise questions from regulatory authorities. Therefore, the circle of accountable persons should be limited. It includes only those employees who, by the nature of their duties, must actually perform tasks that require an advance payment.

In addition to limiting the circle of persons, a limit on amounts should be introduced. This is formalized using a special order, which states who exactly has the right to receive an advance, for what purposes and in what amount. The order is kept in the accounting department.

If an employee has not reported on the amount previously issued to him, he is not entitled to receive an advance until supporting documentation is provided.

Purchasing materials through an accountable person: postings

The accounting entries for the acquisition of inventory items by an accountable person will differ depending on the following factors:

- whether a power of attorney was issued to the employee on behalf of the organization;

- whether the seller of goods and materials is a VAT payer or not.

Let's consider each of these cases in detail.

How to compensate for overexpenditure on an advance report, read in ConsultantPlus. Trial access to the legal system is free.

What is a subreport

In order to ensure the activities of an economic entity, managers may require workers to perform any tasks associated with certain costs. To solve them, the employee is transferred accountable funds in the following form:

cash- money can be transferred to a bank account or plastic card

- financial documents

In accordance with the legislation of the country, reports can be issued to employees on the company's staff working under contracts. If the corresponding condition is present in the accounting documentation of a legal entity, then money can be issued to unauthorized citizens.

After spending money, the employee provides a report to the accountant. It must contain information about the amount and for what needs the money was spent. The accountant checks the documentation and records the transaction in the accounting system.

Postings for receiving advance payment

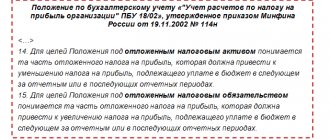

In some cases, buyers transfer money to the seller before purchasing a product, service or work. In this case, the accountant is obliged to allocate VAT from the funds received.

Table 1. Records for recording the received advance payment in the accounting system.

| Wiring Description | Dt | CT | Base | Sum |

| To credit money transferred as an advance | 50 (51, 52) | 62.2 | payment slip | RUB 24,550 |

| For VAT calculation | 76 | 68 | invoice, bank statement | RUB 4,092 |

| To calculate sales revenue | 62.1 | 90.1 | invoice | RUB 24,550 |

| To record VAT on sales | 90 (VAT) | 68 | invoice | RUB 4,092 |

| To deduct VAT on an advance payment (following the sale) | 68 | 76 (advances) | Book of purchases | RUB 4,092 |

Detailed video about advance reports:

Fare

If travel documents are purchased by the accountant himself, then they must be attached to the AO. You can attach tickets both on paper and electronically. Travel documents are written off as expenses of the legal entity, since they confirm the conclusion of an agreement between the citizen and the carrier.

The wiring might look like this:

- to record costs for air tickets: Dt 20 – Kt 71.

Report submission deadlines and responsibilities

According to the law, the accountable person is obliged to provide supporting documents to the accounting department within three days after the official assignment is completed.

If the employee does not do this, then the amount issued is regarded as a loan to the employee. The accountant is obliged to calculate the material benefits from using the resources of the enterprise. In addition, it is necessary to calculate and transfer personal income tax to the budget on the amount of material benefits, the rate in this case is 35%.

The responsibility is quite serious, so it is better not to violate the deadlines for providing supporting documents.

Postings for state employees

The budgetary chart of accounts is different. To record an advance payment, records can be created in the accounting system:

- to transfer payment to the seller: Dt 206 00 000 – Kt 201 01 610

- for registration of goods received after payment of the advance amount: Dt 302 00 000 – Kt 206 00 000

Based on the advance report, you can check the legality of the expenditure of funds by the accountant. Therefore, the accountant needs to be careful and scrupulous when checking the report and recording transactions in the accounting system.

Top

Write your question in the form below