Information about the current manager is not reflected in the statutory documents, but is published in the Unified State Register of Legal Entities, and when concluding transactions, counterparties can check the authority of a particular person.

Who and how long will hold the position of head of a legal entity is determined solely by the decision of the company’s founders or the employee himself.

Company representatives must send notifications about the change of general director to government agencies and contractors as soon as possible, regardless of the reason for the dismissal of the employee and the article of the Labor Code.

So, it is necessary to notify the following authorities when changing the general director.

Meeting of owners and decision making

First of all, the change of the sole legal entity must be recorded in the minutes of the meeting of company participants or in the decision of the sole founder.

The same protocol (decision) can record both the fact of removal of powers from the previous general director and the assignment of powers to a new employee or manager. IMPORTANT! From the moment of signing the protocol (decision) on changing the general director, the enterprise has only 3 days to submit the corresponding notification to the tax office (Clause 5, Article 5 of the Law “On State Registration of Legal Entities and Individual Entrepreneurs” dated 08.08.2001 No. 129-FZ) .

https://www.youtube.com/watch?v=upload

About the dismissal of the general director on his own initiative, read the material: “Dismissal of the general director at his own request.”

The decision to change the general director must be documented in a protocol, which may contain only three questions:

- Exemption from duties of the current director.

- Appointment of a new person to this position.

- Approval of the new director.

Single owner of LLC

Date and place of compilation

- Release from his position... position... full name, passport details, based on his application from... date... - from... date.

- Assign a new... position... Full name, passport details, from... date.

- Responsibilities for making changes are assigned to the legal consultant, full name and passport details.

LLC participant... full name... signature.

Types of info letters

There are quite a few types of newsletters. Their main purpose is to inform the interlocutor, which may involve performing a variety of tasks - notification, statement, confirmation of intentions, advertising message (commercial offer) and much more.

The main task is to notify the client, partner, colleagues, employees of branches, and other departments about the most important company events expected in the near future:

- change of director, chief accountant and other employees;

- change of details;

- change of legal or actual address;

- preparation for inventory;

- changing the work week, reducing hours, etc.

The sender can also report on any informal events - preparation for a corporate party, celebration of the company’s anniversary, exhibition, etc.

This letter can serve as an informational occasion to “remind” yourself or simply confirm intentions in response to a request. For example, a company is negotiating a deal, but at various times for some reason it periodically interrupts them. Subsequently, management came to the conclusion that the deal would indeed be profitable, so a letter of confirmation of intentions could be sent to the partner.

The document has a free form. However, it is built according to a generally accepted algorithm. So, at the very top of the sheet are usually located:

- Company details. There is simply some free space left on the form for them. Ideally, all documents of this scale and focus are printed on the letterhead of a specific organization, which initially contains its name, address, telephone number and other contact information.

- Letter number. It is necessary for correct registration of outgoing correspondence.

- Date the document was signed. Without a signature, it has no legal force.

- Destination. If this is a legal entity, then the organization is indicated first, then the position and name of the specific employee of this organization to whom the message is intended.

In addition to the introductory part, which is the same for a large number of documents, the letter about the change of director has a main part. It may begin with the phrases: “By this letter we notify you...” or “By this letter we inform you...”, or simply “We inform you that from today Ivan Ivanovich Ivanov has been appointed general director.”

To the director of LLC...

According to the contract number... from...

https://www.youtube.com/watch?v=ytaboutru

Based on the protocol of the founders from... date... to perform the duties of... position... LLC... from... date... began... Full name.

Applications:

- A copy of an extract from the Unified State Register of Legal Entities.

General Director.. date.. Full name.

It should be noted that a legal entity has the obligation to notify only tax authorities and banking institutions about changes that have occurred; in other cases, this is done at the discretion of management. However, as practice shows, in order to avoid misunderstandings with business partners, it is better to notify them as well.

Information messages, regardless of their author and addressee, should relate only to the activities of the sending organization or related circumstances. At the same time, they must meet certain requirements in terms of structure and content:

- First of all, it should be noted that the information letter should always contain:

- details of the sender and recipient,

- correct address address (for example, “Dear Petr Semenovich”, “Dear Irina Viktorovna”, “Dear colleagues”, etc.). But if the addressee is not defined, which sometimes happens, then you can limit yourself to the greeting “Good afternoon!”

- Next comes the main, informational part of the letter. Here you need to indicate the reason and purpose for writing it, as well as everything else that is related to the matter being described: news, suggestions, changes, requests, explanations, etc.

- Below in the letter you need to write a conclusion that should summarize all of the above.

If any additional papers, video and photo files and evidence are attached to the letter, this should also be noted in its content as a separate paragraph.

Even at the stage of submitting an application to participate in public procurement, a potential supplier is required to provide general and banking information. This is necessary for drawing up a contract after the tender. Accordingly, if an organization, during the preparation of a tender proposal, is in the process of changing any of the above data, then it should indicate new data in its application.

Moreover, such information will become available to the customer only after opening the envelopes (opening access to electronic documents), when it will no longer be possible to make changes. It should be remembered that before the deadline for submitting competitive and auction applications, the participant can withdraw the proposal, make adjustments and resubmit it.

In the case when the application has already been submitted, the participant has won the tender and the need to change the details arose at the stage of concluding the contract, instead of a notification, a protocol of disagreements is drawn up.

- Letters-messages. They represent a notification (notification) about some processes. For example, about changes in prices for your goods or services, about a change in the general director or company details (including bank details), about concluding contracts, increasing the volume of supplies, etc.

- Application letters. They talk about what the addressee is going to do in the near or distant future. For example, increase prices, stop cooperation with the addressee, or self-destruct.

- Confirmation letters. Everything here is boring and banal - “hello, Ivan Ivanovich, I received the goods, they also sent the accompanying documents, thank you, all the best.”

- Reminder letters. They inform the addressee that he needs to do something - for example, fulfill his obligations under the contract.

- Advertising and information letters. As a rule, they are the longest and often resemble sales proposals. For anyone to read these messages, they must be at least a little interesting and not too banal.

This classification is conditional, but in general it gives an idea of the functions of information messages. If necessary, additional materials can be attached to letters. Very often, message letters (as well as advertising and informational letters) are sent at the request of partners and other interested parties.

You can find a sample information letter.

When to report

Current domestic legislation obliges firms to report a change in their management to the inspectorate at the place of registration no later than three working days from the moment the new employee began performing duties. Moreover, both the new and the previous chapter have the right to submit documentation.

If the notice period for a change of director is not observed, the following sanctions are applied to the legal entity:

- warning (if tax authorities do not consider the violation serious);

- fine 5000 rub. (with a significant deviation from the mentioned period).

A similar penalty is provided for cases of submitting false information. Despite the fact that difficulties may arise if the notification is filled out incorrectly.

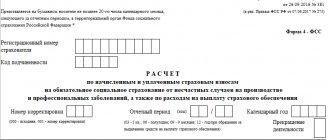

How to fill out

The document in question contains a request to make changes about the new director to the register. The notification form has number P14001. It was established by Federal Tax Service order No. ММВ-7-6-25 and is designed to read information by machine. Therefore, it is important to know some nuances:

- The form must be filled out by hand in block letters;

- black ink is used to write data;

- no errors or corrections are allowed;

- spaces are needed between words;

- if a word needs to be transferred, no signs are placed;

- when a word begins on a new line, and the previous one completely fits into the previous one, leave an empty cell (the computer will mistake it for a space).

We invite you to read: Alimony from the unemployed - receipt and payment

Federal Tax Service (FTS)

Mandatory notification to the Federal Tax Service when changing the head of the company is drawn up in form P14001. In this case, the following elements are filled in and provided:

- title page;

- 1st page of sheet K (with data of the former director);

- 1st and 2nd pages of another sheet K (with the data of the new director);

- all pages of sheet R.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

Document P14001 must be submitted to the Federal Tax Service within 3 days after:

- signing by the founder (meeting of owners) of a decision or protocol on the appointment of a new director;

- the beginning of the powers of the new director in accordance with the decision or protocol.

The new manager, who is approved by the founders or the meeting of owners, fills out and submits form P14001. This form must be notarized.

To the director of LLC...

Agreements between business entities may contain a condition under which each party to the agreement, upon a change of management, enters into an additional agreement with the counterparty to the current contract.

This agreement includes wording that the parties have agreed to change the preamble of the agreement (it is in it that information about the heads of the companies entering into the agreement is usually indicated). An exact extract of the wording from the previous preamble is given, and then a new one is indicated, which the parties agree to consider correct.

In this case, the process follows the general rules. The only small change is that the new founder himself writes an application on his own behalf. And then he is accepted into the leadership of the enterprise.

In this case, a general meeting is held at which certain decisions are made.

- Approval of a new format of constituent and other documents.

- Making changes to the composition of the founders.

You must approach the filling out of these forms with all responsibility.

Form P14001 is found in two versions. One is new, the other is outdated. Everyone keeps it up-to-date, so anyone can fill it out. The field with the Address deserves special attention - only information that corresponds to the KLADR classification is entered there.

Why do you need an extract from the Unified State Register of Individual Entrepreneurs and how to get it? Read about it in this publication.

In this case, the process follows the general rules. The only small change is that the new founder himself writes a statement on his own behalf. And then he is accepted into the leadership of the enterprise.

If a manager is re-elected to a position as part of the “extension of powers” procedure, the Federal Tax Service should not be notified about this, since from the point of view of the register, no changes have occurred in the organization’s management.

In all other cases, notification to the tax office of a change of director is mandatory. For failure to fulfill this obligation within the prescribed period, administrative liability is provided for in Article 19.7 of the Code of Administrative Offenses of the Russian Federation.

Fill out an application for changes in the organization (form P14001) to enter information into the Unified State Register of Legal Entities and have it certified by a notary.

Sample letter to a bank regarding a change of director – Legal Portal

Document to the tax office It is worth noting that the preparation of this document must begin when the general director has already been relieved of his duties, and the new one has already begun to fulfill them and has been entered into the unified state register of legal entities. This happens because until these operations are carried out by the law, dismissal cannot carry with it any legal force and, accordingly, writing an information letter will not have any meaning. After the letter has been written, it must be sent to the tax authorities as quickly as possible. This fact is required by law. In addition, the letter must be drawn up according to a special form P14001. There is no need to attach any additional documents to this letter.

When a new leader appears in a company, the question inevitably arises whether it is necessary to send someone a special letter about the change of CEO. A sample of such a document and the rules for its preparation must be known in advance in order to immediately act in the current situation.

Important

Forced necessity The general director of any enterprise is a person who has quite a lot of power. Acting on behalf of the company, he can enter into contracts, negotiate with counterparties, and also manage the movement of all financial funds that are in its current accounts.

Info

When there is a change in management, these powers are transferred to the new director. Now he will have to resolve all issues related to the financial and economic activities of the enterprise.

To notify partners of the ongoing reshuffle, it is necessary to send them a letter about the change of general director.

Letter about change of general director (sample)

During the activities of organizations, enterprises and other business entities, a change of leadership may occur. Information about this event must be provided to supervisory and regulatory authorities and services.

In particular, there is a certain procedure for submitting notification of a change of general director to banking institutions. articles

- 1 Procedure for changing the manager 1.1 Documents to the bank

- 1.2 Other funds

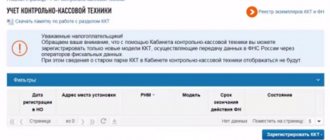

When appointing a new general director of an enterprise, you should submit an application to the Unified State Register of Legal Entities and Individuals (USR), where the re-registration of the manager will be carried out.

Then you should notify the tax service, as well as provide new information to the bank.

Sample notice of change of director

Since otherwise, the tax authorities will consider it invalid;

- When writing, you need to leave spaces between words for better readability of the text;

- When hyphenating a word or sentence, you do not need to put any marks.

There are also a number of features in which it is necessary to correctly draw up a notice of dismissal of a director:

- When designing a title page, it must display the full name of the organization, as well as its status. The address of the enterprise must be recorded in accordance with the KLADR;

- Sheet “K” must contain information about an individual who is authorized to conduct activities on behalf of the organization without a power of attorney drawn up for him. This sheet must also be filled out with information about the new and previous director.

Letter on change of general director: sample and rules for drawing up the document

Taking into account the terms of existing agreements:

- counterparties (along with an additional agreement to amend these contracts);

- creditor banks, as well as the bank in which the current account is opened (the notification in such cases is supplemented by a fresh extract from the Unified State Register of Legal Entities, a card with a sample signature of the new director).

3. Voluntary:

- counterparties with whom agreements on mandatory notification upon change of director have not been signed;

- employees.

Let's consider each of the cases in more detail.

What documents to send to the tax office when changing the director of an LLC. Mandatory notification to the Federal Tax Service when changing the head of the company is drawn up according to form P14001.

Sample letter to bank about change of director

Take, for example, a situation where, for one reason or another, the director was forced to change his last name. In order for the documents confirming his authority to have legal force, it is necessary to make certain changes to them.

To do this, you need to contact the appropriate authorities. You can do this:

- personally;

- through a proxy by issuing a power of attorney for him;

- by mail, sending information by registered mail with notification.

The appeal in this case will be a letter about changing the surname of the general director, the sample of which depends on who exactly it is sent to.

Thus, information is transferred to the branch of the servicing bank to replace the card with a sample signature. Other interested parties must also be notified of the new name of the manager.

Sample cover letter to the bank regarding change of director

The latter is a special circumstance that is subject to assessment by other LLC management bodies and business owners. The grounds for changing the director in this case coincide with the grounds for dismissal at the initiative of the employer, provided for by the Labor Code of the Russian Federation (Part 1 of Article 81 of the Labor Code of the Russian Federation). In particular, company participants may decide to change the general director if he:

- systematically violates his labor duties (clause 5 of Article 81 of the Labor Code of the Russian Federation);

- violated a trade secret (clause “c” of paragraph 6 of Article 81 of the Labor Code of the Russian Federation);

- committed actions that give grounds for loss of confidence in him (Clause 7, Article 81 of the Labor Code of the Russian Federation);

- made a decision that resulted in damage to society (clause 9 of Article 81 of the Labor Code of the Russian Federation).

These are just examples of the actions of the director, which may be followed by his change.

Source: https://pravo-urfo.ru/gosudarstvo/obrazec-pis-ma-v-bank-o-smene-direktora-territoria-prava-ru.html

Making changes to the Unified State Register of Legal Entities

Tax authorities must be notified of a change in management no later than 3 days from the date of the meeting. It is not recommended to violate the deadline provided for by law, since administrative sanctions in the form of a fine of 5 thousand rubles are provided for this.

You should also submit an information letter to the regional branch of the Federal Tax Service about the change of general director according to the sample P14001, certified by a notary.

As a result, the representative of the enterprise will be issued a new extract from the Unified State Register of Legal Entities.

The procedure for making changes lasts no more than 5 days.

A change of LLC founder can occur in the following ways:

- A person leaves - his interest in the capital of the LLC is transferred to the company and sold to a third party (or redistributed among the remaining members).

- The participant sells, donates or bequeaths his share to an “outsider”.

- A new member appears in the Society - the previous founder leaves the company.

- Entry of a new participant with an increase in the capital of the enterprise.

Alienation of share

https://www.youtube.com/watch?v=https:ZvLW3z-gZA0

Step-by-step instruction:

- One of the members of the Society notifies the others about the sale of his part of the enterprise. Notification must be made in writing (sample here). Each of the remaining founders has a pre-emptive right to purchase a share.

- If other members do not want to purchase a share, a certified waiver of the priority right of purchase is issued.

- If the founder-seller joined the Company while legally married, it is necessary to formalize the consent of the spouse to sell the share. The same documents will be required from the buyer.

- With all the papers, the seller and buyer go to the notary. The seller also needs constituent documents confirming his right to part of the capital of the enterprise.

- An authorized representative of the notary's office certifies the transaction and no more than 3 days later sends a corresponding notification to the registration authority with a request to record changes in the register of legal entities.

Important!

You can sell your share in the authorized capital only when it is paid in full (the fact of payment must be confirmed). If payment is not made in full, then only a certain percentage of the share can be sold. Or start the transaction only after full payment.

After a successful sale and purchase, a meeting of the founders is organized, at which a Protocol on amendments to the Charter is drawn up (they must be registered).

The legislator allows the Company to have a single participant. But he can't go out. How does a change of founder happen?

- The owner is selling his business. The procedure is similar to that described above: a purchase and sale agreement is drawn up with a notary.

- The owner transfers his company free of charge. The transaction is subject to notarization. A decision is drawn up by the sole founder to change the founder (see sample here).

- You can save on notary services when a new participant enters. This is also one of the ways to change the composition.

The procedure is as follows:

- A new member joins the Society. He submits an application addressed to the gen. director, which indicates the size of the future share (sample - here).

- A decision is made to admit a new member to the LLC and increase the capital of the company (at the expense of the new member).

- Anyone wishing to join the enterprise contributes an agreed amount.

- Changes are reflected in the company’s constituent papers, which are submitted for state registration.

Within 3 days after registration, you must submit

- amended company charter,

- decision to change the composition of the Company,

- documents confirming the existence of a legal entity. faces,

- a new extract from the unified register,

- application on form P14001, certified by a notary (form here),

- receipt of payment of the duty.

Every time you change members of an LLC, you need to make changes to the charter documents (according to the minutes of the general meeting or the decision of the sole founder), register them and submit them to the Tax and Duty Service. Applications in forms P14001 and P13001 are attached to the papers.

Step by Step Actions

To change your phone number to receive SMS passwords you need:

- fill out a special application;

- in the application, make a note “Corrective”;

- submit the application to a bank employee.

Next, an employee of the financial institution will register the application and enter it into the database with the appropriate changes, which will come into force only in a few days. You can download the application on the bank's official website.

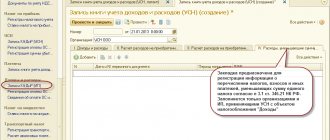

Confirmation of a number change for organizations occurs in the system:

- click “+” on the toolbar, the application form will open, where a number of data will already be entered, they can be edited;

- “Number” – document number, the system numbers it automatically from the beginning of the year, but you can specify it yourself;

- “Date” - can be changed, the current one is automatically indicated;

- “B” - branch of the institution for submitting the document;

- “From” - from whom it is directed;

- “...” - for whom the procedure is being performed.

After this, you need to check all the entered data and save the document. When the document is generated, it will appear in the list marked “Created”. If serious errors are detected, then a “Control Error” appears.

Who signs?

When drawing up a document, many people wonder who should certify the letter: the old or new general director of the organization. The answer here is clear: new. After all, the document on his appointment has already entered into force. And even if the tax authorities are still in the dark about the change of director, only the new boss now has the right to sign and certify the documentation with his visa.

In practice, a situation often occurs when two people are in power in a company at once.

In order to avoid such moments and possible related troubles, it is necessary to immediately indicate in the minutes of the meeting of owners on this issue specific dates for the dismissal of the previous employee and the appointment of a new one.

Is it necessary to notify partners?

By law, the company is obliged to notify only the tax service and the bank about the change of director. However, according to the rules of business communication, counterparties must also be aware of the current state of affairs. This is especially true in cases in which the previous CEO was fired from the organization due to loss of trust. His actions could also be related to business partners.

In addition, there is one more reason to notify business partners: additional agreements should be concluded with them to all contracts in which the full name of the old specialist appears (in order for them to have legal force).

Thus, mass mailing of letters about a change of general director is a mandatory item in the algorithm of any self-respecting company. If you don’t want to waste precious time signing multiple copies, you can use a facsimile of the new boss’s signature.

How to get

The procedure for issuing a notice of a change of general director depends on how you submitted the documentation (see table).

| Way | Bottom line |

| In person or by mail to the tax authority | The applicant receives a sheet of the Unified State Register of Legal Entities in the manner indicated in the application |

| Appeal to multifunctional) | It is necessary for the director or representative of the company to come to this organization |

| Notarial office | To get an answer, you need to contact a specialist who took part in the registration process. |

| Electronic portal | The result is sent to the applicant's email. If desired, you can request the document in writing. |

Applications

Since the new boss is signing, the letter needs evidence of the information provided, otherwise it would open up wide opportunities for scammers. Proxies could take advantage of the resulting confusion when reporting this type of information. Therefore, the following must be attached to each letter about a change of general director:

- A copy of the minutes of the general meeting at which the decision on his appointment was made. In practice, for convenience, it also prescribes the dismissal of the old one.

- A copy of the power of attorney for signing the documentation.

- A copy of the order on the appointment of the general director. The meaning of the power of attorney may be included in it.

Only the first paper will be required, but by attaching copies of the others, you can make your appeal more reasoned. Each organization in this case acts in accordance with its Charter.

The final part of the letter is the signature of the new general director and, if possible, the seal of the organization. In this way, counterparties and other persons to whom the letter will be addressed will learn how the new manager signs.

Notification of counterparties

To notify counterparties of a change of general director, it is recommended to send a letter in free form.

A legal entity does not have a legal obligation to notify counterparties about the appointment of a new manager if this clause is not specified in the contract.

But many companies prefer to notify their customers and suppliers so that there are no documentary and information misunderstandings.

Sample notice of change of general director

Sample notice of change of general director, available upon request

To notify counterparties (clients or suppliers), attaching a copy of the minutes of the founders’ decision is not required. There is no need to make changes to already signed contracts, orders and powers of attorney.

Often the services with which you have to deal try not to recognize powers of attorney and orders issued by the previous manager. To avoid conflict situations after a change of general director, we recommend canceling old powers of attorney and issuing new ones.

If the CEO changes at the same time as the founder

Now that all the formalities have been settled, you need to inform the bank that services the company about the changes that have occurred. There is no single sample information letter about a change of general director; it can be compiled in any form. It is necessary to submit documents confirming the competence of the changes made, that is, a protocol, orders, a new extract from the register and a copy of the passport of the new manager. For businesses that are connected to online banking, you will need to go through the procedure of generating a new key.

https://www.youtube.com/watch?v=ytcreatorsru

To the head of the design bureau...

We hereby notify you that... date... to the position... date... appointed... Full name...

Applications:

- Protocol…

- Orders...

- Extract from the register.

- Copy of the passport…

Typically, it is the head of the company who has the right of first signature on payment documents. Therefore, when you change your manager, you will have to contact your servicing bank to replace the card with sample signatures. 7.14 Instructions of the Bank of Russia dated September 14, 2006 No. 28-I.

The period within which an organization must inform the bank about a change of manager (for the purpose of issuing a new card) is not established by law. Often, banks require, in addition to the protocol (decision) and passport of the new director, to provide them with an extract from the Unified State Register of Legal Entities in which he appears. And here, whether you want it or not, you will have to get an extract. The annoying thing is that until a new card is issued, you will not be able to make any payments through the bank.

It is the responsibility of the company to inform the bank servicing the company that the director has changed, since the previous general director had the authority to sign payment documents on behalf of the LLC and to perform actions with funds and accounts of the company. To serve an organization, the bank is required to identify the client, and to do this it must ensure that the client’s representative has the authority to act on behalf of the latter.

We invite you to read: Adjustment and corrected invoices: feel the difference

Therefore, immediately after registering changes in the register of legal entities, the company should send a notification letter to the bank with a message about the change of director, or better yet, the new director should personally visit the bank in order to draw up a sample signature card and confirm his right to act in relations with the bank on behalf of the LLC .

You must submit to the bank:

- decision to change the director;

- extract from the register of legal entities;

- passport of the new manager;

- order for his appointment.

On the main features of the procedure for replacing the CEO

Unlike partners, banks that serve a legal entity must be notified of changes in the Unified State Register of Legal Entities. According to the instructions of the Bank of Russia dated May 30, 2014 N 153-I

, until the client is identified, it is prohibited to serve him. Therefore, the appointment of a new manager is a reason to prepare and send an information letter about the change of director to the bank, since in addition to sending the notice, the manager will have to come to the bank in person.

When working with official documents, the broadest range of powers is vested in general directors. Therefore, the issue of replacing a person in this position must be approached with the utmost seriousness. And rely only on current legislation.

To avoid possible problems in the future, you need to take care of the following:

- Constituent papers.

- Print transfer process. Material personal assets are transferred separately.

In any case, the candidate must be notified in writing of the replacement no later than 30 days before the actual dismissal takes place. The employee himself informs about leaving if this decision is made of his own free will.

Separately, decisions are made to change the management team. After this, the manager himself must submit documents to the tax authorities within a maximum of 3 days so that the necessary changes can be made.

How is an information letter written?

Features of filling out form P14001 in 2019

We offer step-by-step instructions on how to fill out the form:

- application P14001 consists of 51 pages, we use only those to which corrections are made (there is no need to submit blank pages);

- The application is filled out manually in capital block letters in black ink;

- Several adjustments can be made in one document, but simultaneous amendments and correction of errors are not allowed (two applications will be required);

- when filling out on a computer, use capital letters, height 18, Courier New font;

- Double-sided printing of the application is prohibited;

- page 001 and sheet P are always filled out, regardless of the type of changes;

- Section 6 of sheet P is filled out by a notary.

After filling out this document, it must be certified by a notary before transferring it to the Federal Tax Service.

In the event of a change of general director, it is necessary to fill out pages 001 and sheets K and R.

https://www.youtube.com/watch?v=ytdevru

Step 2. In section 1 of table K for the old director, enter the value 2 and fill out section 2 - full name and tax identification number of the previous director.

Step 3. In section 1 of table K for the new director, enter the value 1 and fill out section 3 - full name, tax identification number, date of birth, registration and actual residence address, telephone number, as well as details of an identification document (usually a passport).

Page 1

Step 4. The applicant’s status number is placed on the first sheet (the code is selected from the options proposed on the form).

Step 5. On sheets 2 and 3, the applicant’s personal data is filled in detail.

Step 6. On page 4 you need to indicate how the applicant will receive documents confirming the fact of making an entry in the Unified State Register of Legal Entities or the decision to refuse state registration.

What will you need?

Changing your number in the system is quite simple, but it takes some time.

For the procedure, you need to visit a bank branch with documents that confirm your identity. A corresponding application indicating the old and new numbers is also submitted there.

After this, you need to wait a little while the bank carries out the procedure.

Required documents

If you need to change your phone number in the Business Online system from Sberbank, you need to contact the bank branch and take some documents with you. This could be a passport or any other document that confirms your identity.

It should be noted that it is best to take with you exactly the document that contains your photograph.

Statement

To change the number in the system, the client must submit a standard application, which must be submitted to the number linked to the card.

The process of changing your number may take several days, which is not entirely convenient. The bank recommends completely blocking the old SIM card. This is due to the fact that this number, until it is changed, gives access to the funds on the card. This way you can protect your money from scammers.