Cash register registration card is issued to the taxpayer immediately after registering an online cash register with the Federal Tax Service. It is accompanied by the seal and signature of the head of the tax authority and confirms the legality of the enterprise. In accordance with Law No. 54-FZ, the date of receipt of this document is considered the date of registration of new equipment.

Additionally, the owner of a registered cash register receives a technical passport, which indicates the individual number assigned to the equipment. The entrepreneur is also returned the originals of all documents submitted to the tax office.

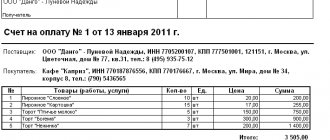

Cash register registration card: sample

The registration card is issued by the tax office. Confirms the legality of using the cash register and its compliance with the law. Contains the following information:

- address of the store or other retail outlet where the cash register is installed;

- description of the business activity in which it is used;

- number of device re-registrations;

- its technical data - model, serial and registration numbers, the same information about;

- information about the owner of the device and OFD.

Cash register registration card – sample:

It is filled out by an employee of the regulatory authority based on the information provided by the applicant.

How to fill out the registration form

The transition of enterprises to online cash registers did not in any way affect the form of accompanying papers. The taxpayer's application, accounting book and cash register registration card remained the same. But the electronic format of some documents was approved:

- application for registration, re-registration or deregistration of the cash register;

- various types of reporting (recording, closing the fiscal drive, making changes to parameters);

- message about assigning a registration number to the cash register.

An application to the tax authority to register a new cash register is filled out using the new form No. 1110061. The form template is available on the Federal Tax Service Inspectorate website in the appropriate section. In addition, in the article “Application for registration of online cash registers 2021: registration rules and sample filling” you can get detailed information on the topic, so there should be no problems with filling it out.

Cash register registration card: where to get what you need

There are two options: come to the tax office in person and bring with you a completed application for registration, or submit an application on the website of the Federal Tax Service. Most applicants prefer the second option.

In some cases, the tax authority may refuse to register you on the basis of Art. 4.2, clause 17 of Law No. 54-FZ:

- If the information required for registration is not provided in full.

- If incorrect data is provided (erroneously or intentionally).

There can be no other reasons for refusal. If the taxman gives a different reason, the company or individual entrepreneur has the right to challenge his actions.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

How to get a cash register registration card: visit to the Federal Tax Service

First, make sure that your cash terminal is listed in the register approved by the tax office. Sign a service agreement with OFD. Choose any operator from the list approved by the regulatory authority. What to do next:

- Fill out the application manually or on a PC - Form KND 1110061. Below we will give a sample of filling.

- Take the document to the Federal Tax Service office. Take with you a certificate of state registration of an individual entrepreneur or legal entity, a taxpayer identification number, all documentation for the cash register, and the company seal (if any).

- You will receive a registration number from the tax office.

- Now carry out fiscalization. You can do it yourself. To do this, connect the cash register device to the computer and run the fiscalization program on it - follow the instructions that appear on the screen, and at the end, punch out the reporting receipt. You can also fiscalize the cash register at the Federal Tax Service. If you choose this option, the tax officer will schedule a day and time to bring the cash register to him.

- Log in to your Personal Account (PA) on the OFD website. In the “Registration of CCP” section, enter into the form fields the details from the report receipt printed during fiscalization.

- Perform similar actions on the website of the Federal Tax Service: in the “Information about documents sent to the tax authority” section (located in the LC), click on the application number, select the “Complete registration” option. Enter the information from the report receipt. Then click on the “Sign and Send” option.

Ready. When the Federal Tax Service completes processing, a registration card will be published electronically in your personal account. If you wish, you can either print out the CCP registration card or receive a certified copy of it on paper.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

How to get a cash register registration card: submit an online application

First, make sure that the model of your cash register is listed in the tax department register, and that the selected OFD is authorized to carry out its activities. In addition, prepare your digital signature. You can quickly apply here.

Your next steps:

- In the personal account on the Federal Tax Service website, open the section “Accounting for cash register equipment” – “Register cash register equipment”.

- A list will open with two options: filling out the application manually or uploading a finished file from your computer. Choose a method convenient for you.

- When filling out manually, enter all the information that is required: information about the FN and the cash register, the address of its installation, the conditions under which it will be used (check the boxes next to the required items), the name of the OFD. Finally, click “Sign and Submit.” The service will offer to confirm the actions using an electronic signature - sign the application with a digital signature. The application will be sent to a Federal Tax Service specialist.

- You can find out at what stage of processing it is in the “Information on the passage of documents sent to the tax authority” tab.

- Opposite the cash register there will be a mark indicating that it has been assigned a registration number.

- Carry out fiscalization, issue a reporting check.

- Return to the Federal Tax Service website again - in the “Information about documents sent to the tax authority” tab (located in the Personal Account), select the “Complete registration” option. Enter the details from the check. Click on "Sign and Submit".

- The final stage is to inform your OFD about the fact of registration. On its website in your personal account, open the “KKT Connection” tab – click on the “KKT Registration” item. Enter the details from the report receipt.

Now everything is done.

The finished card will be posted on the Tax Administration website in your personal account.

We will connect the cash register to the OFD in just 1 day without your participation!

Leave a request and receive a consultation within 5 minutes.

Cash register registration card - sample application

The application form is contained in Order of the Federal Tax Service of the Russian Federation No. ММВ-7-20 / [email protected] (Appendix No. 1). Appendix No. 5 provides a detailed description of all the nuances of filling it out - it describes what to indicate in each line of the document. You can view the order and form here, in MS-Excel - here, to download a sample of the completed application, follow this link.

Basic information you will need to provide:

- Information about the cash register (including information about the machine, installation address) and its owner (company or individual entrepreneur).

- Type of business activity.

- Operation mode – whether there will be a connection with the OFD. If yes, please provide its name.

- Previously generated fiscal documents and replacement of the FN, if any.

You will need information from many documents: an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, TIN certificate, lease agreement or certificate confirming ownership of the premises where the cash register is installed, technical documents for it, etc. Prepare everything in advance for convenience.

How to get a cash register registration card - important points:

- The application must be filled out manually or on a PC. Blue or black ink is allowed.

- Each page is printed separately on the printer. Double-sided printing is not permitted.

- A separate application is required for each CCP unit.

The tax department has the right to request additional information even if the corresponding column is missing in the form.

- Connection to OFD for 12 months

1 review

1 800 ₽

1800

https://online-kassa.ru/kupit/podklyuchenie-k-ofd-na-12-mesyatsev/

OrderMore detailsIn stock

- Registration with the Federal Tax Service

1 review

1 500 ₽

1500

https://online-kassa.ru/kupit/registratsiya-v-fns/

OrderMore detailsIn stock

- Digital signature for online cash registers

4 000 ₽

4000

https://online-kassa.ru/kupit/etsp-dlya-onlajn-kass/

OrderMore detailsIn stock

Nuances

The features of cash register equipment are related to where it can be obtained, whether it is necessary to go through the registration process, what documents to provide for the procedure in question, and so on.

Where to get it?

It will not be possible to obtain a cash register or cash register machine free of charge. The devices in question must be purchased. Currently, there is innovation in this area, which is expressed in online cash registers. Its cost is about 17 thousand rubles or more.

Sellers do not in all cases need to purchase a new device, since some older models are subject to modernization. The service is provided at a technical service center and costs about 5 thousand.

An entrepreneur has the opportunity to save money and purchase a previously used cash register. You can choose to purchase at the service center.

What documents are needed?

To register with the tax authority, you will need to write an application. According to legislative norms, it states:

- full name of the user (we are talking about the name of the organization, personal data of the individual entrepreneur);

- individual taxpayer number;

- address where the device is installed;

- place of its installation;

- model and number assigned to the device at the factory;

- similar data regarding the fiscal accumulator.

Registration of cash register

The lines in the application are filled out depending on what line of business the organization is engaged in. The form according to which the application is drawn up was approved by the Federal Tax Service by order of 2017.

The form is filled out on paper and then provided to the tax officer. You can register a cash register operating online at any tax office.

In addition to the application, you must prepare:

- certificate confirming the state registration of an individual entrepreneur or organization;

- certificate confirming registration with the tax authorities;

- documentation regarding cash register;

- organization seal (if used);

- power of attorney regarding the representative involved in the registration process.

Sample CCP application form

What is a cash register card?

The card is a document that is issued to a person immediately after the procedure for registering a cash register with the Federal Tax Service. The document is stamped and signed by the head of the tax authority.

Through this paper, the legality of the activities carried out by the organization is confirmed. The date on which the document in question was issued is considered the date of registration of the new device.

Sample card

The owner of the cash register, which has been registered, is also issued a technical document. passport, which indicates the individual number assigned to the cash register. The entrepreneur receives back all documents in originals that were submitted for registration.

Where to print a cash register registration card

It is stored on the Federal Tax Service website in electronic form in the taxpayer’s personal account.

Where to find the CCP registration card:

- Open the “Cash Accounting” section.

- Click on the number of the required cash register.

- Click on the inscription “Download registration card”.

- The file will download to your computer and is ready to print. Format – pdf.

The card must be kept at the point of sale where the cash terminal operates so that it can be presented to the tax authorities during an audit.

How to register an online cash register with the tax office

Due to amendments to 54-FZ, the procedure for working with cash registers has changed noticeably, as has the process of registering cash registers with the tax office. Entrepreneurs who were previously exempt from using cash register systems must register it by July 1, 2021. This is not as difficult as it seems. Below we will tell you how to register an online cash register with the tax office.

But simply buying a cash register and registering it is not enough. Please note that to print checks in accordance with the requirements of 54-FZ, you need a fiscal registrar and a cash register program. Our Cash Warehouse MyWarehouse application meets all legal requirements. Download and try it now: it's free.

Now that you are convinced that the cash register corresponds to 54-FZ, we will look step by step at how to register the cash register with the tax office, and we will give instructions for registering the cash register for those affected by the change in the law or who are opening their own business for the first time.

The requirements of the law now include a new mandatory link in the data transfer chain - the fiscal data operator (FDO). It is through him that information will flow to the Federal Tax Service. From July 1, 2017, the use of cash registers without the OFD is impossible (except for the list of exceptions). Therefore, immediately after purchasing new equipment, connect to one of the OFD list approved by the Federal Tax Service.

So, you purchased a cash register and selected an operator. Now you can start registering your online cash register with the tax office.

This can be done in different ways: upload documents via the Internet or submit to the tax office “the old fashioned way” - bring it in person, transfer it through a representative with a notarized power of attorney, or send it by mail.

Registering a cash register with the tax office is mandatory and free - no one has the right to charge you money for registration as such, only for intermediary services. Representatives of the central service center or office of financial departments can become intermediaries: their employees will do everything for you for a fee. But if you do not plan to seek help from specialists, then you can handle it yourself.

The easiest way would be to register an online cash register via the Internet: the whole process takes place in the taxpayer’s personal account on the website nalog.ru. You don’t need to collect and fill out paper documents, or take the cash register to the tax office for inspection and fiscalization: you simply enter the necessary data into the web form.

Where to get a cash register registration card for outbound trading

Sometimes sales are conducted outside the premises: on the street, in organizations, in transport. This is the so-called delivery and delivery trade. Its regulatory definition is given in the Tax Code of the Russian Federation (Article 346.27):

- Delivery trade – carried out at retail using vehicles and mobile equipment (automobile shops, trailers, etc.).

- Carry-out trade – also carried out at retail (from a tray, hand carts, etc.). The seller contacts the buyer in transport, on the street, in organizations.

Such trading also requires an online cash register. But not always - it depends on what goods are sold. The list of goods and types of business activities for which the use of a cash terminal is permitted or completely prohibited is specified in Art. 2 of Law No. 54-FZ. For all others, the use of a cash register is mandatory.

You need to contact the Federal Tax Service, where you can get a cash register registration card for away trade in the same ways as for sales in a stationary retail chain: take a paper application to a Federal Tax Service employee or send an application on the department’s website.

The only difference is that the application does not indicate the address for conducting trading activities. Instead, the legal address of the company or residence of the individual entrepreneur is written.

What to do when moving

When filling out the KKM registration card, the place of operation of the online cash register is entered in the “Installed at the address...” column.

Important to remember! If it is intended to use a cash register on the road, then next to the legal address of the enterprise the mark “Field trade” is placed.

Re-registration is necessary if the taxpayer plans to trade in a new location. All movements are reflected on the form.

To confirm the change of address, the owner of the enterprise needs to contact the same branch of the Federal Tax Service where the initial registration of the cash register was carried out. In addition to information about the entrepreneur, the application must reflect the following information:

- serial number of the online cash register;

- vehicle registration date;

- the type of changes being made;

- reasons why the cash register address changes.

For reference: if the transfer of cash register equipment is temporary, the last item is not necessary to indicate.